Home » 5G Magazine » 5G Tower, Small Cells, DAS Edition | 5G Magazine

5G Tower, Small Cells, DAS Edition | 5G Magazine

Featured articles in this edition

Spotlight Your Innovation in 5G Magazine

- March 23, 2024

Interview with Ravi Sinha, Chairman, Emerging Technology, Small Cell Forum, and Director, Technology Development and Solutions (4G, 5G & MEC Solutions) at Reliance Jio

How is SCF accelerating the adoption of small cells?

SCF, being one of the world bodies, is promoting a small cell ecosystem. We all are working to build much healthier, more flexible, and industry-consumption-worthy frameworks overall. And SCF, being the torchbearers of small cells, works in four prongs. The very first prong is components and interfaces. Within components and interfaces, the different groups work on multiple solutions for a split 6, split 0, and a split two – towards the reference designs for the hardware and interfaces. SCF brought the concepts of FAPI, and being the torchbearers; we’re taking it forward all up to the 5G specs. At present, in terms of interfaces, we have already released the three different versions of FAPI i.e.

- 5G FAPI: PHY API’ – main data path (P7) and PHY mode control (P5) interface [SCF222]

- ‘5G FAPI: RF and Digital Front End Control API’ – (P19) for Frontend Unit control [SCF223]

- ‘Network Monitor Mode API’ – (P4) for 2G/3G/4G/5G [SCF224]

So, those releases are already available for industry consumption. There is a lot of work going on towards RF FAPI, where we all are working hard as a team to release the beamforming capabilities to our small cells. So if you see the components and then interfaces are coming along in a very effective way for the industry to get all our specifications, white papers in a consumable way, and it adds value to what we are doing. The second prong is products and solutions. Earlier, if you see the history, we have mainly worked towards the components and interfaces, and of course, FAPI and nFAPI are very close to our hearts. But, since we are working so closely with the industry on the interfaces, we decided to bring the frameworks and the blueprints. The blueprints and frameworks would enable all the components we are building together to be a part of a solution that the industry can take based on how they want to consume. And that’s how we have started this whole blueprint initiative. And this is going to be a big initiative and close to something which industry can directly consume or consume with the different kinds of services they can have. The third one is all about deployments and operations. We have done a lot of work in the recent past, and we are keeping on doing with a neutral host, especially in the UK with JOTS and multiple operators – MVNOs, MNOs, CSPs- to share a common RF infra or RF plus core infra. We are mainly focused on RF or the RAN piece of it, and how at the edge of 5G and going forward to 6G, the different operators can use the common infrastructure to optimize the cost or consumption space. So a lot of advantages. And then last but not least is the market – because when you’re building the components and the interfaces on top of it, along with the deployment and operations aspect, you are bringing all your blueprints and frameworks. But then when these three layers are built, ultimately it also gives you the opportunity to go for the market, how the market moves, seeing a value to each other within SCF, outside SCF, and how with partnerships, these recommendations and proposals can be brought to the reality and go to the deployment. So, SCF is also building a good and healthy market ecosystem, which is the top layer. It will be a complete 360 where we started from components and interfaces, gone to products and solutions, and then on top of it deployment operation and then market. So this is how we’re envisioning overall. And this is the new look of SCF, we wanted to add value in the sense that it’s not only limited to the white paper or specs, but it is going to the solutions and deployments. This is how SCF is adding value to the industry.

What are SCF focus areas and new initiatives for small cell adoption?

At present, there are two phases that we are planning for: The first phase will focus on the enterprise 5G private networks deployed in isolation from the public network. Because nowadays we see all the industries, mining and a lot of other enterprises, they are at remote places, or at an isolated place, or even if they’re in urban and semi-urban locations, they wanted data sovereignty, where they have data control, and everything is local to them. So for them, this particular use case fits well. And that’s the reason this use case has higher priority, which can go in coordination with MNO.

The fastest-growing area of small cell deployment is in private enterprise networks (SCF forecast – see right)

- However, there are barriers. 36% of deployers said they would roll out more quickly if more plug-and-play deployments were enabled.

- Enterprises are accustomed to certification in other networks and will demand the same for cellular

The second phase will be worked in parallel as an extension to the first phase as a complete MNO-driven enterprise where they can be a part of your connectivity and a part of your smartness. In both these two phases, hyper scalars will play a big role because they can easily fit into your standard isolated case or coordination with MNO. Since coordination with MNO is a proven model where hyperscalers work hand in hand with MNOs, these are the two priorities. After that, CV2X and Industry 4.0 will be the final goal because that is where a big chunk of effort will be consumed.

What business needs and challenges would the SCF technical and deployment blueprints address compared to similar initiatives by other industry bodies?

The challenges with all the initiatives, especially coming from SCF and, of course, O-RAN and a couple of others, who are championing the concept of open RAN, are working in bits and pieces very much defined in certain areas. Being an industry, if you have to consume, you have to add a lot of other stuff on the top to build a solution for a trial or for final consumption or for deployments. So, the challenges are many, especially if you think about the whole Open RAN concept, starting from standardization, specs, and interfaces. And then, on top of it, cloud-native fabric and supply chain-related challenges. With all these challenges, you ultimately move towards a supply chain superiority where you can mix, match and pick the best cost-optimized solution. These challenges will be optimized or minimized if you evolve like all the platforms such as SCF and O-RAN evolved from the components or interface solution provider to a framework or blueprint solution provider. Then, people can see turnkey options available to them with services, partnerships, and collaborations where they can put their management layers and deploy them the way they want. So this is SCF’s vision. There are multiple challenges that the technology is new, Open RAN is something where everybody believes in, but then again, contribution and bringing it to real consumption is a big challenge. But I see that SCF, ORAN, and WPA – we all are working as a team collaborating to bring our best foot forward and solve some of the major existing problems.

| Industry Blueprints (Private NW) | Difference to SCF BP |

| TIP Private NW BP | Focused and prioritized on Split 7.2. Major Focus on Macro Base stations |

| OAISA Private NW BP | Focused and prioritized on Split 7.2. Major Focus on Macro and Micro Base stations. Mainly an Opensource initiative with PoC and Academia in focus. |

| 5GAA Private NW BP | Edge Architecture focused on Automotive, having Vehicle unit and infra around as priorities. |

| MulteFire BP | Uni5G Blueprint caters to Unlicensed bands (2.4 GHz and 5GHz) |

Who are the ecosystem stakeholders, and what is the value proposition for them?

The ecosystem players in the last 10 to 15 years, the ecosystem players were going to the turnkey solution providers but now have moved from there towards the services. Earlier connectivity was a priority, and then, later on, services kind of dominated, and now it’s all about services. So, the ecosystem itself has changed and evolved a lot. Now, it is an MNO, it is a CSP, it is a PNO play with the hyper-scalars. In the era of the private network, the property owner or that specific industry owner wants to own the connectivity and service fabric with them. So the ecosystem itself has evolved, like even the solution provider has changed from MNO to MVNO, PNO, and neutral host operators. But the operators were playing in their own silos, where they were powerful, they had the might, but as they started moving to a private network or enterprise private network domains, they were not that much enabled. And then, there is a lot of confusion about how to build, what the challenges are, and who will be my partner. So, slowly the industry is supporting the ecosystem so that everyone is playing as a team member and helping each other. Some of the initiatives will be related to blueprints and frameworks. The ecosystem overall management will be funneled in the right direction where hyperscalers, MNOs, PNOs, neutral host owners, or the property owners themselves can manage the way they want, whether it’s a local data priority like sovereignty to fully hyper scalar based approaches. So the ecosystem has evolved a lot. But I’m seeing a lot of permutations and combinations where the different ecosystem stakeholders are taking the responsibility in going forward for this whole Open RAN initiative.

What’s the timeline for this initiative? And what’s the roadmap?

The whole blueprint, consisting of multiple blueprints within it, is already released, and the related documents are already available. The enterprise blueprint will first have infrastructure-as-a-service (since this is a cloud-native initiative). Then, on top of it, it will have network function as a service, then management as a service, followed by system integration and certification. So multiple layers will be built within these frameworks. We now see a unique proposition where the first time, the small cell is a major focus. Interfaces they all come, but we are not only talking about nFAPI or a split six, but we are also talking about a split zero and a split two, then putting all of them under a common fabric in terms of management, cloud-native assets, and ultimately going forward for scalable deployment. And we will come with minimum viable product specs, product requirement documents, reference design, and use case-specific individual blueprints. We are also working with industry and stakeholders to have a contributed open-source software fabric in time. The timeline is second quarter 2022. So in the coming three quarters, we’ll have the framework in place. And I’m hopeful that in a couple of quarters, we’ll have the open-source software stacks also available. So the target for the first phase is the second quarter of 2022, and for the MNO coordinated blueprints, the target is the first quarter of 2023. Phase-1

- Enterprise 5G Pvt NW (Isolated) IaaS, PaaS, NFaaS, MaaS, SIaaS Sub-blueprint delivery.

- MVP, PRD, Ref Design.

- Test Frameworks.

- Badging and Certificates.

- Projected Delivery TimeLine: Q2-2022

Phase-2

- Enterprise 5G Pvt NW (MNO) IaaS, PaaS, NFaaS, MaaS, SIaaS Sub-blueprint delivery.

- MVP, PRD, Ref Design.

- Test Frameworks.

- Badging and Certificates.

- Projected Delivery TimeLine: Q1-2023

Future (CV2X and Industry 4.0)

- January 30, 2024

Skyscrapers have been dominating the skyline of most major cities in the last couple of decades, but what has been striking is the appearance of Telco Towers. Red blinking dots over the horizon under a clear sky is quite an indicator. The densification of telco towers will fuel 5G, meaning cell tower companies need to find logistics and infrastructure to deploy the 5G technology.

Two major factors will primarily dominate the expansion of 5G and its success. 5G Telecom gears and 5G passive infrastructure. For 5G gears, we hear a lot of buzz from Global OEMs like Ericsson, Nokia, and Huawei and disrupting players like Mavenir, Parallel Wireless, and Altiostar.

What are 5G Towers?

