Introduction: A New Digital Era for Telecom

The telecommunications industry, once the cornerstone of internet access, now finds itself at a pivotal moment. As Web3 technologies emerge and mature, they offer telecom providers the opportunity to play a much more significant role in the digital economy. Web3, short for “Web 3.0,” isn’t just a buzzword—it represents a profound shift in how value, identity, and connectivity are managed across the internet.

In this new paradigm, telecom providers can move beyond the role of simple connectivity enablers to become core orchestrators of decentralized infrastructure, digital identity, and value exchange. This transformation is driven by the growing popularity of decentralized technologies like blockchain, cryptocurrency, NFTs, smart contracts, and distributed autonomous organizations (DAOs).

For telecom operators, the convergence of Web3 with 5G, edge computing, and IoT represents a once-in-a-generation opportunity to innovate, monetize infrastructure more effectively, and provide real value to users and enterprises. This article explores how telecom companies can capitalize on Web3 and crypto innovations to redefine their business models, unlock new revenue streams, and create a more equitable internet ecosystem.

What Is Web3 and Its Impact on the Telecom Industry

Web3 represents the third major evolution of the internet, following Web1 (the static, read-only web) and Web2 (the interactive, social media-driven web). What sets Web3 apart is its core emphasis on decentralization, transparency, and user empowerment. Unlike Web2, which relies heavily on centralized platforms that control data and monetization, Web3 enables users to own their identities, data, and digital assets using blockchain technology.

Core Pillars of Web3 Transformation

| Web3 Principle | Description |

|---|---|

| Decentralization by Design | Eliminates the need for intermediaries by using peer-to-peer protocols. This reduces centralized corporate control and returns power to users. |

| Token-Based Economics | Uses crypto tokens to incentivize user participation, handle transactions, and represent ownership of assets. This opens new paths for monetization and user engagement. |

| Trustless Environments | Transactions are validated by decentralized networks instead of central authorities. Smart contracts automate execution based on preset conditions, improving efficiency and reducing fraud. |

| Ownership and Interoperability | Allows users to control and move their data, identities, and digital assets across platforms. For telecoms, this raises the bar for privacy, identity solutions, and service flexibility. |

Relevance to Telecom

Telecom companies have long operated the infrastructure that supports digital communication. However, under Web2, the value creation shifted to platform companies like Google, Facebook, and Amazon. Web3 gives telecom operators a unique opportunity to reassert their influence by:

- Providing the high-performance, low-latency networks required for decentralized apps (DApps) and the Metaverse.

- Offering digital identity and blockchain services as core products.

- Monetizing data securely and ethically through decentralized models.

- Building or participating in decentralized networks where they can be both infrastructure providers and ecosystem stakeholders.

A Timely Opportunity

The rollout of 5G networks globally provides a natural synergy with Web3 applications, which require ultra-fast, secure, and low-latency connections. In addition, the demand for real-time experiences—augmented reality, decentralized gaming, and immersive virtual meetings—requires telecoms to rethink their infrastructure, not just in terms of bandwidth, but as programmable, interoperable platforms.

For telecoms, this isn’t just about embracing a new technology—it’s about reshaping their role in the digital value chain.

Blockchain and Crypto: The Backbone of Web3 in Telecom

In the Web3 ecosystem, blockchain and cryptocurrency are not just peripheral technologies—they are the foundational layers upon which decentralized applications, smart contracts, and digital asset ownership are built. For telecom companies, these technologies open the door to profound innovation in areas ranging from operations and billing to fraud prevention, infrastructure monetization, and cross-border transactions.

Understanding Blockchain in the Telecom Context

At its core, a blockchain is a distributed digital ledger that records data in an immutable, verifiable, and time-stamped chain of blocks. Unlike traditional databases, no single party owns or controls a blockchain; instead, it’s maintained across a decentralized network of nodes. This makes blockchain particularly useful in telecom for scenarios where trust, transparency, and automation are critical.

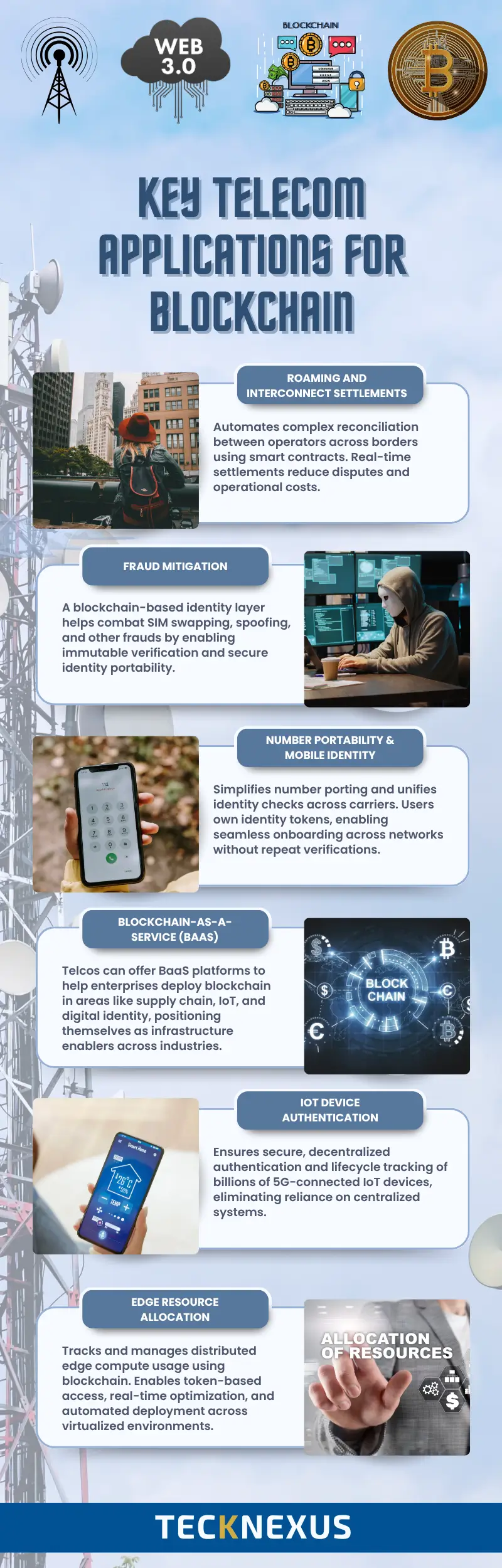

Key Telecom Applications of Blockchain

| Application | Description |

|---|---|

| Roaming and Interconnect Settlements | Automates complex reconciliation between operators across borders using smart contracts. Real-time settlements reduce disputes and operational costs. |

| Fraud Mitigation | A blockchain-based identity layer helps combat SIM swapping, spoofing, and other frauds by enabling immutable verification and secure identity portability. |

| Number Portability & Mobile Identity | Simplifies number porting and unifies identity checks across carriers. Users own identity tokens, enabling seamless onboarding across networks without repeat verifications. |

| Blockchain-as-a-Service (BaaS) | Telcos can offer BaaS platforms to help enterprises deploy blockchain in areas like supply chain, IoT, and digital identity, positioning themselves as infrastructure enablers across industries. |

| IoT Device Authentication | Ensures secure, decentralized authentication and lifecycle tracking of billions of 5G-connected IoT devices, eliminating reliance on centralized systems. |

| Edge Resource Allocation | Tracks and manages distributed edge compute usage using blockchain. Enables token-based access, real-time optimization, and automated deployment across virtualized environments. |

Cryptocurrency is a form of decentralized digital money that relies on blockchain for secure, peer-to-peer transactions. While its financial volatility has garnered attention, its underlying utility for real-time payments, programmable transactions, and user incentives is increasingly relevant for telecom operations.

