EchoStar pivots to asset-light satellite and NTN growth

EchoStar has reset its strategy after regulator-driven spectrum sales, trading long-cycle infrastructure bets for an asset-light, capital-rich posture focused on satcom growth.

FCC scrutiny accelerates divestments and D2D timeline

Federal Communications Commission scrutiny over spectrum utilization forced EchoStar to accelerate decisions it had hoped to phase over time. Complaints from rivals spurred investigations into whether the company was meeting buildout and use obligations. Even if EchoStar prevailed in court, the process risked tying up key licenses and stalling its direct-to-device (D2D) ambitions. The company opted to monetize holdings and remove uncertainty rather than fight a prolonged, value-destructive battle.

With transactions announced, EchoStar exits this chapter with investigations dropped, a simpler regulatory perimeter, and a larger war chest to redeploy. It will prioritize communications and connectivity—its core franchise—without reentering multiyear, capex-heavy spectrum buildouts.

Post-sale cash, debt, and satcom portfolio mix

Before divestments, EchoStar held roughly $4.3 billion in cash. Post-close, management expects about $24 billion in cash and around $13 billion in debt. The portfolio also shifts. EchoStar sold S-band assets to SpaceX and 600 MHz spectrum to AT&T, secured a stake in SpaceX, and retained consumer and enterprise connectivity businesses under Dish Network, Boost Mobile, Sling TV, and Hughes Network Systems. The company scrapped plans for a standalone LEO D2D constellation but remains committed to satellite connectivity. It continues to operate an S-band GEO service over Europe for lightweight terminals, though its long-term disposition remains under review.

How SpaceX and AT&T deals expand EchoStar’s satcom reach

The divestitures came with strategic levers beyond cash, positioning EchoStar to pair satellite reach with terrestrial scale.

Boost Mobile adds Starlink Direct-to-Cell for hybrid coverage

A long-term commercial agreement gives Boost subscribers access to SpaceX’s Starlink Direct-to-Cell service. EchoStar positions Boost as a “hybrid mobile network operator” that keeps a cloud-native core while leaning on partner radio access and satellite coverage. The play is straightforward: combine nationwide terrestrial footprints with space-based reach for rural, maritime, and disaster scenarios. If executed, Boost can differentiate on coverage resiliency without owning a dense RAN footprint.

600 MHz sale to AT&T shifts from spectrum build to partnerships

EchoStar sold 600 MHz spectrum—prime low-band capacity used for wide-area 4G/5G coverage (e.g., 3GPP Band 71)—to AT&T. For EchoStar, the deal converts long-duration spectrum optionality into cash and relief from deployment timelines. For AT&T, it is additional low-band fuel for coverage and indoor penetration. The agreement also underscores a broader shift: EchoStar is stepping away from conventional mobile network ownership and toward partner-led access models.

SpaceX equity aligns launch, NTN, and IoT partnerships

The SpaceX transaction includes an equity stake, aligning EchoStar with the dominant global launch provider and an aggressive NTN/D2D builder. SpaceX’s manufacturing pace and launch cadence, particularly with Starship, reinforce its role as a critical supplier and partner. That alignment could create spillover opportunities in IoT, aviation backhaul, and government services where EchoStar’s channels and integration capabilities are strongest.

Strategy: satellite connectivity scale without capex-heavy assets

EchoStar says it will expand its satcom footprint while avoiding capital-intensive spectrum gambits and greenfield RAN builds.

Hughes targets enterprise, aviation IFC, and defense-grade services

Hughes Network Systems is shifting from consumer broadband toward enterprise, aviation, and defense. The focus is resilient connectivity, multi-transport orchestration, and software-defined engineering for mission-critical networks. Expect more airline IFC pursuits, defense-grade managed services, and multi-orbit solutions that blend GEO, potential LEO/MEO partners, and terrestrial links. Hughes’ established ground systems, managed services, and global channel make it a logical integrator as enterprises ask for SLA-backed, path-diverse connectivity.

