Private 5G networks are on the rise, but many deployments today are custom projects that are expensive to implement and maintain. The TIP 5G Private Networks solution group, chaired by Telefonica, recently completed a trial that shows how the economics of private networks can be substantially transformed through technological innovation.

Using a computer vision application as a driving use case, the group combined private 5G with edge compute for service components with strict requirements – i.e. video processing and the User Plane Function (UPF) – while taking advantage of the efficiencies of a central cloud, where possible. The TIP solution group demonstrated a number of levers to produce a blueprint for a more cost-effective and scalable private 5G solution.

Cloud-native platform for edge and public cloud

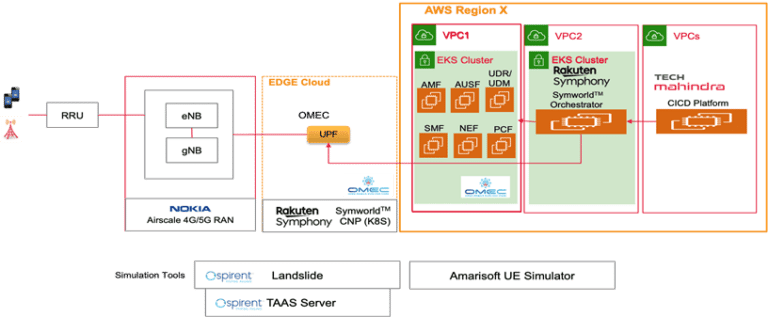

The solution adopts a cloud-native platform that supports virtualized and containerized network functions and extends across the customer premises at the edge and the cloud, creating a hybrid cloud.

Rakuten Symphony (formerly Robin.io) provided its SymworldTM Orchestrator (formerly Multi Data Center Automation Platform (MDCAP)) and SymworldTM Cloud Native Platform (CNP) components for the deployment of multiple clusters in the cloud and at the edge. Orchestrator manages the deployment of the Kubernetes cluster onto the bare metal servers at the edge, and the deployment of both the Mobile Core UPF function and the Computer Vision application. CNP also performs lifecycle management for the Kubernetes clusters on both the edge and the cloud servers.

Open source automation toolchain

The solution adopts an open-source automation toolchain that supports workflows for the installation, configuration, testing, and live operation of software components and infrastructure.

Tech Mahindra integrated industry-standard open-source tools into workflows that orchestrated the component repositories, the cloud, and edge platforms, and the test equipment. The workflow engine integrates the deployment and test platform management services handles activities such as artifact management, release management, service orchestration, and test and log management, and automates use cases such as OS and cluster onboarding and network function onboarding and updating.

Open source, disaggregated 5G NSA core

The solution adopts an open-source, disaggregated 5G NSA core that supports the separation of control plane and user plane functions across cloud and edge (CUPS).

NTT Data integrated the OMEC core from the Open Networking Foundation into the hybrid edge/cloud architecture and validated the integration. This required the creation of a comprehensive mobile core test plan adapted to 5G Private Networks and the development of scripts for the different scenarios that would trigger tests from within the Spirent test suite under the control of the automation workflow and validate the test results.

The architecture and components of the trial have been encapsulated in a blueprint that is suitable for replication in other scenarios. The blueprint is designed to satisfy a number of requirements for the cost-effective and automated delivery of private network services:

- On-premises dedicated 5G connectivity to enable business-critical applications that require high levels of network availability, high network density, in terms of number of devices connected in the deployment area, and/or high throughput connectivity, particularly in uplink.

- On-premises compute, storage & routing to enable applications that demand low latency, high bandwidth, location accuracy, and/or data sovereignty through full control, privacy, and ownership of the data.

- Public Cloud-agnostic computing for service components with less strict requirements to exploit the efficiencies of the public cloud.

- Automated software lifecycle management from delivery to operations. This eliminates on-site, manual intervention that usually is one of the most significant sources of expenditures for dedicated private networks. Once a solution is deployed it also automates the release management of all individual service components.

- Centralized management platform to provide a single management portal for all distributed customer sites.

- HW-SW Disaggregation with transparent optimized licensing fees and equipment costs through the appropriate use of open source software and commodity off-the-shelf (COTS) hardware.

- Replicability of the solution with the exact same features and characteristics across multiple customers.

In this video, David Martín Lambás, Senior Manager – Connectivity Innovation discusses how the project goals were achieved through collaboration in the solution group.

In this video, Dahyr Vergara, CTO of the Open Networks center of excellence at NTT Data, talks about the power of automation in the simplification of 5G Private Network deployment.

“The cost-effective deployment of private 5G networks at scale requires a comprehensive, automated approach to lifecycle management. Our expertise at network automation and toolchain integration helped bring the solution to life,” said Vivek Tiwary, Head of Global Delivery, Network Services at Tech Mahindra.

“We are delighted that SymworldTM Cloud platform has been an integral part of the TIP 5G Private Network solution blueprint to demonstrate highly efficient and automated cloud-native deployment, lifecycle management and orchestration solution that transforms private 5G rollout and management for the edge,” said Subha Shrinivasan, VP Customer Success, Unified Cloud BU, Rakuten Symphony. “We are excited that this blueprint will help operators to unlock opportunities to monetize edge deployments.”

TIP Participants can find out more about the blueprint by subscribing to the 5G Private Networks solution group on TIP’s Confluence site.

All trademarks are the property of their respective owners.