Podcast

- April 22, 2024

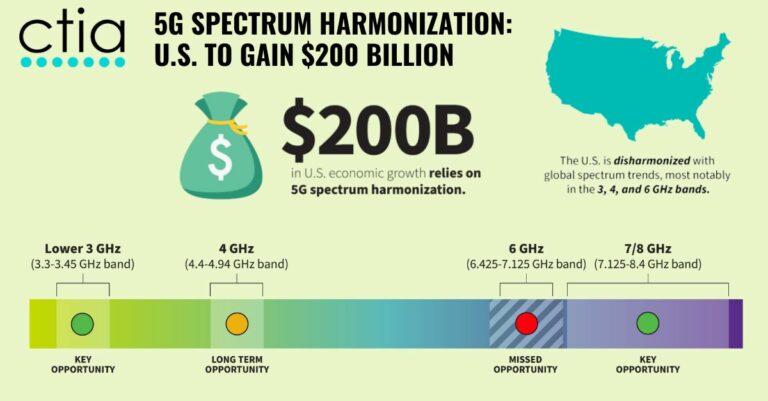

The 5G Guys podcast hosts, Dan McVaugh and Wayne Smith, introduce a new series titled ‘Storytelling and Predictions,’ aimed at sharing their extensive experience and insights into the telecommunications industry without overshadowing their guests. They dive into the impact of 5G on capital expenditure, noting a significant increase in spending to roll out 5G networks, which is now adjusting back to normal levels. The discussion transitions into the differences between CapEx and OpEx spending, emphasizing the shift towards maintenance and optimization of networks post-major rollouts. The hosts reflect on past downturns in the telecom industry, comparing them to the current market dynamics and predicting future trends, such as vendor consolidation and the strategic deployment of mid-band spectrum for 5G. The episode highlights the unique position of the telecom industry amidst economic fluctuations and the evolving landscape of network development.

Podcast

- April 22, 2024

The 5G Guys podcast hosts, Dan McVaugh and Wayne Smith, introduce a new series titled ‘Storytelling and Predictions,’ aimed at sharing their extensive experience and insights into the telecommunications industry without overshadowing their guests. They dive into the impact of 5G on capital expenditure, noting a significant increase in spending to roll out 5G networks, which is now adjusting back to normal levels. The discussion transitions into the differences between CapEx and OpEx spending, emphasizing the shift towards maintenance and optimization of networks post-major rollouts. The hosts reflect on past downturns in the telecom industry, comparing them to the current market dynamics and predicting future trends, such as vendor consolidation and the strategic deployment of mid-band spectrum for 5G. The episode highlights the unique position of the telecom industry amidst economic fluctuations and the evolving landscape of network development.