Crypto Applications for Telecom

| Application | Description | Example Use Cases |

|---|---|---|

| Crypto-Powered Micropayments | Users pay for services like bandwidth, storage, or compute power on a per-second or per-megabyte basis using crypto tokens. | – Travelers using local 5G without a roaming plan – Pay-per-use data consumption – IoT in smart cities |

| Token-Based Incentive Models | Telcos issue tokens to reward user behaviors like network participation, sharing unused bandwidth, or verifying performance. Tokens can be redeemed for services or traded. | – Crowd-powered 5G – Bandwidth sharing – Decentralized network validation |

| Decentralized Billing Systems | Smart contracts automate billing based on real-time network usage data, reducing errors and reconciliation time compared to traditional billing systems. | – Dynamic pay-as-you-go plans – Instant usage-based billing |

| Wallet Integration & Digital ID | Telecoms integrate crypto wallets that manage not only digital assets but also Web3 identities. These wallets enable users to access DApps and decentralized services. | – SK Telecom’s crypto wallet – Identity management and decentralized service access |

| Cross-Border Transactions | Stablecoin-based payments reduce fees and processing time for international remittances and mobile money transfers—especially in regions with high currency volatility. | – Mobile money with stablecoins – International crypto remittances |

Despite their promise, blockchain and crypto integration come with challenges for telecom operators:

| Challenge | Description |

|---|---|

| Regulatory Compliance | Managing crypto payments and personal data on blockchain requires adherence to local financial and privacy laws. Many regions are still developing legal frameworks for Web3 innovation. |

| User Education | Mainstream consumers often lack familiarity with crypto concepts such as private keys, gas fees, or token exchanges. Telecoms must streamline onboarding and simplify wallet interactions. |

| Energy Efficiency | Although proof-of-stake is more sustainable than proof-of-work, running blockchain nodes still has energy demands that telecoms must factor into their infrastructure planning and ESG commitments. |

| Interoperability | Different blockchain protocols are not always compatible. Integrating services across platforms like Ethereum, Polkadot, and Solana can be complex and may require bridges, middleware, or protocol standardization. |

Future Outlook

Blockchain and cryptocurrency will become intrinsic to how telecom services are delivered, monetized, and secured. As usage shifts from static service plans to dynamic, user-controlled microservices, the ability to support token-based, real-time, programmable value exchange will define the leaders in next-gen telecom.

In particular, the combination of 5G, blockchain, and crypto offers a potent platform for:

- Enabling machine-to-machine payments in IoT networks

- Supporting immersive Metaverse environments

- Facilitating decentralized 5G deployments

Forward-thinking telecom providers are already piloting these use cases and creating ecosystems that will be essential in a Web3-dominated world.

Decentralized Networks: Disrupting the Connectivity Monopoly

Telecom infrastructure has historically been a centralized domain, dominated by a few powerful incumbents with deep capital investments in licensed spectrum, towers, and fiber. But Web3 is now catalyzing the emergence of a radically different model—decentralized telecom networks—that empowers users and communities to build, own, and operate connectivity infrastructure.

These community-powered, blockchain-incentivized networks represent a new paradigm for how internet and cellular access is delivered. By democratizing network ownership and leveraging token-based rewards, these decentralized networks have the potential to reshape the telecom industry from the ground up.

The Rise of Community-Based Wireless Networks

In contrast to centralized carriers that require billions in infrastructure spending, decentralized networks use blockchain protocols and crypto incentives to crowdsource the deployment and operation of wireless infrastructure. Participants, often called “hosts,” deploy small, low-power nodes (like hotspots or radio units) in exchange for tokens that reward them for providing coverage or bandwidth.

Leading Examples

| Project Name | Description |

|---|---|

| Helium Network | Known as “The People’s Network,” Helium started with LoRaWAN-based IoT coverage and later expanded to 5G. Users can purchase Helium-compatible devices, install them at home or work, and earn $HNT tokens for validating wireless coverage and routing data. In 2023, Dish Network partnered with Helium to extend its decentralized 5G coverage. |

| Pollen Mobile | A decentralized 5G network focused on mobile broadband. Participants install radios (“Flowers”) and earn PollenCoin ($PCN) based on data usage and validation. Pollen prioritizes user privacy and community ownership of infrastructure through its blockchain-based design. |

| NYM and Althea | These projects go beyond connectivity by building decentralized VPNs and mesh networks. Users pay one another directly for secure, anonymous data transmission, creating a fully peer-to-peer telecom model. |

Advantages Over Traditional Telecom Infrastructure

Decentralized telecom networks offer several strategic and operational advantages, especially for underserved or cost-sensitive markets:

| Advantage | Description |

|---|---|

| Lower Capital Requirements | Traditional telecom networks require vast investments in towers, spectrum licenses, and centralized infrastructure. In contrast, decentralized models use consumer-grade hardware and community participation, spreading infrastructure costs across thousands of contributors. This makes it feasible to expand coverage to remote or rural areas where ROI is too low for incumbent operators. |

| Incentive Alignment | Token-based economics create direct financial rewards for users who contribute to the network, whether by hosting equipment, validating transactions, or referring others. This fosters grassroots growth and local ownership, rather than top-down network planning. |

| Rapid Deployment | Without needing to wait for fiber backhaul or regulatory clearance, decentralized networks can scale faster. Nodes can be installed within hours by individual contributors, with traffic routed through preexisting broadband or even satellite uplinks. |

| Resilience and Redundancy | Mesh-based, distributed architecture makes these networks more resilient. If one node fails, traffic is automatically rerouted through adjacent peers, minimizing downtime. |

| Global Interoperability | By using open standards and blockchain-based identity, decentralized networks support seamless roaming and compatibility across borders and providers. |

The feasibility of decentralized telecom is closely tied to spectrum availability. In many countries, spectrum is tightly controlled and auctioned off to a few large players. However, several trends are supporting the rise of open or lightly licensed spectrum:

- CBRS in the U.S. (Citizens Broadband Radio Service) enables shared spectrum access, allowing startups and community networks to offer LTE/5G services without purchasing spectrum outright.

- TV White Space technologies allow underused broadcast frequencies to be repurposed for rural broadband.

- Software-defined radios (SDRs) and dynamic spectrum sharing enable more flexible use of spectrum and network slicing in real-time.

As regulators become more aware of the potential for decentralized networks to bridge the digital divide, we can expect more innovation in spectrum policy to support these models.

Challenges to Decentralized Telecom Adoption

While promising, this emerging model faces several technical, economic, and regulatory challenges:

| Challenge | Description |

|---|---|

| Backhaul Dependency | Many decentralized nodes rely on existing broadband connections for backhaul. Without stable internet at the host location, the quality of service can degrade significantly. |

| Regulatory Uncertainty | Unlicensed or shared-spectrum operations may conflict with telecom regulations, including lawful interception requirements and licensing mandates. Legal barriers vary by jurisdiction. |

| Coverage Fragmentation | Decentralized networks, driven by individual contributors, may lack coordinated planning, leading to inconsistent or patchy coverage unless augmented by strategic partnerships or roaming protocols. |

| Token Volatility | Crypto-based incentives fluctuate with token market prices. Sudden drops in token value can discourage participation and jeopardize long-term sustainability. |

Rather than viewing decentralized networks purely as competition, forward-thinking telecom companies can:

- Partner with or invest in decentralized network projects to expand coverage into unserved areas more cost-effectively.

- Integrate token-based roaming and identity services into their platforms to offer flexible access options.

- Offer infrastructure-as-a-service (IaaS) to decentralized networks, such as tower hosting, edge compute, or licensed spectrum leasing.

- Use blockchain for inter-network settlements, streamlining multi-operator transactions and billing.

A New Telecom Landscape

The success of decentralized networks underscores a powerful trend: connectivity is no longer a centralized service. Just as Uber changed transportation without owning cars, and Airbnb transformed lodging without owning hotels, decentralized telecom networks are showing that people, not corporations, can build and operate global infrastructure.

For telecoms, this isn’t a threat, it’s a signal to evolve. Those who embrace the shift can lead the way into a future where connectivity is open, programmable, and user-owned.

