Why EMSTEEL’s Private 5G Pilot Matters for UAE Manufacturing

A landmark private 5G pilot at EMSTEEL with e& UAE signals how industrial networks in the region are evolving from connectivity add-ons to strategic infrastructure.

UAE Manufacturing’s First Private 5G Deployment

EMSTEEL Group (ADX: EMSTEEL), one of the region’s largest steel and building materials producers, has switched on a private 5G network at its production facilities with e& UAE, the flagship telecom arm of the e&…

Home » Private Networks » Page 2

Private Networks

Essential insights and practical tools for navigating private networks. Get Details.

Available on Amazon & Google Books

Subscribe To Our Newsletter

- short

- November 26, 2025

- Hema Kadia

- short

- November 26, 2025

- Hema Kadia

- short

- November 26, 2025

- Hema Kadia

- short

- November 26, 2025

- Hema Kadia

- short

- November 26, 2025

- Hema Kadia

- short

- November 29, 2025

- Hema Kadia

Miami International Airport (MIA) is transforming operations with its private CBRS network, central to its Smart Airport 2.0 strategy. The network enables secure, real-time automation across IoT devices, passenger services, and operational systems. From enhancing cybersecurity and reducing costs to monetizing connectivity for tenants, MIA demonstrates how airports can use

- short

- November 26, 2025

- Hema Kadia

- short

- November 26, 2025

- Hema Kadia

- short

- November 26, 2025

- Hema Kadia

- short

- November 26, 2025

- Hema Kadia

- short

- November 26, 2025

- Hema Kadia

- short

- November 29, 2025

- Hema Kadia

Winner – Private Network Startups - Niral Networks, deploys private 5G and Edge AI network at GMR’s energy facility which faced critical connectivity and safety challenges. This air-gapped, industrial-grade solution supports plant automation, AI surveillance, and drone operations, offering high throughput, low latency, and centralized management across multiple sites.

- short

- November 26, 2025

- Hema Kadia

- short

- November 25, 2025

- Hema Kadia

- short

- November 25, 2025

- Hema Kadia

- short

- November 25, 2025

- Hema Kadia

- short

- November 25, 2025

- Hema Kadia

- short

- November 25, 2025

- Hema Kadia

- short

- November 25, 2025

- Hema Kadia

TeckNexus Newsletters

I acknowledge and agree to receive TeckNexus communications in line with the T&C and privacy policy.

Whitepaper

The whitepaper, "How Is Generative AI Optimizing Operational Efficiency and Assurance," provides an in-depth exploration of how Generative AI is transforming the telecom industry. It highlights how AI-driven solutions enhance customer support, optimize network performance, and drive personalized marketing strategies. Additionally, the whitepaper addresses the challenges of integrating AI into...

Whitepaper

As VoLTE becomes the standard for voice communication, its rapid deployment exposes telecom networks to new security risks, especially in roaming scenarios. SecurityGen’s research uncovers key vulnerabilities like unauthorized access to IMS, SIP protocol threats, and lack of encryption. Learn how to strengthen VoLTE security with proactive measures such as...

Whitepaper

Dive into the comprehensive analysis of GTPu within 5G networks in our whitepaper, offering insights into its operational mechanics, strategic importance, and adaptation to the evolving landscape of cellular technologies....

Explore Magazines

Promote your brand

Check Private Network Readiness

Industry Vertical Specific Deep-Dive Assessment

Manufacturing

$750

250 questions based assessment and insights

$750

Utilities

$500

65+ questions based assessment and insights

$500

Mining

$500

160 questions based assessment and insights

$500

Aviation

Coming Soon

75+ questions based assessment and insights

Coming Soon

Ports

Coming Soon

75+ questions based assessment and insights

Coming Soon* Prices does not include tax

Frequently Asked Questions

What is a private network?

A private network is a type of communication network that is exclusively used by a specific entity, organization, or group and is not available for public access. Unlike public networks that allow any user within its range to connect and access its resources, a private network has controlled access mechanisms, often fortified with security protocols, to restrict usage only to authorized entities. Several defining characteristics differentiate private networks from other types of networks:- Dedication of Resources: Private networks often have dedicated resources, which can include hardware infrastructure like servers and switches, operational platforms, and even specific communication channels or spectrums. This ensures that the network’s performance remains optimal, as it doesn’t have to share its resources with random users.

- Controlled and Secured Access: One of the hallmarks of a private network is the tight control over who can access it. Users may require specialized credentials, encryption keys, or specific SIM cards. Access control measures are implemented to protect sensitive data and to prevent unauthorized intrusions.

