Home » 5G Magazine » Open RAN | 5G Magazine July 2022 Edition

Open RAN | 5G Magazine July 2022 Edition

Featured articles in this edition

Spotlight Your Innovation in 5G Magazine

- March 10, 2024

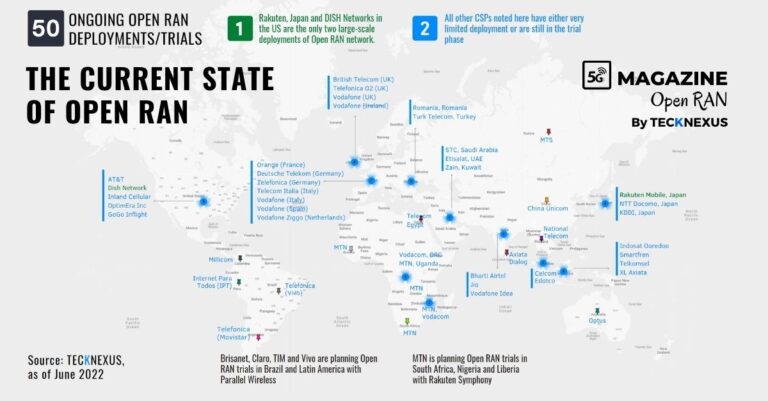

As of June 2022, there are 50 ongoing open RAN deployments and trials.

Rakuten, Japan, and DISH Networks in the US are the only two large-scale deployments of Open RAN network.

All other CSPs noted here have very limited deployment or are still in a trial such as: AT&T, Inland Cellular, OptimEra Inc, GoGo Inflight, Millicom, Internet Para Todos (IPT), Telefonica (Vivo), Telefonica (Movistar), British Telecom (UK), Telefonica O2 (UK) ,Vodafone, (UK) Vodafone (Ireland), Orange (France), Deutsche Telekom (Germany), Telefonica (Germany), Telecom Italia (Italy), Vodafone (Italy), Vodafone (Spain), Vodafone Ziggo (Netherlands), Romania (Romania), Turk Telecom, MTS, Turkey, STC, Saudi Arabia Etisalat, UAE Zain, Kuwait, Telecom Egypt, Vodacom, DRC MTN, Uganda and more.

- March 16, 2024

How did Rakuten Mobile know Open RAN was ready before going all-in for its ambitious network buildout in Japan?

Rakuten Mobile did not know that Open RAN was ready when it started its journey in 2018. The important message is that nothing is ever completely ready until it’s done, and then it’s in decline. That’s the same with 2G because it needed 3G, 3G needed 4G, and 4G needed 5G.

There was a lot of skepticism when Tareq Amin, who was Rakuten Mobile CTO at the time, decided to go down the Open RAN direction and the fully cloud-native virtualized direction in 2018. We have realized that when you do something and try very hard, the rewards are very good.

275,000 cells deployed while maintaining operational headcount of 250 people

The message here is not of being ready but being willing to try and do something different, which is always hard. It will be hard for everybody for different reasons, but that’s how you get different results.

When will we know whether Rakuten Mobile’s Open RAN strategy has been a success and an indicator of Open RAN maturity?

Operationally, we have already seen success in the accelerated rollout of 275,000 cells with very few people operating the network. This is possible because they’re not directly operating the network. They’re using a software platform, Symworld, to create that hyper-scale.

We have proven that cloud-based, fully virtualized software-centric mobile networks are absolutely possible to implement in highly dense coverage areas as well. For example, Tokyo is one of the most highly densely populated markets in the world and we are serving this demanding region with an Open RAN solution.

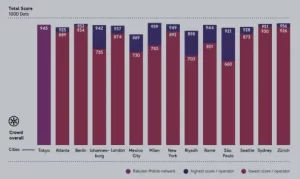

Rakuten Mobile network performance recognized by independent review

Rakuten Mobile’s network in Tokyo receives “very good” rating from independent analyst firm umlaut.

