Deutsche Telekom, the leading German telecom company, and Ericsson, its supplier partner, have announced that they have developed a secure 5G network slicing that can directly link to a private cloud. This development aims to address the concerns of enterprises about implementing edge use cases supported by emerging 5G technology norms.

Network slicing is considered a crucial feature of a 5G SA deployment, enabling the operator to set up discrete virtual networks that function as independent networks, thus facilitating premium, revenue-earning services.

The proof-of-concept (PoC), named after the project, was executed on a 5G standalone (SA) testbed in Deutsche Telekom’s lab with an enterprise smartphone connected to a predetermined set of private cloud applications. Ericsson supplied the 5G core, the radio access network (RAN), and the complete orchestration.

The trial incorporated mobile device management (MDM) and user equipment route selection policy (URSP) to evaluate and validate an application-level device configuration. It also employed TM Forum-based APIs to assimilate third-party management interfaces that enable external management systems to integrate slice ordering and management.

The organizations confirmed that the validated service offers a unified management interface for “automated configuration, provisioning, and complete orchestration of the enterprise slicing service order” and “can be activated without the user requiring any additional setup on their enterprise devices.”

The companies stated, “Enterprise staff can subsequently access private cloud-based applications on their enterprise smartphone device via a secure network slice over the public network.” They further added, “The enterprise administrator can also utilize a range of analytics services in the integrated solution to monitor and analyze the use of the customized network slice.”

This latest PoC is based on prior collaborations between Deutsche Telekom and Ericsson, including a trial in mid-2021 that utilized Ericsson’s 5G SA core and a Samsung smartphone to support a mobile gaming service.

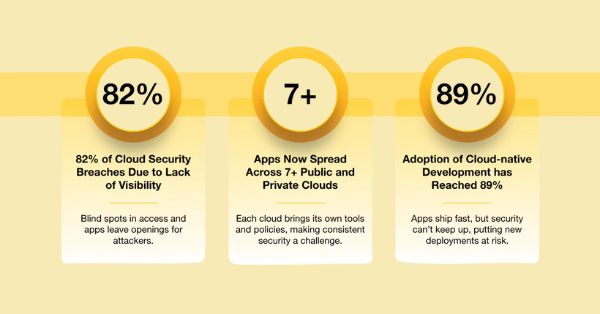

The financial advantages of network slicing have long been emphasized by analyst firms, especially in the context of penetrating various market sectors.

ABI Research predicted as early as 2018 that 5G network slicing would generate “$66 billion in value for enterprise verticals including manufacturing, logistics, and transportation by 2026.” The research firm also recently highlighted that operators need to focus on 5G slice-as-a-service and other ‘value-added services’ crucial for monetization.

Abdul Rahman, associate VP at Deloitte, explained in a presentation at the last year’s RSA Conference that potential vulnerabilities exist, allowing attackers to exploit one network slice and potentially breaching a device operating in an adjacent network slice. These concerns have grown with the recent trend to open up network APIs further, enabling operators to monetize their 5G network investments better.

Rahman further explained the importance of identifying the location of an organization’s most valuable assets, termed “crown jewels,” within network slices. He emphasized that it’s crucial to know which hosts are in proximity to where these “crown jewels” are situated.