Make 4 GHz the Anchor of the U.S. 6G Strategy

The 4.44.94 GHz range offers the cleanest mix of technical performance, policy feasibility, and global alignment to move the U.S. ahead in 6G.

4 GHz Midband: Best Coverage-Capacity Tradeoff

Midband is where 6G will scale, and 4 GHz sits in the sweet spot. A contiguous 500 MHz block supports wide channels (100 MHz+), strong uplink, and macro coverage comparable to C-Band, but with more spectrum headroom. That translates into better spectral efficiency and a lower total cost per bit for nationwide deployments while still enabling dense enterprise and edge use cases. For AI-native RAN features, ISAC (integrated sensing and communications), and advanced uplink-centric applications, this band provides the bandwidth and link budgets to move beyond today’s 5G constraints.

Global Alignment and 6G Standards Timeline

WRC23 placed 4.44.8 GHz into the study queue for IMT2030 in Regions 1 and 3, with strong backers in Japan, South Korea, and China, and a new Radio Regulations footnote supported by more than 40 countries signaling openness to IMT identification in 4.84.99 GHz. That gives the U.S. a clear path to pursue Region 2 alignment ahead of WRC27. Formal 6G work in 3GPP and ITUR WP5D is expected to ramp in late 2025, when requirements, emission masks, channelization, duplex flexibility, and coexistence protocols get set. Choosing 4 GHz now positions U.S. voices to shape FR1 priorities and ensure sharing technologies proven here become part of the global baseline.

Faster Devices and RAN via 3GPP n79 Readiness

The 4.44.94 GHz range overlaps 3GPP Band n79, already deployed in parts of Asia for 5G. Chipsets, RF front ends, filters, and radios exist today, shrinking time-to-market for pre-standard trials and accelerating the 6G device ramp. Leveraging n79 for early prototypes reduces vendor risk, supports multinational interoperability, and shortens the gap between standards freeze and commercial availability.

Policy Window: Turning 4 GHz into a 6G Launchpad

New federal spectrum directives and a manageable incumbent profile create a near-term opening to turn 4 GHz into the U.S. 6G launchpad.

DoD-Centric Incumbency Enables Practical Sharing

Unlike lower 3 GHz, where multiple agencies and mission sets overlap, 4 GHz federal operations are concentrated in well-understood Department of Defense systems (radars, telemetry, tactical links). That clarity supports staged coexistence frameworksgeographic, temporal, and dynamicthat preserve national security while unlocking commercial capacity. It also aligns with the current spectrum pipeline mandate to identify and transition 500 MHz of federal spectrum, giving NTIA, DoD, and the FCC a practical band to meet policy goals without decade-long relocations.

Clean Slate Licensing for 4 GHz 6G

There are no legacy commercial licenses in the 4 GHz band in Region 2. That allows modern licensing from day one, hybrid models that blend exclusive rights for wide-area macro with dynamic access for private networks and venues, coherent technical rules across the full 500 MHz, and guardrails for phased, full-power operations. Just as important, no 5G refarming or device migration is required, reducing operational debt and enabling purpose-built 6G architectures.

Why 3 GHz Is a Slower, Fragmented Onramp to 6G

The 3.14.2 GHz range is vital for 5G today, but its fragmentation makes it a poor anchor for first-wave 6G.

Fragmented 3 GHz Rules Block Wide 6G Channels

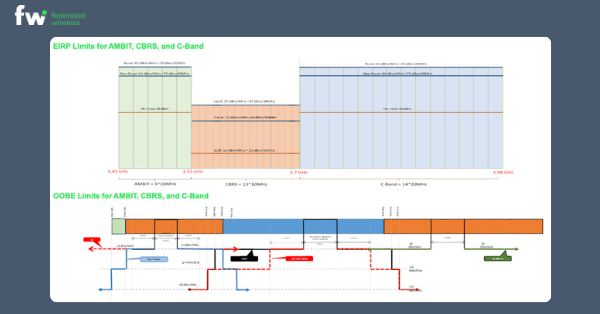

Lower 3.13.45 GHz remains dedicated to dense DoD operations and off the table for near-term commercial access. The 3.453.55 GHz AMBIT block (Auction 110) is full-power but constrained by Cooperative Planning Areas and Periodic Use Areas. CBRS at 3.553.7 GHz (n48) uses a three-tier sharing model with county-level licenses and bandspecific power limits. CBand at 3.73.98 GHz (Auction 107) is cleared and high power on PEA licenses. Each slice carries different licensing, emission masks, blocking, and federal protection criteria. That patchwork impedes end-to-end planning for wideband 6G channels.

Technical Mismatch at 3 GHz Limits 6G Scale

Nonharmonized EIRP and OOBE limits across adjacent 3 GHz segments complicate carrier aggregation and wide-channel configurations, increase device complexity, and slow interoperability. CBRS has become a vibrant ecosystem with hundreds of thousands of active CBSDs across MNOs, ISPs, utilities, and enterprises success which also raises the stakes for any migration to next-gen standards. Meanwhile, clarity on lower 3 GHz will likely take years, with meaningful policy decisions not expected until the next decade. Building a national 6G plan on that basis risks delay and lost influence in standards.

What U.S. 6G Stakeholders Should Do Now

Early alignment on 4 GHz can compress timelines, reduce risk, and position U.S. stakeholders to shape global 6G outcomes.

Prioritize 4 GHz in Standards and Spectrum Policy

Engage in 3GPP and ITUR work items to prioritize 4 GHz as a primary FR1 band; advocate coherent channelization (100/200 MHz), flexible duplexing, and pragmatic emission masks; and support Region 2 harmonization ahead of WRC27. Coordinate among FCC, NTIA, DoD, and industry on a phased sharing roadmap with clear protection criteria and nationwide technical rules across the full 500 MHz.

Launch 4 GHz DoD-Industry Coexistence Pilots

Launch DoD industry pilots to validate sensing, geofencing, and dynamic coordination; evaluate SAS-like controllers for 6G; and field-test protection of aeronautical and maritime services at band edges. Use existing n79 hardware for prototypes, iterating toward 6G PHY/MAC features as standards mature.

Align 4 GHz Product and Deployment Roadmaps

Plan RAN and device portfolios that evolve from n79 to 6G FR1 in 4 GHz, including support for wide uplink, AIRAN inference at the edge, and ISAC. For enterprises, prioritize private network trials in 4 GHz once frameworks open, targeting manufacturing, logistics, utilities, and public safety, where midband propagation and bandwidth deliver immediate ROI.

Bottom Line: 4 GHz Is the Practical U.S. 6G Anchor

Prioritizing 4.44.94 GHz gives the U.S. a practical spectrum anchor to lead 6Gtechnically sound, internationally credible, and aligned with near-term federal mandates.

Focus here accelerates standards influence, derisks commercialization, and creates a cleaner path to AI era wireless, while the 3 GHz patchwork remains essential for 5G but too fragmented to carry the first wave of 6G at scale.