Home » 5G Magazine » 5G Predictions for 2022 | 5G Magazine

5G Predictions for 2022 | 5G Magazine

Featured articles in this edition

Spotlight Your Innovation in 5G Magazine

- March 18, 2024

What were the top 5G trends in 2021 globally & from BT’s perspective?

Neil McRae: 2021 is kind of an interesting year. We are grappling with COVID and building out 5G networks, which are still quite early in 5G. However, from my perspective, UK customers have started to see the value of 5G. Some of the top 5G trends we noted globally and from BT perspective include:

Private Networks

We’ve done a couple of big enterprise deployments of 5G solutions. One working with the ports and shipping area where we’re using a 5G private network to connect the port, where the arrival of container ships in a way that has never really been done before to assist on loading and unloading of container ships, and right now with all the supply chain challenges, anything we can do to to make that simpler and more straightforward is hugely valuable. So that’s one of the big things that we did.

We also did an augmented reality trial with a heat pump manufacturer, who’s using augmented reality to help its engineers diagnose and fix problems in the field. They are using 5G partly with smartphones and trying out new types of devices with augmented reality goggles and devices like that. They definitely see the benefits and opportunities for that.

Edge Computing

A lot of things are going on in edge computing. One of the things we did part of 2020 & part of 2021 is we rolled out an edge compute service focused on CDN with a partner company called Qwilt that allows us to deliver content and much better quality under our control. So that’s very exciting.

Swapping Vendors

From our point of view, in the UK, we’re in the process of swapping out high-risk vendors. While we probably read about the challenges they’ve faced, that’s going really well for us. It’s been challenged by COVID.

But, we’ve got a lot of momentum on that and really starting to see some of the benefits – like being recognized as the best network in the UK, which is massive. A lot of operators are doing similar things.

Open RAN

We are keen to see how some of the new startup networks like Dish and Rakuten start to mature and gain momentum. See if their model works in the way they believe and understand them and what we can learn from them. Because, when you start afresh, you do things differently, think differently. So I’m keen to see what I can learn from them and take that back into our network and make things better for our customers.

There is a lot of momentum for Open RAN and huge amounts of development. However, I still think Open RAN has got a long road ahead. And I still believe that 6G is probably really where we’ll see Open RAN explode, which is probably a few years away. Probably not what most Open RAN fans want to hear about.

Many of us are kind of really into the depths of our 5G rollout, and trying to pivot to something else is probably quite difficult. But, the momentum in the operator community for Open RAN is hugely positive and moving at a phenomenal pace, probably quicker than anyone probably could have realized. And, I think that’s starting to have an impact on the wider industry.

A highlight for me was Ericsson’s launch of their RIC controller, or Service Management and Orchestration (SMO) platform, effectively taking some of the same architectures and using them on Ericsson capabilities. And some of them we are looking at BT.

Keeping the network up in Covid pandemic

But I think if I look back over the last year through this really difficult period in our history, the telecommunication companies, both fixed and mobile, and many service providers behind us have done a tremendous job in keeping the world rotating, during and through this pandemic. I’m working from home today. That’s the direction we’ve got here in the UK at the moment.

Many businesses have been able to pivot to other ways of working and operating, and it’s all been underpinned by the network. So I really want to say a huge thanks to everyone in our industry for the part that they’ve played in keeping the world going while we’ve been dealing with this pandemic.

And it’s starting to look suddenly challenging again with new variants, etc. But you know, we’re ready for it and delivering services to our customers so that they can work, rest, play, eat, talk to their friends and play games, whatever they’re doing, are still able to do via the network. So for me, that’s a real highlight of this year and last year. And I think something everyone in the industry should be proud about.

Rolling out 5G and 4G networks

We continue to roll out both 4G and 5G networks. So there were challenges around COVID, but different sets of challenges.

In the UK, we’re, especially in the metro areas, relying upon landlords of different buildings and facilities to put our antennas at the top of their building. And some elements today got harder for sure, and some of it got easier. Because when there’s no one there, it’s easier to work and get things done. But also, when no one’s there, it’s hard to get into the buildings.

