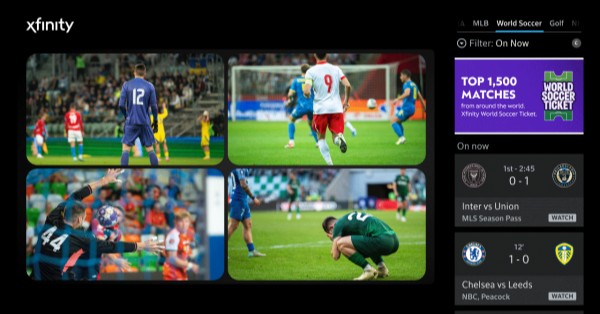

Comcast has launched World Soccer Ticket for Xfinity customers, a soccer-centric bundle priced at $85 per month that consolidates more than 1,500 matches a year across nearly 60 English- and Spanish-language networks and Peacock Premium. The package folds in an X1 set-top, enhanced 4K for select matches, Multiview to watch multiple games at once, real-time stats and odds via Sports Zone, a bilingual voice remote, and 300 hours of cloud DVR. Coverage spans the Premier League, UEFA Champions League, La Liga, Liga MX, NWSL, CONCACAF Champions Cup, MLS shoulder programming, and all matches of the 2026 FIFA World Cup in English (FOX) and Spanish (Telemundo, Universo, Peacock). Customers can access the bundle through the Xfinity Stream app on Apple TV, Fire TV, Roku, Xumo devices, and mobile platforms.

The offer also integrates more than 100 free ad-supported streaming channels within the X1 guide, and it allows single-bill add-ons via Xfinity StreamStore, including MLS Season Pass, Paramount+, and ESPN+, to extend coverage to leagues like Serie A and Bundesliga. In short, Comcast is positioning Xfinity as a one-stop destination for global soccer with hardware, cloud DVR, and discovery layered on top.

Why This Matters Now

Live sports rights are more fragmented than ever, creating friction for fans and churn risk for providers. With the 2026 FIFA World Cup approaching and the U.S. soccer audience growingparticularly among bilingual householdsComcast is using aggregation to simplify discovery and lock in high-value subscribers. The timing also counters a shifting competitive landscape: Disney is launching a direct-to-consumer ESPN service; Paramount Skydance is leaning into premium combat sports; and prior sports-bundle experiments like Venu were shelved. While Comcast calls this the first video package purpose-built for soccer, it’s worth remembering Fubo’s soccer-first origins before it broadened; the difference here is Comcast’s integrated hardware, billing, and bilingual reach at a national scale.

For telecom and pay-TV strategists, this is a template for how to re-bundle premium live sports across linear and streaming, then differentiate with experience features that depend on the access network and in-home Wi-Fi quality. It is also a hedge against cord-cutting: premium sports viewers over-index on ARPU, multi-product attach, and tenure, making them a priority retention segment.

Strategic Takeaways for Operators and Media

Aggregation is the product. World Soccer Ticket brings together broadcast networks (ABC, CBS, FOX, NBC), cable sports (ESPN, FS1, TUDN, Universo, FOX Deportes, ESPN Deportes), Spanish-language flagships (Telemundo, Univision, UniMs), and Peacock, then bridges to third-party streamers via StreamStore. A unified guide, search, and billing experience reduces subscription fatigue and improves content discovery across services. For media companies, this deepens distribution without ceding brand identity or first-party data, provided integrations support metadata, entitlements, and ad measurement.

The Spanish-language growth lever. Comcast’s bilingual interface and rights mix give it an edge with U.S. Hispanic viewers, who are central to soccer consumption. Expect targeted packaging, multilingual audio, and culturally relevant FAST channels to become standard in premium sports bundles.