- Customizability: Because the private network is tailored for a specific entity or group, it can be customized extensively to meet unique requirements. This can range from specific performance metrics and applications that run on the network to how data is routed and stored.

- Varied Scope and Scale: Private networks can differ vastly in their scope and scale. Some may be as small as a home network connecting a few devices, while others can be expansive, such as corporate networks spanning multiple geographical locations. Yet, others could be specific-use networks like those used in a single facility or factory.

- Enhanced Performance Metrics: Private networks can be designed to meet specific Key Performance Indicators (KPIs), ensuring that they deliver on attributes such as speed, latency, uptime, and reliability. This is especially crucial for businesses or applications that cannot compromise on network performance.

- Data Privacy and Security: Given the restricted access and controlled environment, private networks often offer a higher degree of data privacy and security compared to their public counterparts. They can employ advanced encryption, firewall protections, intrusion detection systems, and other security mechanisms to safeguard data.

What is a private 5G network?

A private 5G network is a localized cellular network infrastructure specifically designed to use the 5G standard for a particular business or organizational use, isolated from the broader public 5G networks operated by telecom carriers. It is built to serve the dedicated operational requirements of a single entity or specific user group and is not available for public access. Several defining attributes differentiate private 5G networks from public 5G networks:- Dedication of Resources: Just as with private networks in general, private 5G networks have dedicated resources, ensuring optimal performance. This can include dedicated radio equipment, servers, and even specific bands of the radio spectrum, allowing for greater control over network traffic and reduced latency.

- Controlled and Secured Access: Access to the private 5G network is typically restricted to authorized users or devices within a specific organization or facility. This provides enhanced security, preventing unauthorized devices from connecting to the network.

- Customizability: Private 5G networks can be tailored to meet specific organizational needs. This means they can be designed to prioritize certain types of data, handle specific volumes of traffic, or offer enhanced reliability for critical applications.

- Deployment Flexibility: Organizations can choose where and how they deploy their private 5G infrastructure, allowing for network coverage in areas that may be underserved by public 5G networks, such as remote locations or specific zones within a manufacturing facility.

- Enhanced Data Privacy: Given the closed nature of the private 5G network, data transmitted remains within the confines of the network, ensuring heightened data privacy and compliance with internal policies or regulatory mandates.

- Advanced Performance and Reliability: With the ability to customize and control the network environment, organizations can ensure high reliability, low latency, and other performance attributes critical to specific use cases like automation, IoT devices, or augmented reality applications.

- Operational Efficiency and Independence: Organizations can operate and manage their private 5G networks independently or with reduced dependence on external telecom providers. This can lead to faster issue resolution, better alignment with business goals, and potential cost savings in the long run.

What are the benefits of private 5G for enterprises?

Private networks, particularly those based on the 5G/LTE standard, are increasingly being recognized for their advantages to enterprises. Here’s an in-depth look at these benefits:- Superior Network Coverage and Capacity: Unlike traditional networks, private 5G/LTE networks guarantee extensive coverage, especially in locations where Wi-Fi or wired networks might be inadequate. This ensures efficient communication among machines, sensors, and personnel in settings like smart factories. As a result, there’s a notable surge in efficiency, minimized interruptions, and heightened productivity.

- Guaranteed Performance: These networks offer deterministic performance, ensuring a promised level of service quality, latency, and bandwidth. This is especially invaluable for sectors like manufacturing, healthcare, or transportation, where the consistent and reliable performance of applications and devices is non-negotiable.

- Enhanced Security and Data Privacy: Given that enterprises have complete dominion over their private 5G/LTE networks, they can impose stringent access controls. This ensures that only authorized personnel and devices can access the network. Additionally, the capability to process data locally using edge cloud adds another layer of data security, guarding against potential cyber threats.

- Low Latency and Real-time Edge Computing: One of the standout features of private 5G/LTE networks is their ability to facilitate low-latency communications paired with edge computing. This combination allows data processing to happen locally, enabling instantaneous decisions without relying on distant cloud computing. Such a feature is indispensable in applications demanding immediate feedback, for instance, robotics or autonomous driving.

- Scalability for High-density Deployments: Private 5G/LTE networks are tailored to support large-scale deployments of interconnected devices and applications without any detriment to the network’s performance. This is particularly relevant for endeavors like smart cities or expansive industrial IoT setups.

- Adaptable Network Design and Deployment: The adaptability of private 5G/LTE networks in terms of their design, roll-out, and administration stands out. Enterprises have the freedom to mold the network according to their specific requirements, whether it’s merging with other network technologies or setting up in diverse locations.