So we faced a lot of different things. And we learned a lot from that. We grew our 5G networks, over 100 towns and cities across the UK, and still growing. And let’s not forget 4G. 4G was still a big part of the network.

We grew our coverage in the UK by 1%, which is the most of any operator in the UK. Most of the other operators didn’t grow their 4G coverage at all in some rural locations. That’s becoming more and more important as we build and roll out 5G.

Though we’re dealing with the challenges of COVID, we’re building and expanding networks, and we’re keeping the services super reliable, I think, and that’s probably one of the highlights.

Which 5G areas did not get the expected momentum?

- 5G, API, Predictions

- March 18, 2024

2021 showed us that the secret is out. Organizations in nearly every industry are eager to see how 5G can help elevate their operations, employees, customer experience, etc. While we’re helping these organizations realize some of 5G’s potential, other cellular developments in 2021 are prime examples of complementary solutions that could be critical in making that happen.

Private cellular might be the marquee network technology among today’s 5G advances.

But the tool has different flavors and architectures for taking advantage of new opportunities to inform the larger deployments and in shaping their respective ecosystems. This is because they are finding that 5G isn’t a magic wand that you wave across the enterprise to make things better. It’s a piece of a bigger puzzle you start to put together after determining an organization’s objectives, hurdles, and future roadmaps.

WiFi and wired connections will remain important in building effective network solutions.

While 5G, and in particular private cellular networks, can accelerate their roles as enablers for connected sites, creating harmonious converged networks that could include WiFi are what will fuel innovation and new business models across all enterprises, public and private alike. The increased number of network options gives organizations more to navigate. As these organizations begin to work through that “just right” mix of solutions across different spectrum and architecture types, there are the three big questions to consider as starting points toward that “just right” mix.

What type of site is it?

Sites can be interior spaces, outdoors, remote locations, dense urban environments, sub-parts of a larger space among others.

Each can benefit from “site-specific” solution architectures addressing variables influencing cost, complexity, and performance—each critical in setting a starting point toward “just right.”

Who will use the network?

Understanding this will help determine among other things the data ownership model that can address the mix of networks within the given space.

Are people on the network? Things? Both? Who are the people, what are the things and what do they do, or what are the use cases? The user types and use cases will help inform the mix of data creators and owners together suggesting the right network mix at a particular site.

- March 12, 2024

The telecom industry has been characterized by the ‘generational’ evolution of technology in the past four decades.

1G

Mobile telephony took shape starting from 1G (1st Generation wireless) in 1979 when the first cellular network was launched in Japan. This was soon followed by the rollout of 1G in Finland, Sweden, Denmark, and Norway in the early 1980s.

2G

The next decade witnessed an inflection point, with 2G being launched in Finland in the 1990s. 2G was also known as GSM, which became popular across the world, and made cellular ‘voice’ telephony ubiquitous.

3G 4G

The industry witnessed two more advancements, namely 3G (in 2001) and 4G (in 2009) that aimed at offering faster data speeds. These important milestones in cellular ‘data’ telephony fueled the massive growth of the internet and digitized our lives.

While 1G and 2G introduced voice and text as the ‘killer apps’, 3G and 4G offered mobile broadband connectivity in the comfort of our hands – enabling the OTT and smartphone ecosystem.

5G

5G will not only enable person-to-person communication, but it will digitize society and industries by connecting billions of machines and “things” in addition to people. Consumers will experience blazing fast speeds at lower latencies leading to more per capita data consumption.

Everything that we touch, experience, or “wear” will generate data that will be connected via 5G. Early indicators of this trend are visible, through the popularity of wearable devices for example, and smart connected homes. This explosive demand for data and low latency interactivity will be fulfilled by 5G, which will fuel revenue growth in the retail consumer segment.

Businesses on the other hand will leverage 5G to automate their industrial setups, supply chains as well as connect their assets through sensors for business intelligence. Data-driven decision-making will be facilitated through 5G proliferation as Machine-to-Machine communication gets deployed in volumes.