Features become the moat. Multiview, 4K, cloud DVR, and real-time stats/odds elevate the experience beyond a standalone app. These features are sticky and network-intensive, creating a defensible moat for operators with robust last-mile capacity and managed Wi-Fi. Personalization, voice navigation, and a dedicated soccer hub reduce time-to-content, a key satisfaction metric on busy match days.

Ad-tech and commerce layers matter. Integrating real-time data, sports betting information, and dynamic ad insertion across linear and streaming inventory opens higher-yield monetization. Expect tighter alignment with standards governing signaling and blackout management and deeper partnerships with sportsbooks where permitted.

Network and Technology Implications

Peak concurrency will spike during marquee windows (e.g., simultaneous kickoffs, tournament group stages). Operators should prepare for high bitrates and parallel 4K streams per household when Multiview is active. Priorities include DOCSIS and fiber upgrades for multi-gig downstream, WiFi 6E/7 adoption for in-home distribution, and proactive QoE monitoring to manage jitter and packet loss that are noticeable in fast-motion sports.

Low-latency streaming is differentiating. Support for LL-HLS/LL-DASH over QUIC can shrink glass-to-glass delays and keep live action aligned with data feeds and betting odds. CDNs should incorporate modern caching strategies, including open caching frameworks and content-aware routing to flatten traffic spikes across regions. Where feasible, multicast ABR for popular live events can cut backbone load.

Impeccable device reach and DRM are table stakes. Xfinitys support for Apple TV, Roku, Fire TV, Xumo, and mobile reduces friction. Consistent playback across H.264/HEVC and emerging codecs like AV1, plus wide DRM coverage, minimizes failures at session start. Automated failover to lower renditions under impairment, coupled with session analytics, will preserve QoE and reduce support calls.

Data integration underpins the bundle. Unified entitlement, search, and recommendations across linear channels, Peacock, FAST, and third-party apps require normalized metadata and identity resolution. Operators that invest in a cross-service knowledge graph and privacy-aware first-party data will deliver better personalization and ad yield.

What to Watch Next

Key developments to track in the evolving soccer content and streaming landscape include:

Soccer rights deals and streaming partnerships roadmap

Follow how Comcast deepens integrations with third-party soccer services and whether additional rights windows (e.g., more 4K matches or localized feeds) are added. Watch the outcome of proposed joint ventures among live TV streamers and any shifts in distribution strategy from Disney, FOX, Warner Bros. Discovery, and Paramount Skydance.

Xfinity soccer bundle pricing strategy and packaging

World Soccer Ticket debuts at $85 with Peacock Premium included and cloud DVR. Monitor promotional pricing around the 2026 World Cup and whether Comcast introduces seasonal passes, team-specific add-ons, or multilingual tiers to broaden reach without compressing margins.

Feature roadmap: 4K, Multiview, stats, and commerce monetization

Expect deeper soccer-specific features: advanced Multiview layouts, interactive stats overlays, alternate-language commentary, and condensed match replays. Integration of commercetickets, merchandise, micro-transactionsand responsible betting features will be a battleground for engagement and ARPU.

Action Items for Telecom and Pay-TV Leaders

Use soccer as the anchor for a broader sports aggregator strategy with unified discovery, billing, and customer support. Tie the bundle to multi-gig broadband and managed WiFi for a clear performance narrative. Prioritize low-latency streaming and 4K readiness across the delivery chain. Invest in bilingual UX, metadata normalization, and identity to personalize across apps and channels. Establish clear SLAs with CDNs, adopt real-time QoE telemetry, and rehearse match-day runbooks for peak events. Finally, align ad-tech and compliance to enable dynamic ad insertion, localized blackout enforcement, and, where allowed, betting integrations that do not compromise user trust.

The bottom line: Comcast’s World Soccer Ticket is less about a single sport and more about restoring simplicity to sports viewing through aggregation and superior delivery. As rights fragment and direct-to-consumer offers proliferate, operators that combine network strength with an integrated, bilingual, and low-latency experience will win the next phase of sports streaming.