It is easy to assume that every application aiming for cellular connectivity must want to shoot for 5G, because 5G provides bigger, faster, better communication options than earlier generations like 4G. This view is certainly correct for the high bandwidth use models which have captured popular imagination: mobile phone, mobile gaming, streaming video, etc. This high-end segment represents a significant class of 5G targets; however it is important to remember that 5G also aims at supporting applications needing much smaller bandwidth but requiring highly competitive area, power, and performance profiles. This is a critical high-volume segment for 5G to capture, not only to help advance communication abilities for such applications but also to encourage growth and further investment in 5G infrastructure as a whole.

Why 5G RedCap IoT Devices Are Key to 5G Network Growth

Rationally it is obvious that there should eventually be many, many more IoT devices than smartphones, VR headsets, and other devices requiring high bandwidth support. But real use cases today bring home that adoption isn’t just a rational exercise. In China, traffic lights in cities transmit status (and perhaps waiting traffic info); this information can be picked up by apps like Baidu Maps or Waze to guide route-planning on the navigation map in your car. In dense traffic, access to such information can make an important difference to how quickly you get to your destination. The device in the traffic lights doesn’t need to transmit much data, or to update every millisecond; Reduced capability communication is all that is needed.

There are other use-cases which may in some cases demand a little more bandwidth but still not much. Wearables such as watches, or health monitors are obvious examples. Some, running on batteries, are very power constrained. Others (like traffic lights) can tap into utility power but demand cost-effective solutions for wide-scale deployment.

The 3GPP standardization organization planned for needs like this through their RedCap (reduced capacity) simplified use-case, later adding the eRedCap use case for even higher bandwidths. These provide an easy mapping, from popular 4G/LTE categories in use today to comparable capabilities in the 5G standard.

Why 5G RedCap Adoption Lags in High-Volume IoT Devices

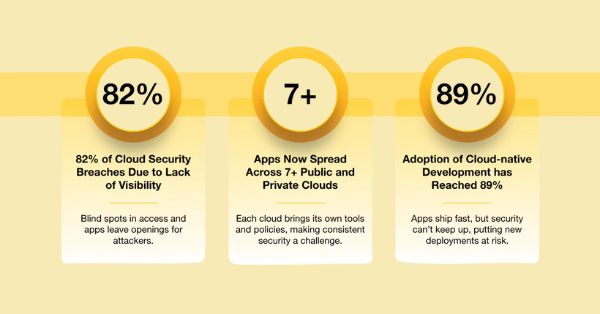

So far, so good – an easy migration path to use-cases with competitive power profiles and cost-effective deployment. So why hasn’t this class of applications been jumping over to 5G? The non-handset IoT market is forecasted at 600-800M units per year, many/most currently on 4G. Investment in infrastructure has moved from 4G to 5G so you would think that IoT product builders should follow, not least for futureproofing. Equally important, infrastructure investment is predicated on this high traffic volume switching to 5G.

There are two problems. First, 5G has little new benefits to offer this class of products beyond futureproofing, so it must at least show price parity with 4G equivalents, something that hasn’t been apparent so far. Second, many IoT OEMs saw opportunity in the reduced capability sector a few years ago, triggering a surge in new products with proprietary modems, all coming to market around two years ago. Inevitably over-supply provoked intense competition and price pressure, in a scramble to remain viable and relevant. Naturally under these circumstances IoT OEMs have concentrated on near-term business optimization rather than longer-term objectives. That has larger consequences; the high-volume RedCap/ eRedCap segment of the 5G market won’t be motivated to switch quickly to 5G unless IoT OEMs can find differentiation and value advantage in making that switch sooner.

Enabling 5G RedCap Success: How Flexible Modems Can Add Value for IoT OEMs

Futureproofing is still a powerful argument for making the switch to 5G – no-one wants to build a product/product-line likely to be obsolete in a few years when 5G connectivity ultimately becomes unavoidable. However, a switch now must also serve the near-term need for added value and differentiation.

IoT OEMs are already debating a variety of strategies around modems, from mostly hardwired solutions for highest performance, to SDR (software defined radio) for maximum flexibility and further future proofing, or intermediate architectures with varying hardware/software partitioning choices. Perhaps we will see winners at multiple points in this spectrum. What is certain is that they all need 5G RedCap/eRedCap platforms offering a range of solutions with much lower area (and therefore cost) and/or higher performance than their current (4G) solutions, and with maximum flexibility to support their own innovations to further differentiate.

These constraints suggest need for a family of modem solutions, providing more competitive area and performance options to support chip vendors and OEM tradeoffs in area, power, and performance. Some level of software flexibility, boosted by vector processing, will be important in any selected architecture to stay current as the 3GPP standard continues to evolve. The fancier features of 5G may not be important in this sector today but at least some (security for example) are likely to become important to add differentiation in future releases.

Also important, an emerging and juicy opportunity for IoT OEMs is in applications requiring satellite network support (non-terrestrial networks – NTN). These are incredibly important for remote deployment in agriculture, wildfire and first responder services in disaster areas where conventional cellular support may be unavailable. NTN support places further demand on modems, an important factor to keep in mind even while dealing with near-term market realities.

With the right strategy and the right modem platform, it is possible to win in the short-term in this challenging market and to win big in the long-term. If these problems sound familiar and you are intrigued about a better path forward, checkout our high-efficiency low-power vector DSP HERE, and give us a call.