- Unparalleled Control Over Network: Complete control over the network translates to the ability for businesses to fine-tune every aspect of it. This includes optimizing performance metrics, fortifying security protocols, ensuring consistent reliability, and, most importantly, preserving data privacy.

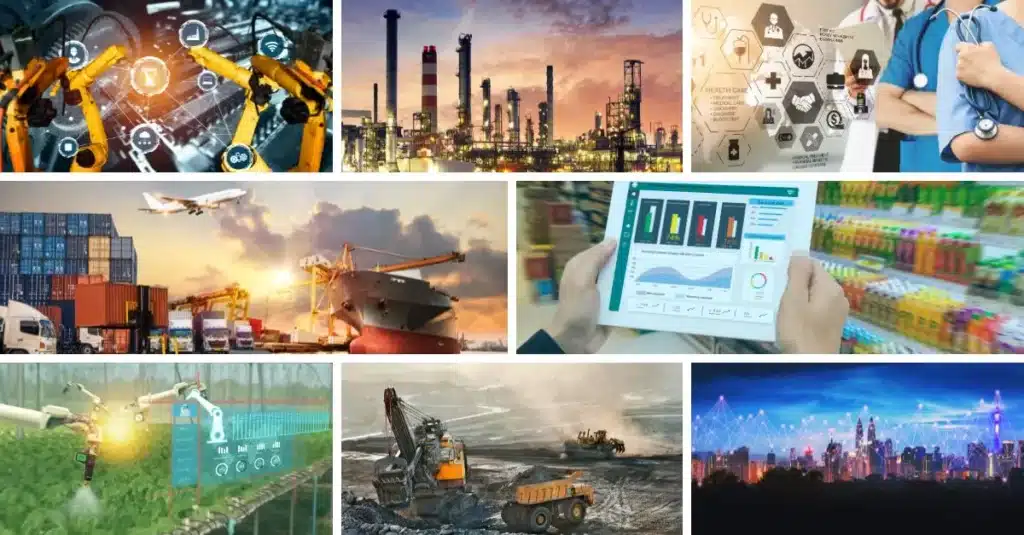

Which industries are using private 5G/LTE networks?

Private networks, especially those harnessing 5G/LTE technologies, are rapidly laying down a technological foundation for numerous industries that seek heightened connectivity, robust reliability, and top-tier security.- For the manufacturing sector, private networks are not just modern tools; they’re transformative catalysts. Smart factories, riding on the backbone of these networks, have incorporated Industrial IoT (IIoT) sensors. This has led to a nuanced shift in operational paradigms, enabling real-time monitoring of manufacturing processes, intelligent predictive maintenance to avoid unplanned downtimes, and rigorous quality assurance to reduce defects. Beyond this, the seamless integration of collaborative robotics allows robots to work hand-in-hand with humans, optimizing productivity. Moreover, augmented reality (AR) applications are emerging as critical training tools, offering interactive sessions that focus on both equipment handling and safety protocols, ensuring a safer and more efficient workspace.

- In the healthcare domain, the influence of private networks is palpable. Remote patient monitoring, once a futuristic idea, is now a reality, making healthcare more proactive and less reactive. By facilitating continuous patient health tracking, medical interventions can be more timely and precise. Furthermore, AR and VR have found an indispensable place in the sector. With private network support, they’re redefining medical training, offering immersive patient care simulations, and providing practitioners with a level of detail and interactivity previously unattainable.

- The transportation and logistics industry has been quick to recognize the merits of private networks. Vehicle-to-everything (V2X) communications, for example, are optimizing road safety by ensuring that vehicles communicate seamlessly with each other and with infrastructure elements. The effects of private networks extend to ports and warehouses, making them smarter, more responsive, and ensuring the rapid movement of goods. Additionally, the dawn of connected vehicles, bolstered by these networks, promises an era where real-time data integration amplifies both safety and user experience.

- The energy and utilities sector’s strategic shift towards private networks epitomizes efficiency. Smart grid management, aided by these networks, promises a future of minimized energy wastage and heightened distribution efficiency. Furthermore, expansive infrastructure, such as pipelines and solar fields, are now being meticulously monitored with drones and sensors powered by these networks, ensuring timely interventions and maintenance. The thrust on predictive maintenance means that energy setups can preempt issues before they escalate, ensuring continuous service.

- For mining, private networks signify safety and efficiency. Activities like operating heavy machinery remotely become feasible, thereby reducing the risks associated with manual operation. Monitoring underground operations ensures that worker safety remains paramount even in the most challenging terrains.