Source: umlaut – 2022/04 Audit Report – OpenRAN Network Rakuten Mobile Japan

Score Comparison – Overall | Selected International Cities

- March 10, 2024

Key RAN disaggregation Components

For RAN disaggregation, we consider below four main components.

Modular/Decomposed

Make the big problem into several smaller problems to incentivize more specialized companies to enter the ecosystem and offer solutions for specific subcomponents. Thereby reducing the entry barrier for new entrants.

Cloudification/Software-based

We can learn and decouple hardware from software based on the success of cloudification in other businesses. Adopting the DevOps approach in software development and utilizing commodity hardware allows us to take advantage of the economies of scale.

Open APIs and Ecosystem

There is a need to define open and well-defined interfaces that allow easier interoperability between the modules in the solution. The industry has proven this with 3GPP-defined global standards and interfaces between the network elements. O-RAN ALLIANCE, TIP, and other communities have emerged to define the Open RAN architecture and related interfaces.

Automation

Disaggregation creates complexity from the standpoint of how we can integrate the solution back in. For this, we need automation capabilities. How can we automate all the repeatable tasks in the component life cycle management of the disaggregated solution?

- March 18, 2024

Introduction

Currently, traditional RAN vendors are delivering to operators a ready-for-deployment RAN solution, which is already fully tested and pre-integrated in their own facilities.

Each vendor manages its own lab and testing resources so that the associated overhead in integration complexity is transparent to the operator. Hardware and software are tied, and the product roadmap is built according to 3GPP specifications for radio functionalities. Logical interfaces between subsystems of the radio site are proprietary defined, so no interoperability between different vendors is possible.

OPEN RAN provides increased flexibility and potential by enabling the selection of “best of breed” network components from a multivendor ecosystem, meaning a significant TCO reduction for operators.

Our estimations consider a potential average of 30% savings in radio and baseband hardware in the long term.

For the open ecosystem to foster innovation and new technology developments whilst also driving costs down, it is necessary that the product development efforts are shared by all stakeholders.

A coordinated community will ensure the full interoperability of the disaggregated solution. This coordination addresses the full interoperability of the disaggregated solution.

System Integration is one of the key areas to consider, as there is no longer a unique entity responsible for the complete E2E solution, including software life cycle management, KPI assurance, service management, etc. A new approach to system integration during the deployment phase is also required to efficiently manage the supply chain disaggregation and fully capture the TCO savings.

- March 16, 2024

What does Open RAN mean to Supermicro?

I think probably the biggest confusion with Open RAN is that there are not one, but two axes that people are looking at.

Disaggregated hardware and software

On one axis is the concept of disaggregated hardware and software. The idea behind that is that you can run virtualized software for performance and run it on standardized hardware. And that’s often why when we write about Open RAN, the term tends to come from that, and it came out of the telecom infrastructure project initiative that Facebook started.

Industry-Directed O-RAN Alliance

The second one is more industry-directed and comes out of the O-RAN Alliance. And what the O-RAN Alliance wants to do is create standardized interfaces between the centralized unit (CU), which sits at the edge of the network, the distributed unit (DU), which performs the layer one processing, and the radio unit (RU).

The idea behind this is that you could use company A’s radio unit with company B’s DU and company C’s CU. And those are the, sort of, separate layers. This is often called OpenRAN and is driven by the O-RAN Alliance, an operator-led standards body and initiative.

Proprietary RAN vs Proprietary hardware

Now you get four quadrants out of this, and you can do all combinations. So you can have a proprietary RAN implementation that runs on disaggregated hardware and software. And you can have an OpenRAN implementation that runs on proprietary hardware. You can do either those two or have a completely open implementation with standardized interfaces but not running on commercially available hardware.

