SoftBank-OpenAI JV launches SB OAI Japan for localized enterprise AI

A new 50-50 joint venture aims to package and localize OpenAI’s enterprise stack for Japanese corporates, with SoftBank itself as the anchor customer.

SB OAI Japan launch details

SoftBank and OpenAI have formed SB OAI Japan, a jointly owned entity that will commercialize “Crystal intelligence,” a bundled enterprise AI offering focused on management and operations in Japan. The venture will combine OpenAI’s enterprise-grade models and tooling with localization, integration, and support led by SoftBank in-market.

Turnkey “Crystal intelligence” for enterprise AI adoption

Crystal intelligence is positioned as a turnkey solution that pairs model access with domain-specific implementation, governance, and support. Expect components such as chat-based assistants, retrieval over private knowledge bases, fine-tuning or instruction customization, usage analytics, and enterprise controls such as single sign-on, data retention settings, and audit trails. The value proposition hinges on reducing time-to-value and de-risking adoption for highly regulated sectors, rather than selling raw model access.

SoftBank deploys first as anchor customer

SoftBank plans to deploy the solution across its own group companies, validate outcomes in production, and recycle those learnings back into SB OAI Japan’s offerings. The company says employees are using AI at scale already and reports creating roughly 2.5 million custom ChatGPT instances for internal workflows—a signal that the venture will lean on real-world usage data to shape productization and services.

Why it matters for telecom and enterprise IT in Japan

The venture aligns with intensifying demand for localized, compliant AI and the need to translate pilots into measurable productivity and operational gains.

APPI-compliant localization and data residency

Japanese enterprises face strict requirements under the Act on the Protection of Personal Information (APPI) and sector-specific guidelines, making data residency, access controls, and auditability nonnegotiable. A Japan-based JV promises local-language models, in-country support, and deployment patterns that respect data sovereignty—key for telecom operators, financial institutions, public sector agencies, and manufacturers managing sensitive operational data.

Go-to-market scale and partner ecosystem

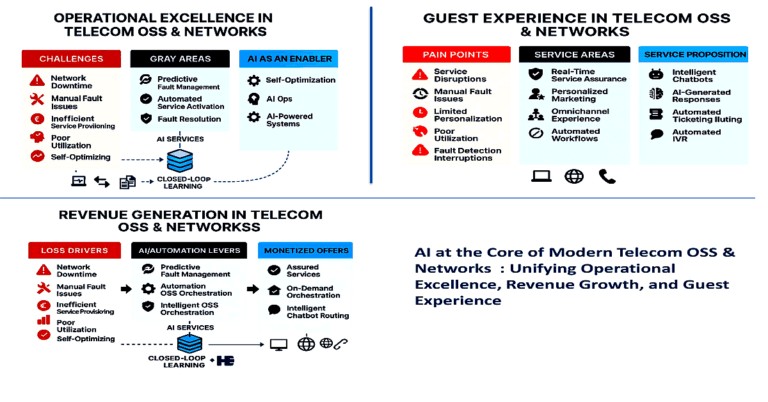

SoftBank brings deep enterprise channels across telecom, cloud, and IT services, plus influence over partner ecosystems that include systems integrators and ISVs. Packaging OpenAI capabilities through SoftBank’s sales and delivery motion could accelerate adoption in accounts that want a single throat to choke for professional services, SLAs, and compliance assurances. For telcos, that can mean faster paths to AI-enabled OSS/BSS processes, customer care automation, and network planning copilots.

AI infrastructure, inference costs, and power strategy

SoftBank has signaled large commitments to AI data centers and related infrastructure in Japan. As inference becomes the dominant cost driver, proximity to end users, power availability, and interconnect density will shape architecture choices. Expect hybrid designs that place latency-sensitive inference closer to the edge while keeping heavy training or fine-tuning in larger regional facilities, balancing performance, cost, and compliance.

Strategic implications, ROI, and risks

The JV tightens the loop between capital, infrastructure, and software consumption, but it also raises familiar questions about ROI, lock-in, and operational risk.