A 5G cell tower, more commonly referred to as a “5G Tower,” stands as the next generation’s pillar in wireless communication. While the tower structure might resemble its predecessors, it’s the equipment attached to it that provides the game-changing fifth-generation (5G) communication services. The equipment, known as a macrocell, has the crucial responsibility of adhering to the standards set by the 3rd Generation Partnership Project (3GPP). This standardization ensures uniformity in 5G services and infrastructure across regions.

5G Towers vs. Small Cells: What’s the Difference?

While the terms ‘5G towers’ and ‘small cells’ are sometimes used interchangeably in casual conversations, they refer to distinct entities with specific roles in our evolving telecommunications landscape.

Physical Structure and Size

- 5G Towers: These are large structures that support multiple sets of equipment from various wireless carriers. They’re designed to accommodate antennas, remote radio heads (RRH), and other vital telecom gear.

- Small Cells: Much more compact, small cells typically fit within a volume of 25 cubic feet. These miniaturized cellular base stations are often mounted on existing infrastructure, such as light poles or utility posts.

Coverage Area

- 5G Towers: These provide a broad coverage area, spanning several miles, and serve as the backbone for wide-area wireless communication.

- Small Cells: With a limited coverage diameter of usually less than half a mile, small cells supplement the main network, particularly in densely populated urban and suburban regions where the demand for connectivity is high.

Network Generation

While 5G is in the name, not all 5G towers exclusively support 5G. They can, and often do, support previous network generations like 4G. Similarly, while many small cells have been installed to bolster 5G coverage, several still operate on 4G networks.

Proximity Controversies

Small cells, given their deployment in high-density areas, often find themselves closer to homes and businesses. This closeness sometimes triggers concerns regarding aesthetics, property values, and potential health implications. In response, bodies like the Federal Communications Commission (FCC) have established guidelines to oversee the safe and strategic placement of small cells, particularly ensuring they don’t pose traffic hazards or other safety risks.

Understanding Cell-Sites and Cell Towers

A ‘cell site’ encapsulates the entire set of equipment and infrastructure, including antennas, buildings, telecom gear like base stations, RRH, and power resources. In contrast, ‘cell towers’ refer specifically to the masts or poles that hold antennas and RRHs. These towers can be shared by multiple carriers or utilized solely by one. Often, wireless carriers lease or rent these towers to mount their equipment. For a deeper dive into the nuances of the 5G cell tower, consult the article titled “5G Cell Tower: Introduction.”

5G Towers’ Role and Upgrade: How Do They Differ from 3G and 4G?

At a glance, 5G towers might appear indistinguishable from their 3G or 4G ancestors. However, the difference isn’t in their skeletal structure but in the innovative equipment they host. This advanced equipment ushers in unparalleled data speeds, ensuring multiple connections without the network feeling the strain, and guarantees lower latency for an efficient user experience. Thus, while the towers might echo the past, the technology they support is leaps and bounds ahead.

Importance of Cell Tower Locations in Mobile Connectivity

The role of cell towers in modern communication is indispensable. As transmitters and receivers of radio frequency (RF) signals, these towers ensure that your mobile devices maintain seamless connectivity for calls, texts, and internet access. The density and placement of these towers directly influence the quality of your mobile network coverage. In urban areas, where the demand for data is higher, the concentration of cell towers is greater, whereas in rural areas, the distance between towers can lead to weaker signals.

Identifying 5G Towers: How Can You Tell If a Tower is 5G-Enabled?

For most of us, distinguishing between a 4G and a 5G-enabled tower by sight is a tall order. While certain antennas are explicitly installed for 5G, their visual markers might be elusive to the untrained eye. Some towers even straddle both worlds, offering 4G and 5G services concurrently. Yet, as we approach the end of 2023, the prediction is clear: a majority of cell towers will be 5G-enabled. For those curious to check the status of a nearby tower, using specialized measuring tools or a 5G-compatible phone could be the key.

Locating Cell Towers: Tools and Techniques

Comprehensive Online Platforms: Various websites aggregate data on cell tower locations. By entering your location details, you can access a map or list of nearby towers. Remember, while helpful, these resources may not always provide real-time or complete data.

Mobile Applications for Signal Tracking: Numerous apps are available that provide detailed insights into the nearest cell towers, including their signal strength and direction. These applications can be particularly useful for tech enthusiasts who wish to delve deeper into network analysis.

Utilizing the FCC’s Database: The FCC’s Antenna Structure Registration Database is a valuable resource for identifying registered antenna structures, including cell towers, across the United States. This database can be particularly useful for locating larger towers and understanding the network infrastructure in your area.

Observational Techniques: Sometimes, the simplest method is to observe your surroundings. Look out for lattice towers, monopoles, or stealth towers cleverly disguised as natural elements. Recognizing these structures can give you a general idea of where your mobile signals are coming from.

Optimizing Your Cell Signal Reception

Enhancing your mobile signal is not just about locating the nearest cell tower; it’s about understanding how to interact with your environment to improve connectivity:

- Seek Higher Ground: As RF signals travel better vertically, moving to a higher elevation can significantly improve your signal strength.

- Open Space Advantage: Outdoor spaces often provide fewer obstructions, offering a clearer path for the signal to your device. Use this knowledge to position yourself strategically for better reception.

- Wi-Fi Calling as an Alternative: In areas with poor cell coverage but available Wi-Fi, enabling Wi-Fi calling can be a lifesaver. This feature allows you to make calls over a Wi-Fi network, bypassing the need for a strong cellular signal.

- Signal Boosters and Repeaters: For those who consistently face poor signal strength in specific locations like homes or offices, investing in a signal booster or repeater can be a game-changer. These devices amplify the existing signal, providing a more robust connection.

5G Tower Proximity and Safety: Is It Safe to Live Near a 5G Tower?

Safety concerns surrounding technology are neither new nor unexpected. The increasing number of 5G towers has reignited debates about their safety, especially in residential zones. But here’s the consensus: 5G towers, fundamentally, don’t differ dramatically from their 3G or 4G counterparts when it comes to emitting radio waves. Moreover, the frequencies 5G employs aren’t drastically higher. The real differentiator is the tower’s design. Most antennas on these towers point outwards, ensuring that the emissions aren’t directed downwards.

How do 5G Towers work?

5G towers operate based on a combination of advanced technologies and principles of wireless communication. Here’s a simplified breakdown of how 5G towers work:

- Basic Principle: At the most basic level, 5G towers, like their predecessors, transmit and receive signals using radio waves. These waves travel between the tower and compatible devices, such as smartphones or IoT devices.

- Frequency Spectrum: 5G employs a broader range of frequencies, especially higher frequencies called millimeter waves (mmWave). These waves can transmit large amounts of data at very high speeds but have a shorter range than lower frequencies.

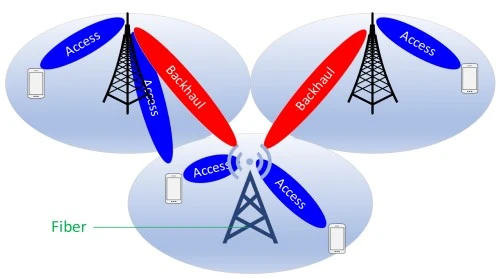

- Small Cells: Given the shorter range of mmWaves, 5G requires a dense network of smaller, more localized base stations, called small cells, in addition to traditional large towers. This setup ensures consistent high-speed coverage, especially in urban areas.

- Massive MIMO: 5G towers utilize Massive Multiple Input Multiple Output (Massive MIMO) technology. This involves having many more antennas on a single tower than 4G, improving the capacity and efficiency of transmissions.

- Beamforming: This is a traffic-signaling system for cellular base stations. In layman’s terms, it’s like a traffic system for cellular signals, directing beams of connectivity to specific devices rather than broadcasting in every direction. This enhances the efficiency and speed of the 5G network.

- Network Slicing: This allows operators to create multiple virtual networks within a single physical 5G network. This ability can ensure that various types of data (like from an IoT device versus a video stream) get the bandwidth and priority they need.

- Edge Computing: 5G networks can leverage edge computing. This involves processing data closer to the data source (like a local server) rather than sending everything to centralized data centers. This reduces latency and speeds up response times.

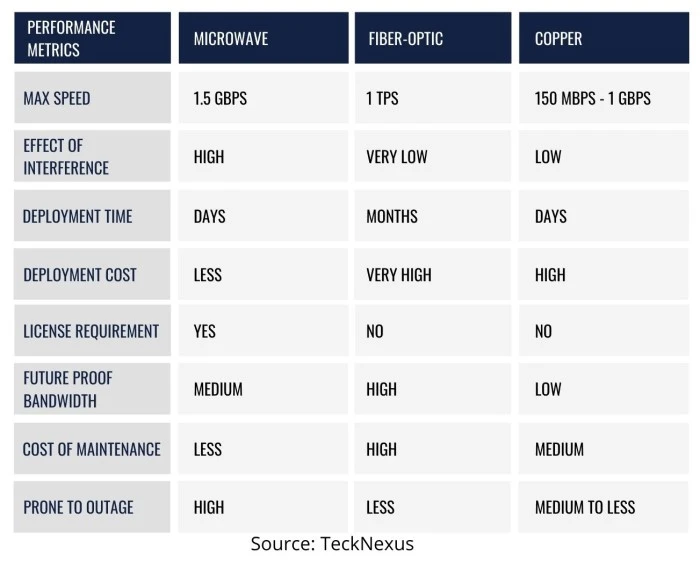

- Backhaul: Once data is collected at the tower, it needs to travel to servers and other parts of the network. This can be done through wired connections, but with 5G, there’s a greater emphasis on wireless backhaul solutions, which use radio waves to transmit data between towers and the core network.

In essence, while the foundational concept behind 5G towers isn’t radically different from earlier generations, the amalgamation of new technologies and strategies makes 5G capable of much faster speeds, greater capacity, and reduced latency.

