Why Telefónica’s €77B Sustainable Infrastructure Investment Matters

A decade-long investment arc tied to the UN SDGs is reshaping Telefónica’s networks, cost structure, and market position across Europe and Latin America.

Scaling SDG 9: Resilient Connectivity and FTTH/4G Coverage

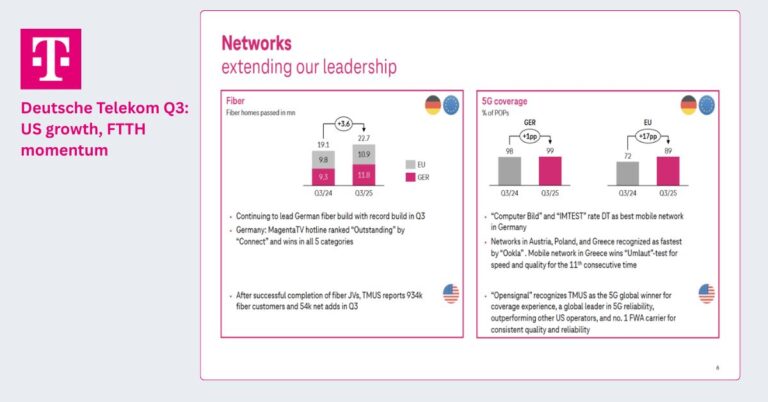

Telefónica reports €77 billion invested over ten years to expand sustainable, resilient connectivity, with SDG 9 (industry, innovation and infrastructure) as the strategic anchor. The operator now serves nearly 350 million accesses, has passed 81.4 million premises with FTTH, and runs one of the largest ultra-broadband footprints globally—second in scale only to China. Mobile broadband reaches 98% of the population with 4G in core markets, with extensive rural coverage such as around 95% in Spain, 99% in Germany, and 85% in Brazil. This network depth underpins nationwide cloud, edge, and IoT adoption and sets a platform for 5G-era services.

Spain’s Fiber-First FTTH Strategy and Copper Decommissioning

Spain is Telefónica’s showcase for fiber-led modernization. Dense FTTH has enabled a managed copper switch-off, which simplifies operations, cuts energy use, and improves service quality. For decision-makers, the takeaways are clear: fiber is now the default access for fixed convergence; it improves latency and reliability, accelerates SD-WAN and SASE rollouts, and lowers lifecycle emissions per bit versus legacy copper. Similar modernization patterns are emerging across Western Europe, with peers such as Orange, Deutsche Telekom, and Vodafone pursuing fiber densification and copper retirement at varying speeds.

Enterprise and Public Sector Impacts: Hybrid Work, AI, and Inclusion

Enterprises gain from broader, deeper access options for hybrid work, industrial automation, and AI workloads that need predictable throughput. Public agencies benefit as rural coverage and affordability measures raise digital inclusion, enabling e-health, tele-education, and smart agriculture. The investment also positions Telefónica for 5G Standalone, network slicing, and edge compute, which are critical for latency-sensitive use cases in manufacturing, utilities, and defense.

Inclusion, Skills, and Diversity Driving Sustainable Growth

Telefónica’s social programs and workforce shifts link access expansion to employability and leadership diversity.

Closing Digital Gaps with Large-Scale Skills Programs (SDG 4)

Beyond coverage metrics, the company is pushing adoption via training and education aligned to SDG 4. Fundación Telefónica initiatives reached about 1.16 million people in 2024, targeting employability skills that convert connectivity into economic outcomes. This demand-side activation is essential: network ROI accelerates when users and SMEs can apply digital tools to real problems, from logistics visibility to SMB e-commerce.

Diversity Gains in Leadership and Governance (SDG 5)

Telefónica reports women in executive roles rising from 19.1% in 2015 to 34% in 2025, aligning to SDG 5. For technology providers and systems integrators partnering with the operator, this shift often correlates with more balanced product roadmaps and governance on AI ethics and data privacy. It also strengthens eligibility for public tenders that include social value criteria.