Vendor lock-in and capital concentration risk

SoftBank is both investor and first customer, creating a closed-loop revenue dynamic that can accelerate scale but also concentrate vendor risk. Buyers should probe multi-model strategies, portability options, and exit plans to avoid single-platform dependency—especially as Anthropic, Google, Cohere, and open-source stacks remain viable for different workloads.

ROI discipline and end-to-end TCO

The market is moving past pilots toward production, where cost per outcome matters more than model novelty. Enterprises should model end-to-end TCO: model access fees, inference scaling, prompt and context costs, orchestration overhead, observability, and human-in-the-loop expenses. Tie investments to operational KPIs—handle time, first-contact resolution, mean time to restore, order cycle time—rather than generic productivity claims.

Governance, security, and IP safeguards

Generative AI introduces risk vectors including prompt injection, data leakage, and inadvertent IP exposure. Buyers will expect SB OAI Japan to provide robust guardrails: retrieval isolation, content filtering, red-teaming, model and data lineage, incident response, and alignment with frameworks like NIST AI RMF and ISO/IEC 42001. Telcos should require evidence of rigorous evaluation on Japanese-language benchmarks and domain-specific tasks.

Near-term AI use cases in telecom and enterprise ops

Near-term value will come from copilots embedded in core workflows, backed by retrieval over private data and tight integration with existing systems.

Network operations and field workforce copilots

Deploy assistants that summarize alarms, recommend remediation steps, and generate change scripts with approval workflows. Augment field technicians with mobile copilots for site surveys, installation checklists, and safety compliance, using computer vision for equipment identification and anomaly detection at the edge.

Contact center, CRM, and revenue operations AI

Use AI to power next-best actions in contact centers, summarize interactions into CRM, automate order capture, and personalize offers while respecting consent and data minimization. For B2B, embed assistants in portals to generate proposals, solution designs, and service orders aligned to TM Forum Open Digital Architecture and GSMA Open Gateway APIs.

IT, security, and back-office automation

Automate knowledge retrieval across policies and code repositories, streamline procurement and legal reviews with contract analysis, and accelerate SOC workflows via alert summarization and guided investigation. Adopt retrieval-augmented generation to keep sensitive data on private stores and reduce hallucination.

Buyer’s checklist for evaluating SB OAI Japan

Treat this as an enterprise platform decision that spans architecture, commercial terms, and operating model.

Architecture, deployment, and latency SLAs

Clarify options for private networking, in-country endpoints, and on-prem or edge gateways; validate token budgets, context window sizes, and latency SLAs for Japanese-language workloads; and ensure support for model routing or fallback to alternative providers when needed.

Commercial terms and SLAs

Negotiate consumption economics beyond per-seat pricing: token tiers, concurrency caps, burst policies, uptime commitments, data retention defaults, and incident credits. Require transparent usage metering and cost allocation down to department or use-case granularity.

Risk, compliance, and governance evidence

Demand model cards, evaluation reports, and red-team results for priority use cases; verify APPI compliance, data residency, and third-country transfer controls; and align policies with internal AI governance and human oversight requirements.

What to watch next for SB OAI Japan

Execution details will determine whether this JV becomes a durable enterprise AI channel or a short-lived packaging play.

Inference placement, interconnect, and energy strategy

Track where inference endpoints and data stores live, interconnect options, and how the JV manages power constraints and sustainability (PUE, renewable PPAs), as these will affect cost and latency for nationwide deployments.

Multi-model and multi-cloud stance

Watch whether SB OAI Japan embraces a multi-model, multi-cloud stance or centers exclusively on one model family; procurement flexibility will influence long-term bargaining power and resilience.

Japan AI regulation and data transfer rules

Monitor updates from Japanese ministries on AI governance and cross-border data rules, as well as sectoral guidance for telecom and finance, which could shape deployment patterns and audit requirements.

Bottom line: this JV could accelerate safe, localized AI adoption in Japan, but buyers should impose rigorous architectural, commercial, and governance guardrails to translate the promise into measurable, defensible value.