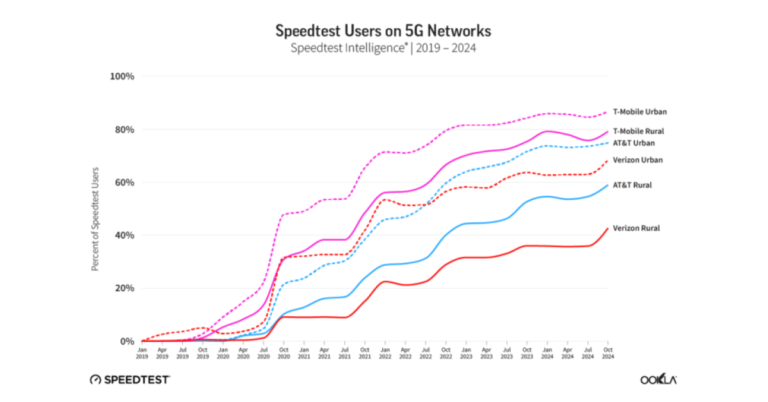

During the first quarter, Verizon‘s fixed-wireless access (FWA) segment saw significant growth, adding 393,000 new customers and raising the total customer base to 1.9 million. This growth surpassed the previous quarter’s results and supports the company’s goal of reaching five million FWA customers by 2025.

Verizon CEO Hans Vestberg reiterated his confidence in the company’s spectrum position during the earnings call, attributing the growth to its extensive C-band spectrum holdings that enable 5G service for over 200 million potential customers. Currently, Verizon uses an average of 60-megahertz of C-band spectrum for its 5G network but holds an average of 160-megahertz of spectrum nationwide.

Vestberg emphasized the capacity benefits of increasing from 60 to 160 megahertz, mentioning that the company is also implementing new software to support more 5G-based FWA customers. The Federal Communications Commission (FCC) is expected to grant Verizon and other US operators further access to spectrum assets following filings related to power limitations near airports and military bases.

With Verizon’s growth in the FWA market, attention shifts to competitor T-Mobile US, which is also targeting the 5G FWA opportunity. T-Mobile ended 2022 with 2.6 million FWA customers, planning further growth using its 2.5 GHz spectrum holdings.

AT&T, however, remains more reserved in its FWA pursuits, but that may change. CEO John Stankey emphasized the focus on “durable” service offerings that provide a solid return on investment. While he acknowledged that some consumer segments may find FWA durable, he remained skeptical about its financial viability for most consumers.

AT&T currently serves over 130,000 FWA customers and hints at plans to revamp its offering. A recently discovered AT&T website advertises an “Internet Air” fixed-wireless service, though no official launch has been announced.

Analyst firms have expressed concerns over the financial and operational aspects of 5G-based FWA services. ABI Research predicts 72 million 5G FWA connections worldwide by 2027, accounting for 35% of the total FWA market. However, the firm also warns that operators need to manage network quality through technological advancements. A PwC report suggests that FWA services could cost more than 22 times as much as mobile connectivity services and have up to 40 times less revenue potential due to competition from fiber or cable internet options.