NFTs: A New Revenue Stream for Telecom and Media

Non-fungible tokens (NFTs) are one of the most visible and dynamic elements of the Web3 ecosystem. Unlike cryptocurrencies, which are interchangeable (fungible), each NFT is unique and represents ownership of a specific digital or physical asset. Built on blockchain technology, NFTs serve as proof of ownership, enabling secure, verifiable transactions without the need for centralized intermediaries.

While NFTs are often associated with digital art and collectibles, their utility goes far beyond novelty images. For telecom and media companies, NFTs open up new monetization channels, deepen customer engagement, and unlock innovative digital experiences that were not possible in Web2.

What Makes NFTs Valuable in Telecom?

NFTs represent more than digital ownership—they introduce programmable value, verified scarcity, and direct creator-to-user engagement. For telecom operators and media brands, NFTs can be used to:

- Package exclusive digital content

- Tokenize physical products or experiences

- Authenticate access to virtual events, perks, or loyalty programs

- Facilitate fan-based engagement across sports, music, and entertainment

The result is a model where content, access, and experiences become tradable and verifiable assets on a blockchain—removing intermediaries and allowing telecoms and IP owners to retain more of the value they generate.

Practical Use Cases for Telecom and Media Players

| Use Case | Description | Example |

|---|---|---|

| Tokenized Access and Subscriptions | Telcos can issue NFTs as membership tokens for premium service tiers, early product access, or beta programs. These tokens are portable and tradeable. | A telco launches NFT-based “VIP access passes” granting premium features, product trials, and priority support—auctioned or gifted to top-tier customers. |

| Event and Content Licensing | NFTs can be used to grant perpetual access to live events, concerts, or streaming services, verifying attendance and ownership. | Coachella’s NFT ticket bundles included lifetime passes, exclusive merchandise, and private performances. Telcos can replicate this for their media partners. |

| Loyalty and Rewards Programs | NFTs enable cross-platform loyalty ecosystems where users earn and trade tokens based on engagement and referrals. | A telco rewards loyal or referring customers with NFTs that unlock discounts, merchandise, or virtual meet-and-greets with influencers. |

| Digital Collectibles for Fan Engagement | Telecoms can collaborate with media or sports brands to launch NFTs tied to highlights, behind-the-scenes content, or merchandise. | The NBA’s “Top Shot” allows fans to buy digital highlights. Telcos could offer similar experiences tied to local sports or music events. |

| Virtual Real Estate and Avatars in the Metaverse | NFTs can represent digital identities, avatars, and virtual spaces as telcos expand into the Metaverse. | SK Telecom and Telefónica explored Metaverse NFTs where users buy branded wearables or virtual venues on their platforms. |

Monetization Opportunities

NFTs give telecoms and media companies new ways to capture and retain value:

- Royalty Payments: NFT smart contracts can enforce royalty payments on all secondary sales. This creates recurring revenue even after the initial sale.

- Creator Ecosystems: Partnering with artists, developers, and influencers, telcos can operate NFT platforms where creators mint content, and the telco earns a platform fee or co-branded revenue.

- Upselling and Bundling: NFTs can be bundled with physical or digital goods, turning one-time transactions into loyalty loops or collector incentives.

Who’s Already Doing It?

- AC Milan & FC Barcelona: Released fan tokens that raised millions in hours, offering voting rights and exclusive merchandise access.

- Nike: Acquired digital collectible firm RTFKT and launched “CryptoKicks,” with some NFTs selling for over $100K.

- Warner Bros. & Disney: Released NFT-backed movie memorabilia and companion content.

- TikTok: Partnered with creators to sell “Top Moments” NFTs featuring viral content.

These early movers are validating NFTs as a legitimate revenue stream—and telecoms, with their distribution scale, infrastructure, and user base, are well-positioned to capitalize.

Challenges and Considerations

| Challenge | Description |

|---|---|

| Market Volatility and Hype | NFTs have experienced speculative bubbles. Telcos must ensure responsible innovation to avoid reputational damage from perceived short-term “gimmicks.” |

| Environmental Concerns | Earlier blockchains (e.g., Ethereum PoW) raised sustainability issues. Telcos should prioritize NFTs minted on proof-of-stake or carbon-neutral platforms. |

| Intellectual Property and Legal Compliance | NFTs linked to copyrighted content require clear user rights and licensing agreements to prevent legal disputes or consumer confusion. |

| Onboarding and User Education | Many users are unfamiliar with blockchain concepts (e.g., wallets, gas fees). Telcos must integrate NFTs into user-friendly apps and existing billing systems for mainstream adoption. |

Long-Term Potential: NFTs as a Strategic Layer

Over time, NFTs could become core infrastructure for identity, access, and value exchange in digital ecosystems. For telecom and media players, NFTs are more than collectibles—they’re programmable assets that can:

- Represent mobile numbers and user IDs

- Manage digital twins of physical devices

- Enable metered access to premium network features

- Grant voting rights in fan-driven or DAO-based governance models

In short, NFTs are the bridge between ownership and experience in Web3, and telecoms have the brand presence, content partnerships, and distribution muscle to lead this transition.

Smart Contracts, DAOs, and DeFi: Reimagining Telecom Operations

While NFTs and crypto tokens often grab headlines, the true operational transformation of Web3 is being driven by smart contracts, decentralized autonomous organizations (DAOs), and decentralized finance (DeFi). Together, these technologies enable telecom operators to automate service delivery, decentralize decision-making, and unlock entirely new business and funding models.

In Web2, telecom operations are governed by centralized systems like business support systems (BSS), proprietary billing engines, and complex legal contracts. Web3 introduces the possibility of self-executing, transparent, and programmable logic that can operate without intermediaries — dramatically reducing costs, improving transparency, and enabling new services.

Smart Contracts in Telecom: Automating the Backend

A smart contract is a program stored on a blockchain that automatically executes an action when specific conditions are met. These contracts are immutable, transparent, and trustless — they don’t require an intermediary or manual approval.

Potential Telecom Use Cases with Smart Contracts

| Use Case | Description |

|---|---|

| Automated Billing and Charging | Smart contracts track real-time service usage (data, calls, roaming) and charge users instantly. Supports pay-as-you-go models and eliminates reconciliation delays. |

| Dynamic Service Level Agreements (SLAs) | SLAs can be codified into smart contracts. If service levels drop (e.g., high latency or downtime), penalties or refunds are automatically triggered. |

| Prepaid Services Without Friction | Smart contracts act as escrow for prepaid plans, releasing services upon payment and returning funds automatically if the service fails—ideal for cross-border use. |

| Roaming Settlement | Enables instant, automated settlement of roaming charges between telecom operators once sessions are completed. Reduces errors, manual processing, and disputes. |

| Device Lifecycle Management | Tracks IoT device events from provisioning to deactivation via smart contracts. Automates updates, onboarding, and revocation securely across decentralized telecom networks. |

DAOs: Decentralized Governance for Telecom Ecosystems

| Use Case | Description |

|---|---|

| Community-Owned Networks | Decentralized 5G/IoT networks like Helium and Pollen operate as DAOs. Token holders vote on network changes, hardware incentives, and expansion strategies, promoting local ownership and governance. |

| Decentralized Product Development | DAOs fund and oversee the creation of telco-specific decentralized applications (DApps) or APIs. Developers propose ideas, receive token-based funding, and build with community input—bypassing traditional R&D. |

| Crowdsourced Policy and Pricing | Governance token holders help shape service rules like data privacy, roaming costs, or rewards. This empowers users and partners to co-create service experiences and policies. |

| Operator Consortia DAOs | Multiple telecom providers can form joint DAOs to manage cross-border or shared initiatives (e.g., Open RAN, spectrum use, Metaverse infrastructure) without relying on a central authority. |

DeFi: Financial Innovation Beyond the Bank

Decentralized Finance (DeFi) uses blockchain to deliver financial services without banks or intermediaries. For telecom, DeFi enables alternative monetization, funding models, and financial services directly embedded into the network.

