Perplexity’s $34.5B bid for Chrome reframes the AI, browser, and distribution chessboard

An unsolicited offer from Perplexity to acquire Googles Chrome raises immediate questions about antitrust remedies, AI distribution, and who controls the internet’s primary access point.

Deal terms, financing, and Chromium commitments

Perplexity has proposed a $34.5 billion cash acquisition of Chrome and says backers are lined up to fund the deal despite the startup’s significantly smaller balance sheet and an estimated $18 billion valuation in recent fundraising. The bid includes commitments to keep Chromium open source, invest an additional $3 billion in the codebase, and preserve current user defaultsincluding leaving Google as the default search engine.

Google has not commented. The timing aligns with a U.S. Department of Justice push for structural remedies after a court found Google maintained an illegal search monopoly, with a Chrome divestiture floated as a central remedy. Perplexity, which recently launched its own AI-centric browser, Comet, has shown an appetite for unconventional moves, from a proposed TikTok tie-up to reported acquisition approaches from larger tech firms.

Why Chrome’s distribution power makes it a crown jewel

Chrome is the dominant browser globally with an estimated two-thirds share, functioning as the front door to search, identity, ads, payments, and device telemetry. Control over Chrome and, by extension, Chromium’s evolutions shapes privacy standards (e.g., third-party cookie deprecation), web capabilities (WebGPU, WebRTC, PWAs), and the pathways through which AI-powered experiences reach users. Industry voices have suggested Chrome could command a markedly higher valuation than Perplexity’s bid, underscoring the strategic value of the asset as a distribution and data nexus.

Antitrust remedies and Chrome divestiture scenarios

The DOJ remedy phase creates a narrow window during which ownership and governance of Chrome could be redefined in ways that ripple across the web and advertising markets.

Remedies under consideration

U.S. regulators have argued that separating Chrome from Google would rebalance search access and reduce the leverage of a vertically integrated stack spanning browser, search, and ads. In parallel, Google faces federal scrutiny over ad tech, heightening the probability of structural remedies that could extend beyond search. Any forced divestiture of Chrome would trigger multi-jurisdictional reviews, with the European Commission and the UK’s Competition and Markets Authority likely to add conduct and interoperability conditions affecting defaults, APIs, and data flows.

Ownership scenarios: independent Chrome, AI platforms, or foundation

Outcomes range from an independent Chrome company (public or investor-backed) to acquisition by an AI platform player (Perplexity or others, including parties previously expressing interest). A foundation-style governance model for Chromium is also possible, especially if regulators require neutrality commitments on defaults, extension policies, and ad-related interfaces. Android distribution agreements, OEM/carrier partnerships, and traffic acquisition costs would be renegotiated under almost any ownership-shifting bargaining power and potentially redistributing hundreds of millions in annual partner payments.

Impact on telcos, edge AI, and enterprise IT strategy

Chrome’s fate directly affects distribution economics, endpoint intelligence, and security baselines for networks and the enterprise stack.

Distribution economics and revenue shifts

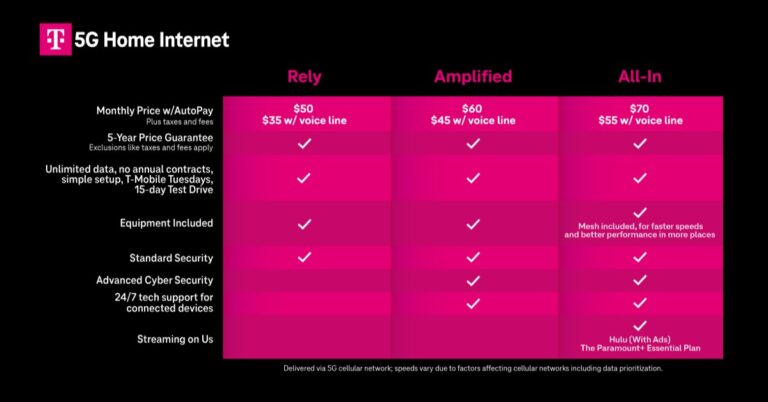

Carriers and OEMs have long used default placements and preloads to monetize search and content discovery. A stand-alone Chrome could alter revenue splits, introduce new default experiences, or create openings for co-branded distribution with telcos and device makers. Changes to Chrome’s search integration would cascade into ad yield, referral economics, and data-sharing agreements that underpin many operator marketing programs.

AI at the endpoint: WebGPU, WASM, and on-device inference

Browsers are becoming AI runtimes via WebGPU and WASM, enabling on-device inference, hybrid search, and low-latency copilots that reduce cloud round-trip. If Chrome governance prioritizes AI featureslocal vector search, multimodal capture, or edge-assisted inference via CDNsnetwork traffic patterns will shift. Telcos and cloud providers can monetize this with GPU-enabled edge nodes and peering strategies tuned for AI-heavy workloads, while enterprises will weigh productivity gains against data residency and privacy posture.

Security and manageability: policy, identity, and patching risks

Chrome Enterprise sets policy, identity, and patching standards for many organizations. Ownership changes introduce vendor risk in update cadences, extension vetting, and certificate handling. CISOs and CTOs should scenario-plan for altered release channels, potential API deprecations, and privacy sandbox adjustments. A parallel-track browser strategy and contractual SLAs with endpoint management vendors can hedge supply-chain and governance uncertainty.

Key signals, timelines, and governance milestones

A short list of signals will reveal whether this is posturing, precedent-setting antitrust, or the start of a new browser era.

Milestones and signals to track

Watch for the courts remedy timetable and any interim conduct requirements; Googles appeal posture and settlement overtures; details on how Perplexity would finance and govern Chrome; reactions from EU and UK regulators; whether other bidders or consortia emerge (including AI vendors or private equity); and positions from OEMs, carriers, and the Chromium developer community on governance, privacy, and monetization.

Actions for telcos, enterprises, and ad-driven businesses

Telcos: model TAC and distribution scenarios under independent Chrome ownership; explore co-marketing or white-label opportunities tied to AI browsing; and assess edge GPU capacity for browser-driven inference. Enterprises: validate a dual-browser contingency, update procurement clauses for ownership change, review extension dependencies, and monitor Privacy Sandbox and identity policy changes that affect measurement and security. Ad-centric businesses: prepare for renegotiated traffic sources, potentially different default search pathways, and tighter attribution constraints.

Bottom line: Chrome governance will define AI-era value capture

Regardless of deal odds, Chrome’s potential separation elevates the browser as the decisive control point for AI, identity, ads, and datademanding proactive strategy from telecom operators and enterprise IT alike.

Strategic takeaway: Governance and defaults will decide winners

If regulators force a Chrome divestiture, governance and defaults just ownershipwill determine who captures value in the AI era; telecoms should position for distribution and edge compute upside, while enterprises de-risk operations with policy, procurement, and security controls that assume the browser stack is in flux.