AI Pulse: Telecom’s Next Frontier is a definitive guide to how AI is reshaping the telecom landscape — strategically, structurally, and commercially. Spanning over 130 pages, this MWC 2025 special edition explores AI’s growing maturity in telecom, offering a comprehensive look at the technologies and trends driving transformation.

Explore strategic AI pillars—from AI Ops and Edge AI to LLMs, AI-as-a-Service, and governance—and learn how telcos are building AI-native architectures and monetization models. Discover insights from 30+ global CxOs, unpacking shifts in leadership thinking around purpose, innovation, and competitive advantage.

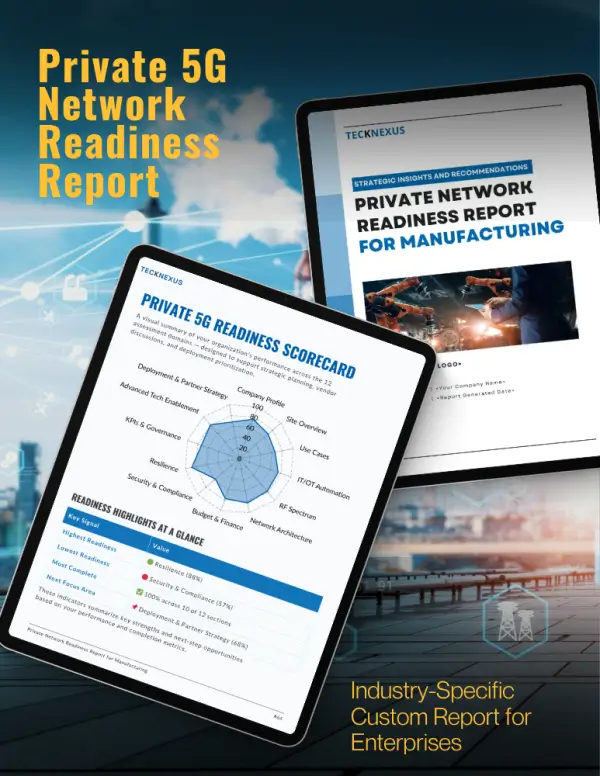

The edition also examines connected industries at the intersection of Private 5G, AI, and Satellite—fueling transformation in smart manufacturing, mobility, fintech, ports, sports, and more. From fan engagement to digital finance, from smart cities to the industrial metaverse, this is the roadmap to telecom’s next era—where intelligence is the new infrastructure, and telcos become the enablers of everything connected.