DeFi in Telecom: What’s Possible?

| Use Case | Description |

|---|---|

| Tokenized Network Access | Telcos can offer connectivity (data packages, bandwidth) as tokenized financial products. These tokens can be traded, staked, or bundled with other assets, transforming prepaid mobile plans into investable and reward-bearing digital assets. |

| Crypto-Backed Financing for ISPs | Small or rural ISPs can raise funds by issuing tokens via DeFi platforms, backed by anticipated revenue or infrastructure value. This provides an alternative to traditional loans, broadening access to telecom investment. |

| Dynamic Pricing and Spot Markets | Bandwidth and network services can be priced in real-time based on demand using DeFi tools. Users can buy cheaper data during low-demand periods or sell excess capacity during peak hours, creating decentralized bandwidth trading markets. |

| Insurance via Smart Contracts | Telecom operators can offer smart contract-based insurance for devices or services. If predefined service failures (e.g., downtime, location outages) occur, the contract triggers automatic payouts, eliminating manual claims processes. |

| Loyalty Finance | Loyalty points can be converted into yield-generating assets using DeFi protocols. Users can stake telco-issued loyalty tokens and earn interest, effectively transforming reward systems into financial portfolios. |

Strategic Benefits for Telecom Operators

- Operational Efficiency: Automating backend functions reduces reliance on legacy BSS/OSS stacks, streamlining costs and speeding service delivery.

- Transparency and Trust: Blockchain-native systems are auditable and tamper-proof, improving customer trust and enabling regulatory oversight with less overhead.

- Revenue Diversification: DeFi, DAOs, and smart contracts open entirely new monetization models beyond connectivity, including tokenized services, digital asset trading, and marketplace integration.

- Enhanced User Experience: Offering programmable services that are user-controlled (via tokens or contracts) aligns with the Web3 ethos and enhances engagement and loyalty.

Implementation Challenges

- Legal and Regulatory Complexity: Smart contracts and DeFi tools often exist in gray areas of law, particularly regarding consumer protections and financial oversight.

- Integration with Legacy Systems: Full transition from traditional OSS/BSS to blockchain-native tools is complex and may require middleware, gradual migration, or hybrid models.

- User and Partner Readiness: DAOs require new governance cultures; smart contracts need rigorous testing and user-friendly interfaces to avoid service disruption.

The Path Ahead

These technologies aren’t just optional upgrades—they represent a redefinition of what a telecom service provider is. In the Web3 world, telcos can evolve into autonomous platforms, capable of:

- Enabling fully programmable services

- Collaborating through token-governed alliances

- Facilitating decentralized business models

Operators that begin investing in these capabilities today — whether through internal development, partnerships, or ecosystem participation – will be best positioned to thrive in the tokenized, decentralized future of telecom.

Enabling the Metaverse: Telecom’s Role in the Future of Immersive Connectivity

The Metaverse is more than just a buzzword—it represents a seismic evolution in how people work, socialize, and engage with content. Defined as a persistent, immersive, 3D virtual environment where users interact through digital avatars, the Metaverse is widely expected to become a major economic and cultural force. But behind the flashy visuals and virtual real estate lies a fundamental requirement: massive, low-latency, high-capacity connectivity infrastructure.

This is where telecom comes in.

Far from being passive observers, telecom operators are essential enablers of the Metaverse. From delivering immersive virtual experiences to supporting decentralized identity and asset ownership, telcos will play a foundational role in making the Metaverse possible.

Why the Metaverse Needs Telecom

The Metaverse is not a self-contained application—it’s a network of networks, requiring:

- Ultra-low latency for real-time interaction

- High bandwidth throughput for streaming 3D content and holographic video

- Seamless mobility between physical and digital worlds

- Persistent identity and security layers

- Massively distributed edge compute infrastructure

Without the underlying 5G, fiber, edge computing, and decentralized infrastructure, the Metaverse simply cannot scale to mainstream use. Web3 may provide the tools for ownership and governance, but telecom provides the physical rails.

Infrastructure Pillars Supporting the Metaverse

| Pillar | Key Capabilities | Telecom Opportunity |

|---|---|---|

| 5G and Future Wireless Standards | – Sub-10ms latency – Support for millions of simultaneous device connections – Edge processing for immersive apps |

Build and manage next-gen wireless infrastructure to act as the “air bridges” into the Metaverse |

| Edge Computing | – Real-time AR/VR rendering – Localized AI decision-making – Caching of 3D content closer to end users |

Offer Edge-as-a-Service to developers and Metaverse platforms for low-latency application performance |

| Decentralized Identity & Ownership Layers | – SIM or wallet-based identity – Blockchain-powered ID tokens – Secure issuance and recovery of digital identity |

Serve as trusted digital custodians, enabling identity security across Metaverse environments |

| Quality-of-Experience Guarantees (QoS) | – Guaranteed bandwidth for VR meetings – Priority lanes for gaming/simulation – Dynamic pricing based on content and traffic |

Offer differentiated QoS-based subscriptions tailored for immersive experiences beyond traditional data plans |

Real-World Telco Investments in the Metaverse

Several leading telecom operators have already made strategic investments and partnerships in the Metaverse space:

- SK Telecom launched “ifland,” a virtual social platform offering digital events, avatars, and branded environments. The company also supports Metaverse developer ecosystems via 5G and AI infrastructure.

- Telefónica created a dedicated unit for exploring Metaverse and Web3 business models. It has partnered with Meta, Qualcomm, and others to explore immersive commerce and identity layers.

- T-Mobile US and Deutsche Telekom have invested in XR development and 5G enhanced gaming and virtual environments, positioning themselves as experiential connectivity providers.

- China Mobile and Huawei are exploring national-scale Metaverse applications, including smart city twins and government-hosted virtual citizen services.

- Verizon and AT&T are developing edge-enabled services to support business and entertainment applications that overlap with Metaverse frameworks, including holographic meetings and immersive sports streaming.

Web3 Synergies: NFTs, Crypto, and Smart Contracts in the Metaverse

The Metaverse and Web3 are distinct but highly interdependent:

- NFTs represent digital ownership of avatars, land, fashion, media, and identity credentials.

- Smart contracts automate transactions, access permissions, and interactions in virtual worlds.

- DAOs govern virtual communities, spaces, and platforms through collective voting and tokenomics.

- Crypto payments are used for in-world commerce, asset trading, and real-money payouts to creators or workers.

Telecom operators that support these interactions—either by hosting infrastructure, integrating wallets, or issuing platform tokens—will capture value beyond their traditional role.

Strategic Roles Telcos Can Play in the Metaverse

- Connectivity-as-a-Service for Virtual Worlds – Offer on-demand, high-quality, location-aware connectivity optimized for immersive platforms, billed via smart contracts or tokens.

- Edge Compute and Content Hosting – Become the default edge provider for Metaverse application developers, providing APIs and dev tools.

- Digital Asset Custodian – Offer white-label crypto wallets and NFT vaults with biometric authentication and recovery mechanisms for mainstream users.

- Marketplace and Platform Aggregator – Curate verified, high-performance Metaverse experiences for mobile and broadband subscribers, including subscription bundles, partner access, or in-app upgrades.

- Creator and Brand Partner – Develop branded experiences, virtual storefronts, or fan engagement platforms in collaboration with brands, influencers, or sports leagues.

Considerations for Telco Entry into the Metaverse

- Cross-platform interoperability is key—users must be able to move freely between ecosystems.

- Regulatory frameworks around virtual identity, taxation, and IP protection are still emerging.

- Energy use and sustainability must be addressed, especially for VR/XR workloads at scale.

- User safety, moderation, and privacy require clear governance strategies in immersive spaces.

Conclusion: Telecom as the Metaverse Backbone

The Metaverse represents a massive shift in how people interact with digital content. But it is only as real-time, secure, and immersive as the networks that support it. In this future, telecoms are not just enablers—they are essential partners in creating a new category of digital reality.

Those who move early and boldly, building the infrastructure, services, and partnerships, will define their role not just in the internet of tomorrow, but in the virtual economies, societies, and identities of the future.