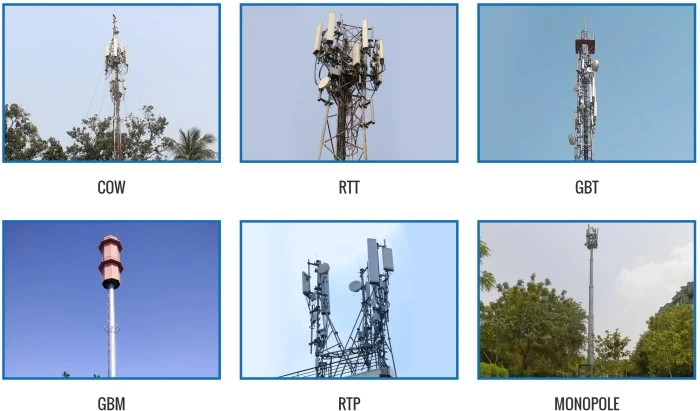

What are the different types of cell towers?

Broadly the cell towers can be classified into four categories, specified below:

Monopole Towers

- Built from a single tubular mast and requires only one foundation

- Small footprint on the ground

- Height can range from 40 feet tall to 200 feet tall across tenants

- Antennas are attached to the exterior on the top of the cell tower

- Some cities have banned the construction of new monopoles because they are eyesores.

Guyed Towers

- They have three guyed lines anchored to the ground and guy wires to anchor and support them.

- Requires a larger amount of land, usually around 100 meters or more

- Height can range from 200 to 300 feet tall and can support multiple wireless tenants

- Antennas are attached to the exterior on the top of the cell tower

Lattice Cell Towers

- Self-supporting towers made of steel latticework in a square or triangular shape

- They are very stable and easy to construct

- Height can range from 200 to 400 ft

- Antennas are attached to the exterior on the top of the cell tower.

Stealth Cell Towers

- In some cities, zoning codes require that towers blend into the surroundings.

- Typically a monopole tree is disguised as a tall tree, e.g., a palm tree or pine tree.

- They are costlier to build

- They cannot provide the same amount of coverage to the tenants as other types of towers

Read 5G Cell Towers: Introduction for details on the above cell tower types.

Related Articles:

- 5G Cell Towers: An Introduction

- What are macro cells, small cells, and Distributed Antenna Systems (DAS) & how it works?

- How do you select cell towers for deployment, and how to upgrade to 5G towers?

- 5G towers backhaul infrastructure?

- How can tower companies protect critical infrastructure through PPP programs?

- Why is it so expensive to get access to cell sites?

- How will 5G DAS and 4G/LTE DAS implementations differ?

- How To Harness the Potential of 5G? Network signal boosters?

Who are the top 12 global 5G tower companies?

China Tower

China Tower Co., Ltd. (“China Tower”) is a large-scale state-owned communications infrastructure service company. The company mainly constructs, maintains, and operates base station supporting facilities such as communication towers, high-speed rail and subway public network coverage, and large-scale indoor distribution systems. It is the primary infrastructure supplier to three major China National Carriers, China Mobile, China Telecom, and China Unicom, and is spread across 31 provinces in China. Founded: 2014 Headquartered: HQ in Beijing, China and has established cell tower locations in 31 provincial-level branches and local and municipal-level branches across the country Infrastructure: 2.1 million communication towers China Tower solutions include: China Tower has implemented the “One Core and Two Wings11” strategy to increase optimization, coordination of resources, and sharing, leveraging them to compete and gain cash flow. One core refers to the traditional cell tower business of providing Macro, Small Cell Towers, and DAS infrastructure. Two wings refer to the TSSAI (Trans-Sector Site Application) business, which provides tower-specific data information to industries, and the Energy business, of providing power to different industries.

- Macro station business consisting of the ordinary ground communication tower, landscape tower, simple tower, ordinary floor tower, floor holding pole

- Microsite business consisting of microcell tower station, holding micro pole station, and social sharing microsite

- Room division business includes constructing commercial buildings, large venues, subway tunnels, communication equipment, and connectivity.

- Site-based information service integrates site resources, dedicated transmission lines, data platforms, and various third-party equipment to provide customers with information services such as data collection, return, aggregation, analysis, and application.

- Energy business, i.e., power generation business,e.g., portable lithium battery packs

China Tower’s 5G Strategy: Rapid scale implementation of 5G technology in China has helped China Tower to improve its financial numbers. During H1, 2021, there was a 16% YoY on their revenues, and as per the company, 5G technology is becoming the key growth driver of their Telecom Service Providers (TSP) business. China Tower has also implemented multiple measures to facilitate large-scale 5G cell towers construction, such as:

- Exerted advantage in resource coordination via actively harnessing the implementation of 5G supporting policies and coordinating site entry in key scenarios

- Improved resource utilization efficiency via fully utilizing resources, including existing towers and ancillary facilities for shelters and making full use of social resources

- Reinforced leadership in technological innovation via enhancing the application of innovative products, including low-cost high-frequency based 5G radio waves cell towers and ancillary facilities for power supply, and promoting the sharing solutions of 5G passive DAS at low costs with access to all frequency bands

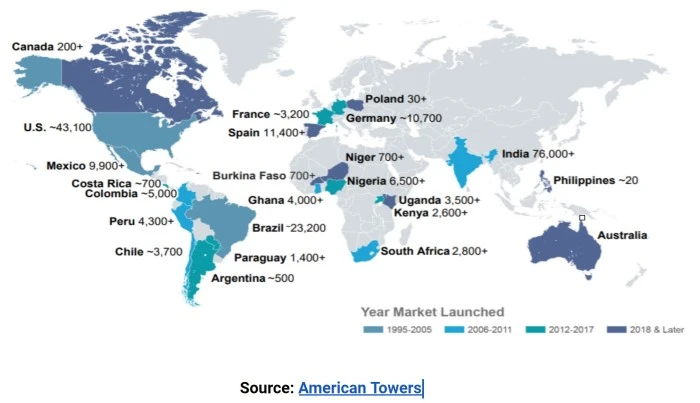

American Tower Company (ATC)

Spread across six continents and 24 Countries and having more than 6000 employees, ATC is one of the leading providers of the wireless infrastructure of cellular communications in North America. Founded: 1995 HQ Location: Boston, MA, with operations across the United States and in Argentina, Australia, Brazil, Burkina Faso, Canada, Chile, Colombia, Costa Rica, France, Germany, Ghana, India, Kenya, Mexico, Niger, Nigeria, Paraguay, Peru, Philippines, Poland, South Africa, Spain, and Uganda Infrastructure: 214,000 communications sites including 43,000 properties in the United States and Canada and more than 171,000 properties internationally

- Build-to-Suite

- ATC provides Site Candidate Information Packages (SCIP) consisting of detailed data analysis for new or collocated sites to MNOs.

- ATC provides Site Data Package (SDP), which contains legal, logistical, and site infrastructure reports

- Cell Tower Acquisition

- For ATC, Tower operations are their core business, backed by financial strength and technical expertise. They support MNOs with fast and efficient deployments.

- Compliance related to the environment, safety, and regulators are ensured.

- Concealed Structures

- With network expansion, the city skylines are getting dominated by cellular towers.

- There can be requirements from civic authorities to conceal those. ATC provides expert solutions by which they beautify and conceal cellular towers.

- Broadcast Towers

- Provides taller towers at great locations for optimal coverage to national broadcasters and local stations, along with the expertise needed to reach target audiences

Strategy and Positioning for ATC 5G Towers: With 43K towers, technical expertise, and provisioning for incremental capacity, ATC is equipped strategically to support wireless carriers in their 5G journey. Also, deploying 5G technology in various bands will increase the new 5G cell tower deployment. In summary, the major drivers for ATC are continued investment in 4G/LTE and increased momentum in 5G. Awards:

- FORTUNE magazine named American Tower one of the World’s Most Admired Companies in 2021.

- American Tower Named to Forbes America’s Best Mid-Size Employers List in 2021

- American Tower Named as One of Newsweek’s America’s Most Responsible Companies 2021

Indus Towers

The merger of Bharti Infratel Limited and Indus Towers formed Indus Towers Limited. The combined strength makes Indus one of the world’s largest telecom cell tower companies. Indus’ leading customers are Bharti Airtel, Vodafone Idea Limited, and Reliance Jio Infocomm Limited, India’s leading wireless telecommunications service providers by revenue. Founded: 2006 HQ Location: Gurgaon, Haryana, India Infrastructure: 183,462 towers and 332,551 colocations (as of 30th September 2021), and a nationwide presence covering all 22 telecom circles. Communication Tower Solutions of Indus Towers include:

- Towers – Deploys ground-based towers, rooftop towers or poles, lightweight hybrid poles, monopoles, or camouflaged towers that merge with the backdrop, in addition to mounting the operator antennae at the appropriate height.

- Tower Operations Center (TOC) – provides an end-to-end tower management solution, incorporating the aspects of top-line maintenance, reliable tracking measures, and sustainable energy practices.

- Power – provides uninterrupted Energy Supply to Telecom Equipment.

- Space acquisition – acquire space from residential and commercial property owners For Housing Telecom and Power Equipment.

- Smart Cities – has rolled out its Smart Digital Infrastructure of Smart poles, LED lights, CCTV cameras, Variable Digital Messaging Board, Environment Sensors, and City Public Wi-Fi, including the fiber backbone, in partnerships with New Delhi Municipal Council (NDMC), Vadodara Municipal Corporation (VMC), Dehradun Smart Cities (DSCL), Bhopal Smart City (BSCDCL)

- Green Sites – Towers are powered through either grid-sourced electricity or diesel generators and devised innovative ways of deploying batteries using the combo solution, the NCU, turbo solutions, variable speed diesel generator sets, and micro cooling solutions that target sites with temperature-sensitive equipment and cool them separately.

Strategy and Positioning for Indus 5G Towers: India has begun its 5G journey, and several operators like Airtel, Vodafone India, and Reliance Jio are doing trials. Indus towers expect the 5G rollout to happen soon and increase demand for Site Infrastructure.

Cellnex

Cellnex is Europe’s leading independent wireless telecommunications operator and 5G infrastructure company. Founded: 2000 HQ Location: Headquartered in Barcelona, Barcelona, they provide service in Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden, and Switzerland. Infrastructure: They have 128,000 sites and 75,000 already in the portfolio; the rest are closed or deployed until 2028. Communication Tower Solutions of Cellnex include:

- Telecom Infrastructure Services – Offers its communications and broadcast sites to wireless operators and customers who distribute their services using wireless technologies.

