Lumen surpassing 1,000 customers on its Network-as-a-Service platform is a clear marker for where enterprise networking is headed. AI adoption, multi-cloud architectures, and distributed applications are pushing organizations toward on-demand, software-driven connectivity. Traditional change windows and multi-week circuit turn-ups cannot keep pace. NaaS brings the model of cloud self-service, elastic capacity, and usage-aligned economics to the network. That shift is now at scale.

The announcement also signals that managed connectivity is consolidating around a few design points: fast provisioning, API control, integrated security, and direct cloud on-ramps. For enterprises rebuilding network architectures around AI workloads and edge use cases, these capabilities are no longer optional. They are table stakes.

What Lumen NaaS Is Actually Delivering

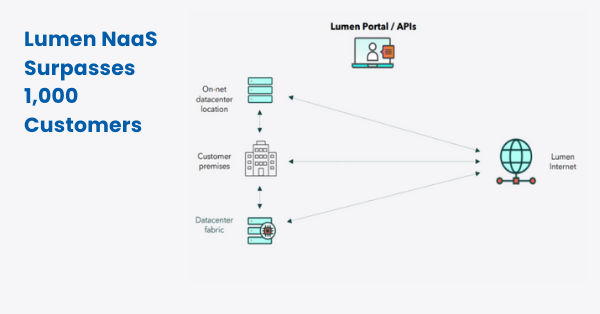

Lumen’s Network-as-a-Service (NaaS) approach combines flexible, on-demand connectivity with integrated security and automation. By unifying multiple network types under one self-service platform, the company enables enterprises to move faster, scale efficiently, and align network resources directly with business needs.

Lumen NaaS On-Demand Connectivity: Internet, Ethernet, and IP VPN

Lumens platform bundles three core service types under a single digital experience. Internet On-Demand provides public internet access with capacity that can be turned up in minutes. Ethernet On-Demand delivers Layer 2 private connectivity for data center and site-to-site needs. IP VPN On-Demand offers Layer 3 private connectivity for routed WAN designs. All can be provisioned self-service, scaled up or down based on demand, and stitched to cloud regions and third-party data centers via cloud on-ramps.

The platform integrates with major hyperscalers, enabling direct paths to AWS, Microsoft Azure, and Google Cloud. That matters for application performance, data gravity, and cost control. Dynamic bandwidth lets teams align network spend with workload peaksthink month-end processing, AI model training, large data migrations, or event-driven traffic.

Integrated NaaS Security: DDoS Mitigation and Threat Intelligence powered by Black Lotus Labs

Internet On-Demand can be paired with DDoS Essentials for automated mitigation of volumetric attacks. Lumen also brings threat intelligence and proactive blocking via its Defender capability, powered by Black Lotus Labs. This reduces the operational burden on security teams by filtering malicious activity before it reaches enterprise perimeters, an important safeguard as more traffic traverses public paths alongside private links.

Scale and Network Economics Behind the Platform

The viability of NaaS depends on reach, capacity, and automation. Lumen leans on a large footprintapproximately 163,000 on-net buildings and 340,000 global fiber route miles deliver low-latency, high-throughput paths across metros, intercity routes, and edge locations. The company is investing to extend intercity fiber, scale beyond 100G, and upgrade backbone capacity across key corridors. Those moves are essential for AI-era east-west traffic patterns, cloud adjacency, and predictable performance under load.

Importantly, the platform pushes edge-to-core automation. That means faster service activation, consistent policy, and fewer human touchpoints across links, sites, and clouds. The operational savings and speed-to-service are as valuable as the raw bandwidth.

Proof Points and Use Cases

The customer roster spans retail, financial services, energy, media, aerospace, and sports. Brands such as Best Buy, Columbia Sportswear Company, Foot Locker, Hanmi Bank, Clearway Energy Group, MTN Satellite Communications, Pac-12 Enterprises, Churchill Downs Racetrack, C3Aero, and IVision are using the platform for real workloads. Typical patterns include:

Cloud migration and SaaS integration: Private Layer 2 and Layer 3 connectivity combined with direct cloud on-ramps reduce jitter and egress surprises while improving app performance.

Mergers and acquisitions: Rapid site turn-ups and temporary bandwidth bursts simplify consolidation timelines and decrease reliance on costly interim solutions.

Media and live events: High-capacity, time-bound circuits spun up in minutes support broadcast backhaul, fan connectivity, and vendor operations.

Disaster recovery and backup services: Dynamic bandwidth aligns network capacity with replication windows, enabling more efficient DRaaS/BaaS operations.

Market Context: How Lumen NaaS Stacks Up

NaaS is now a competitive field. Equinix Fabric, Megaport, PacketFabric, Colt On Demand, Zayo’s on-demand offerings, and carrier initiatives from AT&T and Verizon all chase similar objectives: faster provisioning, flexible billing, and cloud adjacency. Lumens angle is a unified portfolio that spans public internet and private L2/L3 under one digital platform, backed by owned fiber, metro depth, and integrated security. Industry recognitions as being named 2024 NaaS Service Provider of the Year in North America by MPLIFY (formerly MEF)adds third-party validation to that approach.

Standards also matter. Enterprises should expect growing support for MEF-aligned APIs and operational models that make inter-provider automation simpler. API-first provisioning, telemetry, and policy federation will separate marketing from reality as multi-cloud, multi-network estates expand.

What to Watch Next

Here are the key trends and capabilities that will shape the next phase of NaaS adoption:

API-First NaaS Operations and Lifecycle Automation with Terraform, Ansible, and ITSM

Look for mature APIs, SDKs, and integrations with Terraform, Ansible, and ITSM tools. Deep observability, intent-based changes, and closed-loop automation will be the next competitive battlegroundespecially when tying NaaS to SD-WAN and SASE stacks or to cloud constructs like Azure Virtual WAN, AWS Cloud WAN, and Google Network Connectivity Center.

NaaS Pricing Transparency, SLAs, and FinOps Governance

Usage-based and subscription models can reduce waste but introduce variability. Enterprises should demand transparent unit economics, clear burst policies, and strong SLA constructs for jitter, latency, packet loss, and mitigation timelines. Align procurement and FinOps with network engineering to avoid surprise bills.

NaaS for AI and Edge: Low-Latency Interconnect, 400G Backbone, and Diverse Cloud On-Ramps

As GPU clusters proliferate across clouds and colocation sites, low-latency, predictable interconnect becomes a gating factor. Track backbone upgrades (400G and beyond), segment routing adoption, and the availability of regionally diverse cloud on-ramps. Proximity and path diversity will materially influence AI training and inference performance.

Actions for Network Leaders

Run a controlled pilot. Start with a few sites, a data center, and at least one hyperscaler to validate provisioning speed, performance, and security integrations. Test both steady-state and burst behavior.

Integrate with existing stacks. Ensure compatibility with your SD-WAN, SASE, identity, and observability tools. Validate API coverage and operational workflows across Day 02.

Engineer for resilience. Use diverse paths and on-ramps, define clear failover policies, and verify DDoS playbooks and enforcement. Measure real latency and loss across routes that matter to your applications.

Negotiate outcomes, not headlines. Tie contracts to measurable SLAs and remediation, not just peak speeds. Insist on transparent pricing, capacity tiers, and service credits aligned to business impact.

Bottom line: Lumens NaaS momentum reflects a broader industry pivot to agile, software-based connectivity. For enterprises modernizing around AI, data-intensive workloads, and multi-cloud architectures, the opportunity is to convert network from a bottleneck into a lever for speed and resilience.