How Web3 and Decentralized Telecom Empower Small Businesses

Web3 and decentralized telecom are not only reshaping the technology landscape for large corporations—they are leveling the playing field for small businesses, startups, and independent operators. For decades, telecom infrastructure and digital communication tools have required costly, centralized services that were out of reach for smaller enterprises. With the advent of decentralized networks, blockchain-powered tools, and crypto-based billing models, small businesses can now access secure, scalable, and affordable telecom services.

This democratization of connectivity and digital tools could fuel a new wave of entrepreneurship, especially in emerging markets, rural regions, and underserved sectors.

The Small Business Dilemma in Traditional Telecom

Before Web3, small businesses typically faced:

- High costs for enterprise telecom solutions and private network setup

- Limited control over communication infrastructure, identity systems, and customer data

- Long contracts and vendor lock-in

- Security and privacy gaps with third-party services

- Difficulty scaling globally due to cross-border fees, roaming costs, and data compliance challenges

Web3 eliminates or transforms many of these barriers by offering modular, pay-per-use, and decentralized alternatives.

Key Benefits of Decentralized Telecom for Small Businesses

| Benefit | Details | Example |

|---|---|---|

| 1. Lower Operational Costs | – Pay only for bandwidth or usage – Dynamic crypto micropayments (per second/MB) – No need for proprietary equipment or licensed software |

A small retail chain uses Helium 5G or CBRS-based networks for in-store IoT devices, saving on managed service costs. |

| 2. Secure & Private Communications | – Blockchain-based messaging & decentralized VPNs for secure communication – Smart contracts enforce encryption and access control – Users control credentials and authentication |

A fintech startup uses blockchain-secured VOIP with multi-signature access, reducing SIM swap and phishing risks. |

| 3. IoT & Edge Device Integration | – Plug-and-play deployment of IoT devices – Token-based identity and smart contract-based service provisioning and billing |

A rural farm uses decentralized LoRaWAN or 5G for remote sensors, paying only for the data transmitted with no telco lock-in. |

| 4. No Vendor Lock-In | – Open standards and DApp compatibility – Easier migration between services or providers without data loss or downtime |

A startup switches from one decentralized storage provider (e.g., Filecoin) to another without disruption or migration fees. |

| 5. Crypto-Based Revenue Models | – Accept crypto payments – Issue loyalty or community tokens – Earn rewards by contributing resources (e.g., compute, storage, bandwidth) to the decentralized ecosystem |

A coworking space issues tokens redeemable for Wi-Fi, printing, or room time, and sells these tokens directly to customers or partners. |

Industry-Specific Use Cases

| Industry | Use Case | Details |

|---|---|---|

| Agriculture | Remote monitoring via blockchain-connected sensors | Enables secure, real-time data collection from field sensors. |

| Micropayment-driven weather data access | Farmers can pay per use for hyper-local, blockchain-verified weather updates. | |

| Smart contracts for automated insurance or supply chain settlement | Triggers automatic payouts or contract fulfillment based on sensor or logistics data. | |

| Healthcare | Blockchain-based communication between clinics and patients | Enables secure, verifiable, and tamper-proof patient messaging and data sharing. |

| Decentralized identity and data wallets for privacy compliance (HIPAA, GDPR) | Patients control their data and share it selectively with healthcare providers. | |

| Encrypted medical IoT devices using Web3-enabled edge networks | Ensures device data integrity, privacy, and interoperability through blockchain authentication. | |

| Retail | Loyalty NFTs offering exclusive deals or digital collectibles | Customers earn tradable, branded NFTs tied to purchase history or engagement. |

| Secure, tokenized e-commerce transactions without payment gateways | Reduces transaction fees and fraud via crypto payments and smart contracts. | |

| Decentralized customer engagement tools (e.g., on-chain reviews, dispute resolution) | Transparent, tamper-proof consumer feedback and dispute tracking. | |

| Education | Blockchain certificates and identity tokens for student records | Enables portable, verifiable academic credentials. |

| Smart contract-based payment plans or donation systems | Automates tuition payments or scholarship disbursements. | |

| Access to bandwidth via token-based educational network hubs | Students or schools unlock network access through token payments or educational NFTs. |

Empowering Local Telecom Entrepreneurs

Web3 also supports bottom-up telecom entrepreneurship, where individuals or cooperatives can:

- Deploy decentralized 5G or Wi-Fi hotspots

- Provide community broadband access in rural or underserved areas

- Earn crypto rewards while delivering real connectivity services

Example: In a developing nation, a local entrepreneur can deploy a hotspot connected to the Helium or Pollen network and earn tokens while offering affordable internet access to their community.

This grassroots model promotes economic empowerment, digital inclusion, and local ownership, especially in regions neglected by legacy carriers.

Challenges for Small Business Adoption

- Education & Onboarding: Many SMBs are unfamiliar with wallets, crypto economics, and smart contract security. Simple user experiences are essential.

- Regulatory Compliance: Businesses must ensure compliance with financial, data, and telecom regulations when using decentralized tools.

- Volatility & Perception: Crypto’s fluctuating value and past scandals may deter risk-averse businesses without clear, stable onramps.

How Telecom Operators Can Help

Larger telecom companies can support SMBs by:

- Offering Web3 toolkits or API platforms for decentralized billing, identity, or messaging

- Providing managed Web3 services, such as NFT issuance, tokenized loyalty programs, or crypto wallets

- Building educational programs and marketplaces that help small businesses discover and adopt decentralized tools

This dual approach allows telecoms to retain relevance among small business customers while cultivating new revenue opportunities and partnerships.

Final Thought

Web3 telecom doesn’t just empower tech giants—it unlocks new freedoms for the smallest players in the global economy. By lowering entry barriers, reducing costs, and restoring control, decentralized telecom enables small businesses to operate with the same digital agility and resilience as their largest competitors.

In a Web3 future, connectivity is a service anyone can access, customize, and even provide—and that’s revolutionary.

Identity and Privacy in Web3: A New Role for Telecoms

In Web2, digital identity is fragmented, controlled by centralized platforms like Google, Facebook, and Apple. Users often surrender personal information to access services, leading to widespread data breaches, surveillance capitalism, and a loss of control over personal data.

Web3 reimagines identity from the ground up. In this decentralized future, users own and control their identities, determine what data they share, and interact across platforms using verifiable credentials stored in digital wallets.

This shift presents telecom operators with a unique opportunity: to move beyond connectivity and become trusted custodians of digital identity and privacy. Given their history as regulated, verified service providers with billions of user accounts, telcos are well-positioned to take on this critical role in the next era of the internet.

What Is Decentralized Identity (DID)?

Decentralized Identity (DID) is a model where users control their identity credentials, such as name, age, credentials, or biometric data—without relying on centralized databases. These credentials are:

- Stored in secure, user-controlled wallets

- Verifiable via blockchain records

- Shareable selectively and with full consent

- Resistant to tampering, fraud, or unauthorized surveillance

Unlike Web2 logins (e.g., “Sign in with Google”), Web3 logins can use DID tokens or zero-knowledge proofs, where a user can prove a fact (like being over 18) without revealing additional personal information.

Why Identity and Privacy Matter in Web3

As services become increasingly decentralized, the need for trustless but verifiable interactions grows:

- In decentralized finance (DeFi), users need to prove their identity for regulatory compliance (KYC/AML) without revealing sensitive data.

- In the Metaverse, avatars must be tied to authentic identities to prevent impersonation or harassment.

- In healthcare, patients must control access to their medical records without relying on centralized databases.

Decentralized identity ensures that users—not corporations—retain sovereignty over their digital selves.

Why Telecoms Are Uniquely Positioned to Lead

Telecom providers already perform key identity functions today:

- SIM card registration involves KYC in most markets.

- Mobile numbers serve as unique identifiers for two-factor authentication and account recovery.

- Telcos manage sensitive user data, billing, and communication records under strict regulatory compliance.

