AI layoffs surge: impact on telecom and enterprise tech

October’s job-cut announcements surged, with AI and cost control reshaping staffing plans across technology and adjacent sectors.

October job cuts: key stats

Planned layoffs spiked to roughly 153,000 in October, up more than 180% from September and about 175% from a year ago, according to the latest Challenger job-cuts tally. Year-to-date announcements for 2025 have crossed 1.09 million, the highest October-through-period since the pandemic shock of 2020 and above comparable 2009 levels. While announced cuts do not always translate into immediate separations—and can include unfilled roles and hiring freezes—the scale signals a cooler labor market and recession-like caution.

Sectors hit hardest by AI and cost cuts

Technology remains the epicenter. In October, tech represented just over one-fifth of planned cuts, and year-to-date tech reductions have already surpassed last year’s count. The sector is unwinding pandemic-era hiring while absorbing AI-driven automation across software development, support, and corporate functions. Warehousing also posted elevated cuts, with tariff-related costs cited as a drag on margins across logistics and supply chains. Across reasons given, cost reduction led by a wide margin, and AI adoption was the second-largest driver—underscoring both macro pressure and structural transformation.

Hiring plans mask tech-only rebound

October also showed a jump in announced hiring plans. But nearly nine in ten of those adds were in technology, with anecdotes pointing to selective backfills where prior reductions overshot. Excluding tech, hiring intentions were modest. Seasonal hiring is also muted: retail and delivery services are far below typical September–October peaks, a soft signal for holiday demand and a warning for consumer-exposed IT spending.

Why it matters for telecom, cloud, and enterprise IT

The cuts reflect a pivot from growth-at-any-cost to profitability, with AI rebalancing roles and budgets across the stack.

AI shifts roles toward data, platform, and AIOps

In networks and IT operations, automation is compressing Level-1/Level-2 support, QA, and routine fulfillment roles as AI copilots and AIOps tools absorb tickets, playbooks, and anomaly detection. At the same time, demand is rising for data engineering, MLOps, platform engineering, and model governance. Telcos advancing toward autonomous networks—under frameworks from TM Forum, ETSI ZSM, and 3GPP SA5—need talent that can build closed-loop assurance and policy-driven automation. In the RAN, O-RAN Alliance initiatives, SMO platforms, and RIC xApps/rApps will concentrate hiring around data pipelines, inference optimization, and real-time control. The skills mix is changing fast; organizations that lag on reskilling risk operational bottlenecks just as AI scales.

Cost-out pressure reshapes roadmaps and partners

Operators and enterprises will intensify total cost of ownership scrutiny across core, transport, and IT. Expect tighter vendor consolidation, outcome-based SLAs, and managed services expansion where internal headcount is constrained. Cloud FinOps will gain teeth as CFOs challenge GPU-as-a-service economics and long-term consumption commitments with AWS, Microsoft Azure, and Google Cloud. Yet AI infrastructure spend will remain targeted, especially for customer care automation, field service augmentation, and network planning—often leveraging NVIDIA accelerators and vector databases. Approval cycles are lengthening, so suppliers should prioritize offers with rapid, measurable payback.

Tariffs and supply chain strain delay edge and logistics digitization

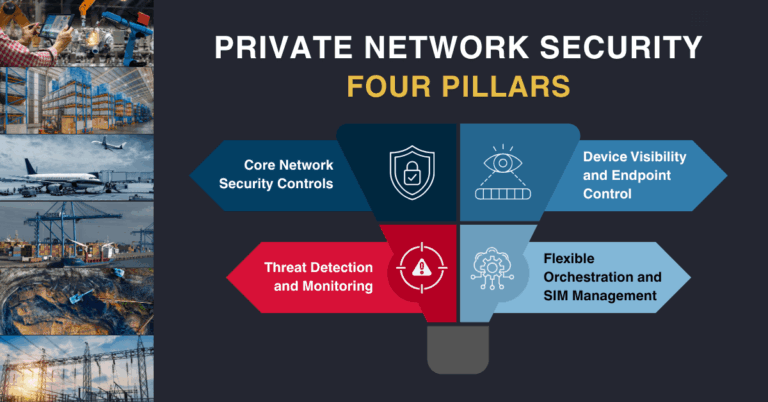

With warehousing under pressure from tariffs and soft demand, some edge automation and IoT projects will slip to the right. Private 5G and Wi-Fi 7 still have a role in driving throughput, safety, and asset tracking, but buyers will insist on sub-12-month ROI with clear opex reductions. Integrators and ISVs that bundle connectivity with workflow automation, computer vision, and robotics orchestration will fare better than those selling connectivity alone.

What leaders should do next

Use this reset to pivot toward AI-native operations, disciplined spend, and standards-based automation.

Reskill for AI-native operations

Launch targeted reskilling in data engineering, Python, prompt design, retrieval-augmented generation, and model evaluation. Cross-skill NOC and assurance teams into AIOps and closed-loop control. Establish an AI product council across network, IT, security, and customer operations to prioritize high-ROI use cases. Put model risk management in place early, aligning with emerging regulatory practices and your internal compliance controls.

Standardize data and automation architecture

Standardize telemetry with OpenTelemetry and adopt a unified data fabric so AI systems can observe, decide, and act. Build feature stores and policy engines that span network domains. Govern LLM usage with clear data boundaries and audit trails. Favor platforms that integrate with ServiceNow, Kubernetes-based network tooling, and CI/CD pipelines. In telecom, lean on TM Forum Open APIs, MEF LSO, and GSMA Open Gateway to decouple services from channels and partners.

Update procurement for outcomes and portability

Renegotiate contracts toward outcome pricing tied to ticket deflection, MTTR reduction, or forecast accuracy. Scrutinize GPU utilization, placement, and cooling costs across on-prem and cloud. Co-innovate with hyperscalers, but reduce lock-in through portable architectures—GitOps for network (e.g., Nephio), multi-cloud MLOps, and open RIC ecosystems from the O-RAN community. For field-heavy domains, prioritize vendors that provide prebuilt adapters to OSS/BSS and proven integrations with SMO and assurance stacks.

Signals to watch in Q4 and early 2025

Monitor labor, demand, and capex signals to calibrate plans and partner engagement.

Labor and demand signals

Track openings for AI/ML, platform engineering, and NOC roles across major telcos and OEMs; it’s a leading indicator of where automation budgets will land. Watch seasonal retail hiring and delivery activity as proxies for consumer momentum. Read guidance from AT&T, Verizon, T-Mobile, Comcast, BT, and Deutsche Telekom alongside hyperscalers and integrators like Accenture and TCS to gauge enterprise IT appetite.

AI and network investment signals

Listen for commentary on GPU procurement, data center expansion, and 400G/800G optical upgrades (including IPoDWDM) that underpin AI workloads. In mobile, track progress on O-RAN RIC trials and autonomous network scorecards. Keep an eye on tariff and export-control developments, as they influence warehousing, logistics, and edge deployment timing. Finally, factor in AI policy moves—such as the EU AI Act’s implementation timeline—when planning model governance and vendor risk.

The takeaway: October’s cuts are a wake-up call, not a freeze. Winners will be those who pivot headcount and architectures toward AI-driven, standards-based automation while enforcing ROI discipline and preserving strategic flexibility.