Nvidia H20 production pause at a glance

Nvidia has reportedly paused production activities tied to its H20 data center AI GPUs for China as Beijing intensifies national-security scrutiny, clouding a long-anticipated reentry into the market.

What changed with H20 production

Multiple suppliers have been asked to suspend work related to the H20, Nvidias made-for-China accelerator designed to meet U.S. export rules. Reports point to requests affecting advanced packaging partner Amkor Technology, memory supplier Samsung Electronics, and manufacturer Foxconn (Hon Hai). The move follows weeks of mounting pressure in China: regulators summoned Nvidia for information on the H20, and major tech platforms were urged to stop purchases pending a national security review. Nvidia has said it actively manages its supply chain in response to market conditions, reiterating that cybersecurity is a priority and asserting there are no backdoors in its chips.

Regulatory context in the US and China

The pause arrives shortly after Washington signaled it would grant export licenses for the H20, reversing an earlier halt that triggered unsold inventory writedowns at Nvidia. In China, the Cyberspace Administration has raised concerns about potential tracking or remote-access capabilities and told some firms to hold off on orders. The episode underscores a widening gap between U.S. export policy, which seeks controlled but continued commercial flows, and Chinas risk posture, which is shifting toward self-reliance and tighter vetting of foreign AI hardware.

Why it matters for Nvidia, China, and AI supply chains

The H20 is Nvidias linchpin for retaining a foothold in the worlds second-largest AI market; any prolonged disruption has material revenue and ecosystem consequences.

China revenue exposure and market share risk

Analysts estimate Nvidias annual sales exposure in China exceeds $20 billion when unconstrained. After earlier restrictions, Nvidia recorded a multibillion-dollar writedown tied to H20 inventory and noted that quarterly sales would have been meaningfully higher absent curbs. A full ban in China would jeopardize near-term revenue and the companys data center market share, while a partial allowance for less advanced parts could soften the blow but still compress demand as local capacity scales.

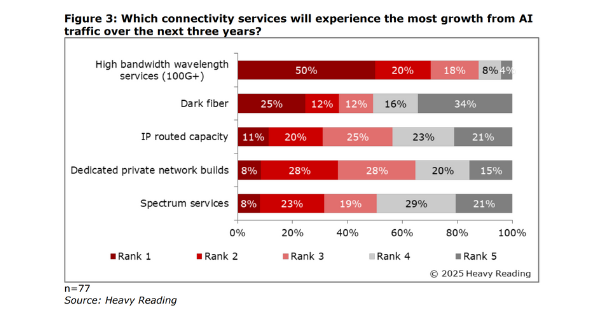

Security-led policy shaping AI chip approvals

Beijings concerns over chip telemetry, control paths, or location features mirror a broader trend: governments are baking security assurances into AI hardware regimes. In the U.S., lawmakers have floated requirements for security mechanisms and location verification in advanced AI semiconductors. The result is a dual tighteningexport controls from Washington and national-security screening from Beijingthat raises compliance bar and time-to-market risk for any cross-border AI silicon.

Market and supply chain impacts

A supply pause affects not only Nvidia but also Chinese hyperscalers, device makers, and upstream manufacturing partners.

Impact on Chinese hyperscalers and platforms

Internet majors and AI developers in Chinanamed in reports as including ByteDance, Alibaba, and Tencentface procurement uncertainty and may accelerate shifts to domestic accelerators. Short term, training roadmaps could slip if alternative capacity is scarce. Over 20262027, increased availability of local GPUs and NPUs is likely to reduce reliance on U.S. vendors for sensitive workloads, especially in government-adjacent domains.

Implications for packaging, memory, and integrators

Packaging and memory partners tied to the H20 must rebalance loading plans. Amkors advanced packaging capacity and Samsungs memory allocations may need re-routing to other Nvidia SKUs or customers if H20 volumes are deferred. Integrators like Foxconn could face line retooling or idle capacity. Any sustained lull could ripple into component pricing and availability across adjacent AI server builds.

Strategic responses for Nvidia and rivals

Vendors will need parallel tracks: regulatory engagement, security transparency, and product localization without fragmenting their roadmaps.

Security assurance and compliance playbook

Nvidia can deepen technical disclosures and verification pathwaysdocumented firmware behavior, auditable telemetry, geofencing mechanisms, and third-party security testingwhile preserving IP. Clear delineations between commercial-use features and any system-management functions will be vital. Fast, iterative engagement with Chinese regulators to resolve specific concerns could reopen a pathway for H20 or successors.

Competitive outlook: domestic and US vendors

Domestic Chinese silicon vendors stand to gain from procurement shifts, with ecosystems around local GPUs and AI accelerators maturing in software stacks and frameworks. U.S. rivals remain constrained by the same export regime; their ability to capitalize is limited unless they deliver compliant, accepted alternatives. Over time, software portability, compiler toolchains, and model performance on non-Nvidia platforms will become decisive in retaining developers and workloads.

Action plan for enterprise AI infrastructure

Network strategists, CIOs, and infrastructure buyers should treat this as a multi-quarter supply and compliance risk and update roadmaps accordingly.

Diversify accelerators and design for heterogeneity

Design for heterogeneity across training and inference. Qualify at least two accelerator options per workload class, including domestic devices where applicable. Use containerized runtimes, open compilers, and framework abstractions to reduce lock-in. For short-term capacity, consider cloud-based GPUs with clear data residency guarantees.

Procurement contingencies and security governance

Structure contracts with export and regulatory contingencies, multi-sourcing clauses, and flexible delivery windows. Build inventory visibility beyond tier-1 suppliers to packaging and memory. Establish a security validation playbook covering firmware provenance, device telemetry, and remote management features, aligned to local regulations.

Signals to watch in China’s AI hardware market

Policy clarity and supply actions over the next 90180 days will set the trajectory for Chinas AI hardware market through 2026.

Regulatory milestones to track

Outcomes of Chinas national security review of the H20, any formal guidance on acceptable foreign AI chips, and the scope of U.S. export licenses will define what can ship, to whom, and when. Track potential movement on proposed U.S. hardware security legislation, which could reshape design requirements globally.

Market and supply indicators to monitor

Monitor order patterns from major Chinese platforms, pricing for alternative accelerators, and lead times for advanced packaging and high-bandwidth memory. Watch for Nvidia roadmap adjustments, such as successor parts or feature changes aimed at addressing security concerns without eroding performance competitiveness.

Bottom line: the reported H20 production pause highlights how AI hardware is now governed as much by security policy as by performance and price; resilient architectures and flexible sourcing are the right response for buyers on both sides of the Pacific.