Verizon’s Immediate C-Band Deployment

Verizon, in an unprecedented move, has secured early access to the 5G spectrum, setting itself apart in the competitive race. With SES and Intelsat making way by swiftly clearing their satellite operations from the C-band, Verizon demonstrated agility by immediately capitalizing on this opportunity. Their enthusiastic announcement about this significant network upgrade has been echoed in numerous press releases, spotlighting their enhanced presence in diverse cities. These strategic moves could reshape the telecommunications landscape and position Verizon as a market leader in the upcoming years.

Market Dynamics: AT&T’s Hush and T-Mobile’s Regulatory Maze

AT&T’s Muted Strategy in the C-Band Expansion – While Verizon’s achievements are creating a buzz, AT&T remains conspicuously silent. Their strategic quietness raises questions in the industry and among analysts about their potential moves and responses to the changing 5G landscape.

T-Mobile’s FCC Roadblock – Conversely, T-Mobile’s ambitions are hindered by bureaucratic red tape. The delays they face from the FCC approvals are becoming increasingly significant, especially with their 2.5GHz spectrum caught in a regulatory gridlock. This delay may impact their future deployment strategies and market positioning against competitors like Verizon.

The Anatomy of the $10 Billion C-Band Project

The C-Band Auction: A Game Changer – The 2021 FCC’s C-band auction emerges as a pivotal turning point for 5G deployment in the U.S. This auction presented a unique challenge and opportunity, demanding satellite giants SES and Intelsat to shift their operations, thus freeing the coveted C-band for 5G use.

The Role of Incentives in Speedy Transitions – The FCC move of a $10 billion incentive plan was crafted to catalyze the migration process. SES and Intelsat’s aggressive strategy in launching new satellites over the years showcases the powerful lure of these incentives. But, as with any large financial dealing, the specter of disagreements arose. The ongoing tussle between SES and Intelsat about the incentive’s distribution has added a layer of complexity to this already intricate scenario.

T-Mobile’s Spectrum Struggles and Future Prospects

T-Mobile’s Auction 108 Woes – T-Mobile, despite its impressive investment in Auction 108, finds itself in a challenging position. The bureaucratic struggles surrounding the FCC’s actions have put T-Mobile’s massive investment at a standstill, which could potentially shift market dynamics if not resolved soon.

The Push for FCC Spectrum Release – Given the stakes, there’s a growing clamor from various sectors, including prominent figures, pushing the FCC to grant T-Mobile access to the spectrum they rightfully secured. The outcome of this push could be a defining moment for T-Mobile’s future in the 5G spectrum arena.

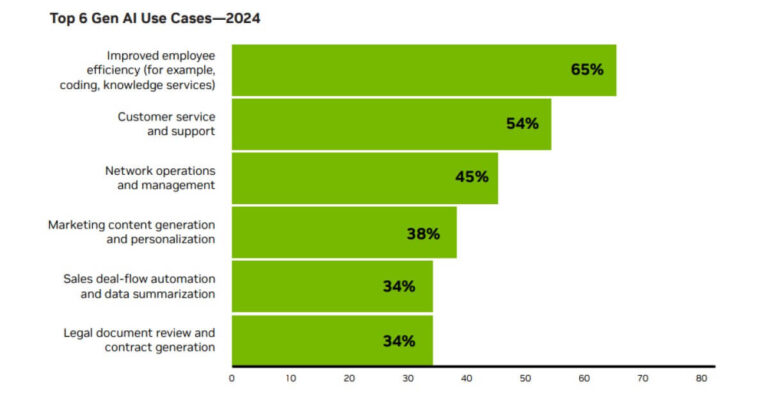

Spectrum Capacity: The Nexus between Speed and Revenue

C-Band: The New Gold Standard in Telecommunication – Verizon’s strategic deployment of the C-band has set a precedent. The boost from 60MHz to a whopping 160MHz signifies not just faster services but a broader customer base. The nexus between spectrum availability and service speed has never been more evident.

The Revenue Implications of Enhanced 5G Connectivity – This expansion is not just about speed and reach; it’s also about revenue. With more areas getting high-speed C-band coverage, there’s a noticeable trend of customers gravitating towards premium plans, reflecting a potential surge in revenue for Verizon.

Financial Strategies in the 5G Expansion Era

Verizon’s Spend-Smart Approach – Verizon’s strategy of streamlining its capital expenses, despite its aggressive C-band buildout commitments, has turned heads. The discernible reduction in network spending, even after such substantial investments, signals a strategic shift in Verizon’s financial approach toward 5G deployment.

The Evolving 5G Investment Landscape – Experts opine that this spending slowdown is a natural progression in the 5G deployment cycle. Once initial targets are met, companies tend to re-evaluate and optimize their investments. However, the industry anticipates continued spending, albeit at a different pace and strategy, in the foreseeable future.