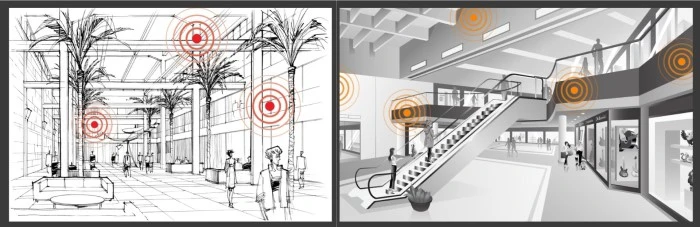

- DAS and Small Cells – Offers multi-operator telephone network solutions for indoor and outdoor facilities with high user densification through technologies such as DAS (Distributed Antenna Systems) and Small Cells

- Audiovisual Broadcast networks – are Spain’s main broadcasting infrastructure operator, offering comprehensive turnkey or modular service to its main private and public audiovisual groups.

- Smart Cities, IoT, and Security – Provides communications networks and IoT solutions to efficiently manage urban resources and services to enable smart cities.

Cellnex 5G Tower Strategy: Cellnex is one of the key proponents driving and accelerating 5G in Europe. They are building 5G infrastructure that they envision as a “neutral host” and have “sharing schemes “between operators. At MWC21 in Barcelona, through Edzcom, a subsidiary of the Group, Cellnex showcased the latest technology in private communications networks to allow companies and industries to perform their processes through their infrastructure. Cellnex also demonstrated at MWC21 below 5G use cases it is working on:

- 5G Catalunya Pilot, jointly with MásMóvil, aims to turn the city of Barcelona into an open innovation stage

- 5GMED – focussed on Future RailwayMobile Communications System (FRMCS) and advanced services for cooperative connected and automated mobility (CCAM)

- 5G Lean project, a collaboration with Nokia and Quobis to bring connectivity to rural areas

Cellnex partnered with BASF (chemical company) to deploy the first private 5G network in a Spain chemical plant. In this deployment, Cellnex will install and deploy a private 5G network at BASF’s production center in La Canonja, Tarragona, for various industrial use cases.

Vantage Towers

Vantage towers aim to develop and deploy mobile infrastructure at scale for accelerating Europe’s transition to 5G. It is the second-largest tower company in Europe. Founded: 2000 HQ Location: Headquartered in Düsseldorf, Germany, they have towers across Germany, Spain, Portugal, Czech Republic, Ireland, Romania, Hungary, and Greece. Infrastructure: They have 82,000 communication sites, including macro sites, small cells, and DAS. 100% of the electricity that Vantage Towers uses to operate its infrastructure is obtained from renewable energy resources such as wind, solar, and hydropower.

Vantage Tower Solutions include:

- Infrastructure assets

- Ground-based and rooftop assets for 4G/LTE and 5G rollout

- DAS and small cells for indoor and outdoor requirements

- Services

- Colocation to rent space, equipment, and network access on ground-based and rooftop tower sites

- Build-to-suit – ground-based and rooftop macro sites, small cell, and distributed antenna system (DAS) solutions

- Enhance network performance services.

Vantage 5G Tower Strategy: Vantage towers look to position itself as a “5G Superhost” to cater to enterprise users and wireless carriers.

Crown Castle

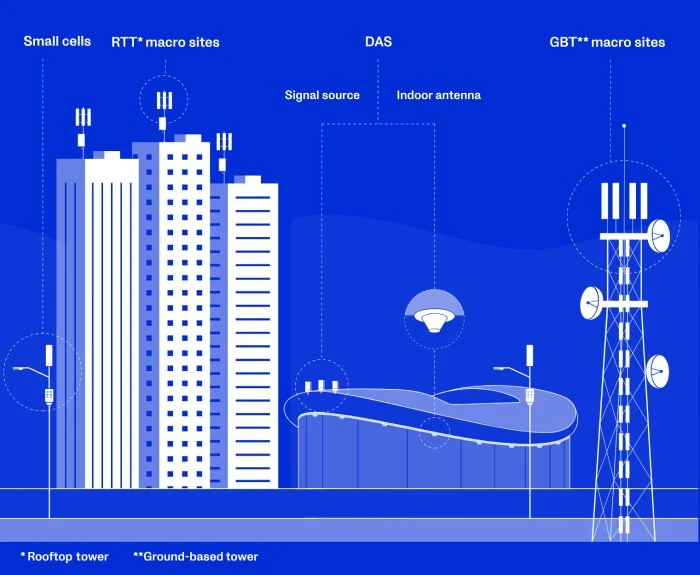

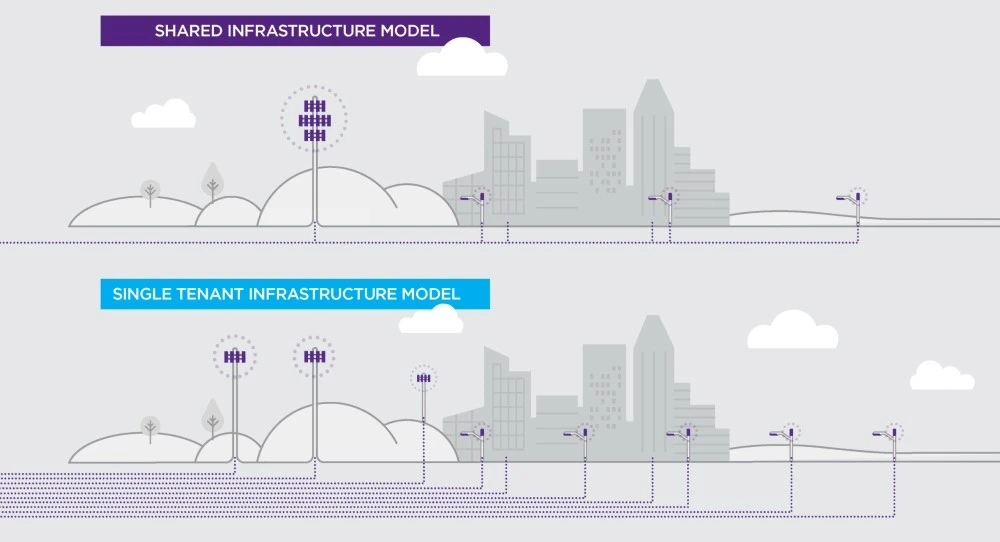

Crown castle brings in 25 years of expertise, with 40K+ towers deployed and 80K+ miles of fiber. It is changing how MNOs are deploying their technologies. It provides two models for cell sites, shared infrastructure and single-tenant, like ATC. Founded: 1994 HQ Location: Houston, TX Infrastructure: 40K+ towers, ~80K small cells on air or under contract, and ~80K route miles of fiber

Tower Solutions of Crown Castle include:

- Towers & Roof-top

- Installs monopole, lattice, and guyed towers, which are fed by backhaul coaxial copper or fiber

- Provides equipment shelters and ground space to allow connectivity for fiber and edge data centers

- In dense areas where towers are not feasible to install, provides rooftop sites.

- Small Cells – Installs small cells for indoor, outdoor, and mixed-use areas working with commercial real estate companies, carriers, and partners.

- Fiber – Includes managed SD-WAN solutions, optical encryption, video transport, dark fiber, wavelength, cloud connect, ethernet, and private networks.

Crown Castle 5G Tower Strategy: Crown Castle has restricted its operations mainly to the US and has concentrated more on Small Cells and Fiber deployment. Its recent ten-year collaborations with Verizon and Dish Network for 15 years for providing site infrastructure point to its increased focus on 5G deployment.

SBA Communications

SBA communication is the third-largest tower company in the Americas. A $51.8 B enterprise operates in 15 markets. It has around 33K+ towers in the United States, Brazil, Canada, Argentina, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Nicaragua, Panama, Peru, and South Africa. They were founded: in 1989. HQ Location: Boca Raton, Florida Infrastructure: 33K+ communication sites, including towers, buildings, rooftops, distributed antenna systems, and small cells.

Tower Solutions of SBA communication include:

- Towers – Owns and operates towers, including towers requested by wireless carriers leveraging in-house site acquisition, zoning, and construction expertise.

- Leasing – Leases antenna space on multi-tenant towers and other communications facilities to wireless service providers under long-term lease contracts.

- Site Management – provides site marketing and management services to property owners. Currently, SBA manages ~ 9,700 communication site locations for third-party property owners.

- Site Development – Provides network design, site identification and acquisition, zoning approvals, and permitting. Cell site audits to augment existing wireless facilities to wireless service providers and operators to develop their network.

- Construction – Provides construction services on a single cell tower basis or by delivering a complete turnkey network deployment solution customized to meet the needs of wireless service providers.

- Technical services – Installation and commissioning; quality and support services; architectural and engineering services; and program management and deployment

SBA 5G Towers Strategy: The two primary businesses of SBA include site leasing and site development. With the continued growth of 5G service in the Americas, a substantial 5G network will continue, driving strong revenue results.

IHS Towers

IHS towers call themselves towers of strength. They provide telecommunications infrastructure to emerging markets. Founded: 2001 HQ Location: Principal executive office is located in the UK Infrastructure: 30,207 towers in nine countries – Colombia, Peru, Brazil, Nigeria, Kuwait, Cote d’Ivoire, Cameroon, Rwanda, Zambia

Tower Solutions of IHS include:

- Colocation and lease amendments – Adding new customers to existing towers and Adding new equipment and services at existing towers for existing customers

- Build-to-suit solutions – Building a new tower site based on customer-specific needs

- DAS Inbuilding solutions, Small cell, Fiber connectivity

- Mobile connectivity to remote rural locations

IHS 5G Towers Strategy: The African market is untapped, with a huge growth opportunity. The strategy for MEA cell tower companies are

More Cell Tower+ Increased Penetration= Increase in SIM sales+ Cash Flow for new Technology

The 5G strategy for IHS towers in Africa will be to push MNOs to quickly migrate from 3G to 4G/LTE and subsequently to 5G.