This makes them natural bridge-builders between Web2 and Web3 identity frameworks, especially if they integrate:

- Blockchain-powered ID issuance systems

- Digital wallets tied to phone numbers or SIM cards

- User-centric privacy dashboards for data sharing controls

Example: A telco issues each subscriber a verified identity token stored in their mobile wallet. That token is used to log in to DApps, access services, or sign documents—all without disclosing sensitive personal information to intermediaries.

Identity Use Cases for Telecoms in Web3

| Use Case | Responsibilities | Real-World Example |

|---|---|---|

| SIM-Linked Digital Wallets | – Integrate with mobile infrastructure to store crypto assets and verifiable credentials (e.g., citizenship, medical status, loyalty badges) – Enable seamless access to Web3 services via mobile wallet |

SK Telecom’s “My Wallet” app supports NFTs, crypto, and decentralized identity credentials. |

| Decentralized KYC Services | – Offer identity verification as a service for DApps, exchanges, and fintech platforms – Monetize telco-trusted credentials through B2B APIs |

Telefónica has invested in blockchain and identity platforms for decentralized KYC services. |

| Web3 Login Services | – Provide decentralized single sign-on (SSO) for Web3 apps (e.g., “Sign in with [Carrier Name]”) – Use DID tokens or verifiable credentials to manage access securely |

Conceptual use case; modeled on Web2 SSO but backed by telco-issued decentralized credentials. |

| Selective Data Sharing & Consent Control | – Give users control to grant/revoke access to personal data across apps – Enable compliant, privacy-first engagement across Web3 services |

A health app can verify a user’s age/location via a telco-issued verifiable credential without sharing full identity. |

| Decentralized Contact Discovery & Spam Control | – Build encrypted, token-based systems for secure contact matching – Leverage on-chain identity reputation to prevent spam, fraud, or phishing attacks |

Conceptual example: contact validation via identity tokens could block robocalls or scam messages. |

Privacy and Compliance Benefits

- GDPR and CCPA Alignment: Decentralized identity gives users true data ownership, aligning with global privacy laws.

- Consent-by-Design: Instead of broad, opaque terms of service, every data request can trigger a clear, transparent consent prompt.

- Tamper-Proof Records: Audit trails and data exchanges are logged immutably on blockchain, enhancing trust and legal defensibility.

Risks and Implementation Considerations

- Interoperability Standards: There are multiple DID frameworks (e.g., W3C DID, Sovrin, uPort). Telcos must support broadly accepted protocols to ensure compatibility.

- User Experience: Key management, credential revocation, and wallet recovery must be simple enough for everyday users—not just crypto natives.

- Custodial vs. Self-Custodial Debate: Some users will prefer full control over their identity tokens; others will want telco-managed solutions. Flexibility is key.

- Data Sovereignty: Telcos must ensure that decentralized identity frameworks comply with national laws on data residency and surveillance.

Strategic Advantages for Telcos

By embracing Web3 identity:

- Telcos become identity platforms, not just connectivity providers.

- They can charge for verification-as-a-service, partner with governments or enterprises, and monetize B2B identity APIs.

- They reinforce customer loyalty and trust in a world where privacy is a competitive advantage.

- They future-proof themselves against disruption by Big Tech, whose dominance over user identity is increasingly under scrutiny.

Long-Term Vision: Identity as Infrastructure

In a decentralized internet, identity becomes as essential as DNS or IP routing. Telecoms that act now to develop robust identity solutions—anchored in privacy, interoperability, and user control—can become digital gatekeepers for a new era of trusted, open digital ecosystems.

Risks, Regulation, and Roadblocks: What Could Slow Web3 in Telecom

While Web3 holds immense promise for telecom operators, its disruptive nature introduces a range of technical, regulatory, economic, and operational challenges. These issues, if not addressed early, could slow adoption, erode trust, or expose telcos to unintended legal or financial risks.

As telecoms explore token-based economies, decentralized infrastructure, and blockchain services, they must navigate a highly dynamic and uncertain landscape. Understanding these roadblocks isn’t just about risk management—it’s a prerequisite for building resilient, scalable, and legally compliant Web3 strategies.

1. Regulatory and Compliance Uncertainty

Perhaps the most significant constraint is the lack of clarity in global regulation of Web3 technologies. While telecom is already a highly regulated sector, layering in crypto, NFTs, and decentralized apps introduces entirely new compliance considerations.

Key Regulatory Challenges

- Cryptocurrency Regulations: Telecoms offering token-based services, wallets, or crypto payments may be subject to financial regulations, including money transmitter licenses, anti-money laundering (AML), and know-your-customer (KYC) obligations.

- Security Classification: Some tokens or NFTs might be classified as securities, especially if they are offered with expectations of profit. This could trigger scrutiny from securities regulators such as the U.S. SEC or the EU’s MiCA framework.

- Data Privacy: Decentralized identity systems must comply with GDPR, CCPA, and other national data protection laws, even if the data isn’t stored centrally.

- Cross-Border Transfers: Telcos operating in multiple jurisdictions face challenges in transferring user identity data or processing cross-border crypto transactions due to conflicting regulatory requirements.

- Smart Contract Legality: Automated enforcement of agreements may be enforceable in some regions, but is legally untested or unenforceable in others.

Strategy Tip:

Operators should engage proactively with regulators, contribute to standard-setting bodies, and create regulatory sandboxes to pilot Web3 services under controlled conditions.

2. Technology Maturity and Scalability

Web3 technologies are powerful, but they are not yet mature or battle-tested at telecom scale.

Infrastructure Constraints

- Blockchain Throughput: Most blockchains still cannot support the transaction volumes required by global telecom operations (e.g., real-time billing or millions of IoT connections).

- Interoperability Gaps: Dozens of competing blockchain protocols exist, each with different smart contract languages, consensus models, and identity frameworks. Lack of cross-chain standards could fragment deployments and limit service interoperability.

- Latency and UX Friction: Web3 apps can be slower and more complex to use than centralized alternatives. Gas fees, wallet integration, and key management remain hurdles for average users.

- Energy Use: While many chains are migrating to energy-efficient consensus mechanisms (e.g., proof-of-stake), some still rely on energy-intensive models that are incompatible with ESG goals or regulatory standards.

Strategy Tip:

Focus on hybrid models that combine blockchain with centralized systems where necessary. Partner with L2 (Layer 2) solutions and interoperability bridges to overcome scalability limits.

3. Economic Risks: Volatility and Sustainability

Crypto markets are notoriously volatile, and most token-based Web3 telecom models (e.g., incentives for decentralized networks, micropayments in tokens, NFT-based subscriptions) rely on token value stability.

Key Economic Risks

- Token Devaluation: Telcos issuing their own tokens risk collapse in utility or user trust if token prices fall sharply. This undermines incentive structures and discourages adoption.

- Over-Hyped Models: Some early Web3 projects were built more on speculation than utility, leading to “pump and dump” behavior. Telecoms must avoid over-promising or marketing Web3 features as silver bullets.

- Sustainability of Incentive Models: Some decentralized networks (e.g., Helium) have struggled with declining token rewards as supply outpaces demand. Telecoms must align incentives to long-term value creation, not short-term hype.

- Costs of Experimentation: Pilots and infrastructure investments in Web3 carry upfront costs, and many use cases lack proven ROI.

Strategy Tip:

Anchor token economies in real utility and demand. Consider stablecoins, hybrid billing systems, or fiat onramps to minimize volatility exposure.

4. User Experience and Trust

Web3 concepts like wallets, private keys, NFTs, and smart contracts remain confusing or intimidating to mainstream users. Poor onboarding or unclear benefits could undermine adoption.

UX Pain Points

- Key Management: Users may lose access to services if they forget their private key or seed phrase. Telecoms must offer recovery methods without undermining decentralization.

- High Friction Onboarding: Requiring users to install browser wallets, bridge assets, or manually approve smart contract interactions adds complexity.

- Fraud and Scams: Web3 is fertile ground for phishing, NFT fraud, and wallet drainers. Telcos must ensure consumer protections are in place for services they offer or endorse.

- Trust Gap: Many users remain skeptical of crypto due to high-profile collapses (e.g., FTX, Terra), seeing it as volatile or risky.

