In an interview with The Economic Times, Regional VP of Asia Pacific at Verizon Business Group, Robert Le Busque, shared the company’s optimism for the private 5G market in India. Currently, Verizon Business is conducting multiple proofs-of-concept in the country.

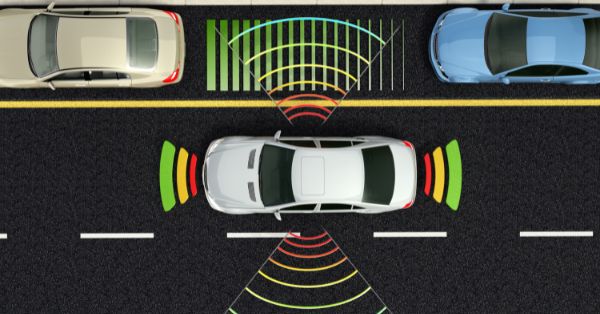

Le Busque revealed that early adoption has been observed in industries not typically known for technological innovation, including automotive manufacturing. Verizon Business is assisting these companies in understanding how private 5G networks can boost productivity and enhance worker health and safety at their facilities. Additionally, the firm is collaborating with local logistics and supply chain operators for private 5G network deployment.

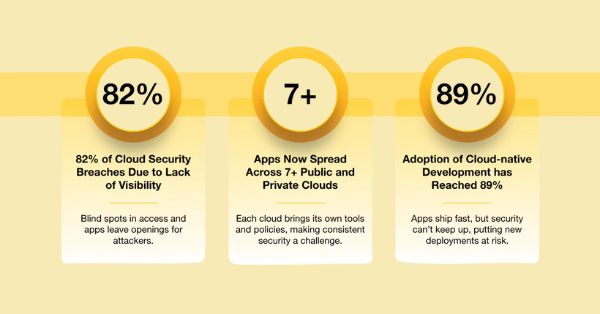

India presents vast opportunities for private 5G implementation, given its extensive manufacturing base and significant investments in smart manufacturing. Le Busque emphasized the potential for network and managed service providers like Verizon, as well as application and device manufacturers, to be part of this technological ecosystem.

Verizon Business is actively engaging with customers and partners in India, discussing the benefits of private 5G networks and the value they offer. Le Busque mentioned the importance of spectrum allocation to provide these services and Verizon’s readiness to help customers identify other spectrum providers as needed.

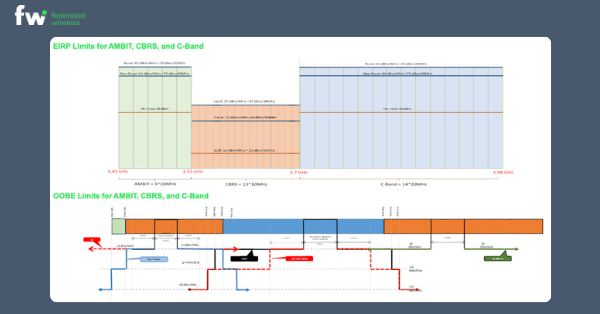

Le Busque also touched on the millimeter wave (mmWave) and ultra-high bands, explaining that Verizon has experience in both mid-band and mmWave 5G technology. He expressed confidence in the company’s ability to provide solutions and expertise to Indian customers and partners, regardless of policy settings.

India’s Department of Telecommunications (DoT) is working to identify 5G spectrum bands for private network deployment, and the Telecom Regulatory Authority of India (Trai) will determine pricing for allocating these bands. DoT’s initial guidelines allow companies to lease spectrum from telecom operators or obtain it directly from DoT, and enterprises can request telecom operators to establish their private networks.