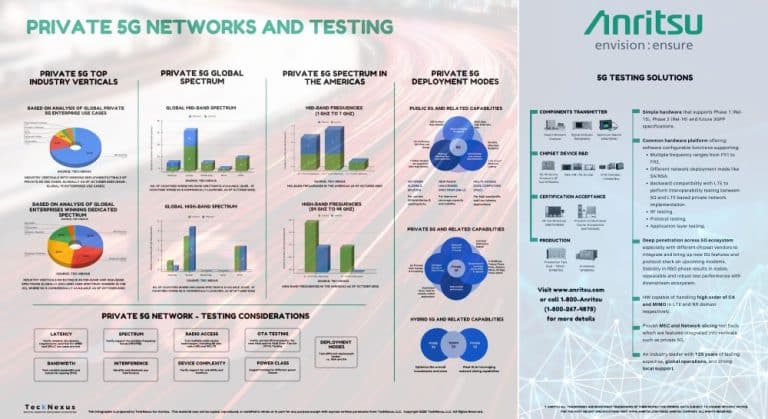

The Citizens Broadband Radio Service (CBRS) is redefining how spectrum is accessed, shared, and utilized in the United States. Positioned within the 3.5 GHz band (3550–3700 MHz), CBRS enables a unique, dynamic spectrum-sharing model that combines federal, commercial, and unlicensed use. Established by the Federal Communications Commission (FCC), CBRS stands at the center of innovation in wireless connectivity, powering private 5G networks, rural broadband expansion, and enterprise digitization.

As the world looks for scalable ways to improve connectivity, CBRS has emerged as a flagship initiative, both for its technical sophistication and for its role in closing digital gaps across industries and communities.

What Is CBRS? Understanding Its Role in Modern Wireless Networks

CBRS refers to a 150 MHz block of mid-band spectrum in the 3.5 GHz range, which was historically reserved for military and satellite communications. In 2015, the FCC designated this spectrum for shared use, creating CBRS under Part 96 of its rules. The CBRS framework officially went live for commercial use in 2020, making the U.S. the first country to implement large-scale, three-tiered dynamic spectrum sharing.

This initiative was not just regulatory—it marked a bold experiment in enabling broader, fairer access to valuable spectrum. Since its launch, CBRS has enabled thousands of deployments ranging from industrial campuses and hospitals to rural towns and school districts.

How CBRS Spectrum Sharing Works: Inside the 3-Tier Access Model

The CBRS spectrum-sharing framework is managed by a cloud-based Spectrum Access System (SAS), which assigns spectrum dynamically based on user priority and location. Here’s a breakdown of the three CBRS tiers:

1. Incumbent Access (Tier 1)

This tier includes federal users, primarily U.S. Navy radar systems and a few legacy satellite and wireless operators. These users have absolute priority and must be protected from any interference.

2. Priority Access Licenses (PALs) – Tier 2

PALs were auctioned in FCC Auction 105 and provide licensed access to defined 10 MHz channels in specific U.S. counties. PAL licensees must accept interference from incumbents but are protected from GAA users.

3. General Authorized Access (GAA) – Tier 3

The GAA tier allows any user to access available CBRS spectrum without a license. While unprotected, GAA still offers substantial value for enterprises, schools, and service providers looking for cost-effective wireless access.

CBRS Spectrum Summary Table

| CBRS Feature | Details |

|---|---|

| Spectrum Band | 3.5 GHz (3550–3700 MHz) |

| Access Model | Three-tiered: Incumbent, PAL, GAA |

| Coordination Mechanism | Spectrum Access System (SAS), supported by Environmental Sensing Capability (ESC) |

| License Duration (PAL) | 10 years (renewable); auctioned on a per-county basis |

| Key Use Cases | Private LTE/5G networks, fixed wireless access (FWA), network offloading, neutral host |

| Leading SAS Providers | Federated Wireless, Google, Amdocs, Sony, CommScope |

| Device Support | CBSD (Citizens Broadband Radio Service Devices) registered with SAS |

| Mid-band Benefits | Strong balance between coverage and throughput; ideal for enterprise-grade wireless |

CBRS Use Cases: Real-World Applications Across Industries

The CBRS band supports a growing set of applications that benefit enterprises, public institutions, and local service providers. Its flexibility, performance, and accessibility make it ideal for:

1. Private LTE and 5G Networks

Organizations can deploy CBRS-based private networks to power smart manufacturing, logistics automation, campus-wide mobility, and secure IoT connectivity, without relying on public carrier infrastructure.

2. Fixed Wireless Access (FWA)

WISPs (Wireless Internet Service Providers) use CBRS to provide rural and suburban broadband, expanding coverage in areas where fiber and cable are too costly to deploy.

3. Mobile Network Densification

Major carriers like Verizon use CBRS to add capacity in congested urban areas. It acts as a supplemental downlink for improving mobile user experience in hotspots.

4. Neutral Host Solutions

CBRS enables shared wireless infrastructure in venues like stadiums, airports, hospitals, and malls. Multiple operators can use the same CBRS network to serve their customers, lowering costs and improving indoor coverage.

