India Rejects Nokia’s 5G Network Slicing Patent

Nokia’s recent legal challenge in India over its 5G network slicing patent underscores a growing global clash over intellectual property (IP) rights in next-generation telecom infrastructure. The Delhi High Court is now reviewing Nokia Technologies’ petition after the Indian Patent Office rejected its application for what it calls an “enhanced registration procedure” for 5G network slicing.

The patent was denied on January 8, 2025, based on the argument that it lacked novelty and was merely a software-based invention without hardware components. According to Section 3(k) of India’s patent law, software-only inventions are not patentable. Despite this setback, Nokia maintains that the method provides a novel, security-enhancing authentication mechanism critical for enterprise 5G deployments.

Why the Patent Matters: Security and Customization in 5G

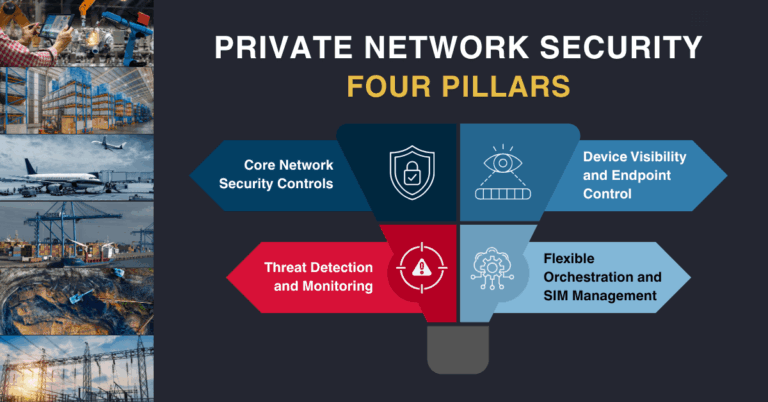

Network Slicing allows telecom operators to split a single network into multiple virtual slices. Each slice can be optimized for specific applications—whether it’s ultra-low latency for gaming, high reliability for hospitals, or tailored throughput for enterprises. Nokia’s rejected patent claims a method that strengthens this slicing process by embedding third-party authentication directly into the device registration phase, enhancing both security and efficiency.

Such a feature becomes particularly relevant as 5G matures to support sectors like healthcare, smart cities, and manufacturing, all of which require secure, dependable connectivity.

India’s IP Policy: A Gatekeeper or a Bottleneck?

India’s patent regime is taking a cautious stance on software-based innovations. By rejecting Nokia’s application, the Indian Patent Office signaled a reluctance to grant protection to inventions not involving hardware, even if they are considered patentable elsewhere. Nokia has already received approvals for the same invention in countries including the U.S., Japan, and South Korea.

This legal pushback could reshape how global vendors approach 5G investment in India. Firms like Ericsson, Huawei, and Samsung—all active players in the network slicing space—may have to recalibrate their IP strategies.

Global IP Arms Race: The Role of SEPs in 5G Dominance

The battle over Standard-Essential Patents (SEPs) is intensifying. As of 2025, Huawei, Qualcomm, and Ericsson are leading the SEP count for 5G, collectively holding over 57,000 patent families.

Huawei accounts for nearly 20% of all 5G patents globally and is deeply embedded in modem technology, while Qualcomm dominates mobile chipset IP. Ericsson, although trailing in overall value metrics, continues to push network infrastructure innovation.

Patent disputes related to SEPs have surged by 40% year-over-year. Licensing these patents under FRAND (Fair, Reasonable, and Non-Discriminatory) terms is now a minefield, with courts in China, the EU, and the U.S. frequently stepping in to resolve disputes.

Investor Insights: Risks and Rewards in the 5G IP Battlefield

From a financial perspective, IP rights are reshaping the competitive landscape in telecom. Investors are finding that IP strength often predicts stock performance better than market share alone.

Patent Quality Over Quantity

Firms with enforceable, high-value patents are outperforming those with large, but lower-quality, portfolios. Qualcomm’s IP strength has supported a 22% year-to-date stock rise, while companies like Ericsson—with a broader but less differentiated IP base—have seen stagnating valuations.