This will benefit OPEX optimization.

These strategic directions of 5G adoption will have a larger macro-economic impact as the benefits of technology will directly contribute to the bottom-line of businesses – either through new revenue streams or through greater OPEX savings.

Bridging the Chasm between Promise and Practice

From the point of view of carriers, the 5th generation standard is not a mere “upgrade” from its predecessor. It is a complete overhaul of how telecom networks are architected, designed, and deployed.

Carrier networks today are encumbered by legacy software, and with 5G – the network is re-imagined into a cloud-native, composable, and nimble architecture. 5G opens up an entirely new market that extends far beyond the traditional revenue streams of voice, messaging, and internet connectivity.

For bridging the gap between the promise of 5G, and its realization, there are ten key ingredients that will require flawless execution.

Cloud-Native Standalone 5G – Ease of deploying new use cases

5G embraces the cloud ‘by design’, rather than as an after-thought. Traditional network “boxes” have been re-architected as ‘network functions’, and organized around service-based interfaces.

5G Network Functions are packaged as portable images which can be deployed either on-premise or in the public cloud. Hybrid models are also supported through this architecture, which may involve both the public as well as the private cloud.

As a result, hyperscalers such as Google, Microsoft, and Amazon have become potential deployment choices. This accelerates the lifecycle of new services and use cases that are developed over 5G. Moreover, it gives carriers and their customers an asset-light option for scaling new services on-demand.

- November 5, 2023

Is it possible to reflect on 2021, and make predictions for 2022 without mentioning the COVID-19 pandemic? Probably not. But as we say “goodbye” to 2021 and “hello” to 2022, let’s try and think about the past, present, and future while making minimal reference to a certain global pandemic.

Reflections on 2021

Costly year for operators seeking to gain ‘5G’ spectrum

2021 turned out to be a costly year for operators seeking to gain ‘5G’ spectrum around 3.5 GHz. In February, the US held the world’s most expensive auction ever, raising $81 billion for the US Treasury. Use of the spectrum, unfortunately, is suspended pending resolution of concerns raised by the US Federal Aviation Administration regarding the potential for interference to avionics equipment.

Mobile operators generally spend a lot on capital expenditure, including spectrum. Over the years, they have been able to distract investors from this problem by boasting impressive cash flow. But as growth in consumers’ willingness to spend money on their mobile products slows and/or declines, operators have needed to protect their financial ratios.

Cell towers look like great candidates for off-loading

One way to do this is to offload their assets. Cell towers look like great candidates for off-loading. They seem to have plenty of potential buyers looking for stable returns so can command a good sales price. Their sale does not reduce capacity in a network as they can still be used through leases – which would be an operational expense, not a capital expense.

Vodafone, one of Europe’s most stressed telcos, took advantage of this accounting magic by offloading its cell sites into Vantage Towers. The company keeps its own books but is majority held by Vodafone itself. It held an Initial Public Offering in March 2021, raising EUR 2.3 billion. Orange, Telefonica, Telstra, and other operators have followed the same path in the past 12 months.

Vendor swapping to address security concerns

Operators in the past have sought to reduce costs by using cheaper vendors from China. Huawei, in particular, has become notorious for offering very attractive financing arrangements for its discounted kit.

But in the last years, the industry has raised more security concerns about the use of Chinese companies in Western countries’ critical infrastructure. Governments are now pressuring or requiring operators to remove all Chinese equipment from their networks.

In the UK, for example, the need for operators to remove Huawei from their networks has greatly reduced the spending on new network deployments, with the majority of operator budgets being spent on vendor swaps. Excluding Chinese vendors leaves only a couple of equipment vendors with which to do business.

- November 5, 2023

5G is the fastest-growing generation of cellular integration inside vehicles. An increasing focus on customer experience pushes automotive manufacturers to develop a raft of new capabilities that will fundamentally change what you can do using your car. Let us take a moment to look back at 5G Automotive in 2021 and predict the trends for 2022.

