- Tech News & Insight

- September 18, 2025

- Hema Kadia

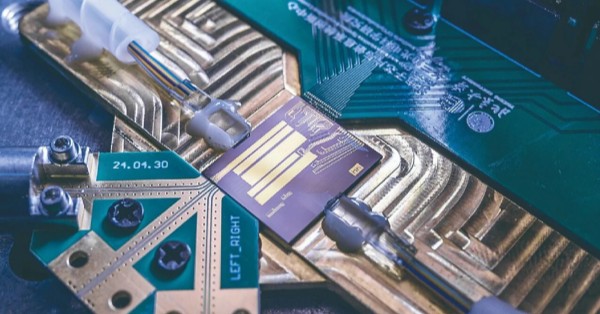

Tidal Wave Technologies has selected UK-based RANsemi to supply AI-enhanced Open RAN small cells for next-generation industrial private 5G networks across India. The companies will integrate RANsemi’s small cell platform into private 5G systems targeted at harsh, safety-critical environments. Initial focus areas include open-cast coal mines, large port terminals, and complex logistics hubs. The goal is to deliver resilient, low-latency connectivity for automation, remote operations, and worker safety. The partnership will be showcased at India Mobile Congress (IMC) 2025 with a live demonstration of integrated small cells and edge intelligence.