Cloud-Native Architecture

For us at Supermicro in particular, we are most interested in the disaggregated hardware and software because we want to go after that standardized server model. And it’s the standardized server model that ties back to the 5G cloud-native architecture. So, when you put those two together, you get the benefits of 5G Open RAN.

How would you describe the state of the Open RAN market today?

It’s happening very quickly now. Initially, there was a lot of skepticism and different degrees of buy-in as to whether people would really adopt Open RAN and whether it provided the benefits.

Adoption – Now we see that there is an industry-wide adoption at different levels. Ericsson, who has the most proprietary equipment, was probably the last one to come in. But they’ve been fairly open now about that they are going to do Open RAN. Japan is emerging as a leader in actual Open RAN deployments and development, NTT Docomo and Rakuten are prime examples. At other operators, we see more CRAN deployments following the Open RAN model of disaggregated vRAN software running on COTS hardware.

Optimum for specific deployments – Open RAN won’t be the optimum solution in every single case – it’s not that it’s going to be 100% that the model is going to move to Open RAN. And I think once people have started to recognize that, the adoption gets a little easier because it becomes about: when is this the optimal solution and when is the best place to use it.

Open RAN adoption for 4G Networks – Now we’ve seen two pioneers in the Open RAN space. The first one happened with 4G networks, particularly in rural areas. In the older networks, a lot of the voice still runs over the TDM 2G network. So you end up having to run three networks: a 2G, a 3G, and a 4G network, and each one has its proprietary equipment that gets very expensive, mainly where your population density is not that high.

Rural Market – We saw Open RAN being adopted by the 4G industry in rural markets, where the processing power, you could argue, wasn’t too complicated. But it validated the systemic principle and the whole idea, the concept.

Open RAN in Greenfield & Rural Markets for 5G Networks –

Translating that into 5G networks, we’ve again seen the early adoption happening in these more rural markets, but also by two greenfield operators, notably Rakuten and DISH Network. Now for them, it’s easier to adopt new technology because they have no legacy, and they don’t have to worry about backward compatibility or interoperability between the two. So unsurprisingly, they’ve gone ahead of the fastest.

Going Mainstream – Now we’re starting to see it go mainstream, and you’ll hear more and more announcements daily.

Do you think Open RAN can help improve global connectivity so that we can bridge the digital divide that is still quite prevalent?

We have been involved very early, right from the beginning. At the inception of running the software on disaggregated hardware. Intel was really, the creator and pioneer of this. We have worked very closely with them from the beginning.

Supermicro is also a member of both TIP and the O-RAN Alliance, as one of the workgroup editors.

Many of the early reference designs have been built on Supermicro hardware. And we continue to expand and engage with all the main industry players, the independent software vendors, and several operator networks. So for us, 5G RAN is another edge network application, and it fits beautifully with our standardized server technology. In each successive generation of its Xeon processors, Intel has enhanced the set to improve 5G baseband, networking, and AI processing. The latest fourth-generation Xeon server processors gain new instructions that enable Massive-MIMO capability and accelerate vRAN workload execution.

There has been a holdup in the lack of widely available GPS-enabled timing-sensitive Fronthaul NICs (FH-NIC) that would allow the separate and expensive Fronthaul Gateway appliance to be integrated into the DU. These FH-NICs are now becoming available from several suppliers, some even with integrated accelerators. The combination of these FH-NICs and the latest processors is at the maturity needed for large-scale deployment.

Supermicro will have a broad range of servers based on next-generation Intel Xeon Scalable processors for both 5G Core and RAN.

- March 16, 2024

nGRG: An O-RAN Alliance, Next Generation Research Group

Mission – Engage academia more broadly in addition to industry partners in future networking research. Achieve O-RAN sustainability from 4G/5G to 6G . Unified 6G technology path and timeline in the industry to avoid incompatibility b/w O-RAN and other SDOs.

Partnership – The nGRG group will work in a partnership approach, where Academia and Industry will be jointly researching and publishing Research Reports covering various research streams within the nGRG group.