- The agricultural domain is undergoing a silent revolution, with precision farming enabling farmers to take data-driven decisions on irrigation, sowing, and harvesting. Smart livestock management techniques, powered by these networks, keep track of livestock health and movements, ensuring both productivity and well-being.

- Entertainment, media, and broadcasting are leveraging these networks to provide consumers with next-gen experiences. Immersive AR/VR sessions and high-definition live streaming become norms, not novelties. The retail sector is reshaping consumer experiences with augmented shopping interfaces and real-time inventory management. As for smart cities, they’re evolving into nerve centers of efficiency, with intelligent traffic systems and enhanced public surveillance mechanisms, all anchored by private networks.

- Educational institutions are evolving too, with interactive virtual classrooms and real-time collaborative research. Finally, sectors like aerospace, defense, sports, and gaming are leveraging these networks across a spectrum of applications, from secure drone operations to immersive stadium experiences.

- 5G for Smart Manufacturing

- 5G for Smart Healthcare

- 5G for Smart Transportation

- 5G for Energy & Utilities

Who are the ecosystem players for private 5G/LTE networks?

Private 5G/LTE network deployment is a collaboration of multiple industry entities, each bringing specialized knowledge and solutions to the table. Here’s a comprehensive breakdown of these players and their functions:- Telecom Equipment Vendors: They are the backbone suppliers of critical hardware and software components for setting up the private 5G/LTE infrastructure. This encompasses everything from base stations and antennas to routers and network management tools.

- System Integrators: Often regarded as the architects of private 5G/LTE networks, system integrators deliver holistic solutions, from the initial design to deployment and eventual network management. They ensure that a business’s specific needs are addressed, integrating seamlessly with pre-existing systems.

- Mobile Network Operators (MNOs): The bridge between users and the digital realm, MNOs offer the actual connectivity services, including spectrum licenses and infrastructure. They may either directly cater to enterprises or collaborate with system integrators for comprehensive solutions.

- Cloud Providers: They cater to the increasing need for cloud functionalities in private 5G/LTE networks, from edge computing to data storage and analytical tools. These providers empower businesses to analyze data on-site, bolstering responsiveness and security.

- Device Manufacturers: The endpoint of any network, device manufacturers ensure that smartphones, wearables, tablets, and various IoT devices can connect seamlessly and efficiently to the private 5G/LTE networks.

- Neutral Hosts: A cost-effective solution for many, neutral hosts offer shared infrastructure, allowing diverse businesses to maintain individualized networks on a common infrastructure.

- Regulators: The gatekeepers of the industry, regulators oversee spectrum allocation and adherence to international standards and local regulations. They are instrumental in ensuring a stable and compliant operational environment.

What strategies should be adopted by private 5G/LTE network ecosystem players?

- Telecom Equipment Vendors: Focus on R&D to continuously innovate and provide tailored hardware and software solutions for private networks, emphasizing low latency, security, and reliability. Collaborate with MNOs and system integrators to enhance product compatibility and understand evolving industry needs. Engage in targeted vertical strategies, working closely with industry specialists to cater to niche requirements.

- System Integrators: Undertake a comprehensive assessment to discern enterprise needs, ensuring the network solutions are tailored accordingly. Cultivate partnerships with equipment vendors and MNOs for a holistic solution spectrum. Embrace collaborative endeavors, teaming up with other ecosystem entities to share resources and expertise, thereby ensuring smooth deployment and operation. Focus on vertical-specific strategies to offer highly specialized solutions, especially in sectors with unique demands like healthcare or manufacturing.

- MNOs: Leverage existing infrastructure assets to create tailored connectivity solutions. Develop customized service-level agreements based on enterprise-specific requirements. Foster strategic alliances with system integrators and equipment vendors to expand service offerings. Consider collaborative endeavors to tap into shared resources and knowledge, leading to efficient and optimized service provision. Engage in vertical-specific strategies, collaborating with industry stakeholders to fine-tune offerings for distinct sectors.

- Cloud Providers: Introduce innovative cloud solutions optimized for 5G/LTE, such as ultra-low latency edge computing. Collaborate with device manufacturers to ensure seamless data flow and analytics processes. Also, invest in vertical-specific cloud solutions catering to industries like manufacturing or healthcare, where localized data processing and analysis are crucial.

- Device Manufacturers: Prioritize R&D to ensure devices are 5G/LTE compatible, energy-efficient, and secure. Form partnerships with MNOs and cloud providers to ensure seamless device-network interactions. Emphasize vertical-specific device innovations, especially in sectors where IoT integration is on the rise.

