Lynk–Omnispace Merger with SES to Scale D2D NTN

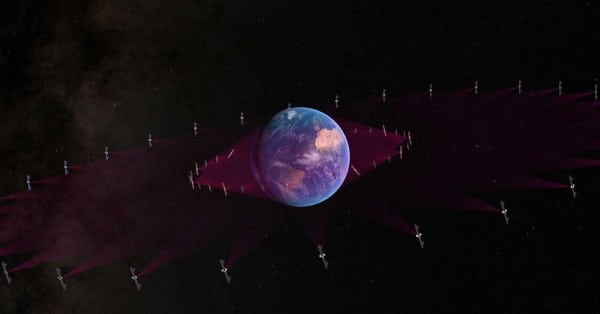

A planned merger between Lynk Global and Omnispace aims to fuse spectrum assets, satellite technology, and SES’s multi-orbit infrastructure to scale 3GPP-compliant direct-to-device services worldwide.

Merger Highlights: Spectrum, Tech, and SES Multi-Orbit

The combined company will pair Omnispace’s globally coordinated S-band holdings—about 60 MHz anchored by ITU filings and aligned to non-terrestrial network standards—with Lynk’s patented multi-spectrum D2D platform. The move is designed to lift D2D from niche messaging into a broader portfolio of voice, data, and IoT services that work with standard smartphones and connected devices. SES, already an investor in both firms, will become a major strategic shareholder and provide access to its GEO and MEO assets and ground network to improve coverage, resiliency, and time-to-market.

Leadership and Closing Timeline

Ramu Potarazu is slated to lead the combined entity as CEO, with Omnispace’s Ram Viswanathan becoming chief strategy officer. The companies are targeting closing late this year or early next, subject to approvals. Near term, Lynk plans additional satellites to validate multi-orbit relay with SES, building toward more continuous coverage by 2027.

Why the D2D NTN Merger Matters Now

Satellite-to-phone is shifting from trials to spectrum-backed services, and control of harmonized frequencies will determine coverage quality, capacity, and regulatory scalability.

D2D Moves from Trials to Capacity-Backed Services

Lynk has already launched commercial messaging and alerting in small markets with a handful of LEO spacecraft. Omnispace brings licensed, globally coordinated S-band designed for mobile services and compliant with 3GPP NTN, offering a cleaner regulatory path to scale. Together, they can move beyond intermittent connectivity toward more reliable voice and data without modifying handsets.

Multi-Orbit, Multi-Spectrum Economics for NTN

SES’s MEO and GEO network and global ground footprint can offload backhaul, enable store-and-forward or relay, and improve cost per bit compared with a pure-LEO approach. That matters as D2D traffic ramps and as service providers seek predictable economics for consumer roaming, IoT backhaul, and mission-critical use cases.

Spectrum and 3GPP NTN Standards Landscape

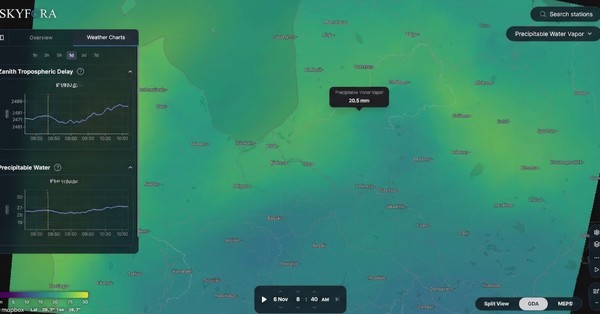

The crux of D2D is access to harmonized, protected spectrum mapped to 3GPP NTN, and aligned with national regulators and the ITU.

Omnispace S-Band and 3GPP NTN Alignment

Omnispace’s S-band portfolio, paired with high-priority ITU filings, was engineered for mobile satellite services and aligns with 3GPP Release 17 NTN specifications, with enhancements in Release 18. This positions the merged company to support both IoT (NB-IoT/LTE-M over NTN) and handset-based NR-NTN services as device vendors enable satellite waveforms in standard silicon.

U.S. S-Band Interference and FCC Alignment

In the United States, S-band use has faced interference concerns where terrestrial mobile allocations overlap with satellite plans. Omnispace has sought updated FCC alignment with international S-band allocations to mitigate conflicts, an important gating factor for nationwide U.S. coverage. The outcome will shape deployment timelines and service tiers across markets.

