Home » 5G Magazine » 5G Magazine – Private Networks Edition

5G Magazine – Private Networks Edition

5G Magazine - "Private Networks" edition provides an in-depth view of the current state of the global Private 5G Networks covering ecosystem players' expectations, challenges, strategies, deployments, architecture, and use cases.

The featured articles/interview in this edition are from AT&T Business, Amdocs, OnGo/CBRS Alliance, and Capgemini Engineering. Additionally, we cover 27 ecosystem players, including network equipment vendors, mobile network operators, cloud/edge vendors, enterprises, CBRS spectrum operators, and private network specialists, including neutral hosts and system integrators. Sample ecosystem players we have included in this issue are Nokia, Ericsson, Rakuten, AT&T, Parallel Wireless, Verizon, Telefonica, Vodafone, Bosch, Mercedes-Benz, Lufthansa, Celona, Federated Wireless, Athonet, and Airspan.

Log In or Register to Access This Content

Login

Register

Login with LinkedIn

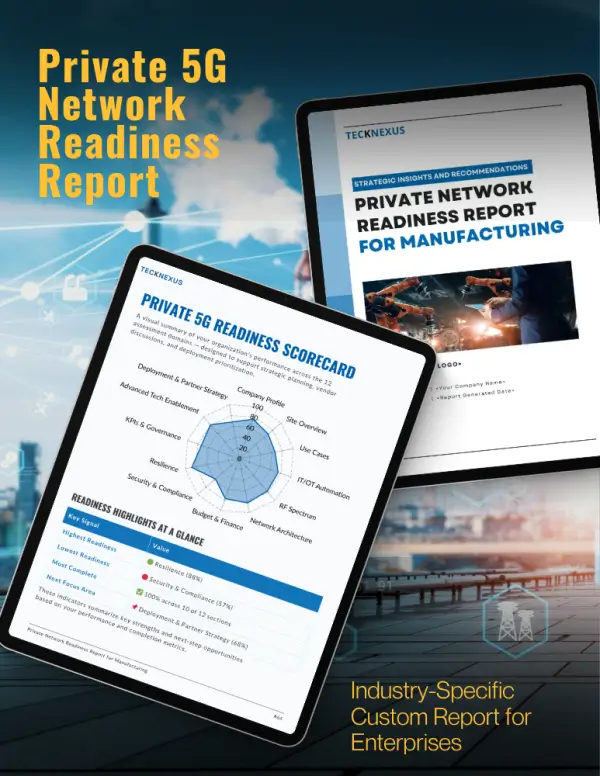

Essential insights and practical tools for navigating private networks. Get Details.

Available on Amazon & Google Books

Subscribe To Our Newsletter

- All

- 5G

- 6G

- AI

- API

- AR

- Assurance

- Automation

- Blockchain

- Digital Twin

- Edge/MEC

- FWA

- IoT

- Metaverse

- Monetization

- Network Infrastructure

- Network Slicing

- Open RAN

- Orchestration

- OSS-BSS

- Predictions

- Private Networks

- RAN

- SASE

- Satellite & NTN

- SD-WAN

- SDN-NFV

- Security

- Semiconductor

- Sustainability

- Telco Cloud

- Testing & QA

- Towers & Cells

- VNF

- VR