Europe’s progress toward continent-wide 5G coverage is showing signs of momentum, but also deep disparity. As the region moves through the mid-stage of its 5G deployment lifecycle, the latest Speedtest Intelligence® data from Ookla highlights sharp contrasts in availability and adoption. Countries like Denmark and Spain are racing ahead, while the United Kingdom and Belgium continue to lag behind due to regulatory, economic, and political hurdles.

5G Availability Up, But Gaps Widen Across Europe

By Q2 2025, the average EU mobile subscriber spent 44.5% of their time on 5G networks, up from 32.8% a year earlier. Yet this average conceals the stark contrast between leaders and laggards.

- Denmark leads the region with 83.9% 5G availability, followed by Sweden (77.8%) and Greece (76.4%).

- At the other end, Belgium (11.9%), Hungary (29.9%), and the United Kingdom (45.2%) are significantly behind.

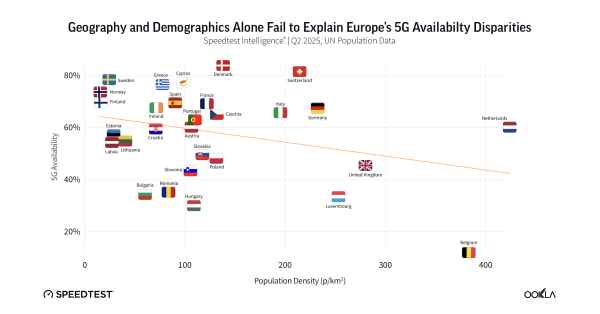

The data confirms a “two-speed” 5G landscape—one driven less by geography or population density and more by the timing of spectrum allocation, infrastructure policy, and investment incentives.

Early Spectrum Assignment Drives Nordic Leadership

Northern and Southern European countries have capitalized on early and coordinated spectrum allocation, especially in the 700 MHz and 3.5 GHz bands. In Sweden, Telia’s spectrum license included a €25 million rural investment obligation. These mandates pushed operators toward universal population coverage targets nearing 99%, even in difficult terrains.

Denmark and Sweden also benefit from strong network sharing models, like TT Network and Net4Mobility, supported by low-cost loans from the European Investment Bank (EIB) and the Nordic Investment Bank (NIB).

Spain Emerges as Europe’s 5G Standalone (SA) Leader

When it comes to 5G Standalone (SA), which removes reliance on legacy 4G infrastructure, Europe is significantly behind global leaders like the U.S. and China. But Spain is bucking the trend.

Spain’s 5G SA sample share reached 8% in Q1 2025—six times the EU average of 1.3%—thanks to aggressive deployment by MasOrange and Telefónica. The Spanish government’s subsidy-heavy approach, backed by EU recovery funds under the “UNICO-5G” initiative, financed over 7,000 new sites in underserved areas.

This model contrasts sharply with countries like the UK, where mandated vendor equipment replacements under the Telecoms Security Act, post-Brexit funding shortfalls, and soft spectrum coverage obligations have slowed progress.

UK: Low Coverage Despite High SA Ambitions

The United Kingdom ranks among the lowest in 5G availability in Europe, with just 45.2% availability and 37.6% user time on 5G. Yet it performs better in 5G SA deployment, with a sample share of 3.6%, surpassing the EU average.

The UK government’s Wireless Infrastructure Strategy aims for full 5G SA coverage by 2030, and regulatory conditions linked to the Vodafone-Three merger mandate 99% SA coverage by the same year. However, execution remains challenged by low ARPU, high energy costs, and infrastructure permitting delays.

Belgium and Central Europe: Regulatory Paralysis and Political Delays

Belgium’s federal structure and tight radiation limits in Brussels delayed spectrum auctions from 2019 to 2022. Despite recent moves, its 5G availability sits at just 11.9%, one of the lowest among EU states.

Hungary faces similar challenges. While spectrum was made available earlier than in Belgium, limited operator competition and a lack of firm rollout mandates have left its coverage at only 29.9%. These gaps underscore the broader trend: policy execution, not geography, determines 5G competitiveness.

Europe Completes Pioneer Band Assignments—But mmWave Is Next

One bright spot in 2025 has been the near-complete assignment of the EU’s 5G “pioneer bands”, originally outlined in the European Commission’s 5G Action Plan. All member states, except Malta have now allocated 60 MHz in the 700 MHz band and 400 MHz in the 3.4–3.8 GHz band.

However, deployment of the 26 GHz mmWave band remains limited. This band, intended for capacity boosts in dense urban areas, is expected to play a bigger role in high-traffic locations like stadiums and business districts. Until demand justifies rollout, most operators remain focused on mid-band densification and Dynamic Spectrum Sharing (DSS) to boost early 5G availability.

DSS and Low-Band Deployments Help Lagging Countries Catch Up

In lagging countries, DSS and 700 MHz deployments have driven sharp year-over-year improvements. For instance:

-

Sweden saw a 21.3% YoY increase, driven by rural-focused 700 MHz rollouts.

-

Italy’s 20.5% growth followed 3G sunsets and reforms easing EMF rules for faster deployment.

-

Malta, despite lacking a formal 700 MHz assignment, expanded rapidly via DSS due to its compact geography.

These gains show that policy clarity and spectrum reuse can be effective tools, even for countries starting from a low base.

Policy Levers Make or Break 5G Progress

Analysis of 5G availability versus spectrum auction timing confirms that earlier and more transparent allocation leads to better coverage. While many operators deployed NSA networks using DSS to gain a first-mover advantage, true competitiveness in 5G relies on dedicated spectrum and policy enforcement.

Countries that prioritized coverage obligations, fair auction pricing, and shared infrastructure—like Denmark and Switzerland—have achieved near-universal coverage without excessive state subsidies. Meanwhile, inconsistent policies and lack of accountability continue to stall progress elsewhere.

Conclusion: A Mixed Bag, But Tools to Close the Gap Exist

Europe’s Digital Decade 2030 goal of 100% outdoor 5G population coverage is achievable—but only with consistent execution. The continent now faces a clear choice: either replicate best practices from its frontrunners or risk falling further behind the U.S. and China in advanced wireless infrastructure.

The experience of countries like Spain, Denmark, and Sweden proves that policy precision, smart subsidies, and early spectrum alignment can overcome geography, demographics, and economic headwinds.

For Europe to lead in 5G Standalone and next-generation applications like Edge/MEC, consistent and transparent policymaking will be essential. Closing the digital divide within the EU starts with treating 5G not as a tech race, but as a strategic enabler of digital sovereignty and long-term competitiveness.