The Strategic Imperative of 5G Spectrum Harmonization for U.S. Economic Prosperity

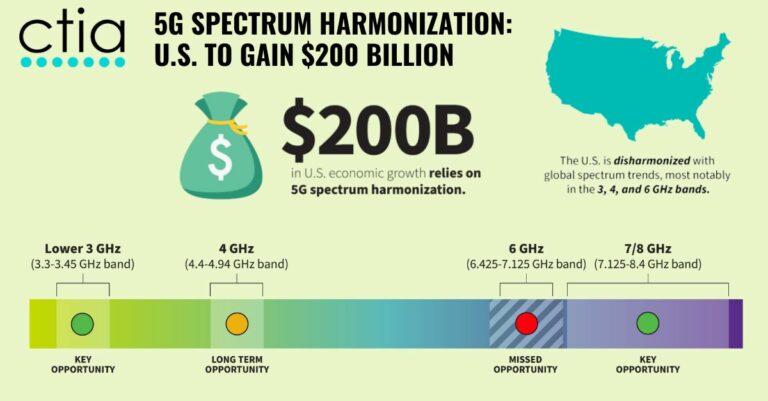

In an era of rapid technological advancement, the United States stands at a pivotal point with the adoption of 5G technologies. The study “Advancing U.S. Wireless Excellence: The Case for Global Spectrum Harmonization,” commissioned by CTIA and conducted by Accenture, sheds light on a crucial opportunity: harnessing the power of globally harmonized mid-band spectrum for 5G could potentially unlock a staggering $200 billion in economic growth within the United States over the next decade.

A Closer Look at the Potential Economic Windfall

The report underscores the multifaceted benefits of embracing 5G spectrum harmonization. It’s not merely about technological advancement but a comprehensive economic upliftment across various sectors.

In short, leading the way in 5G spectrum harmonization offers several advantages for the U.S. economy:

- Economic Growth: The study projects up to $200 billion in economic growth over the next decade, with benefits spanning various industries.

- Consumer Advantages: American consumers stand to gain from reduced costs of wireless products and services, and the accelerated development of innovative 5G applications.

- Network Infrastructure Development: It would aid in the growth of trusted network infrastructure companies, fostering a more secure and robust wireless ecosystem.

- Supply Chain Security: Aligning with global standards could bolster the U.S. network equipment supply chain, allowing domestic manufacturers to compete more effectively with their international counterparts.

This growth is attributed to both direct and indirect influences of 5G adoption.

The International Race for 5G Dominance

Globally, nations are rapidly aligning their 5G networks with internationally harmonized bands. This collective move towards a unified approach in 5G spectrum is not just a technological trend but a strategic economic maneuver. The United States, however, finds itself in a spectrum deficit compared to its international peers, notably China. This gap represents a missed technological opportunity and a potential economic setback. It not only affects the wireless sector but also impacts related industries like manufacturing and utilities.

The Consumer Advantage in 5G Adoption

One of the key highlights of the report is the direct benefit to American consumers. The harmonization of 5G spectrum is expected to lower the costs of wireless products and services significantly. This price reduction stems from the economies of scale achieved through global standardization. Additionally, it will accelerate the rollout of innovative 5G applications, enhancing consumer experiences and creating new avenues for business and entertainment.

Empowering American Industry Through 5G

The report strongly emphasizes the transformative power of 5G across various industries. From smart manufacturing and precision agriculture to advanced home broadband services, spectrum harmonization is expected to fuel a wave of innovation and efficiency. This technological leap is about enhanced connectivity and reshaping industries and creating new economic frontiers.

Critical Spectrum Bands for U.S. Focus

The report identifies specific frequency bands that are pivotal for the U.S. to focus on:

- The lower 3 GHz band: Already harmonized and widely used globally, this band is an ideal starting point for the U.S. to enhance its mid-band 5G allocations.

- The 7/8 GHz band: Identified for future mobile use internationally, this band presents an opportunity for the U.S. to lead in the development of the wireless ecosystem.

Securing the Supply Chain through Spectrum Leadership

An integral aspect of the report is the emphasis on supply chain security. By leading in spectrum harmonization, the U.S. can secure its network equipment supply chain, providing a significant advantage to trusted domestic equipment manufacturers. This move is strategic in countering the dominance of Chinese manufacturers and establishing a more

Economic Implications of Spectrum Leadership

The study highlights that leadership in adopting key spectrum bands could lead to substantial economic benefits, including:

- Job Creation and Industry Leadership: More than $150 billion could arise from new jobs and leadership in emerging industries, bolstering the U.S. export market.

- Economies of Scale: Around $44 billion could be gained by leveraging economies of scale in network equipment and device production.

Strengthening the Supply Chain

Harmonizing with global standards is not just about economic growth; it’s also about securing the U.S.’s network equipment supply chain. This move would enable American manufacturers to compete more effectively on a global scale, particularly against Chinese equipment manufacturers.

About CTIA: Championing the U.S. Wireless Industry

CTIA (www.ctia.org) represents a wide array of stakeholders in the U.S. wireless communications industry, advocating for policies that foster innovation and investment. As a leader in coordinating industry best practices and educational events, CTIA plays a pivotal role in promoting and advancing the wireless industry in the United States and globally.

Full report: Download here