Action Plan for Enterprises and Policymakers

Enterprises should press for adoption programs tied to connectivity projects—digital upskilling, device access, and local enablement—so investments translate into productivity. Governments and development banks can align rural coverage obligations with innovation funds and shared infrastructure models, including neutral host and open-access fiber, to improve economics and speed time-to-coverage.

Decarbonization and Energy-Efficient Network Economics

Telefónica’s climate plan links network modernization to energy intensity gains and a net-zero trajectory by 2040.

Net Zero 2040: 52% CO2 Cuts and 90% Energy-Intensity Gains

The operator targets net zero by 2040—ten years ahead of many international timelines—and reports a 52% reduction in CO2 emissions across the value chain from 2015 to 2024. Energy use per unit of traffic has fallen by about 90% in the same period, a meaningful feat given exponential data growth. The recipe is familiar but execution-heavy: fiber deepening, 4G/5G RAN modernization, data center consolidation, virtualization, and smarter cooling and power systems, increasingly managed with AI-driven operations.

Key Decarbonization Levers: Renewables, XGS-PON, 5G SA Efficiency

Expect increased renewable procurement via PPAs, continued copper decommissioning, and upgrade paths to XGS-PON for more bits per watt. In mobile, 5G Standalone features such as advanced sleep modes, carrier shutdown, and Massive MIMO optimization will be critical to flatten energy curves as traffic scales. Scope 3 remains the hard part; suppliers will face stricter design-for-circularity, repairability, and embodied carbon requirements, aligned with GSMA and ITU guidance and growing EU regulation.

Finance and Reporting: Green Capex, SLBs, and KPI-Linked SLAs

Green capex and sustainability-linked bonds will likely remain part of Telefónica’s funding mix, tied to verifiable KPIs on emissions, energy intensity, and circularity. Buyers should expect more granular emissions reporting embedded in SLAs, and vendors should anticipate contract clauses that link performance fees to energy and carbon outcomes.

Implications for Buyers, Partners, and Competing Operators

The network and ESG trajectory has direct purchasing, partnering, and competitive implications across the telecom value chain.

Guidance for Enterprise Connectivity and Edge Procurement

When sourcing connectivity, ask for energy and emissions transparency per service, green SLAs, and lifecycle assessments for CPE and on-prem edge. Evaluate FTTH reach for site consolidation, SD-WAN/SASE performance, and redundancy options that combine fiber and 5G for uptime. For edge workloads, confirm 5G SA readiness, coverage in target regions, and integration with major clouds for streamlined deployment and policy management.

Guidance for Vendors and Integrators on Energy and Scope 3

Align offerings to operator energy roadmaps—RAN and transport equipment with lower idle consumption, AI-based energy controllers, and circular hardware programs. Demonstrate credible Scope 3 plans validated by recognized frameworks to remain in preferred supplier tiers. Co-investment models in rural and industrial corridors, including shared backhaul and neutral-host small cells, can improve business cases while meeting policy goals.

Competitive Priorities: 5G SA, Network Slicing, Edge, and ESG Reporting

The bar is set on fiber density, rural coverage, and measurable decarbonization. Differentiation will hinge on 5G SA coverage pace, practical network slicing offers, edge locations tied to customer workloads, and the maturity of emissions reporting that CIOs can plug into corporate ESG systems.

Bottom Line

Telefónica’s decade-long SDG program pairs network scale with measurable social and climate outcomes, creating operating leverage for the 5G-to-edge era.

Outlook and Next Steps

With fiber-led modernization, broad 4G coverage, and a 2040 net-zero target, Telefónica has built a defensible platform for growth; the next phase will be judged on 5G SA commercialization, Scope 3 reductions, and how quickly inclusion and skills translate into higher digital adoption in the markets it serves.