- Regulators: Ensure clear and adaptive guidelines are set for private 5G/LTE deployment, emphasizing safety, security, and interoperability. Engage in periodic dialogue with industry players to understand the evolving landscape and adjust regulations accordingly.

- Industry Associations: Spearhead efforts in fostering collaboration, knowledge-sharing, and standardization. Support vertical-specific endeavors, collaborating with other players to develop standards, best practices, and blueprints tailored to specific vertical industries. Organize collaborative platforms where vendors, integrators, and MNOs can engage in constructive dialogues.

- Neutral Hosts: Diversify infrastructure offerings to cater to a broad spectrum of enterprise sizes and needs. Establish partnerships with MNOs and equipment vendors to ensure the infrastructure is optimized for multiple network types. Engage in collaborative endeavors to optimize shared infrastructure utilization, ensuring efficient resource distribution.

What are the frequency bands used for private network deployments?

- Licensed Bands: These bands are exclusively allocated to specific entities by regulatory bodies. License holders have exclusive rights to operate within these bands in specific geographical areas.

- n77/n78 (3700 MHz – 3800 MHz): Used in regions like Germany.

- n38 (2570 MHz – 2620 MHz): Used in regions like France.

- n77 (3800 MHz – 4200 MHz): Used in the UK.

- n79 (4400 MHz – 5000 MHz): Common in Japan and China.

- Shared Bands: These bands are neither exclusively licensed nor completely unlicensed. Instead, multiple entities can share access to these bands, often managed by a spectrum access system to prevent interference.

- CBRS (Citizens Broadband Radio Service)

- n48 (3550 MHz – 3700 MHz): Used in the USA. CBRS uses a three-tiered spectrum access system to manage shared usage, including Incumbent Access, Priority Access Licenses (PAL), and General Authorized Access (GAA).

- Unlicensed Bands: Unlicensed bands don’t require specific licenses from regulators. They can be freely used as long as operators adhere to regulations about interference and power levels.

- n96 (5925 MHz – 7125 MHz): This unlicensed band is used in the USA and South Korea.

- Another portion, n96 (5900 MHz – 6400 MHz), is used in the European Union.

What are the challenges of private 5G/LTE networks?

Here are some of the private 5G/LTE network challenges:- Spectrum Availability: The radio frequency spectrum, especially frequencies suitable for 5G/LTE, is limited and often already occupied by other services. Acquiring licenses can be cumbersome, expensive, and sometimes subject to regulatory constraints. Not all countries have a clear policy on the use of spectrum for private networks, making it a gray area for many businesses. Furthermore, shared spectrums can lead to unpredictable network performance due to interference.

- Infrastructure Deployment: Establishing a private network requires significant infrastructure, from base stations to small cells and antennas. Geographic challenges, like deploying in rural or remote locations, can amplify costs. Additionally, securing permissions, ensuring connectivity backhauls, and optimizing for coverage can become complex undertakings.

- Integration with Existing Systems: Merging a new private 5G/LTE network with established IT and OT systems can introduce technical challenges. Bridging the gap between legacy systems and new technologies requires not only technical adaptability but often also organizational change management to ensure smooth transitions.

- Security and Privacy: As with any digital network, private 5G/LTE networks are susceptible to cyber threats. While these networks might offer better isolation, they introduce new vulnerabilities unique to 5G/LTE technology. Moreover, as data becomes more distributed, ensuring compliance with regional and global privacy standards becomes increasingly intricate.

- Skill Shortage: The nascent nature of 5G/LTE technology means there’s a limited pool of experts familiar with its deployment and management. This deficit compels companies to compete for talent, driving up costs. In-house training becomes essential, but that, too, requires time and resources.

- Interoperability: Ensuring that private 5G/LTE networks can communicate effectively with other networks or systems is pivotal. Avoiding vendor lock-in is crucial to maintaining flexibility in scaling and upgrading systems. Relying on a single vendor might simplify initial deployment but can become restrictive as business needs evolve.

- Operational Costs: Beyond the initial setup, the continued operation, management, and upgrading of private networks can incur substantial costs. As technology evolves, the need for periodic upgrades, maintenance, and potential system overhauls can strain financial resources.

- Regulatory Compliance: Different regions have varying regulations regarding private network use, management, and security standards. Adhering to these ever-evolving regulations, especially for global enterprises operating in multiple regions, can become a logistical challenge.

Brand Connect

Amplify Your Brand & Boost Your Business

- Thought-Leadership Management

- Magazine Article

- Executive Interviews

- Whitepapers

- Research Reports

- Custom Research

- Blog Series

- Webinars

- Podcasts

- Advertorials

- Display Ads

- Event Partnership