OpenAI launches agentic AI shopping in ChatGPT to rival Google and Amazon

OpenAI has moved beyond product recommendations to full in-chat checkout, a shift that could rewire how consumers discover, decide, and pay online.

What’s new: Instant Checkout in ChatGPT

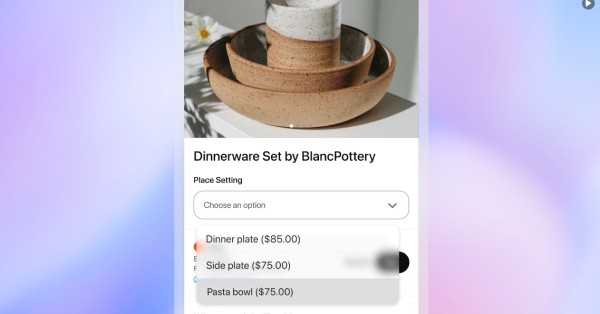

ChatGPT users in the U.S. can now buy from Etsy sellers without leaving the conversation, with more than a million Shopify merchants “coming soon.” The feature, called Instant Checkout, is available to logged-in Free, Plus, and Pro users. It supports Apple Pay, Google Pay, Stripe, and credit cards. The flow is simple: ask for ideas, get curated products with images, prices, and reviews, tap Buy, confirm shipping and payment, and the merchant fulfills the order using its existing systems. Brands like Glossier, Skims, Spanx, and Vuori are expected to be part of the broader Shopify rollout.

Why it matters: AI-controlled discovery and payments

Agentic shopping compresses discovery, comparison, and payment into one thread. That reduces drop-off and changes who controls demand. For a decade, Google search and Amazon have been the gatekeepers for retail intent. If purchase journeys start inside AI assistants, the platform that brokers the conversation can shape what gets surfaced, how it is ranked, and what fees apply. OpenAI says results are organic and unsponsored, ranked for relevance, and that it will take a small fee on completed orders. Even so, this is a new channel with new economics for merchants and marketplaces.

Protocol showdown: OpenAI ACP vs Google AP2

OpenAI is not just launching a feature; it is proposing plumbing for agent-driven commerce and inviting others to build on it.

Inside OpenAI’s ACP for agent-driven checkout

OpenAI will open source ACP, the specification that powers Instant Checkout in partnership with Stripe. ACP defines how an AI agent requests offers, receives product and price data, initiates a payment, and hands fulfillment to the merchant. Open sourcing lowers integration friction for Shopify apps, Etsy tools, and custom storefronts. It also positions ACP as a candidate standard for agent-to-merchant transactions across the web.

Google’s AP2 and the race for agent payments

Google has unveiled AP2, an open protocol for purchases initiated by AI agents. Expect competition over adoption, SDKs, and policy controls, similar to the early days of app store payments and sign-in standards. Merchants and platforms will face a choice: build to ACP, AP2, both, or rely on aggregators that abstract the differences. The winner will not just process payments; it will influence how products are discovered and which data flows where.

Stripe’s orchestration and merchant ownership

Stripe is positioned as the economic layer for these agentic flows. It handles tokenization, PCI scope, and settlement while the merchant retains order management and fulfillment in their existing stack. That design reduces data custody risks for OpenAI and assuages merchant concerns about ceding checkout. But it also centralizes payment orchestration power with a few infrastructure providers.

Competitive dynamics in AI commerce: discovery, fees, trust

This shift will reshape traffic patterns, take rates, and the rules of ranking — with real consequences for retailers and platforms.

Impact on marketplaces, search, and ad revenue

Amazon faces the risk of intent leakage as high-value queries move to assistants. Google risks erosion of commercial queries that fund its ad business. Both have histories of privileging house brands and charging for visibility; they are unlikely to cede control quietly. Expect tighter integration of their own agents, preferred protocols, sponsored agent answers, and incentives that pull checkout back on-platform. Meanwhile, OpenAI, Perplexity, and Microsoft’s Copilot Merchant Program are building alternative paths that emphasize conversational curation and instant buy.

Trust, compliance, and technical risks

Trust and transparency are the biggest hurdles. Users need clear signals on why a product was recommended. Merchants need predictability on ranking, fees, and dispute processes. Hallucinations, mispriced items, and mismatched inventory can create liability. Regulators (FTC, CFPB, EU’s DMA) will scrutinize agent recommendations, dark patterns, fee structures, and self-preferencing. Payments teams must manage chargebacks and fraud in a context where the assistant is the UI but the merchant is the merchant of record. Latency and reliability also matter; a slow or failed agent flow will crush conversion.

What’s new: LLM quality and open protocols

Conversational commerce is not new, but two things have changed: LLM quality makes open-ended search feel personal and useful, and standardized protocols promise to make agentic checkout repeatable at scale. If ACP or AP2 gains traction, agent-driven buys could become as standardized as “Pay with PayPal” — but powered by multi-merchant recommendation and instant fulfillment.

What companies should do now

Enterprises should treat agentic shopping as both a new channel and a new systems interface, with clear owners across product, growth, payments, and risk.

Action plan for merchants and brands

Pilot ACP integrations where available and assess support for AP2. Optimize product feeds for LLMs: high-quality images, structured attributes, real-time inventory, accurate shipping estimates, rich reviews, and clear returns. Instrument attribution so you can compare agentic conversion rates, average order value, and repeat purchase versus existing channels. Revisit pricing and promotions to account for potential assistant fees. Prepare service playbooks for agent-originated orders and returns.

Guidance for payments, risk, and data teams

Validate PCI scope, tokenization paths, and dispute handling with Stripe or your PSP. Stress-test fraud controls for conversational flows, including identity verification and address hygiene. Add observability for agent events: offer requested, offer accepted, payment initiated, and fulfillment status. Build safeguards against hallucinated products and stale pricing by enforcing offer validity windows and server-side final pricing.

Opportunities for telcos, CSPs, and edge

Agentic commerce increases conversational traffic and real-time transactions, creating opportunities for telcos to provide verified identity, SIM-based authentication, and fraud signals via network APIs. CPaaS and RCS Business Messaging can host branded agent experiences with built-in payments. Edge locations near payment and catalog services can reduce latency for offer retrieval and authorization. Carriers with billing relationships can explore co-branded wallets, while ensuring compliance with payments and data residency rules.

Key metrics to track

Track share of intent captured by assistants, assistant-driven GMV, take rates, ranking volatility, refund/chargeback rates, and latency-to-conversion. For platforms, watch developer adoption of ACP vs AP2, ecosystem tooling, and regulatory responses to agent recommendations and fees.

Strategic takeaways for AI commerce

Agentic checkout moves the center of gravity in e-commerce from pages to prompts, and from marketplaces to models.

Next 6–12 months: adoption and protocol pushes

Expect rapid merchant pilots on Etsy and Shopify, aggressive courting of brands, and feature races around trusted recommendations, verified sellers, and returns handling. Google and Amazon will harden their own agent flows and promote their protocols. Fees and ranking policies will evolve; transparency will be a differentiator.

Medium-term scenarios for standardization and trust

If ACP or AP2 standardizes agent-to-merchant interactions, assistants could account for a meaningful slice of retail GMV, shifting ad spend and SEO strategies toward LLM-native optimization. If standards fragment or trust falters, agentic checkout will remain niche and revert traffic to incumbent marketplaces. Either way, now is the time to build integrations, instrument the data, and negotiate terms while leverage is still fluid.