What’s at Stake in the CBRS Spectrum Battle

A new push to auction mid-band spectrum has revived calls to repurpose the 3.5 GHz Citizens Broadband Radio Service (CBRS) band, putting a mature shared-spectrum ecosystem on defense.

OBBB Act: Mid-Band Auction Threat to CBRS

The One Big Beautiful Bill Act directs the U.S. government to identify at least 800 MHz between 1.3 GHz and 10.5 GHz for auction, with a significant tranche in the near term. While 3.13.45 GHz and 7.48.4 GHz have protections, CBRS at 3.553.7 GHz and the 6 GHz unlicensed band do not. That exclusion has raised alarms across the CBRS community, which sees renewed risk that regulators chase easy spectrum by refarming what’s already working.

Why National Carriers Seek CBRS Reallocation

National operators and CTIA have long argued that exclusive, high-power mid-band licenses are the most efficient way to scale 5G. From their vantage point, relocating CBRS could expand full-power holdings contiguous with C-band. But that view discounts the last five years of CBRS executionthousands of operators, industrial private networks, neutral host deployments, and rural fixed wireless providers relying on dynamic sharing to fill real coverage and capacity gaps.

CBRS as the De Facto Fourth U.S. Network

The OnGo Alliance frames CBRS as the country’s fourth wireless pillar when measured by connected radios and active users. By its count, CBRS networks now serve well over 13 million users across enterprises, education, healthcare, municipalities, WISPs, and carrier offload at a scale that rivals or exceeds some facilities-based challengers in practical impact.

The Real Cost of CBRS Refarming

Relocation is not a paper exercise; it is an industry-wide rip-and-replace with high cost, long lead times, and limited upside.

$14B Invested and 420k Radios Deployed

More than $14 billion has been invested across the CBRS stack licenses, RAN, devices, infrastructure, sensors, and software. Over 420,000 CBRS radio nodes (CBSDs) are in service. The device ecosystem is broad: Apple and Samsung ship n48-capable handsets; industrial and FWA suppliers support n48 CPEs and routers; Ericsson, Nokia, Samsung, JMA Wireless and others provide radio and DAS. This is not a pilot; it is production infrastructure.

Refarming Costs and Disruption Don’t Pencil Out

Refarming would force replacement or retuning of hundreds of thousands of base stations and millions of end devices, plus upgrades to SAS integrations and enterprise control planes. Estimated industry costs land in the $12$14 billion range before addressing Navy radar system changes, which are hard to price and harder to execute. The disruption would span airports, factories, hospitals, campuses, utilities, venues, and rural broadband footprints.

No Viable Replacement Band for CBRS

There is no obvious, like-for-like band to move CBRS users into. The lower 3 GHz range is protected for defense use and technically messy for shared frameworks compared with today’s coastal Environmental Sensing Capability (ESC) model. Moving to a new band would trigger fresh device work, re-certifications, and multi-year supply-chain cyclesdelaying rather than accelerating national spectrum goals.

Evidence That CBRS Spectrum Sharing Works

CBRS has delivered on incumbent protection, spectrum efficiency, and market innovation at scale.

Zero Harmful Interference to Navy Radars

Spectrum Access Systems (SAS) and ESC networks from providers like Federated Wireless have coordinated operations without documented harmful interference to Navy radars since launch. The framework dynamically clears the spectrum for incumbents and returns it to commercial use with high reliability.

Rising Utilization and Expanded Coverage

CBRS 2.0 policy refinements expanded unencumbered availability to roughly 240 million people, adding tens of millions more to areas where CBRS can run with fewer coastal constraints. General Authorized Access (GAA) usage consistently outpaces Priority Access Licenses (PALs), demonstrating that shared access can deliver high utilization while preserving priority protections.

Enterprise-Grade CBRS Devices and Integrators

With more than a thousand FCC-authorized CBRS devices and a robust integrator community, enterprises are standardizing on private 5G over CBRS for mobility-critical operations. Examples range from John Deere’s factory playbooks to logistics hubs, airports, hospitals, and smart campuses. For rural America, CBRS underpins fixed wireless growth aligned with BEAD-funded builds.

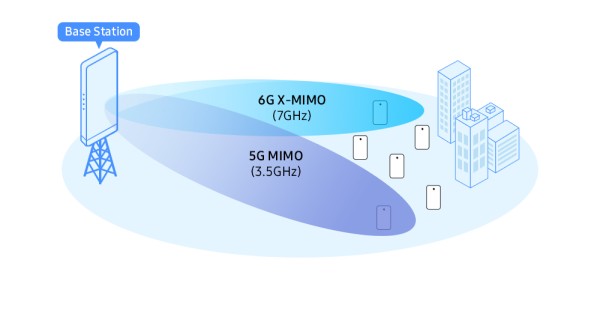

Smarter Mid-Band Paths to 6G Capacity

The U.S. can expand mid-band capacity without dismantling CBRS.

Extend C-Band (3.98–4.2 GHz)

Incremental spectrum above today’s C-band, notably 3.984.2 GHz, presents a tractable path as fixed satellite services consolidate and compress. Transitions here pose far less disruption than uprooting a live shared band that is already monetized by thousands of operators.

4.4–4.9 GHz as Greenfield Mid-Band

The 4.44.9 GHz range, currently federal, lacks commercial license incumbents, making it a candidate for new full-power or hybrid-sharing models. Studying this corridor alongside coordinated federal missions could yield capacity with lower migration pain.

Preserve 6 GHz and Proven Sharing Models

Keeping the 6 GHz unlicensed band intact sustains WiFi growth and complements licensed mid-band 5G. Together with CBRS, these bands form a practical spectrum portfolio that supports enterprise private networks, neutral host, and operator macro needs en route to 6G.

What Telecom Leaders and Enterprises Should Do Now

Plan for continuity, hedge for optionality, and engage in policy to de-risk roadmaps.

Keep Building CBRS; Design for Multiband

Proceed with CBRS deployments; the timeline for any hypothetical relocation would span many years. Specify devices with 3GPP n48 plus adjacent mid-band support to ease future spectrum aggregation. Maintain SAS vendor diversity and ensure ESC coverage matches coastal requirements.

Balance PAL/GAA; Evaluate Neutral Host

Optimize PAL holdings where density and interference economics warrant them; lean on GAA elsewhere. For venues and campuses, evaluate neutral-host CBRS to unify multi-operator service while retaining enterprise control and security.

File Data-Backed Impact with FCC/NTIA

File data-driven comments with the FCC and NTIA detailing operational reliance on CBRS, cost-to-migrate, and service continuity risks. Coordinate with industry groups such as the OnGo Alliance to align messaging across verticals.

Align Rural FWA Plans with BEAD

WISPs and regional operators should tie CBRS-based fixed wireless plans to BEAD milestones, highlighting speed-to-serve, cost-per-pass, and upgrade paths to 5G-Advanced.

Bottom Line

Refarming CBRS would burn billions, stall private wireless momentum, and jeopardize real-world connectivity gains without delivering proportional national benefit.

A better path is to protect what works in 3.5 GHz, unlock adjacent mid-band where transitions are feasible, and scale shared-spectrum playbooks that have made the U.S. a reference point for private 5G and efficient spectrum use.