Top 5 Automotive Trends & Technology from 2021

5G supported Automotive Manufacturing | Fact #1

- An emphasis on 5G integration with manufacturing plants of Automotive OEMs has driven faster response times between equipment in the factory

- COVID-19 has put a lot of stress on the supply chain to overcome the short supply of semiconductor components

- 2021 has seen the fully networked factory to cope up with the growing demand

4G vs 5G debate with Auto OEMs | Fact #2

- European & North American Auto OEMs have accelerated their plans of 5G integration into vehicles

- Many mandatory features like Intelligent Speed Assist in Europe has pushed the need to increase the data rates

- In 2021, the industry has seen many RFIs and RFQs with increased volume for 5G in the future

Vehicle-to-Everything (V2X) integration | Fact #3

- The debate between C-V2X, DSRC has been mostly settled in the favor of C-V2X

- NCAP (New Car Assessment Program) mandate in China has driven global Auto OEMs to launch early integration plans of V2X

- 2021 has seen V2X to be a standard feature request from Auto OEMs

- March 16, 2024

The nationwide rollout of 5G might best be described as a promise that has yet to be fulfilled. The challenge of delivering 5G to a broad audience is more complicated than a single issue, but if there is one glaring problem that has held deployment back, it’s accessible reliable bandwidth. That means when the government sold off sections of C-band in two separate auctions this past year, several of the big, nationwide telecom providers jumped at the chance to bolster their frequency portfolios.

The capabilities of this newly available spectrum have led industry observers to suggest that the 5G bandwidth problem might finally be approaching a long-term solution. But questions about C-band and its capabilities still linger. How are telecoms going to deploy C-band? Will it finally deliver true 5G? To understand, it’s helpful to take a deeper look at the challenges.

Understanding the problem

We’ve heard a lot about the capabilities of 5G, and what it will offer in terms of drastically higher capacity, lightning-fast speeds, and virtually zero latency. In order to deliver on the promise of 5G, telecoms have created networks that feature more capacity.

But, the big 5G problem has been that high-capacity frequency bands with low propagation do not travel very far and are weakened or blocked outright by physical barriers. In other words, 5G is tremendous if you are standing right next to the tower, but if there is a building in between, you are out of luck.

One of the leaders in network development, Verizon, has deployed 5G on the super high mmWave frequencies.

But this signal is not reliable at more than 1,500 feet or so, and building a virtual forest of new 5G towers is not the most practical or economical solution for any company.

Other telecoms are likewise building and rolling out 5G networks, but also haven’t been able to fully sort out the problem of physical barriers to high frequencies.

Either the speeds are no greater than LTE or the range is poor.

Getting the band(width) back together

- March 16, 2024

“Sustainability is not a choice anymore for businesses & people.”

5G+ Edge so far

Even during the challenging times, technologies such as Cloud, IoT, AI, 5G, and Edge have advanced farther than ever imagined. 5G+ technology has ushered-edge applications that are already transforming many businesses and consumers across the world.

5G+ edge applications for autonomous cars are bringing passengers such experiences that were once possible in science fiction movies. The integrated Smart Factory† and Remote Monitoring of Oil & Gas Drilling are promising tremendous value to businesses in terms of cost optimization, growth, and innovation. Precision Farming, Smart Patient Monitoring, Smart Grid, and Smart Homes are delivering direct value to the lives of billions of people around the world.

For such transformations to come to fruition, complementary technologies in hardware and software must advance at the same time.

Telco companies quickly promoted the 5G+ portfolio as their key business imperative and enabled 5G+ infrastructure across the globe, electronics companies developed new edge-specific hardware such as IoT edge sensors, edge routers, edge transmitters, and receivers. Network technologies developed new message protocols, higher bandwidth, and processed terabytes of data at the edge to handle 5G+ requirements.

Edge application framework uses scalable Microservices and Kubernetes clusters to transform edge computing and move the Cloud prowess closer to the source of data. Security services for the edge applications are using modern AI techniques, support dynamic updates to defend against rapidly evolving sophisticated attacks, and security is embedded as an integral part of the hardware.

