India’s internet market is about to witness a major shift as Starlink, the satellite broadband service by Elon Musk’s SpaceX, gears up to launch with plans starting at just INR 840 (approximately $10) per month. This move could reshape connectivity in underserved regions while creating new dynamics in India’s growing 5G and FWA markets.

Starlink India Pricing and Regulatory Approval Update

Starlink recently received a Letter of Intent (LoI) from India’s Department of Telecommunications (DoT), following its agreement to comply with local licensing and Security norms. The service, once approved by the Indian National Space Promotion and Authorization Center (IN-SPACe), will mark the official entry of satellite broadband in India’s consumer market.

Despite potential regulatory costs—including a proposed INR 500 ($6) monthly charge per urban user, an 8% license fee, a 4% revenue share, and a spectrum usage fee of INR 3,500 ($42) per MHz annually—Starlink appears undeterred. Its $10 per month pricing undercuts global rates and signals a volume-driven strategy.

In comparison, Starlink’s monthly plans in Nigeria start at $35, while in Bangladesh, the Residential Lite package costs around $34. The pricing for India represents a steep discount of over 80% from its U.S. offering, where the service typically costs $80/month.

India’s Rural Connectivity Gap Presents a Growth Opportunity

Starlink aims to add up to 10 million subscribers in India, tapping into vast unconnected or poorly connected regions. According to TRAI data from April 2025, India’s rural teledensity stands at just 59.26%. Even in technically connected areas, users often face unreliable service and high latency.

This gap is especially pronounced in rural and remote zones, where the economics of traditional telecom infrastructure don’t always justify investment. Satellite & NTN solutions like Starlink offer a viable alternative.

With broadband Monetization becoming increasingly important for telecom providers, satellite broadband represents both a competitive threat and a complementary technology.

Starlink India Challenges 5G FWA from Jio and Airtel

India’s top operators—Reliance Jio and Bharti Airtel—have invested heavily in 5G-enabled FWA solutions. These services have been positioned as key revenue drivers in both urban and semi-urban areas.

However, if Starlink can deliver reliable speeds at $10/month, it may attract price-sensitive users who are currently underserved or unimpressed by FWA performance. Over time, telcos might assess each region to determine the better fit between terrestrial and satellite connectivity.

Notably, Starlink has reportedly formed partnerships with both Jio and Airtel to distribute its service. These alliances could ease regulatory friction, accelerate infrastructure deployment, and allow bundling of satellite broadband with existing services.

Starlink India Hardware Cost Could Limit Rural Adoption

One critical hurdle is hardware. Globally, the Starlink user terminal (satellite dish and router) is priced at around $349. For Indian users, especially in rural areas where ARPU (average revenue per user) is below $2, this presents a significant barrier.

Without public subsidies, financing options, or government support, widespread adoption in lower-income segments may be limited. Starlink’s success in rural India could hinge on its ability to lower or defer upfront equipment costs.

In some regions like Nigeria, Starlink has bundled the equipment cost with long-term contracts or even offered it for free with one-year service commitments. A similar model could boost adoption in India.

Capacity Constraints Could Slow Adoption

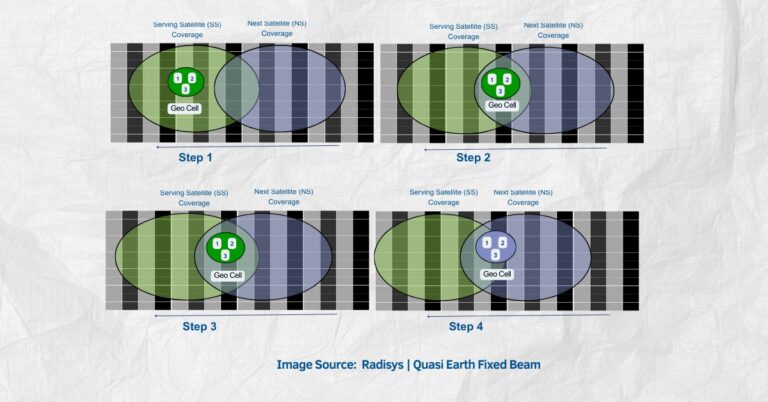

Despite ambitious subscriber targets, Starlink may face capacity issues. The company currently supports about 4 million users globally with a fleet of nearly 7,000 satellites. Even with projections to expand to 18,000 satellites by 2030, only a fraction—estimated at 0.7% to 0.8%—would be available to serve India at any given time due to orbital coverage limitations.

Initial bandwidth capacity in India is projected to support around 30,000 to 50,000 users, with scalability to 3 Tbps by 2027. Analysts caution that limited capacity could blunt the impact of Starlink’s low pricing, especially if early demand outpaces service capability.

In fact, Starlink has already paused new subscriptions in some U.S. and African regions when demand exceeded network capacity, indicating that scale management is a critical issue.

Competing Satellite Players and Market Dynamics

While Starlink is the headline act, it won’t be alone in India. Eutelsat OneWeb and Jio Satellite Communications received their licenses in 2021 and 2022, respectively. However, they had to wait nearly two years for IN-SPACe approval—something Starlink is currently navigating.

Other contenders include Amazon’s Project Kuiper and emerging players like Spacecoin, which claims it will offer satellite broadband for just $2/month. Though unproven at scale, these ultra-low-cost providers could further pressure prices and intensify competition.

What’s Next for Starlink India and the Satellite Broadband Sector?

The regulatory path remains a key determinant for how fast satellite broadband can scale in India. IN-SPACe, formed in 2020 under the Department of Space, functions as a single-window agency for private space players. Its decisions on spectrum use, infrastructure access, and licensing will shape the future landscape.

If Starlink secures final approvals and can overcome hardware cost barriers, it could meaningfully disrupt not just the broadband market, but the broader Telecom infrastructure strategy in India.

The next few quarters will be critical. Operators, regulators, and technology providers must decide whether to compete, collaborate, or co-exist in this evolving digital ecosystem.

Key Takeaways:

- Starlink plans to launch in India with plans as low as $10/month.

- Regulatory costs may challenge the low-cost model, but scale is the strategy.

- Hardware costs remain a major barrier for rural adoption.

- Capacity constraints may limit rapid user growth despite low prices.

- Partnerships with Jio and Airtel may drive bundling and distribution.

- Final approvals from IN-SPACe are pending.

With the world’s largest unconnected population still offline, India represents a high-stakes testing ground for satellite broadband at scale. Whether Starlink succeeds will depend not just on price but also on execution, partnerships, and regulatory agility.