Telus AI data-centre partnerships to scale sovereign compute in Canada

Telus is in active talks to bring partners into its data-centre and AI business, signaling a capital-light approach to scale sovereign AI compute in Canada.

Capital-light partnerships and strategy to expand Canadian AI capacity

Telus’s CFO confirmed “significant” discussions on partnerships that would expand the company’s data strategy while preserving balance-sheet flexibility. The model could echo Telus’s earlier monetization of passive infrastructure—such as the minority stake sale of tower assets to Caisse de dépôt et placement du Québec (CDPQ)—by tapping long-duration capital to co-fund growth. For Canada’s enterprise and public-sector buyers, this points to more locally hosted AI capacity with data residency, compliance, and low-latency connectivity tied to Telus’s national network footprint.

In March, Telus said it would operate AI data centres and sell access to Canadian firms building and running AI models. Partner capital can accelerate GPU procurement, facility buildouts, and interconnect investments while aligning with customers that require sovereign environments distinct from hyperscale public clouds.

Modular AI data-centre build to mitigate oversupply and tech risk

Management addressed investor concerns about potential AI compute oversupply by emphasizing a modular build strategy—adding capacity in phases as demand materializes. This reduces stranded capital risk in a market with volatile GPU supply, rapid chip roadmaps, and evolving workload profiles. It also keeps Telus positioned to incorporate new silicon and cooling designs without locking into a single generation. For enterprises, a modular provider typically means faster time-to-capacity for pilots, with clearer paths to reserved instances or private clusters as projects scale.

Telus Q3 results: revenue mix, deleveraging, and AI investment runway

Telus delivered a mixed quarter—steady top line, outsized net income from a one-time item, and continued focus on leverage and portfolio optimization.

Mobility and wireline trends: net adds, ARPU, and pricing outlook

Operating revenue was flat at $5.1 billion, with net income up 68% to $431 million, primarily from a gain tied to a debt repurchase; on an adjusted basis, net income declined 10%. Mobility net adds were 82,000, down from last year as promotional intensity weighed on average revenue per user, which fell 2.8%. The pricing environment appears to be stabilizing post back-to-school, but ARPU recovery will depend on roaming normalization and upsell traction.

On the wireline side, Telus added 40,000 internet customers, beating expectations and signaling healthy demand for higher-speed access and converged bundles—an important cross-sell channel as AI and edge workloads push more traffic to fixed broadband.

Deleveraging plan, net-debt-to-EBITDA targets, and dividend strategy

Telus is prioritizing deleveraging: long-term debt declined by $2 billion to $25.7 billion, and the company plans to move net-debt-to-EBITDA from roughly 3.5x to 3.0x by 2027. Dividend growth was moderated to preserve flexibility, consistent with a multi-year capital plan that balances network, AI data-centre expansion, and shareholder returns.

Telus Health monetization and non-core asset optimization

Telus Health grew operating revenue 18% and remains a likely candidate for strategic partnering or partial monetization, with market expectations pointing to potential private equity involvement in the next 12–18 months. Telus is also extracting value from non-core assets, including legacy copper, and consolidated its technology and customer service outsourcing affiliate, Telus Digital, to streamline execution across network, data, and service operations.

Why sovereign AI and data residency matter in Canada now

The timing aligns with tightening data-residency requirements, heightened AI adoption, and demand for local alternatives to U.S.-centric infrastructure.

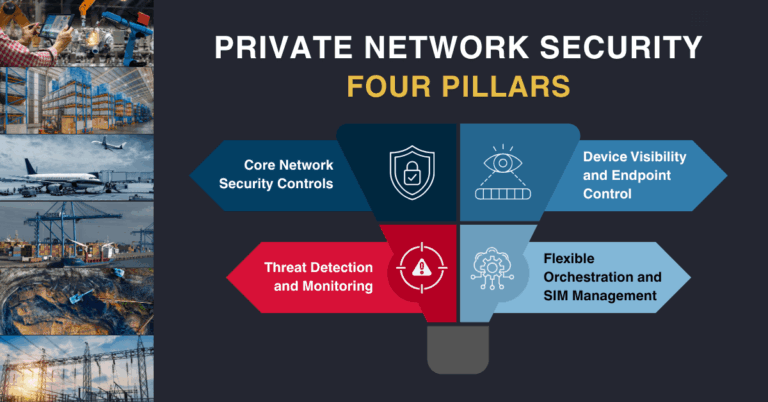

Compliance-driven demand for Canadian-hosted AI and security controls

Public-sector agencies and regulated industries face stricter expectations around data control and model governance. A Canadian-hosted AI stack with local interconnects, security certifications, and contractual clarity on data handling can reduce risk versus cross-border processing. Telus’s network reach, enterprise channels, and modular data-centre roadmap position it as a domestic option for inference clusters, fine-tuning, and RAG workloads that require predictable latency and compliance.

With privacy frameworks tightening and industry regulators intensifying oversight of AI model training and deployment, providers that can offer auditable environments and strong identity, logging, and encryption controls will gain share. Telus’s partnership push suggests it aims to match these requirements while pacing capital outlays to demand.

Market constraints: power, cooling, and accelerator roadmap dynamics

Canadian AI capacity is expanding, but the market is constrained by power availability, cooling requirements, and the rapid turnover of accelerator tech. A modular approach and partner capital can help navigate site-by-site power timelines and adopt higher-density designs as they mature. For buyers, this should translate into more near-term capacity options and clearer upgrade paths as new AI chips and interconnects arrive.

What Canadian enterprises and partners should do about AI hosting

Enterprises evaluating Canadian AI hosting should weigh technical fit, governance, and long-term economics while watching Telus’s partnership structure and rollout cadence.

Buyer checklist: data residency, security, capacity, network, and economics

– Data residency and contractual controls: verify where data and model artifacts live, who can access them, and exit/migration terms.

– Security and compliance: look for attestations such as ISO 27001, SOC 2, and sector-specific controls; assess key management, logging, and tenant isolation.

– Capacity roadmap: confirm near-term GPU availability, reservation options, and upgrade paths as new accelerator generations ship.

– Network and interconnect: evaluate latency to your sites, private connectivity to clouds, and peering for hybrid AI workflows.

– Performance and cooling: understand power density per rack, cooling approaches, and how thermal constraints may affect SLAs.

– Economics and flexibility: compare reserved versus on-demand pricing, minimum commitments, and the ability to right-size clusters over time.

2025–2027 signals: partnerships, sovereign wins, ARPU, and power pipeline

– Structure and scale of Telus’s AI/data-centre partnership(s): look for the mix of infrastructure capital, ownership stakes, and expansion milestones.

– Sovereign AI wins: public-sector and regulated-industry references will validate demand and inform capacity pacing.

– ARPU trajectory and churn: stabilization would ease funding pressure and support continued AI buildouts.

– Telus Health monetization: proceeds could accelerate deleveraging or be redeployed into high-return digital infrastructure.

– Power and site pipeline: announcements on new campuses, interconnect hubs, and sustainability metrics will indicate execution velocity.

Bottom line: Telus is aligning balance-sheet discipline with a phased AI infrastructure strategy tailored to Canadian data residency needs; if partnerships land as signaled, expect more local compute capacity and tighter network integration for enterprise AI over the next 12–24 months.