GTL Infrastructure

GTL Infra is India’s independent Shared Telecom Infrastructure Service Provider with a presence across all 22 telecom circles in India. GTL is the pioneer in introducing the infrastructure-sharing concept in India. Founded: 2004 HQ Location: Navi Mumbai, Maharashtra, India Infrastructure: 28,000+ telecom towers across 22 telecom circles in India.

Tower Solutions of GTL Infra include:

- Tower & Infrastructure sharing

- Provides 2G, 3G, 4G, and 5G cell towers that can be shared across telecom operators in India

- Provides space in shelters and optimum heights for mounting antennae on towers for the operators to host their active equipment

- Energy Management – provides uninterrupted power supply in its Cell Sites at a pre-determined cost from the customer.

GTL 5G Towers Strategy: For India, the spectrum auction will still happen for 5G, and the telecom outlook is still not out of the woods. Although GTL must be ready for 5G, during the last few years, it has lost cash, and liabilities are higher than assets, so its stance on 5G is still not decisive.

Phoenix Tower International (PTI)

Phoenix Tower International owns and operates wireless infrastructure sites and focuses on infrastructure expansion throughout Latin America, the Caribbean, the United States, and Europe. Founded: 2013 HQ Location: Boca Raton, FL Infrastructure: 13,500 towers, 986 km of fiber, and over 80,000 other wireless infrastructure and related sites in 18 countries throughout Europe, the United States, Latin America, and the Caribbean.

Tower Solutions of PTI include:

- Colocation services and Build-to-Suite (for wireless carriers) – Provides reliable collocation services with established processes and local and regional personnel expertise and constructs a high-quality site to suit the specific needs of wireless companies, if it does not have an existing site available to meet customer needs

- Land and rooftop acquisition with Asset management (for landlords) – Works with landlords and real estate owners on land and lease acquisition solutions under existing wireless infrastructure, whether wireless towers or equipment on rooftops.

- Real estate management and marketing – Site marketing, lease management, record keeping, billing, collections, installation oversight, and access management

- Tower acquisition – Provides services from the start of the process for tower acquisition to its final closing, including transaction structures that can act as alternative financing.

Tower Vision

Tower Vision is an independent tower management company specializing in providing shared passive infrastructure and related services to the telecommunication industry in India. India-based customers include Bharti Airtel, Jio, Vodafone Idea, BSNL, MTNL, and Tata Communications. Founded: 2006 HQ Location: Gurgaon, Haryana, India Infrastructure: 9,000 towers and 15,000 + multi tenancies sites across all telecom circles in India and broad portfolio of passive infra including Ground Based Tower (GBM), Ground-Based Mast (GBM), Roof-Top-Pole (RTP), Outdoor Small Sell Sites (ODSC), Cell On Wheels (COW), in-building solutions, smart poles, and fiber-based solutions

Tower Solutions of Tower Vision include:

- Towers and infrastructure sharing

- Ownership, management, and operation of wireless communication towers of all types across the country

- Acquisition, deployment, maintenance, and asset management of telecommunication towers based on the Build, Own, and Operate model.

Helios Towers

Helios Towers (HT) owns and operates telecommunications towers and passive infrastructure in six high-growth African markets. Their primary business is building, acquiring, and operating telecommunications towers capable of accommodating and powering the needs of multiple tenants. Founded: 2009 HQ Location: London, UK and operates across South Africa, DRC, Congo B, Ghana, Tanzania, Senegal, Madagascar, Malawi, Chad, Gabon, Oman Infrastructure: 8,765 sites with 17,773 tenants

Tower Solutions of Helios Towers include:

- Colocation – Leasing space on their existing towers

- Build-to-Suit – Builds cell phone tower to suit customer needs, if the current portfolio does not meet the business needs

- Sale & leaseback – MNO’s existing portfolio of towers is acquired and leased back to their former owners and colocating other tenants to increase the use of infrastructure.

- In-building solutions – provide infrastructure in large-scale buildings such as shopping malls, high-rise buildings, and stadiums.

- Managed services – run day-to-day site operations in case customers do not want sale and leaseback transactions.

Helios Tower 5G Towers Strategy: Helios Towers plans to build 1000 Telecom towers in SA to fuel the growth of 5G. It has negotiated with local players and wants to buy existing cell towers from wireless carriers like Vodacom and MTN.

Way Forward for Tower Companies

Cell towers across different geographies have their drivers and challenges.

- In many markets, like in India, we see consolidation and mergers, the recent merger of Bharti Infratel and Indus towers and the acquisition of VIOM Networks. However, in other Asia markets like China, their outlook looks robust with 5G rollout happenings.

- In regions like Oceania, wireless carriers like Optus and Telstra are selling their stakes in their existing cell towers business.

- We have also seen Operators selling their existing cell phone tower stakes to different companies in Europe and the Americas. This generally fuels the expenses that wireless carriers need to make for 5G deployments.

One of the major expenditures for Tower Companies is power provisioning at the cell towers. In urban areas, it is mostly based on electricity, but in rural areas, they are highly dependent on diesel. With rising awareness of clean environments, there has been a continuous focus from Tower companies to implement greener power like solar panels.

Are 5G Cell Towers Safe, and is it Dangerous to Live Near a 5G Cell Tower?

The safety of 5G cell towers has been a topic of public concern and scientific inquiry. To address this question, it’s essential to understand the technology behind 5G and the nature of the radiofrequency radiation (RFR) it emits.

Understanding 5G Technology

5G, the fifth generation of cellular network technology, offers faster speeds and more reliable internet connections on mobile phones and other devices. Unlike 4G towers, 5G can operate in three different frequency bands:

- Low-band spectrum: Offers better coverage and penetration but with lower speed improvements over 4G.

- Mid-band spectrum: Provides faster speeds and lower latency than the low-band but does not penetrate buildings as effectively.

- High-band spectrum (millimeter waves): Offers the highest speed and capacity but has a shorter range and is obstructed more easily by buildings and other structures.

Radiofrequency Radiation from 5G Towers

5G cell towers, like earlier generation cell towers (3G, 4G), emit RFR, a type of non-ionizing electromagnetic radiation. The key characteristics of RFR from 5G towers are:

- Frequency Range: 5G operates at a higher frequency than previous cellular networks, but it’s still within the non-ionizing part of the electromagnetic spectrum, meaning it lacks sufficient energy to remove tightly bound electrons from atoms and cause ionization, which is required to damage DNA and cause cancer.

- Intensity: The intensity of RFR decreases rapidly with distance. The exposure levels from cell towers are generally low, especially when compared to other sources of RFR we commonly encounter in daily life, like WiFi routers and cell phones.

Health Concerns and Research

- Cancer Risk: Current research, including studies by the International Agency for Research on Cancer (IARC) and the American Cancer Society, suggests that exposure to non-ionizing radiation from cell towers is not sufficient to cause cancer. These studies, however, are ongoing, as 5G is a relatively new technology.

- Other Health Effects: Some studies have explored potential links between cell tower radiation and other health issues like headaches, sleep disturbances, or cognitive disruption, but the results are not conclusive.

Regulatory Standards and Compliance

Regulatory bodies like the Federal Communications Commission (FCC) in the United States set exposure limits for RFR from cell towers. These standards are based on thresholds for known adverse health effects and include a safety margin. Cell towers, including 5G towers, are required to comply with these standards.

Proximity Considerations

Living near a 5G tower doesn’t necessarily mean higher exposure to RFR. As mentioned, the strength of the radiation decreases with distance, and the antennas are typically designed to spread the signal horizontally rather than directly downward.

Personal Experiences and Perceptions

Individual comfort levels with living near 5G towers can vary. Some people report no issues living close to cell towers, while others express discomfort or concern, particularly when small cells are installed close to residential areas.

Conclusion

The balance of scientific evidence to date suggests that 5G cell towers are safe and pose minimal health risks to people living nearby. However, it is important to continue monitoring and researching, especially as the technology evolves and becomes more widespread. For those concerned about potential risks, consulting credible sources and staying informed about ongoing research is advisable.

- November 5, 2023

An Interview with Ravi Puvvala, VP Strategic Accounts, and Partnerships at HARMAN Automotive

What are the challenges of critical infrastructure?

When we think about infrastructure, in any part of the world, there are three classifications of companies. They are

- Mobile network operators

- Tower operators

- Road operators

There are a lot of common infrastructure functionalities across all three categories of the companies. The common functionalities include any type of wireless infrastructure, which is a base station, a repeater, or a back-end connectivity network. And sometimes, the real estate is shared between all of the three entities. But they have different sets of goals, and this is where we are seeing critical issues in terms of how to make progress. Because, you know, each of these categories of companies, are looking to monetize their investment. And at times they collide with the other type of companies who are trying to protect their infrastructure to provide critical functionalities, like traffic lights, which is part of the road operators’ infrastructure. The tower operators are providing the real estate space so that the mobile operators can include their base stations and transmission towers, but the mobile operators are leveraging both the real estate of the road operator or the tower operator to run a multi-billion dollar business. So in all of this, what we really foresee is a lack of a business model on how we can leverage infrastructure through public-private partnerships.

What are PPP programs and how does it accelerate infrastructure investment?

If we look at roadmaps from the government, the governments are essentially having a 20-year plan. And it will take a State Department’s of transportation counties and cities, truly 20 years to deploy critical infrastructure. For us to accelerate 5G into every part of the country, we need collaboration between public entities and private entities. And, thanks to President Biden, there’s a $1.2 trillion bill to improve the critical infrastructure, but that needs to trickle down to how the funding goes into not just at a city or a county level, but more at the smart state level. This is where a coalition of partnerships is required, where everybody can contribute their technology, the resources, and most importantly building a business case in terms of what problems that they are trying to solve for the local state. And at the end of the day, it should be a zero-sum game to the state in return, where a business model all of these entities can share the revenue.

What are the Use Cases and related problems that we should be solving?