D2D Satellite Competitive Landscape and Positioning

Spectrum consolidation is underway as major contenders secure frequencies and carrier partnerships to corner coverage, capacity, and distribution.

Starlink D2D Spectrum Pivot and Capacity

SpaceX is expanding from a U.S. texting and alert service using T-Mobile’s terrestrial holdings to a higher-capacity phase by pursuing S-band spectrum from EchoStar. The goal is a large capacity uplift for second-generation D2D. Starlink already flies hundreds of D2D-capable LEO satellites and is onboarding markets beyond the U.S., creating first-mover pressure on coverage density and developer ecosystems.

AST SpaceMobile’s Broadband-First D2D Strategy

AST SpaceMobile is targeting broadband-class D2D with BlueBird satellites and is assembling spectrum via partnerships, including efforts to access L-band in North America through Ligado Networks and S-band globally where approved. It has marquee U.S. MNO partners and is preparing for heavier launch cadence to achieve continuous coverage.

Lynk–Omnispace–SES Differentiators

The merger pairs a purpose-built, licensed S-band asset with a proven low-cost D2D platform and deep MNO relationships across 50+ countries. SES adds a global ground network and multi-orbit backhaul. The focus is pragmatic: standards compliance, regulatory scalability, and handset backward compatibility to reach billions of devices without new antennas.

D2D Technical Roadmap and Multi-Orbit Operations

Execution will hinge on satellite density, spectrum availability by country, and integration with terrestrial networks and devices.

Near-Term Launches and SES Relay Validation

Lynk plans to launch satellites to validate multi-orbit relay with SES, a key step toward reducing service intermittency and improving latency. Expect a hybrid architecture that uses LEO for access and MEO/GEO for aggregation and backhaul, plus globally deployed teleports for integrated core and policy control with MNOs.

Device Compatibility and Service Tiers

Initial services will center on messaging and IoT, expanding to voice and data as spectrum, link budgets, and device firmware mature. Backward compatibility with standard phones remains a core promise, while newer smartphones and automotive platforms can tap higher-throughput S-band channels over time as 3GPP NTN features proliferate in chipsets.

Implications for MNOs, Enterprises, and Government

D2D will become a standard coverage and resiliency feature embedded into networks, plans, and devices.

Guidance for MNOs

Use this merger to accelerate NTN integration testing across core network functions, policy, emergency alerts, roaming, and billing. Prioritize markets with clear S-band access, then extend via roaming. Define tiered plans that blend terrestrial coverage with satellite fallback, and align device certification with NTN-capable firmware. Negotiate QoS and service-credit frameworks tied to coverage probability and message delivery SLAs.

Guidance for Enterprises and Automotive

Design operations assuming ubiquitous, antenna-free connectivity for field teams, vehicles, and sensors. Target use cases in logistics, maritime, energy, rail, utilities, and public safety. Map device roadmaps to NTN-capable modules for NB-IoT/LTE-M and plan data minimization for satellite links to control costs. For automotive, treat D2D as a baseline safety and telemetry channel for remote regions.

Guidance for Public Sector and Emergency Management

Incorporate D2D into disaster recovery, early warning, and continuity communications. Align procurement with 3GPP NTN standards and national spectrum policies to ensure interoperability across agencies and cross-border operations.

Risks, Open Questions, and Key Milestones

Regulatory clarity, capacity scaling, and device readiness will determine how fast D2D becomes mainstream.

Regulatory Path and Spectrum Access

Track FCC decisions on S-band alignment, country-by-country market access, and any coexistence conditions with terrestrial networks. Watch how the combined entity secures national authorizations to translate global ITU filings into domestic licenses.

Capacity, Quality, and Economics

Measure progress by usable MHz per market, satellite density, ground segment integration, and achievable throughput per user. Unit economics will improve with multi-orbit backhaul and spectrum depth; pay attention to pricing models for messaging versus broadband tiers.

Ecosystem and Device Readiness

Monitor chipset and handset vendor timelines for Release 17/18 NTN features, MNO device certification, and application developer support for satellite-aware services. Enterprise gateways and modules supporting NB-IoT/LTE-M over NTN will be key for IoT scale.

Milestones to Track

Closing of the merger, initial S-band market launches beyond early island markets, SES relay demonstrations, additional satellite deployments, and new MNO commercial agreements across the Americas, Europe, Africa, and Asia will signal momentum.