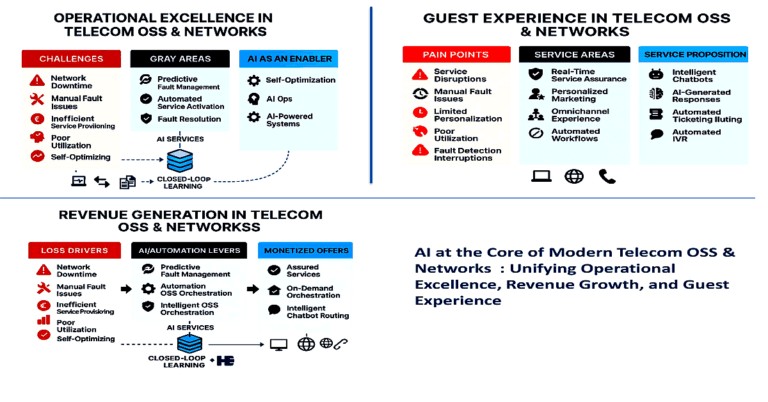

Resilient multi-transport with SDN, SD-WAN, and AI ops

The company is leaning on a cloud-based mobile core and software-first operations to stitch together terrestrial and space. Think SD-WAN/SDN across satellite and cellular; policy-based routing that favors application experience; and AI-assisted operations for anomaly detection and failover. For customers, the value is uptime and predictable performance rather than raw peak speeds. In an AI-heavy era with more edge inference and data synchronization, that resiliency story will resonate with industrials, public safety, and government.

MDA smallsats order and Europe S-band outlook

EchoStar ordered 100 satellites from MDA Space, signaling continued interest in smallsat architectures and potentially targeted services. Separately, the company continues an S-band GEO service in Europe supporting lightweight terminals. Management is evaluating the future of that spacecraft and service in light of the SpaceX deal, aiming to preserve customer continuity while optimizing the new portfolio.

D2D and NTN competition and standards landscape

EchoStar’s shift lands amid a hot competitive phase for direct-to-device and non-terrestrial networks.

Competitors and 3GPP NTN roadmap (R17–R19)

SpaceX is scaling Starlink Direct-to-Cell, while AST SpaceMobile and Lynk Global push their own cellular-to-satellite models with MNO partners. Apple and Globalstar continue iPhone emergency messaging, and Amazon’s Project Kuiper advances toward initial service. 3GPP Release 17 introduced NTN support, with Releases 18 and 19 expected to harden performance and roaming for ground-to-space links. In this context, EchoStar’s partner-first strategy reduces capital risk while keeping a seat at the table through Boost, Hughes, and systems integration plays.

Implications for MNO design and enterprise connectivity

For MNOs, satellite partnerships are shifting from marketing add-ons to network design choices that influence coverage, resiliency, and disaster recovery. For enterprises, resilient multi-transport connectivity becomes a default requirement for OT, aviation, maritime, and remote operations. EchoStar can monetize this through managed services, integration, and SLAs rather than spectrum arbitrage.

Risks, dependencies, and near-term execution milestones

The plan is credible, but value creation hinges on execution across partners, products, and regulatory arcs.

Partner, regulatory, and competitive risks

Partner concentration with SpaceX raises dependency risk. Commercial terms for D2D, device support, and roaming will shape Boost’s differentiation. Competitive responses from MNOs with their own satellite deals may compress margins. Regulatory evolution around NTN, power limits, and interference could affect service quality. The European S-band service path remains unresolved.

Launch timing, device support, and capital allocation milestones

Watch Boost’s Starlink Direct-to-Cell launch timing, device compatibility, and pricing. Track Hughes’ aero wins, defense contracts, and multi-orbit service announcements. Monitor how quickly EchoStar deploys capital into adjacencies versus buybacks or deleveraging. Keep an eye on MDA satellite manufacturing progress and any disclosures on their mission profile. Finally, follow 3GPP NTN updates and FCC/NTIA guidance that could influence D2D scale and economics.

Bottom line: EchoStar has swapped spectrum optionality for strategic flexibility. If it executes on hybrid terrestrial-satellite connectivity and enterprise-grade resiliency, the pivot can deliver durable growth without owning the heaviest assets.