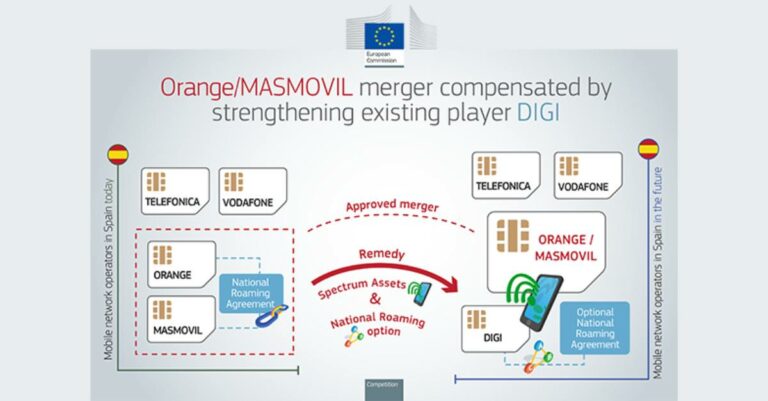

The EU Commission’s Conditional Approval In a significant development for the European telecommunications sector, the European Commission has granted conditional approval for the creation of a joint venture between telecom giants Orange and MásMóvil. This decision, governed by the EU Merger Regulation, hinges on strict adherence to a set of commitments proposed by both companies.

In-Depth Examination of the Joint Venture Prior to reaching this decision, the Commission conducted a thorough investigation into the proposed transaction. This scrutiny revealed several critical insights. Orange operates as a full mobile network provider, while MásMóvil is a hybrid operator, partly relying on its own network and partly on national roaming agreements, notably with Orange, to offer comprehensive services across Spain. This landscape also includes major players like Telefónica and Vodafone, along with numerous mobile virtual network operators (MVNOs), with Digi being the largest in Spain.

Commission’s Findings and Concerns The Commission’s investigation highlighted significant concerns that the merger, in its original form, could hamper competition in the retail markets for mobile and fixed internet services in Spain. Key findings included:

- The merger would create Spain’s largest operator in terms of customer numbers, significantly increasing market share across all relevant retail markets.

- Direct competition between Orange and MásMóvil, particularly given MásMóvil’s competitive pricing and growth trajectory, would be eliminated.

- Potential for significant consumer price hikes, exceeding 10%.

- Anticipated efficiencies from the transaction, such as cost savings or enhanced 5G and fiber rollout, were unlikely to counterbalance its anticompetitive effects.

Mandated Remedies to Foster Competition To alleviate these concerns, Orange and MásMóvil agreed to:

- Divest portions of MásMóvil’s spectrum across three bands to Digi, facilitating Digi’s development of an independent mobile network.

- Offer Digi an optional national roaming agreement, allowing it to utilize the joint venture’s network, complementing its own impending network rollout.

Digi: A Suitable Remedy Taker The Commission, after a rigorous review, including consultation with an independent advisor, endorsed Digi as an appropriate entity to acquire the divested spectrum. Digi’s current status as Spain’s largest and fastest-growing MVNO, coupled with its mobile network operational experience in other EU states and its expanding fixed broadband network in Spain, underlined its suitability.

Ensuring a Competitive Telecom Market in Spain The Commission’s thorough market testing and feedback collection from various stakeholders confirmed that these commitments effectively address the competition concerns. The decision is poised to maintain a competitive telecom landscape in Spain, benefiting consumers through competitive pricing, quality services, and accelerated 5G network deployment.

Regulatory Oversight and Compliance The Commission’s decision is contingent on full compliance with the outlined commitments. An independent trustee, under the Commission’s supervision, will oversee the implementation of these commitments, ensuring they align with the intended objectives of preserving market competition.

About Orange and MásMóvil Orange, headquartered in France, is a global telecommunications operator. In Spain, it operates through OSP, offering a range of mobile and fixed electronic communication services under multiple brands. MásMóvil, controlled by UK-based Lorca, predominantly serves residential customers in Spain

with its diverse brand portfolio, including Yoigo, MásMóvil, Virgin, and others. While MásMóvil’s network primarily focuses on urban areas with mid-band and high-band spectrum, it lacks low-band spectrum necessary for rural network deployment.

Merger Control Rules and Procedure The transaction was initially notified to the European Commission on February 13, 2023. Following the commencement of an in-depth investigation on April 3, 2023, the Commission expressed preliminary competition concerns on June 27, 2023. The Commission’s role is to assess such mergers and acquisitions, ensuring they do not significantly impede effective competition in the European Economic Area. The majority of notified mergers are routinely cleared; however, complex cases such as this undergo more extensive Phase II investigations.

Ongoing Investigations and Broader Impacts This decision comes amid other significant merger investigations, including Lufthansa’s proposed acquisition of ITA Airways and IAG’s intended acquisition of Air Europa. The conditional approval of the Orange-MásMóvil joint venture sets a precedent in the telecom sector, highlighting the Commission’s commitment to maintaining market competition while fostering industry growth.