Business leaders and technologists are excited that we are at a true inflection point in 5G+ edge technologies to accelerate digital transformation across businesses and people. While the core of 5G+ edge technologies have matured to enable large-scale applications, there are still challenges in the areas of security, hardware, and application integration.

Technology innovators are working smart to close these gaps and advance the digital transformation ubiquity. On the other hand, the recent environmental crisis, and the impacts of pandemics have brought unforeseen challenges to business leaders.

Although the new climate agreements by nations and the regulatory mandates force businesses to act, sustainability is still not seen as a means to improve the bottom line and achieve growth.

“Agility” is the new corporate mantra, and “sustainability” is no longer a choice but a pivotal business goal.

Why does “sustainability” matter so much now more than ever?

- March 10, 2024

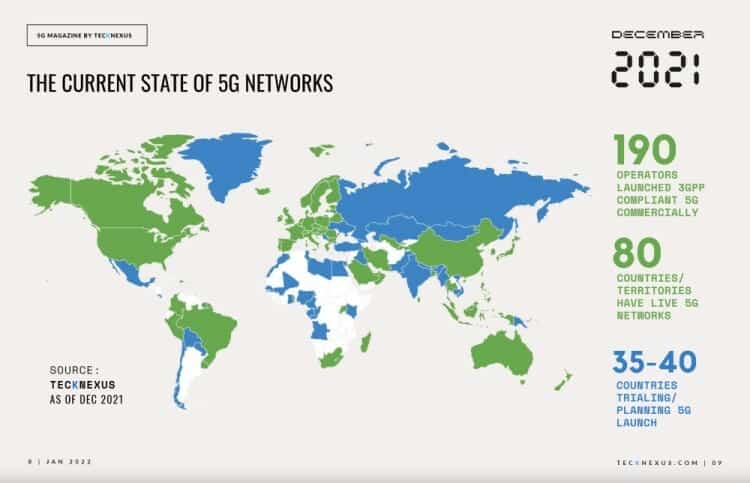

To get the latest updates on the global rollout of 5G Networks, Open RAN networks, and Ecosystem players, purchase or subscribe to our “5G Trackers | Bundled Offer.“ The below ebooks and infographics are included in the “5G Trackers | Bundled Offer.”

3GPP-compliant 5G network rollouts – globally and regionally

As of December 2021, the 5G network has been commercially deployed by 190 wireless service providers across the world. This eBook details the global and regional 5G network rollouts, including which countries have already launched 5G and how many networks have been deployed in different regions of the world. It also provides insights into which countries are planning to roll out 5G networks in the near future, so you can plan your strategy accordingly.

Open RAN technology-based 5G/4G network trials & rollouts

The Open RAN Tracker provides a comprehensive map of where Open RAN is being deployed/trialed around the world, as well as a breakdown of how many deployments are in each region.

It also gives you insights into who are the operators leading the Open RAN deployment and who are the ecosystem technology vendors. This guide also provides an overview of the challenges and benefits of Open RAN, as well as profiles of leading operators in this growing market.

700+ 5G Companies Infographic

This 5G & Edge Companies Infographic is the perfect resource for anyone looking to learn more about the global 5G network rollouts and the companies enabling those networks. Featuring over 700+ 5G companies, this infographic provides a snapshot of leading and emerging players of the 5G ecosystem.

We have broadly classified the ecosystem players into 20 categories and we continue to add new categories & players addressing the changing landscape.

Read the complete article in the 5G Magazine

Content, Design, And Lead Generation Services to Elevate your Marketing Efforts

Sorry, we couldn't find any posts. Please try a different search.

- All

- 5G

- 6G

- AI

- API

- AR

- Assurance

- Automation

- Blockchain

- Digital Twin

- Edge/MEC

- FWA

- IoT

- Metaverse

- Monetization

- Network Infra

- Network Slicing

- Open RAN

- Orchestration

- OSS-BSS

- Predictions

- Private Networks

- RAN

- SASE

- Satellite & NTN

- Security

- Semiconductor

- Sustainability

- Telco Cloud

- Testing & QA

- Towers & Cells

- VR