Strategy Tip:

Simplify the front end with mobile-first onboarding, social login integrations, and custodial wallet options. Offer clear tutorials and anti-fraud guarantees.

5. Organizational Resistance and Culture

Embracing Web3 may require a radical shift in mindset within traditional telecom organizations:

- Siloed Operations: BSS, OSS, finance, and network teams may operate independently, making integration of cross-functional Web3 tools difficult.

- Risk Aversion: Public telcos—especially those with regulatory oversight—may hesitate to adopt unproven technologies.

- Lack of Talent: There is a shortage of professionals with expertise in blockchain, crypto economics, decentralized architecture, and smart contract security.

- Legacy Systems: Integration with legacy billing, CRM, and network management platforms may require significant reengineering.

Strategy Tip:

Create dedicated innovation teams or internal Web3 task forces. Partner with Web3-native startups or accelerators. Upskill employees and cross-train in blockchain principles.

The Cost of Inaction

Despite the risks, the greater danger lies in waiting too long. Telcos that fail to evolve may:

- Lose relevance in digital identity, content, and customer engagement

- Cede innovation space to digital-native competitors or Web3 startups

- Become commoditized infrastructure providers with shrinking margins

Early movers will help shape standards, capture first-mover advantages, and build defensible ecosystems.

In Summary: Navigating the Road Ahead

| Challenge Area | Strategic Response |

|---|---|

| Regulation | Engage policymakers, run pilots in sandboxes |

| Scalability | Use L2s and hybrid architectures |

| Economic Volatility | Build stable, utility-based token models |

| UX Complexity | Prioritize seamless onboarding and wallet design |

| Organizational Inertia | Create internal champions and cross-functional task forces |

Web3-Enabled Use Cases in Telecom: Real-World Examples and Pilots

The shift to Web3 is not a theoretical exercise—it’s already happening. Around the world, telecom operators and tech startups are launching live pilots, forming partnerships, and deploying decentralized technologies that go beyond traditional connectivity. These real-world examples of Web3 in telecom provide valuable insight into what’s working, where value is being created, and how telcos can adapt or replicate these innovations.

This section highlights a range of Web3-enabled telecom use cases, organized by function, platform, and commercial maturity.

1. Decentralized 5G and IoT Networks

Helium 5G – “The People’s Network”

Model: Community-powered wireless networks incentivized by $HNT tokens

- Participants host 5G or LoRaWAN hotspots and are rewarded for coverage and data routing.

- Dish Network has partnered with Helium to augment its 5G footprint with decentralized deployments.

- Real value: Cost-effective expansion in underserved areas, minimal capital expenditure, and community alignment.

Pollen Mobile

Model: A decentralized 5G network for mobile broadband users

- Users deploy “Flowers” (radios), “Bees” (smartphones), and “Bumblebees” (mobile coverage mappers).

- Earnings in $PCN tokens based on network usage and validation.

- Targets developers and early adopters in urban areas with a strong privacy ethos.

2. Blockchain for Roaming, Billing, and Settlements

Telefónica + GSMA Blockchain Sandbox

Model: Blockchain-based roaming agreements and number portability

- Telefónica and other operators participated in GSMA’s inter-operator blockchain trials, testing automated roaming settlements.

- Smart contracts replaced slow, error-prone billing and dispute reconciliation systems.

- Outcome: Faster, more accurate revenue settlements and reduced fraud risk.

ClearX and Deutsche Telekom

Model: Automated intercarrier settlement via blockchain

- ClearX developed a blockchain clearinghouse for roaming and interconnect billing.

- Deutsche Telekom trialed it to simplify contract negotiation, usage tracking, and dispute resolution.

- Benefits: Improved efficiency and transparency in B2B telco settlements.

3. Decentralized Identity and Digital Wallets

SK Telecom – Web3 Crypto Wallet & DID Services

Model: A Web3 identity and wallet platform integrated into Korea’s largest carrier

- SKT’s “My Wallet” stores NFTs, tokens, and identity credentials.

- Supports DID (Decentralized Identity) services, enabling access to blockchain-based apps and services.

- Partners with NFT marketplaces, Metaverse platforms, and payment apps.

Vodafone – SIM-Based Identity Services

Model: Blockchain-enhanced digital identity management

- Vodafone is exploring how SIM-based credentials could be integrated into Web3 applications.

- Goal: Provide users with a portable, verifiable identity layer tied to telecom-grade trust infrastructure.

4. Telco-Led NFT and Metaverse Initiatives

SK Telecom’s “ifland” Metaverse Platform

Model: A 3D social platform built around avatars, events, and branded experiences

- Integrated with SKT’s telecom services for immersive interaction.

- Hosts concerts, business meetings, fan clubs, and influencer-driven content hubs.

- Potential NFT integration for avatar customization, ticketing, or virtual real estate ownership.

Telefónica + Polygon (MATIC)

Model: Enabling NFT issuance and token-based engagement on a Layer 2 blockchain

- Telefónica partnered with Polygon to explore NFT ticketing, loyalty, and content distribution models.

- Token-based access to digital services is being prototyped for consumer engagement.

5. DeFi, Tokenization, and Blockchain Finance

Nova Labs + Dish – Tokenized Incentives for 5G

Model: Dish allows users to earn crypto for deploying infrastructure nodes

- Dish subscribers or partners can receive crypto rewards for hosting Helium-compatible devices.

- This enables a token-driven extension of Dish’s 5G footprint without the cost of tower builds.

Celo + Mobile Network Operators in Africa

Model: Crypto payments and stablecoin-based micropayments over mobile networks

- Celo is working with local operators to deliver stablecoin-based payment rails in unbanked regions.

- Telcos play a dual role: providing infrastructure and offering wallet services.

6. Blockchain Content Distribution and Rights Management

Audius – Web3 Music Streaming Platform

Model: A decentralized platform for artists to distribute music without intermediaries

- Artists retain more revenue; telecoms can partner as edge hosts, aggregators, or access providers.

- Token-incentivized ecosystem for sharing, curation, and streaming.

Mediachain (acquired by Spotify)

Model: Rights and royalties ledger for media content

- Blockchain ensures fair compensation and tracking for content creators.

- Potential for telcos to offer white-label versions to local content providers and broadcasters.

7. Smart Contracts for Device Insurance and SLA Automation

Etherisc and Telcos in Emerging Markets

Model: Parametric insurance based on smart contracts

- Automatically pays out for device theft, connectivity failures, or service outages.

- Tied to real-world events like tower uptime or SIM deactivation.

EdgeQoS Experiments

Model: SLA enforcement for edge computing services using blockchain triggers

-

If performance drops below the threshold, smart contracts trigger refunds or resource redistribution.

8. Web3 Marketplaces and SuperApps Powered by Telcos

MTN Group (Africa) – Web3 SuperApp Initiatives

Model: Combining crypto payments, digital identity, NFT ticketing, and mobile banking

- Focused on building a unified interface for decentralized services.

- MTN is exploring the integration of Web3 finance and connectivity across its user base.

Lessons from the Field: What’s Working

- Token-based incentives work best when tied to real, recurring utility, like connectivity or infrastructure hosting.

- Partnerships with Web3-native platforms (e.g., Polygon, Celo) accelerate time to market.

- Web3 adds value fastest when integrated into existing user behavior—like SIM-based identity or wallet top-ups.

- Pilots succeed when they combine technical feasibility, clear user benefit, and business model alignment.

Key Takeaways for Telecom Innovators

- Start with low-risk, high-impact pilots, such as identity services or blockchain-based billing.

- Partner with experienced Web3 firms to share expertise, reduce build time, and validate use cases.

- Use pilots to test regulatory acceptance, user appetite, and infrastructure requirements.

- Always align Web3 services with customer value and core telco capabilities—avoid launching gimmicks disconnected from real usage.

