Reliance Jio’s 5G Financial Backing and Strategic Alliances

Reliance Jio, a major player in India’s telecom sector, has strategically secured a loan ranging from US$1.5 billion to $2 billion from HSBC, aimed at purchasing 5G network equipment from Nokia. This move is backed by insurance cover from Finland’s Finnvera and follows a similar financial strategy involving a nearly $2 billion loan from BNP Paribas for 5G equipment from Ericsson, insured by the Swedish export credit agency EKN. These financial maneuvers underscore the company’s commitment to a robust nationwide 5G rollout, with an investment exceeding US$24 billion.

Reliance Jio’s Aggressive 5G Rollout and Customer Growth

Jio’s ambitious 5G rollout plan is already making waves, with services reaching 96% of census towns in India. The company, which claims to host 85% of India’s operational 5G cells on its network, is on a mission to have close to 1 million operational 5G cells by December. Moreover, Jio has successfully amassed a substantial 5G customer base, with numbers soaring above 62 million, indicating a strong consumer appetite for enhanced connectivity.

Bharti Airtel’s 5G Journey and Customer Acquisition

Bharti Airtel is also making significant strides in the 5G space, boasting over 50 million unique 5G customers within a year of launching its Airtel 5G Plus service. The service, available across all Indian states and union territories, reflects Airtel’s commitment to facilitating nationwide 5G access.

CTO Randeep Sekhon highlighted the company’s delight at the rapid adoption and expansion of Airtel’s 5G coverage, which has witnessed a fifty-fold increase within a year.

The 5G Demand Phenomenon in India

The demand for 5G services in India is palpable, with both Jio and Airtel experiencing a surge in customer numbers. A study from Ericsson reveals a promising future, estimating that 31 million users in India will upgrade to 5G in 2023. Furthermore, the report highlights a 30% higher customer satisfaction rate among Indian 5G users compared to 4G users, indicating a positive reception and potential for customer retention for the operators investing in 5G rollout.

Competitive Landscape and Future Implications

The competition between Reliance Jio and Bharti Airtel is intensifying, with both operators vying for a larger share of India’s burgeoning 5G market. The substantial investments and rapid adoption of 5G technology by these telecom behemoths underscore a promising future for 5G in India. With over 100 million users already on board and substantial financial backing, the race to dominate India’s 5G market is well underway, offering enhanced connectivity and opening new possibilities for consumers and businesses alike.

Challenges and Opportunities Ahead

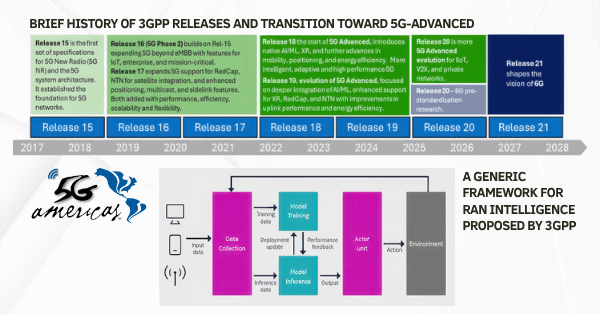

Despite the rapid advancements, challenges such as infrastructure development, regulatory frameworks, and technology standardization loom large. The telecom giants will need to navigate through these challenges while capitalizing on opportunities to innovate and enhance service offerings. The evolution towards 5G also opens doors for advancements in IoT, AI, and other technologies, potentially revolutionizing various sectors, including healthcare, education, and manufacturing, thereby contributing to India’s socio-economic development.

Conclusion | India’s unfolding 5G Story

The unfolding 5G story in India, led by Reliance Jio and Bharti Airtel, is one of strategic financial investments, rapid network rollouts, and a response to surging consumer demand. As the nation steps into the new era of connectivity, the implications are far-reaching, promising to reshape the digital landscape and catalyze technological advancements across various sectors. The journey ahead, while promising, will require sustained efforts, strategic planning, and a focus on innovation to realize the potential of 5G in India fully.