From the World of transportation when we look at smart transportation and how we are building smart roads, most of the traffic on these roads is towards commercial vehicle freight. They occupy 90% of the vehicle capacity on the road and there is a need to provide a safe infrastructure to these companies. When we envision how should be smart transportation look like we are seeing many states are trying to deploy automated freight trucking. If we can provide a network and infrastructure not just for trucking companies, but we can dedicate certain lanes for automated vehicles. When we look at the technology at a particular intersection, there are a lot of ways we can provide safety for vulnerable road users. These could be bicyclists, two-wheelers, who have to share the road where all types of vehicles and trucks. We are really hoping that the infrastructure bill will improve and provide a framework. But what is also concerning is that there are many cybersecurity problems that we are worried about. And there is a growing threat in terms of potential attacks on critical infrastructure. So, we are really looking at the type of use cases ranging from automated vehicles, infrastructure for automated vehicles, and also building a framework where we can provide security to the critical infrastructure. In short, we are looking at a combination of advanced networking, as well as cybersecurity as a framework to provide a plethora of use cases that come out of it.

What are the ongoing use cases and activities in the United States?

USDOT funded projects to build dedicated lanes from downtown Detroit to Ann Arbor

In the state of Michigan, there are a lot of federally funded projects that are being deployed, especially a project that allows building a dedicated lane for autonomous vehicles, which would go from downtown Detroit to Ann Arbor. There are many companies, including the company that came out of Google’s Sidewalk Labs, CAVNUE – they work with the local order volumes, especially the big three. Also, the state DOD is to provide an infrastructure where we can deploy these autonomous vehicles through dedicated lanes, but also have the site infrastructure to be able to monitor if these vehicles are performing in a safe manner. Similar efforts are going on with other states.

Austin, Texas Public Infrastructure Network Nodes through private companies

The city of Austin, for many reasons, is attracting a lot of manufacturing capacity from companies like Samsung, and also from auto OEMs, like Tesla. Tesla is also moving their headquarters to Austin. And that’s also driving a lot of the public, private companies to come up with public-private partnerships on how they can improve the infrastructure. There’s an institute called autonomy Institute in Austin, where they’re trying to deploy public infrastructure network nodes. This is sort of a concept on how to build a smart tower or a smart pole. So if you can imagine a pole and every section of the pole that trying to build a technology that can be contributed to your partner. So just to give you an example of what a smart pole could look like, the bottom of the pole could be an air D server, and then the next portion of the pole could be a Wi-Fi access point. And then the next portion of the pole could be a small cell integrated with 5G, and then the next portion of the pole could be your distributed antennas, or technology that can improve smart lightning. So essentially, what they’re trying to build is a pole, where multiple of these technologies are integrated, and make it as a blueprint for a sort of smart poles posts that can be deployed not just on streets, arterial roads, but also on highways. So this is an example of how public-private partnerships can come together to build smart infrastructure network nodes. This in return to be able to have the rights to access to data or be able to provide mechanisms to safely navigate both autonomous vehicles as well as nonautonomous vehicles on the same on, you know, on the same highways.

Arizona through Smart State efforts

One of the things noted from the last decade of efforts through Smart City programs is that it was taking a lot of time for startups or technology companies to engage at a city level. On average, the engagement lifetime could be sometimes four years or even longer than that, which was a very time-consuming effort. What Arizona has been able to achieve is that they are able to collect many cities, many counties under one umbrella called a smart state. This initiative is led by an individual named Dominic Papa, who is able to collect all of the counties to go through a single procurement process. They’re setting an example of how the state should be focusing on deploying the infrastructure throughout the region. Every state in the country has its top use cases that they care about e.g. if we take the case of Texas, they care a lot about the taxes. If we talk about the border states like Arizona there’s a lot of freight that’s going across the borders, so they need to ensure there is safe freight trucking that’s going between the borders. In Arizona, we have also seen companies like Waymo that are very advanced in deploying autonomous vehicles. The legislation allows them to start experimenting in the state of Arizona. So, Arizona has become a real hub of attracting many innovative technology companies due to weather, due to very sophisticated highway systems, and also the driver mechanism where the state is fronting a lot of the technology validation, building a blueprint, and providing an avenue to navigate the funding between all the counties in the state.

- November 5, 2023

Despite the shiny consumer gadgets and promises of industry 4.0, Telecom companies are keeping a secret: they’re not as efficient at acquiring and managing cell sites as they should be. Here are five issues that Telecom, and in particular 5G providers, need to grapple with.

1: The industry started in the 1980s

5G engineers and business managers are world-class. The problem is that mobile networks are built on legacy systems and practices that were established with the mobile industry itself, in the 1980s and 1990s.

These were fine when mobile networks needed only a small increase in cell sites every year. However, these current practices do not support the scale of the networks that the full 5G vision requires.

2: Getting access to information is hard and expensive

Finding a cell site in 2021 is liking finding an apartment in the 1990s. Thirty years ago you might have found an apartment by browsing ads in a newspaper, taking phone numbers from paper signs in grocery stores, or just using your personal networks. Telecom companies rely on essentially the same processes in 2021. Telecom companies still pay engineers to walk the streets eye-balling promising properties. They then file ‘Site Finders Reports’ listing promising locations.

This process is slow and unproductive. Of those potential sites, the majority of these fail as the real estate owner cannot be found or business negotiations collapse. Each of those failed negotiations represents thousands of dollars in costs – costs that are absorbed by the industry and ultimately passed on to consumers. 5G providers could save time and money by being able to access digital solutions to improve the way willing landlords lease their properties for a cell site in a given neighborhood.

3: Negotiations with landlords may favor one side or the other

These practices may bias negotiations in favor of landlords or those looking for sites. Why? For the same reason that you may be more likely to get ripped off going to a car dealership than using an online broker – asymmetric information. For example, when the potential tenant, the mobile operator or Towerco, has incomplete information about alternative sites and how much they would cost, they tend to end up paying more than they need to. Markets, especially in the telecoms sector, have advanced in leaps and bounds since the 1990s. These developments have generally empowered buyers with more complete information about their options.

In 2021 you are more likely to find a place to live by browsing properties online in the area you want to live, see what you can get for your money, and choose a property that looks like a good deal to you. This same phenomenon has transformed every area of modern life, from how consumers choose financial products, to how they hail rides in taxis. Just as Airbnb revealed that many property owners were happy to rent out their spare room for a little extra cash, we suspect there are many landlords who are not aware of the opportunities of cell site leasing. Local governments, for example, would often value the extra income as they face unrelenting pressure to provide value for money to taxpayers.

4: Cell site co-location can be made easier to unlock the opportunity

With a significant need to increase capacity, cell sites must come from both new builds and co-location on existing sites. Whether existing wireless carriers, new market entrants (such as CBRS) or Internet of Things deployments, access to existing cell sites can significantly increase the speed of deployment whilst reducing the costs and burden of developing a new site. This co-location provides a significant opportunity for tower companies, infrastructure providers, and wireless carriers who own their own sites. Making these existing sites available to the wider market can help reduce overheads by sharing costs across the industry.

5: The industry still relies on paper records

Original contracts were often made on paper. This made sense in the 1990s, but in the 2020s, these records tend to be incomplete, obsolete, or just wrong, especially when companies are spun off or merge with others. The result is that it can be hard to find the right phone number to call to re-negotiate an expiring contract or just to make a routine maintenance visit. Sometimes the most relevant information is held in the inbox of a manager who retired several years ago and is essentially lost to the company.

The telecoms industry is fantastic at producing innovative products and services. However, the core processes required to deploy the underlying network have not evolved. By embracing digitization and cloud-based platforms, the deployment of next-generation networks can finally keep pace and underpin these innovations.

- November 5, 2023

We’ve heard a lot about 5G as the next generation of telecommunications. It’s clear that 5G is a drastically improved connection, and, according to the marketing, can even bring high-speed networks to communities and places that have not had convenient access and fast data speeds in the past.

So, why is it taking so long to roll out?

Perhaps the biggest delay is that replacing widely used legacy technology is never going to be a quick, easy or cheap process. Deploying 5G-capable millimeter-wave or C-Band (mmWave) small cells – as telecoms in the U.S. are doing now – requires significant capital.

In addition, there are major technological challenges for providers to overcome – which have been reflected in the early criticisms about mmWave 5G cells – including line-of-sight conditions, rain fade, and device capability. Ongoing research and testing are working out the kinks in the cells, but the early reviews have caused providers and consumers both to rethink priorities.

These operators now face a difficult balancing act: deliver on the lightning-fast speeds promised by 5G marketing while deciding how much money to invest in deploying mmWave and C-Band cells. Fortunately, there is a tool available to operators that is much more affordable and instantly solves the connection issue: commercial 5G network signal boosters.

The benefits of network signal boosters to enhance 5G

A 5G network signal booster serves as a mini base station, solving many of the coverage problems that have plagued the technology rollout. Boosters used in conjunction with 5G new radio nodes (gNBs) are often called “repeaters,” and will allow the signal to reach a much larger population for a much lower cost.

The significantly lower cost of installing a network booster as compared to installing a gNB is partly due to the booster not requiring pulling new fiber to a site, or requiring a long, on-site construction process. This lets operators radically expand their coverage in a very short period of time. How significant are the savings?

Recent research from SureCall commissioned from analyst firm iGR indicated that deploying a 5G mmWave booster cost an average of just 10% of the overall expenditure from installing a gNB and running fiber to the site. If the fiber was already there, then installing the booster was 15% of the cost. Operators are realizing significant savings outside of installation costs, as well.

Network signal boosters are deployable within a few hours, capable of combining access and transport traffic, and do not require fiber backhaul, all lowering build, and operational expenditures. Current generations of 5G mmWave network signal boosters are inherently reliable and use less power than a gNB – many can even run on solar.

For network operators struggling to get their 5G signal to a waiting public, this hybrid network architecture of gNBs and signal boosters is likely to become the preferred path. The potent combination of savings and benefits can get a large user base up and running quickly, and at a much lower cost.

The bottom line on signal boosters is literally the bottom line: Augmented 5G coverage at low costs. Network signal boosters allow operators to minimize the number of gNBs deployed and get revenue flowing quickly after lighting up the 5G node. This means the return on investment of installing a new gNB can be measured in months instead of years.

