Home » 5G Magazine » Technology and Connectivity Trends | 5G Magazine Jan 2023 Edition

Technology and Connectivity Trends | 5G Magazine Jan 2023 Edition

2022 is behind us, and we are now looking forward to the years ahead with exciting predictions from industry thought leaders about Technology and Connectivity Trends over the next 2 to 5 years. We at TeckNexus analyzed over 60 sources and identified 150+ global technology and connectivity trends which we have presented in a visually appealing word/ keyword cloud format.

Log In or Register to Access This Content

Login

Register

Login with LinkedIn

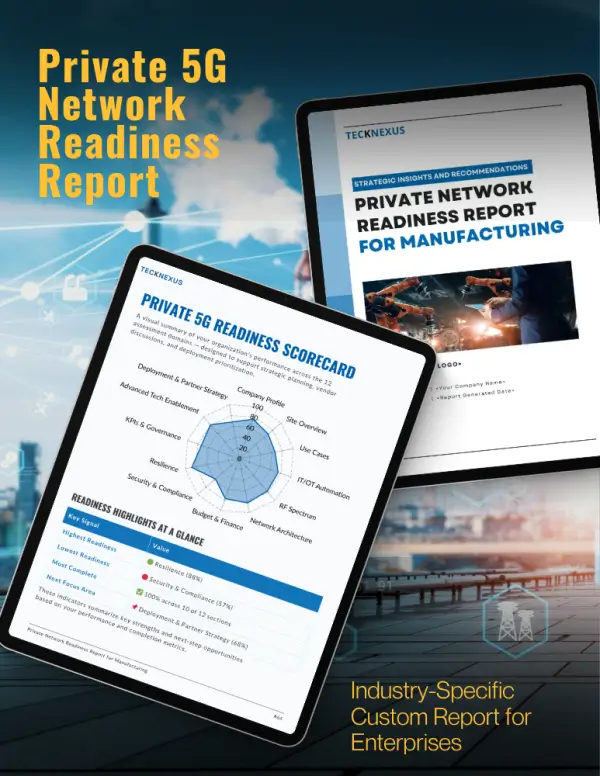

Essential insights and practical tools for navigating private networks. Get Details.

Available on Amazon & Google Books

Subscribe To Our Newsletter

- All

- 5G

- 6G

- AI

- API

- AR

- Assurance

- Automation

- Blockchain

- Digital Twin

- Edge/MEC

- FWA

- IoT

- Metaverse

- Monetization

- Network Infrastructure

- Network Slicing

- Open RAN

- Orchestration

- OSS-BSS

- Predictions

- Private Networks

- RAN

- SASE

- Satellite & NTN

- SD-WAN

- SDN-NFV

- Security

- Semiconductor

- Sustainability

- Telco Cloud

- Testing & QA

- Towers & Cells

- VNF

- VR