Home » 5G Magazine » Satellite Connectivity and NTN | 5G Magazine

Satellite Connectivity and NTN | 5G Magazine

This edition dives into the evolving world of satellite technology and its synergy with modern communication networks, highlighting key developments and challenges. Seraphim opens the discussion with a detailed look at the global race in satellite connectivity, emphasizing its impact on the mobile phone industry. Astrocast then explores the economic aspects of Satellite IoT, underlining its growing importance in global connectivity.

Log In or Register to Access This Content

Login

Register

Login with LinkedIn

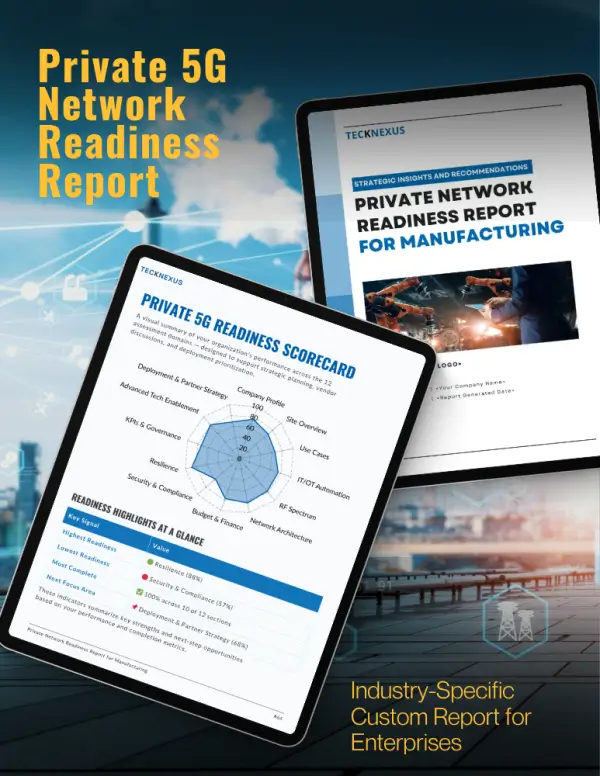

Essential insights and practical tools for navigating private networks. Get Details.

Available on Amazon & Google Books

Subscribe To Our Newsletter

- All

- 5G

- 6G

- AI

- API

- AR

- Assurance

- Automation

- Blockchain

- Digital Twin

- Edge/MEC

- FWA

- IoT

- Metaverse

- Monetization

- Network Infrastructure

- Network Slicing

- Open RAN

- Orchestration

- OSS-BSS

- Predictions

- Private Networks

- RAN

- SASE

- Satellite & NTN

- SD-WAN

- SDN-NFV

- Security

- Semiconductor

- Sustainability

- Telco Cloud

- Testing & QA

- Towers & Cells

- VNF

- VR