Qualcomm Acquires Arduino to Expand Edge AI and Robotics

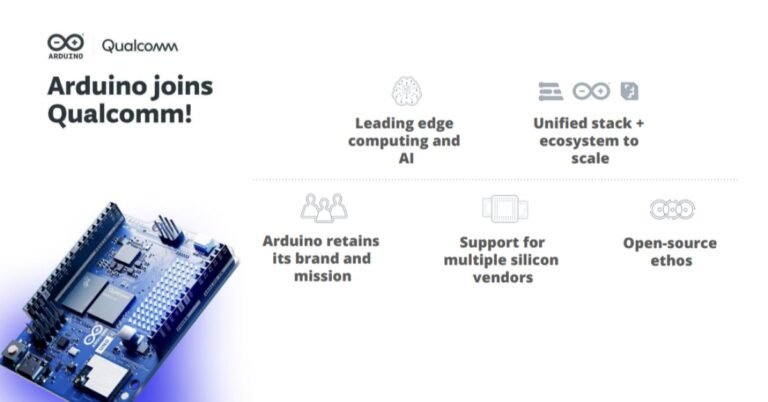

Qualcomm is acquiring Arduino to anchor an end-to-end developer funnel from hobbyist prototypes to commercial robots and industrial IoT systems.

Acquisition Highlights and Uno Q Launch

Qualcomm will acquire Italy-based Arduino and operate it as an independent subsidiary; financial terms were not disclosed. The move positions Qualcomm closer to the grassroots of robotics and embedded innovation where Arduino’s low-cost boards dominate early prototyping. As part of the announcement, Arduino introduced the Uno Q, a new board priced around $45–$55 featuring Qualcomm’s Dragonwing QRB2210 processor that runs Linux alongside Arduino tooling and supports vision workloads. Qualcomm says it intends to preserve Arduino’s community, leadership, and supplier relationships—including ongoing support for microcontrollers from STMicroelectronics, Renesas, Microchip, and NXP.

Strategic Rationale and Developer Funnel

This acquisition extends Qualcomm’s diversification beyond smartphones and modems into industrial IoT, robotics, and automotive—segments that already contribute roughly a third of chip revenue. Arduino gives Qualcomm a direct line to startups, labs, and system integrators at the earliest stages of product discovery. The company has been stitching together a developer-to-production path through recent buys like Foundries.io (secure embedded Linux lifecycle and OTA) and Edge Impulse (ML tooling for edge devices). By meeting developers at the prototyping bench and offering an upgrade path to production-grade SoCs and modules, Qualcomm aims to convert experimentation into long-term silicon design wins.

Why Qualcomm + Arduino Matters for Robotics, Edge AI, and Telecom

The Arduino tie-up broadens access to Qualcomm compute for small teams while reinforcing an ecosystem play that spans on-device AI, connectivity, and lifecycle operations at the edge.

Bridging Prototyping to Production for Edge AI Robotics

Historically, smaller developers struggled to access Qualcomm parts, which were sold in large volumes to established OEMs. Meanwhile, rivals like Nvidia popularized developer kits for robotics with Jetson modules available off the shelf. The Uno Q narrows that gap with a Linux-capable Arduino board powered by Qualcomm silicon, easing the leap from microcontroller-based proof-of-concepts to embedded Linux designs capable of perception, planning, and control. Combined with Edge Impulse for model development and Foundries.io for Yocto-based OS builds, SBOM, and OTA, Qualcomm can offer a more coherent pipeline from prototype to certified production hardware.

5G, Wi‑Fi 7, and Industrial Connectivity Impacts

Robots and autonomous mobile systems increasingly depend on reliable, low-latency links and local AI. Packaging compute with connectivity is Qualcomm’s core strength. Expect tighter coupling of Linux-capable Arduino boards and future Qualcomm modules with Wi‑Fi 7, Bluetooth LE, and 5G (including RedCap) to support private networks in factories and warehouses. For system architects, this creates a practical path to blend on-device inference with 5G slicing, TSN-aligned timing, and edge offload when needed—optimizing latency, bandwidth, and energy without overbuilding the network or cloud tiers.

