- Tech News & Insight

- November 20, 2025

- Hema Kadia

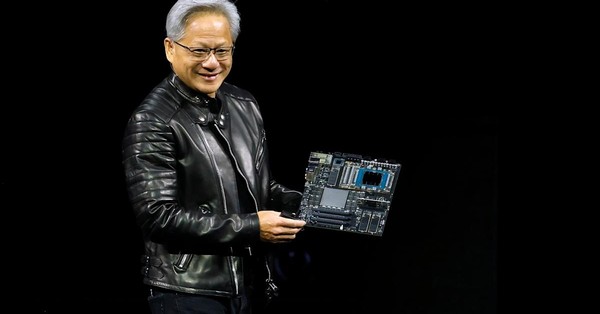

Nvidia’s latest quarter signals that AI infrastructure spending is not cooling and is, in fact, broadening across clouds, sovereigns, and enterprises. Nvidia delivered $57 billion in revenue for the quarter, up more than 60% year over year, with GAAP net income reaching $32 billion; the data center segment accounted for roughly $51.2 billion, dwarfing gaming, pro visualization, and automotive combined. Management guided next-quarter sales to about $65 billion, exceeding consensus by several billion and underscoring that supply remains tight for cloud GPUs even as deployments ramp across hyperscalers, GPU clouds, national AI initiatives, and large enterprises.