Geopolitical Dynamics

India’s rejection of Nokia’s patent highlights a broader trend: IP law is increasingly influenced by national strategic interests. Governments are scrutinizing foreign patents in critical infrastructure, which may deter or delay international investment. Investors should closely monitor regional regulatory trends, particularly in markets like India, China, and the EU.

Emerging Investment Themes

Startups focusing on areas such as Private 5G, Open RAN, and security in network slicing are attracting significant capital. Firms like Montsecure and Astellatech, which specialize in secure 5G interoperability, have seen valuation surges of up to 50% in 2025.

The Stakes of Nokia’s Legal Appeal

Nokia’s case is scheduled for further hearing in November 2025. The outcome could set a crucial precedent in India, potentially opening the door for software-based IP claims if the court rules in Nokia’s favor. A win may also reinforce Nokia’s strategy of promoting secure, customizable 5G networks for enterprise and public-sector clients.

In its defense, Nokia argues that its “enhanced registration procedure” prevents unauthorized devices from accessing enterprise network slices. This could be vital in sectors demanding strict authentication and policy control, such as defense, telemedicine, and industrial automation.

However, the Indian Patent Office remains firm in its position, citing the 3GPP D1 technical standard as prior art, and emphasizing the invention’s lack of novelty and absence of hardware-based claims.

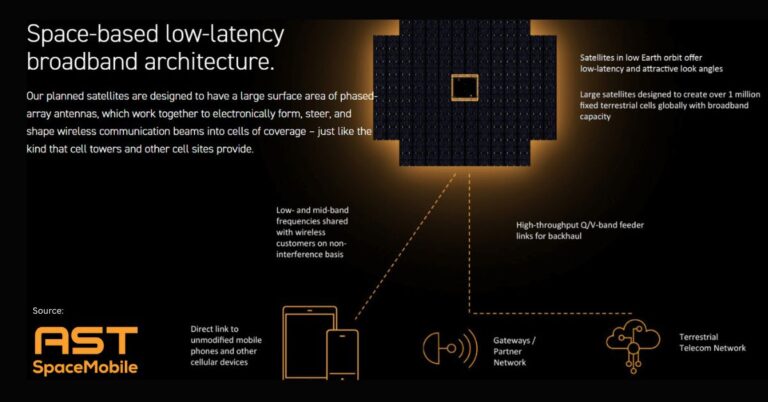

Global Deployments Highlight Demand for Network Slicing

Despite the legal gridlock in India, network slicing is already in live or pilot deployment across regions including the U.S., Germany, South Korea, Japan, and China. Major telecom operators, such as Verizon, AT&T, T-Mobile, Vodafone, and Deutsche Telekom, are exploring use cases that include industrial IoT, healthcare, and premium broadband services.

Even Google, through its Google Fiber initiative, has partnered with Nokia to explore residential network slicing that prioritizes bandwidth for specific tasks like gaming or video conferencing.

Looking Ahead: Strategic Recommendations for Stakeholders

For Telecom Vendors:

- Strengthen R&D that combines software and hardware components to comply with global IP standards.

- Build jurisdiction-specific patent strategies, especially in emerging markets with unique legal frameworks.

For Investors:

- Prioritize IP-heavy firms with successful litigation records, such as Qualcomm.

- Diversify holdings across multiple regions to mitigate geopolitical and legal risks.

- Track legal rulings, like Nokia’s pending verdict, which may influence regulatory shifts and market entry strategies.

For Policymakers:

- Clarify and modernize IP laws to reflect the software-driven nature of next-gen networks.

- Balance national security concerns with the need to attract foreign investment and innovation.

Conclusion: Telecom’s Next Battleground is IP Law

The 5G ecosystem is no longer defined solely by infrastructure or spectrum, it’s shaped by who owns the underlying intellectual property. Nokia’s ongoing legal struggle in India illustrates the complexities of protecting software-defined innovations in a fragmented global IP environment.

As the 5G patent race accelerates, companies with robust and enforceable IP will shape not just the market, but also the regulatory frameworks and investment flows of the next decade. For stakeholders ready to navigate this high-stakes terrain, the payoff could be substantial.