In a recent revelation through court documents, Meta has projected an optimistic revenue forecast from its generative AI products, expecting to generate between $2 billion and $3 billion by 2025, and an impressive $460 billion to $1.4 trillion by 2035. These figures underscore the significant financial impact that generative AI technologies are poised to have on the tech landscape over the next decade.

The Growing Economic Impact of Generative AI

The integration of generative AI into various business models is becoming increasingly mainstream, with companies like Meta at the forefront of this technological revolution. Generative AI, which includes any form of artificial intelligence that can generate content such as text, images, and even code, is becoming a crucial element in the tech industry’s revenue streams.

Meta’s Generative AI Products and Strategies

While the specific products Meta categorizes under its “generative AI” umbrella were not detailed in the court documents, it is known that Meta has been actively developing and monetizing AI through various initiatives. These include partnerships and revenue-sharing agreements related to its open-source Llama AI models. Meta has also introduced an API for customizing and evaluating these models, potentially opening up new revenue streams through enhanced user customization and integration capabilities.

Monetization and Market Strategy of Meta’s Generative AI

Meta’s CEO, Mark Zuckerberg, hinted at future monetization strategies during the company’s Q1 earnings call, including the potential introduction of advertisements and subscription models within Meta AI’s offerings. This strategic pivot not only aims to enhance direct revenue from AI but also to embed AI deeply into the digital economy’s fabric, affecting everything from content creation to consumer interactions.

Financial Commitments and Legal Controversies

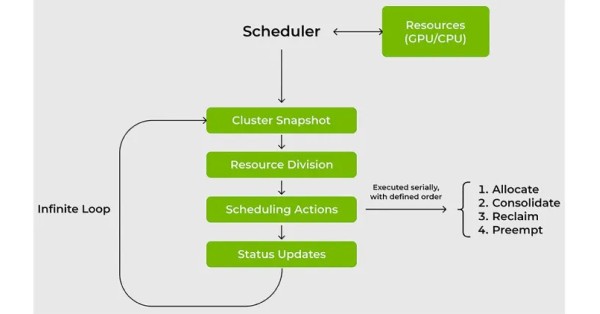

The disclosed financial figures reveal Meta’s aggressive investment in AI, with its “GenAI” budget surpassing $900 million in 2024 and expected to exceed $1 billion in the following years. These investments highlight the company’s commitment to leading in the AI space, notwithstanding the substantial capital expenditures, projected between $60 billion and $80 billion in 2025, largely funneling into expansive new data centers essential for AI development and deployment.

Challenges in AI Development

However, Meta’s ambitious AI initiatives are not without their challenges. The company has been embroiled in legal disputes over its methods of training AI models, particularly involving allegations of using copyrighted books without proper licenses. The authors of these books have sued Meta, claiming unauthorized use of their materials to train Meta’s AI. This lawsuit highlights a growing challenge in the AI industry: the ethical and legal implications of training data acquisition.

Meta’s Defense and Industry Implications

In response to these allegations, Meta has defended its practices by emphasizing the transformational nature of its AI models, which they claim foster significant innovation, productivity, and creativity. The company maintains that its use of copyrighted materials falls under fair use, a stance that underscores the ongoing debate over intellectual property rights in the age of AI.

Strategic Takeaways for Telecom and Technology Leaders

The implications of Meta’s forecasts and strategic AI investments are profound for executives in the telecom and technology sectors. As AI technologies continue to evolve, they will increasingly affect network demands, data management needs, and service offerings. Telecom leaders must consider how AI can be integrated into their services to enhance customer experiences and operational efficiency.

Preparing for an AI-Driven Future

For CTOs and network strategists, the key will be in preparing infrastructure that can support the heavy data and processing loads AI requires. This may involve investing in more robust data centers, considering cloud solutions, or exploring edge computing to reduce latency in AI-driven applications. Furthermore, the ongoing legal considerations around AI training data highlight the importance of adhering to ethical standards and intellectual property laws, which will undoubtedly shape the regulatory landscape of AI development.

In conclusion, while the financial prospects of generative AI are promising, they come with a set of strategic, operational, and legal challenges that industry leaders must navigate. Staying ahead in this dynamic field will require a balanced approach of aggressive technological adoption and meticulous risk management.