Key Activities -Under the oversight of O-RAN TSC define, O-RAN 6G research agenda and key priorities. Establish research/study items based on defined research priorities, and form research streams to conduct the studies and report the outcomes in technical reports. Publish white papers and technical reports based on the outcomes of the studies in the Group.

- November 5, 2023

Introduction

Open RAN is currently discussed by both, operators of national public networks and suppliers of campus network solution. The most extensive installation to date is in the field of national public networks by Rakuten Mobile in Japan, build up in order to enable cost reduction in the area of radio access networks in addition to increase flexibility in system operation and independence from manufacturers.

In the area of campus networks, Open RAN facilitates the way for a highly innovative ecosystem with new business models, shorter innovation cycles and thus faster market launch of individual solutions tailored to specific applications.

Open RAN therefore has the potential to become a game changer in the mobile communications industry. However, until then, some obstacles still need to be overcome.

The history of Open RAN

Since 1998, the development & standardization of mobile radio systems has been promoted in the 3GPP committees. The previous architecture and interface definitions are largely based on traditional networks. However, modern approaches such as SDN (software-defined networks), virtualization, cloud-native or edge computing require additional and, in particular, open interfaces.

The O-RAN Alliance, initiated by major mobile network operators at the beginning of 2018, aims to define these open interfaces and architectural elements. This open approach (also commonly referred to as Open RAN – Open Radio Access Networks) drives the opening up of the previously largely proprietary base station architecture and reduces today’s dependency on few manufacturers (“vendor lock-in”) as with Open RAN, different providers can deliver components for the radio access networks.

- March 23, 2024

Telecom Infra Project (TIP)

TIP’s OpenRAN Project Group’s (OpenRAN PG) mission is to accelerate innovation and commercialization in RAN domain with multi-vendor interoperable products and solutions that are easy to integrate in the operator’s network and are verified for different deployment scenarios.

TIP’s OpenRAN program supports the development of disaggregated and interoperable 2G/3G/4G/5G NR Radio Access Network (RAN) solutions based on service provider requirements.

- November 5, 2023

Background

One of the unexpected outcomes of the pandemic was that many people who started working from home, realized the need for optimal connectivity, not just for data but also for voice.

Western countries may be moving on from legacy 2G/3G technologies, but those legacy technologies still have a big role to play in many developing countries, specially. In particular, 2G and 3G have active roles in African countries. One needs 2G/3G for IoT, roaming, and for voice fallback in devices that do not support voice over 4G/5G (VoLTE/VoNR)

Researchers and analysts are also highlighting that as legacy technologies are being phased out in the USA, emergency calls for roaming devices may not work, causing delays that could cost lives.

In the EU and UK, eCall devices were made mandatory in all new cars sold since April 2018. If a vehicle with an eCall device is involved in a serious accident, it will be connected with the nearest emergency-response network regardless of where the vehicle was purchased or registered. The eCall devices rely on the 2G/3G circuit switch (CS) core network and would not work if 2G or 3G was unavailable. Next Generation eCall (NG-eCall) will overcome this restriction by enabling emergency calling over IMS; however, it will take time to be deployed. Also, the existing vehicles expect eCall support for at least 15 years, which is a long time.

Read the complete article in the 5G Magazine

Content, Design, And Lead Generation Services to Elevate your Marketing Efforts

Sorry, we couldn't find any posts. Please try a different search.

- All

- 5G

- 6G

- AI

- API

- AR

- Assurance

- Automation

- Blockchain

- Digital Twin

- Edge/MEC

- FWA

- IoT

- Metaverse

- Monetization

- Network Infra

- Network Slicing

- Open RAN

- Orchestration

- OSS-BSS

- Predictions

- Private Networks

- RAN

- SASE

- Satellite & NTN

- Security

- Semiconductor

- Sustainability

- Telco Cloud

- Testing & QA

- Towers & Cells

- VR