CBRS for Enterprises: Building Private 5G with Shared Spectrum

As the demand for low-latency, high-reliability wireless connectivity grows across industries, enterprises are increasingly turning to private 5G networks as a way to modernize operations, boost security, and enable digital transformation. One of the most accessible and powerful enablers of this shift in the United States is CBRS.

CBRS provides a unique opportunity for enterprises to deploy their own private LTE or 5G networks using licensed or unlicensed spectrum without relying on traditional mobile operators. Unlike traditional spectrum models that limit access to nationwide carriers, CBRS opens the door for manufacturers, logistics firms, hospitals, campuses, and energy providers to take control of their own wireless infrastructure.

Why CBRS Is the Best Fit for Enterprise-Grade Private 5G

CBRS brings together the core ingredients needed for robust enterprise-grade wireless networks:

- Mid-band spectrum (3.5 GHz): Offers the right mix of indoor penetration, coverage area, and capacity—ideal for industrial and campus environments.

- Flexible licensing model: Enterprises can either acquire a Priority Access License (PAL) for more predictable performance or use General Authorized Access (GAA) spectrum for low-cost, scalable deployments.

- Localized control: Unlike public 5G, CBRS enables full control over network architecture, data flow, quality of service (QoS), and security policies.

- Device ecosystem support: Thanks to the wide adoption of Band 48, enterprises can choose from hundreds of certified CBRS-ready devices and modules.

Key Enterprise Use Cases Powered by CBRS

| Industry | Use Case |

|---|---|

| Manufacturing | Factory-floor automation, robotics, AR/VR-enabled inspections |

| Logistics & Ports | Autonomous vehicles, smart inventory, worker safety applications |

| Healthcare | Wireless medical devices, secure staff communication, XR in surgical suites |

| Education | Campus-wide broadband, private networks for research labs and dorms |

| Energy & Utilities | Grid monitoring, emergency response, remote asset control |

CBRS vs. Public 5G and Wi-Fi: Which Is Best for Your Business?

| Capability | CBRS Private 5G | Public 5G | Enterprise Wi-Fi |

|---|---|---|---|

| Coverage Control | Full control (indoor & outdoor) | Limited to carrier coverage | Limited indoors |

| QoS & SLAs | Enterprise-defined | Carrier-defined, often best-effort | Basic QoS, limited SLAs |

| Data Sovereignty | On-premise or local cloud | Data routes through the carrier | On-premise |

| Security | Custom enterprise controls | Shared infrastructure | WPA/WPA2/3 |

| Device Mobility | Excellent for roaming | Good, but not private | Limited |

| Licensing Costs | PAL (low-cost) or GAA (free) | High (via carrier) | No spectrum cost |

Real-World CBRS Deployments in the U.S.

- John Deere is using CBRS for industrial automation at its factories.

- Dallas-Fort Worth International Airport has deployed a private CBRS network to improve operations and passenger experience.

- University campuses are leveraging CBRS to provide resilient, high-capacity wireless networks for students and research environments.

CBRS Technology: SAS, ESC, and Spectrum Automation Explained

What sets CBRS apart is its automated spectrum coordination. The Spectrum Access System (SAS) ensures spectrum is used efficiently, safely, and in compliance with FCC rules. SAS vendors dynamically assign frequencies based on user priority and real-time availability.

To further protect incumbent operations like naval radar, an Environmental Sensing Capability (ESC) network detects military activity and alerts the SAS to reallocate spectrum if needed—an essential component of CBRS’s reliability and coexistence model.

CBRS vs. Licensed Spectrum: Breaking Down the Differences

Traditional licensed spectrum is sold in wide geographic blocks to major mobile operators at high cost. In contrast, CBRS democratizes spectrum access, offering localized licensing, lower entry barriers, and shared access for innovation at scale.

This makes CBRS especially appealing for:

- Enterprises that need site-specific wireless control

- Schools and municipalities deploying community networks

- Operators offering custom coverage or FWA without heavy spectrum investment

Why CBRS Is Critical for the Future of U.S. Wireless Networks

CBRS is far more than a regulatory experiment—it’s now a proven model with real-world impact. In just a few years, over 400,000 CBRS radios have been deployed, and the CBRS ecosystem includes thousands of enterprises, system integrators, and rural ISPs.

By enabling shared spectrum access, CBRS addresses some of the most pressing issues in wireless: spectrum scarcity, affordability, coverage gaps, and lack of control for enterprises. It’s also laying the groundwork for how other countries may manage spectrum in the future.

CBRS: A Blueprint for Scalable, Shared Wireless Infrastructure

CBRS demonstrates how innovative spectrum policy, when paired with automation and market flexibility, can unleash enormous value for both commercial and public sectors. It promotes efficient spectrum use, encourages private investment in wireless infrastructure, and supports a diverse ecosystem of users and applications.

As demand for wireless connectivity continues to grow across homes, factories, farms, and cities, CBRS is likely to remain a pivotal enabler of U.S. digital transformation, 5G innovation, and inclusive broadband access. Also, see FCC’s Proposed CBRS Changes Face Strong Opposition from 25 Organizations.