Competitive Landscape: Nvidia, Raspberry Pi, NXP, Renesas, ST

Nvidia remains the reference platform for high-performance robotics developers with Jetson Nano and Orin variants, robust CUDA tooling, and ROS 2 adoption. Raspberry Pi continues to set the baseline for low-cost Linux prototyping, while NXP i.MX, Renesas RZ, and ST’s STM32MP lines are entrenched in industrial designs. Qualcomm’s play is to win mindshare earlier, then offer scale-up options to QRB/RB platforms with stronger AI and vision acceleration. Success will depend on software readiness (Linux BSP quality, ROS 2 performance), long-term availability, and total cost versus established alternatives.

What to Watch Next: Software, Silicon, and Community Signals

Execution will pivot on software maturity, silicon roadmap clarity, and how well Qualcomm protects Arduino’s open community while adding industrial-grade options.

Software Readiness: Linux BSP, ROS 2, and Inference Stacks

Assess the Linux BSP for the QRB2210, kernel versioning and upstreaming, camera and sensor drivers, and graphics/vision stacks. Robust support for ROS 2 (DDS performance, real-time behavior), ONNX Runtime or similar inference engines, and clean integration with Arduino IDE and CLI will be critical. Developers will also look for Yocto recipes, container support, and CI/CD hooks to streamline field updates via Foundries.io.

Silicon Roadmap and Total Cost of Ownership

Enterprises will want a clear migration map from Uno Q to higher-tier Qualcomm robotics SoCs and production modules with industrial temperature ranges, functional safety options, and long-term supply. Compare performance-per-watt and BOM costs to Jetson, i.MX, and Raspberry Pi ecosystems. Transparent pricing for modules, reference carrier boards, and connectivity add-ons (Wi‑Fi 7, 5G RedCap) will influence design-in decisions.

Community Strategy and Partner Ecosystem

Arduino’s value is its global community, education footprint, and shield/accessory ecosystem. Qualcomm’s stated “no change” approach needs to translate into continued openness, broad distribution, and community-led libraries. Watch for partnerships with ROS 2 foundations, university programs, and system integrators to accelerate industrial use cases without alienating hobbyist and startup users.

CTO and Network Strategist Recommendations

Use the acquisition to pilot faster, de-risk scale-up, and align compute, connectivity, and lifecycle operations from day one.

Pilot on Uno Q and Plan Migration to QRB/RB Platforms

Adopt Uno Q for rapid proofs-of-concept that require Linux, vision, and modest AI. From the outset, define a migration track to production-grade Qualcomm QRB/RB platforms, including thermal design, power budgeting, and safety/compliance requirements. Align with ROS 2 LTS distributions and validate performance on representative workloads (SLAM, defect detection, pick-and-place).

Co‑Design Connectivity and Edge Lifecycle Operations

Co-design compute and network: evaluate Wi‑Fi 7 versus private 5G based on mobility, interference, and latency profiles; consider 5G RedCap for cost/power-sensitive devices. Standardize on secure boot, measured attestation, and OTA using Foundries.io or equivalent. Establish a software bill of materials and vulnerability management pipeline to meet industrial cybersecurity baselines (e.g., IEC 62443).

Build the Partner Stack for Private 5G and Edge AI

Engage operators and hyperscalers for private 5G, edge orchestration, and data pipelines; partner with ROS 2/DDS vendors and system integrators for deployment acceleration. Compare Qualcomm’s SDKs and tooling with alternatives from Nvidia, NXP, and Renesas, and pilot cross-platform portability via ONNX and containerized nodes to avoid lock-in.

Bottom line: By bringing Arduino under its wing, Qualcomm is turning a broad developer funnel into a strategic go-to-market for robotics and industrial edge AI. If the software lands cleanly and the roadmap holds, this could reshape how prototypes become connected, AI-enabled products on private and public networks.