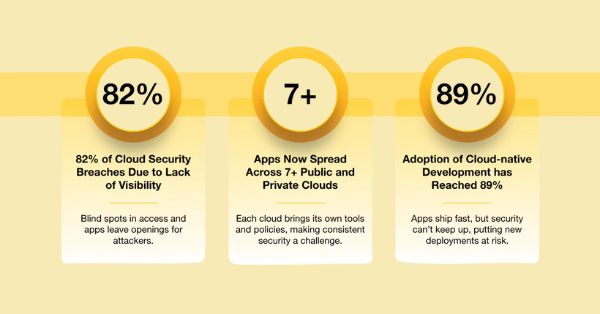

India has experienced a remarkable surge in 5G technology adoption, marking a significant milestone in its digital transformation journey. The launch of 5G networks in October 2022 initiated one of the fastest nationwide rollouts globally, driven primarily by major telecom operators like Reliance Jio and Bharti Airtel. By December 31, 2024, India had deployed over 464,990 5G base transceiver stations (BTS), a substantial increase from 412,214 at the end of 2023.

The growth in 5G availability has been equally impressive, with services now accessible in 779 out of 783 districts across the country. This rapid deployment has translated into a substantial increase in 5G subscribers, with projections estimating approximately 270 million users by the end of 2024, accounting for 23% of the total mobile subscriptions in the region.

This shift is not only reshaping consumer experiences but also driving significant increases in mobile data consumption, with 5G users consuming about 3.6 times more data than their 4G counterparts. The surge in 5G adoption is further supported by the growing availability of 5G-capable devices, which accounted for over 52% of smartphone shipments in 2023.

Leading Startups Powering India’s 5G Development

- VVDN Technologies: Founded by Vivek Bansal, VVDN offers comprehensive 5G solutions, including Radio Access Networks (RAN) and cloud services, collaborating with telecom operators to facilitate 5G deployments. The company designs, builds, integrates, and manages 5G solutions. Its 5G team’s strong expertise in FPGA and ARM-based platforms, Thermal Design, Signal Integrity, Antennae, and RF engineering helps it develop strategic design and architecture for various 5G solutions targeted for industry verticals like wireless, enterprises, telcos, data centers etc.

- Tejas Networks: Bangalore-based Tejas Networks founded by Arnob Roy, specializes in optical networking solutions that meet the high bandwidth and low latency demands of 5G networks. The company designs and manufactures high-performance wireline and wireless networking products for telecommunications service providers, ISPs, utilities, defense, and government entities. Tejas has an extensive portfolio of leading-edge telecom products for building end-to-end telecom networks based on the latest technologies and global standards with IPR ownership. The company is currently a part of the Tata Group.

- Niral Networks: Niral Networks offers a cloud-native 5G networking platform using an open Network Operating System for enterprises. It enables easy integration with third-party Edge applications, and centralized management, and aims to reduce total ownership costs. Founded by Abhijit Chaudhary and Dr. Inder Gopal, Niral Networks is democratizing 5G and Edge networking infrastructure by providing 5G infrastructure as a service for last-mile connectivity in Enterprise, Defense, Rural, Agriculture, Mining, etc. using open and disaggregated Network Operating System called NiralOS™ integrated with COTS hardware.

- Signalchip: Another Bangalore startup founded by Himamshu Khasnis and Rajesh Mundhada, Signalchip is a fabless semiconductor company working on 5G chipsets for smartphones and enterprise applications, contributing to the semiconductor landscape in India. The company is developing highly innovative semiconductor solutions for next-generation communication technologies.

Major Telecom Operators

Established telecom operators are integral to the 5G landscape in India. Reliance Jio and Bharti Airtel have been the primary drivers of the 5G rollout, investing heavily in nationwide deployment.

- Reliance Jio: A subsidiary of Reliance Industries and a pioneer in the Indian telecom sector, Jio is at the forefront of 5G development in India. The company has invested heavily in infrastructure to support 5G rollout across the country, collaborating with global tech giants like Qualcomm and Samsung for 5G technology development. By December 2024, Jio’s 5G user base reached 170 million, contributing to its total subscriber base of 479 million.

- Bharti Airtel: One of India’s leading telecom operators, Airtel continues to roll out 5G services across major cities in India. The company reported a strong mobile Average Revenue Per User (ARPU) of Rs 233 (USD 2.8) in the second quarter of fiscal year 2025. Airtel’s 5G service is now available across all 28 states and 8 union territories in India.

Despite the rapid expansion of 5G in India, customer satisfaction remains a challenge, with concerns around network consistency, service quality, and pricing. While telecom operators continue to scale their infrastructure, addressing these issues will be key to sustaining long-term adoption.

Looking ahead, India’s 5G evolution is set to unlock transformative opportunities across industries—from ultra-low latency streaming in entertainment to AI-powered diagnostics in healthcare and enhanced remote learning in education. With a strong mix of innovative startups, telecom leaders, and government-backed initiatives, India is poised to become a global force in 5G-driven innovation. The groundwork laid over the past few years is now fueling the next phase of advancements, ensuring that 5G becomes an integral part of India’s digital future.