Building a Web3 Strategy Roadmap for Telecom Operators

Transitioning into the Web3 ecosystem is not a matter of simply adopting a few new technologies—it requires a fundamental rethinking of telecom business models, capabilities, partnerships, and organizational structure. The decentralized internet introduces new market dynamics, new customer expectations, and entirely new forms of competition. To lead in this space, telecoms must take a strategic, phased, and adaptable approach.

This section provides a structured Web3 roadmap tailored specifically for telecom operators, including foundational actions, capability development, and guidance for navigating uncertainty.

Phase 1: Assess and Align – Understand Your Strategic Landscape

Before launching Web3 products, operators must take stock of their current position and readiness.

| Category | Action Items |

|---|---|

| Internal Audit: Capabilities & Gaps | – Assess technical capabilities in blockchain, cloud-native infrastructure, data governance, edge computing, and DevOps. – Evaluate internal knowledge on smart contracts, tokenomics, and DeFi. – Identify limitations of legacy systems (BSS/OSS) and integration needs. |

| Market and Competitive Landscape | – Track emerging Web3 use cases and competitors such as decentralized telcos, crypto wallets, and super apps. – Survey consumer and enterprise segments to understand interest and readiness. – Map industry-specific Web3 use cases aligned to your market context. |

| Leadership Buy-In | – Communicate the Web3 vision across executive teams. – Align initiatives with digital transformation and new revenue objectives. – Designate internal Web3 champions or launch an innovation task force. |

Phase 2: Define Where to Play – Choose the Right Strategic Control Points

You don’t need to do everything. Focus on the areas where you can create unique, defensible value.

Four Strategic Roles to Consider:

Here is your Four Strategic Roles to Consider section in a clean, easy-to-read table format:

| Strategic Role | Key Responsibilities |

|---|---|

| Multi-Connectivity Operator | – Build Web3-compatible infrastructure (5G, Open RAN, edge compute) – Monetize network access through smart contracts, tokens, and API-based platforms |

| Trust and Identity Enabler | – Provide decentralized identity, KYC-as-a-service, and privacy management tools – Serve as a digital custodian for user wallets, NFTs, and credential storage |

| Aggregator and Curator | – Bundle and personalize DApps, Metaverse content, and Web3 experiences for end users – Develop NFT-driven loyalty programs and community engagement platforms |

| High-Fidelity Experience Provider | – Deliver immersive services like VR meetings, holograms, and gaming with quality-of-service (QoS) guarantees – Create premium bandwidth tiers linked to NFTs or smart contract access control |

Prioritize by:

- Your core assets (infrastructure, user base, billing systems)

- Your existing trust position (e.g., regulated operator vs. OTT)

- Your access to developers, partners, and innovators

Phase 3: Build and Validate – Launch Low-Risk Pilots with Clear Metrics

Start small, but smart. Use pilots to build internal capabilities, test business models, and generate momentum.

Pilot Opportunities

- Deploy an NFT-based loyalty program for early adopters or fan communities

- Offer a crypto-compatible digital wallet tied to a mobile identity

- Build a blockchain-based inter-operator settlement layer with roaming partners

- Launch a token-incentivized 5G micro-deployment in an urban or underserved area

- Provide edge-as-a-service offerings for Metaverse or IoT developers

Key Pilot Metrics

- User adoption and retention

- Operational efficiency (e.g., SLA enforcement, billing cycle reductions)

- Token circulation and velocity

- Regulatory engagement and feedback

- Developer/partner ecosystem participation

Phase 4: Scale and Expand – Invest in Ecosystem Infrastructure

Once use cases are validated, scale services across markets, partners, and platforms.

Infrastructure Investments

- Develop a Web3-ready core network—cloud-native, open, programmable

- Offer middleware APIs for Web3 developers to integrate into your billing, network, or identity layers

- Build or join multi-operator consortiums around shared ledgers, roaming, or DeFi

Organizational Investments

- Upskill teams on blockchain development, token economics, and governance

- Partner with universities, accelerators, and startups to nurture talent and innovation

- Create a Web3 operating model with new metrics, incentives, and agile teams

Risk Management and Governance

- Develop a governance framework for crypto custody, NFT issuance, and DeFi participation

- Create cross-functional regulatory compliance teams

- Implement robust identity protection, wallet recovery, and fraud mitigation protocols

Phase 5: Lead and Influence – Shape the Future of the Ecosystem

Telecom operators that lean into Web3 early can help define the rules, standards, and partnerships that shape the next decade of the internet.

Ecosystem Leadership Tactics

- Join open-source blockchain foundations and Web3 alliances (e.g., W3C, GSMA, Decentralized Identity Foundation)

- Launch or support telco-led DAOs, open Metaverse platforms, or decentralized identity standards

- Advocate for Web3-ready policy frameworks that support innovation and consumer protection

- Create cross-industry plays with cloud, banking, gaming, and media partners to co-create interoperable ecosystems

Your Web3 Strategy Toolkit (Summary)

| Strategic Step | Actions |

|---|---|

| Assess & Align | Internal audit, market scan, leadership buy-in |

| Choose Where to Play | Prioritize based on assets, gaps, and market needs |

| Build & Pilot | Launch low-risk pilots tied to clear KPIs |

| Scale & Invest | Expand offerings, talent, and ecosystem partnerships |

| Lead & Influence | Shape standards, governance, and multi-industry models |

Why the Future of Telecom is Decentralized

The evolution from Web1 to Web3 is not just a technological upgrade—it is a restructuring of power, control, and value in the digital world. Telecom operators, once the central enablers of global connectivity, have seen their influence eroded during the Web2 era by over-the-top platforms, hyperscalers, and digital-native ecosystems.

But Web3 opens the door for telcos to reclaim relevance—not by reverting to the old models, but by reinventing themselves as orchestrators of decentralized infrastructure, identity, and value exchange.

What Makes Web3 a Historic Opportunity for Telecom

Unlike previous disruptions that marginalized telcos, Web3 plays directly into the industry’s core competencies:

- Infrastructure ownership → Enabling decentralized, high-fidelity connectivity (5G, fiber, edge)

- Identity and trust → Becoming digital ID custodians in the DID ecosystem

- Billing and settlement expertise → Automating and securing value transfer with smart contracts

- Distribution power → Aggregating and personalizing Web3 services for consumers and enterprises

Telcos have what it takes to not just survive in the Web3 era, but to lead.

Five Strategic Shifts Telcos Must Embrace

| Strategic Shift | Description |

|---|---|

| From Proprietary to Open | Telcos must evolve from closed, siloed systems to open standards, APIs, and interoperable ecosystems, enabling global programmability and integration. |

| From Utility to Platform | Rather than merely selling bandwidth, telecoms should create platforms that power decentralized identity, micropayments, token-based services, and edge computing. |

| From Subscriber to Stakeholder | In Web3, users are active participants. Telcos should build services that encourage user ownership, governance participation, and shared value creation. |

| From Centralized Control to Distributed Collaboration | Telecoms need to embrace decentralized organizational models, DAOs, and agile cross-industry partnerships across finance, media, IoT, and public services. |

| From Legacy Revenue to Digital Assets and Tokens | Future revenue will come from NFTs, token ecosystems, DeFi, and monetized APIs, extending beyond traditional SIM card sales and data plans. |

Why Inaction Is the Greater Risk

The risks of embracing Web3 are real, but the risks of doing nothing are greater:

- Continued commoditization of connectivity services

- Further erosion of influence by hyperscalers and fintech apps

- Loss of relevance with digitally native, privacy-aware consumers

- Missed opportunities to monetize trust, identity, and infrastructure

In a world where trust is programmable, where networks are owned by their users, and where identity is portable across platforms, telecoms that fail to evolve will be left behind.

A Call to Action for Telecom Leaders

- Assess your capabilities.

- Choose your plays.

- Launch meaningful pilots.

- Invest in talent, infrastructure, and ecosystem growth.

- Shape the standards and partnerships that define the next internet.

This is not a wait-and-see moment. It is a build-and-lead moment.

The decentralized future is already taking shape. Telecom operators that act now—boldly, intelligently, and collaboratively—can shape Web3 not just as participants, but as architects.