Rolling out powerful networks nationwide

For years, booster manufacturers have known about the signal frequency issue that is now plaguing 5G. They have worked with carriers and stakeholders to create products that serve different deployment configurations and frequency bands. In the U.S., the three major carriers (Verizon, AT&T, and T-Mobile) have all adopted mmWave and C-Band to support their 5G rollouts. Verizon, in particular, has led the way with mmWave, initially adopting a high-band spectrum to create a fixed wireless access home broadband service, and then building out mmWave 5G mobile network.

This product now reaches areas in more than 80 cities. As a key component of its network, Verizon has deployed network signal boosters to maximize the signal and improve performance for the end-user. This allows the company to drastically increase the service of its 5G Ultra Wideband® network in a cost-effective and reliable way – and the booster can be deployed within hours.

As companies continue to build networks around the world, key learnings from early examples like Verizon will point to the power of a hybrid 5G architecture that combines gNB’s and signal boosters for a faster and more cost-effective deployment. Network signal boosters are an ideal solution for realizing the potential benefits of 5G.

Boosters consume much less power than a gNB, don’t require backhaul, can be up and running in just hours, and need minimal maintenance. By embracing signal boosters, operators can offer customers the true benefits of 5G and realize positive ROI in months rather than years.

- March 18, 2024

What are the frequency bands associated with 5G?

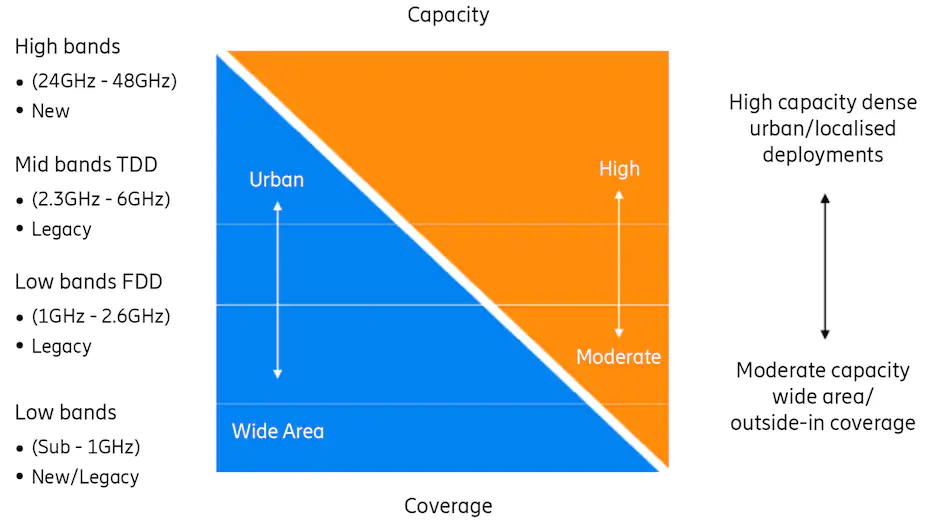

5G technology is carried over low, mid, and high-frequency bands with their own characteristics that alter how distributed antenna systems must be architected within buildings. High bands, such as mmWave, provide the fastest speeds and lowest latency but cover shorter distances and are easily disrupted by man-made and natural obstacles. Conversely, low bands like 600MHz offer slower 5G speeds but can travel longer distances and are more resilient to interference by materials. Mid band frequencies 2.5GHz and C-band are middling in both coverage and speeds.

For the purposes of this discussion, the two primary 5G frequency bands we expect to see moving forward are mmWave and C-band. Each brings different strengths to a 5G deployment, helping to create tailored signals for specific use cases. mmWave has the highest bandwidth of available technology, while C-band is a newer trend in the wireless industry. During a recent auction, all major carriers bid heavily on C-band and spent over $80 billion.

What’s different about mmWave?

mmWave provides higher bandwidth than C-band, allowing for better download and browsing speeds, as well as lower latency. The caveat is that it does not travel as far as other bands as it requires a line of sight to the antenna. With this smaller coverage area, mmWave DAS needs more antennas in a space than a 4G/LTE system would require.

This is the same trend we saw when we jumped from 3G to 4G/LTE frequencies. Repeater placement can also help overcome any problem areas, like stairwells, where coverage propagation is a challenge.

What’s C-band’s role?

C-band has a higher frequency than bands used for 4G/LTE technology, but has higher antenna sensitivity, meaning it doesn’t propagate as well. When compared to 4G/LTE, C-band is better for wider deployment, but increased antenna sensitivity requires a denser antenna deployment within the DAS. It doesn’t require as much as mmWave, but it’s an increase from the previous generation. C-band can go through walls and its DAS is implemented in the same way as 4G/LTE bands.

How should decision-makers prepare for 5G DAS deployments?

- January 15, 2024

Introduction

Early 2020. The world was navigating itself well through its myriad of problems using innovation, automation, and the adoption of new technologies. But a microorganism of the size of 50nm had other plans. By the first quarter of 2020, it has spread its venomous tentacles across the world. All hustle-bustle of the world is gone, and people from corporates to daily wagers were locked up at their homes.

But could the world economy take a pit stop? The answer was simply NO. To cater to this emerging situation, the world woke up to an unprecedented adoption of technology and digital transformation. There was a ubiquitous need for high-speed, reliable, and low latency telecommunication standards.

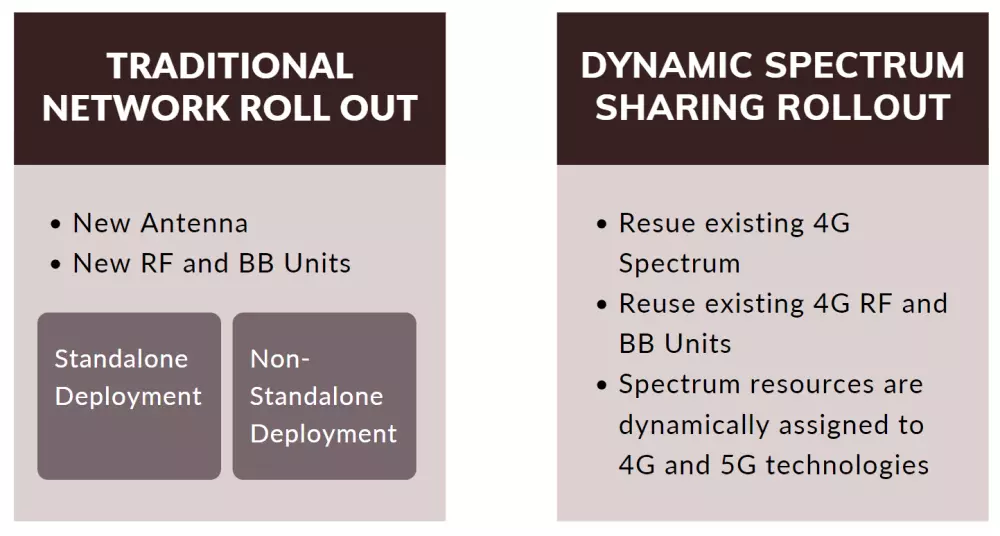

The digital transformation continued with more vigor, with the world-embracing 5G. 5G provided a communication system that was fast, reliable, had low latency and was designed to support a plethora of applications across industry verticals. 5G operated across the spectrum from mm-wave in the high band, to cm wave in mid-band and low-band. The year 2020 and 2021 saw several CSPs involved in trials of 5G and subsequent commercial network launches.

As of Sept 2021, there are around 180 live commercial deployments of 5G globally.

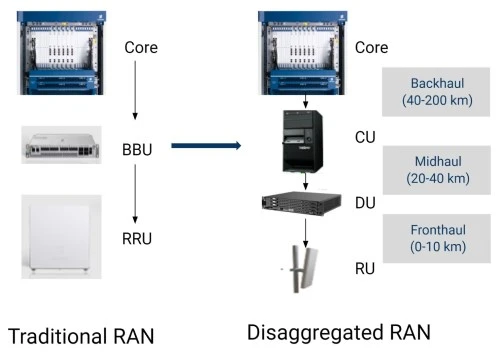

Based on the market forecast by GSMA Intelligence 5G connections are expected to reach 15% of the global connection base by 2025. This will mean a huge investment from the wireless carriers to not only procure 5G gears but also to acquire site infrastructure to install them. Telecommunication deployment be it wireline or wireless, is built on active and passive components. The passive components are generally the site building, cell towers, ducts, and cable and the active components generally consist of telecommunication gears like base stations, Remote Radio Units, and antenna systems.

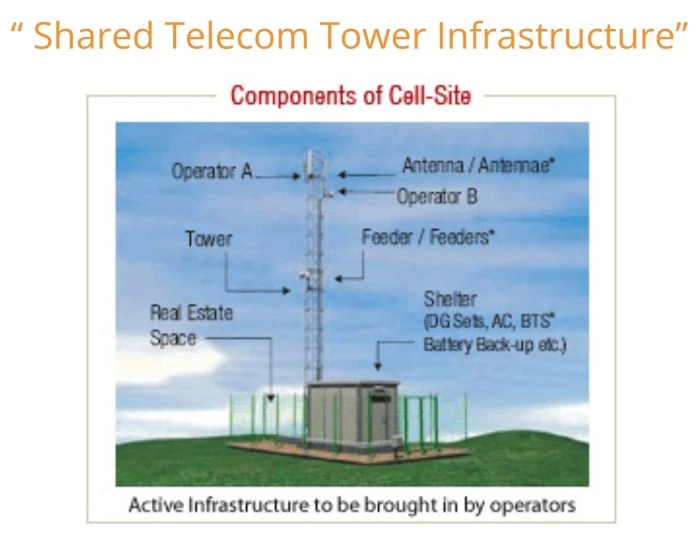

In most commercial presentations about the deployment of any telecom technology, discussions move around the telecom gears, but site infrastructure is vital to power the entire technology implementation. While discussing site infrastructure we frequently hear two terms cell towers and cell sites. Quite often, they are used interchangeably, but there is a striking difference between the two.

Cell Site: The Cell-Site is used to identify the entire infrastructure (active and passive) be it antennas, buildings, telecom gears (comprising of the base station, Remote Radio Head), and power resources.

Cell Towers: Cell towers are the poles or mast, on which antenna systems, RRH (Remote Radio Head) are installed. A cell tower can be shared by multiple wireless carriers, or a single wireless carrier can use it. Generally, the cell towers are taken on rent or lease by the wireless carrier to install the gears.

How do 5G Towers Look Like? What are the different types of Cell Towers?

Monopole Towers

- Built from a single tubular mast and requires only one foundation

- Small footprint on the ground

- Height can range from 40 feet tall to 200 feet tall across tenants

- Antennas are attached to the exterior on the top of the tower

- Some cities have banned the construction of new monopoles because they are eyesores.

Guyed Towers

- They have three guyed lines anchored to the ground, in addition to guy wires to anchor and support them.

- Requires larger amount of land, usually around 100 meters or more

- Height can range from 200 to 300 feet tall and can support multiple wireless tenants

- Antennas are attached to the exterior on the top of the tower

Lattice Cell Towers

- Self-supporting towers made of steel latticework in square or triangular shape

- They are very stable and easy to construct

- Height can range from 200 to 400 ft

- Antennas are attached to the exterior on the top of the tower.

Stealth Cell Towers

- In some cities, zoning codes require that towers should blend in the surroundings

- Typically a monopole tree is disguised as a tall tree e.g. palm tree or pine tree

- They are costlier to build

- They cannot provide the same amount of coverage to the tenants, like other types of towers

So now that we understand what a 5G cell tower looks like, let us, deep-dive, understand the component of telecom gears that can be installed on a cell tower. To deploy a 5G technology on a cell site, we need a 5G BBU (Base Band Unit), which does the digital signal processing, and an RRU (Remote Radio Head) along with antenna systems for RF processing and antenna systems.

- November 5, 2023

Macro Cells and Small Cells

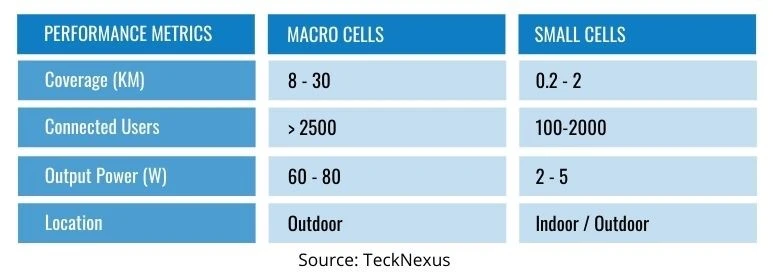

5G operates across a wide spectrum of bandwidth and supports a varied number of use cases. This wide spectrum will allow wireless carriers to conceptualize a large number of deployment options to suit their needs. 5G will operate in two frequency ranges – Frequency Range 1 (FR 1- 410MHZ to 7.1 GHz) and Frequency Range 2 (FR2 -24.25Ghz – 52.6 GHz). Deployment options for wireless carriers can range from Macro Cells (for coverage) to small cells (for capacity).

Wireless carriers will consider capacity, coverage, mobility, and spectrum availability to decide their deployment strategies to determine whether they will go for Macro and Small cells. Let us now understand the definitions of Macro Cell and Small Cell.

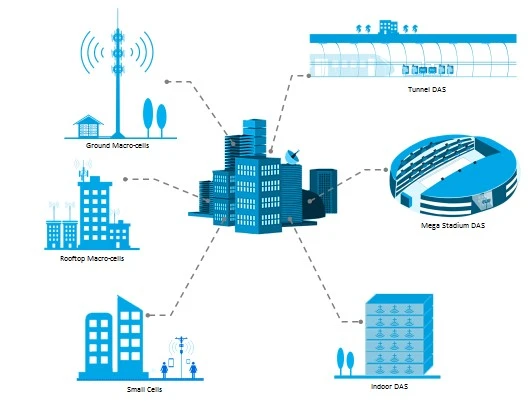

Macro Cell: Macro Cell typically provides coverage to a large geographic area. They are typically installed on rooftops, poles, and in some instances, on Ground-Based Towers. The major advantage of using Macrocell in 5G is that it can provide 5G services to a large geographic area. 5G macro cells also use Massive MIMO technology, which allows large transmission and reception of data.

Small Cell: Small Cell has been used to deploy legacy technologies like 3G and 4G and would play a more important role in 5G deployment. It will empower wireless carriers to deploy cell sites in strategic locations and offer higher capacities in the small coverage area.

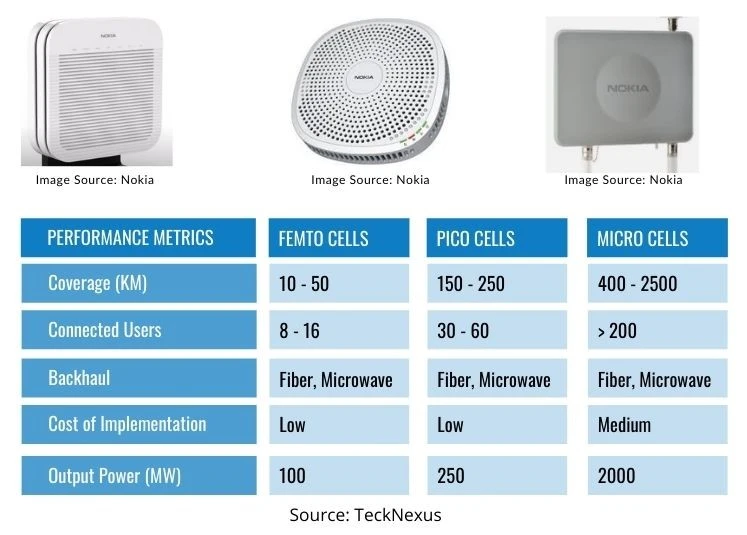

Femto Cell vs. Pico Cell vs. Micro Cell

Femto Cell: Femto cells are small mobile base stations that are used to extend coverage in the residential or small office complexes. They are used in areas with network congestion, and it acts to offload a Macro Cell. It can also serve to provide in-building coverage.

Pico Cell: Pico Cells are small cellular base stations covering areas like buildings, hotels, hospitals, and shopping malls. It is generally used to extend coverage and increase throughput.

Micro Cell: Microcells are generally a bit bigger in comparison to Pico and Femto Cells. They can support more no of connected users and cover a greater geographic area. They are mostly used for enterprise premises.

Small Cell Forecast, Challenges, and Opportunities

The small cell market size is expected to grow from USD 626 million in 2020 to USD 2413 million by 2025, as per the research by MarketsandMarkets firm.

One of the major drivers of the small cell market is the introduction of CBRS (Citizen Broadband Radio Service) in private networks. Both LTE and 5G private network is gaining business potential which can beef up small cell deployment. With mm-Wave 5G deployment taking shape of commercial network deployment, small cells will play a major role in paving the success story of 5G use cases.

Challenges:

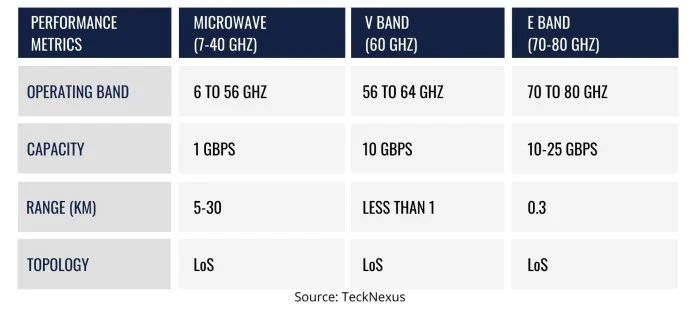

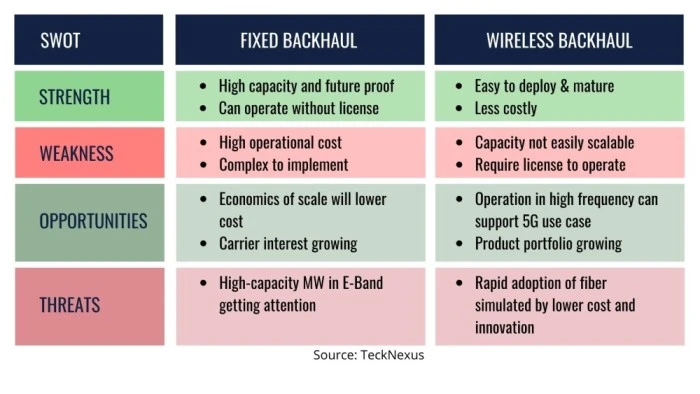

But the major challenge in the rapid small cell deployment will be the backhaul connectivity. The small cell will be deployed to cater to increase capacity in residential or enterprise premises where commissioning of fiber can be a challenge. If proper bandwidth at backhaul is not available, it can be a potential bottleneck. Therefore, to tackle the issue of backhaul, the wireless carriers need to think of alternate backhaul options like satellite, high-capacity Microwave.

Opportunities:

One of the major opportunities for small cells is that since the transmitted power for small cells is quite low the Mobile terminals will also need to operate in small powers, which will enhance the better battery life of the UEs. This will improve the performance of the mobile handsets too.

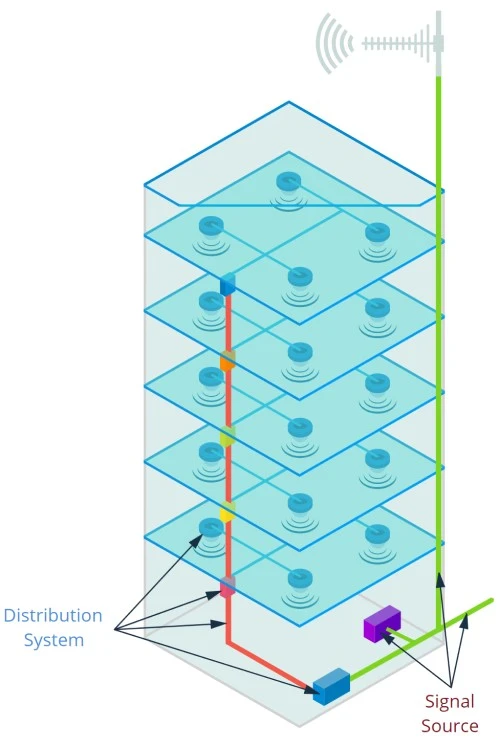

Distributed Antenna System (DAS)