Telecom Equipment Market Rebounds, per Dell’Oro

After two years of decline, telecom equipment spending is edging back into positive territory with early signs of a broad-based rebound.

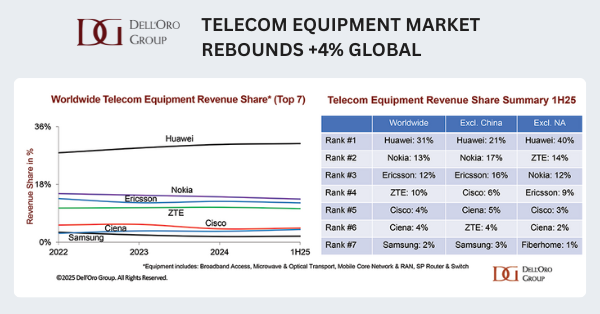

H1 2025: +4% Global, +8% ex‑China

Dell’Oro Group’s preliminary data indicates worldwide telecom equipment revenues across six tracked sectors rose 4% year over year in the first half of 2025, with markets outside China up a stronger 8%.

The scope covers broadband access, microwave transport, optical transport, mobile core networks, radio access networks (RAN), and service provider router and switch—effectively the operator stack from access through core and backbone.

Improved comparables, stabilizing inventories, and favorable currency movements underpinned the recovery, easing the overhang from elongated supply chains and uneven capex cycles in 2023–2024.

Growth Drivers: Core, Optical, IP Routing

The rebound was not limited to a single pocket of spend, but three areas led the gains: mobile core networks, optical transport, and service provider routers and switches.

This pattern aligns with operators advancing 5G Standalone (SA) and cloud-native core programs, scaling 400G/800G coherent optics in metro and backbone, and refreshing IP underlays for converged services, segment routing, and traffic engineering.

By contrast, RAN remains comparatively muted in many markets as 5G macro buildouts mature and operators prioritize utilization, software features, and energy efficiency over new greenfield sites.

Vendor Shifts: Huawei Up; Western RAN Under Pressure

Global supplier rankings stayed largely unchanged, but revenue shares shifted modestly.

Huawei gained ground, while Ericsson and Nokia saw slight declines versus 2024 levels, reflecting a mix of geographic exposure, product mix, and the relative strength of transport and core versus macro RAN.

In IP/optical and broadband access, competitive intensity remains high with tier-one vendors defending share through platform convergence, silicon transitions, and tighter software integration.

Why the Uptick Matters for 2025–2026

The return to growth clarifies where operators are actually placing near-term bets and how vendor roadmaps should recalibrate.

Normalization vs. Sustainable Demand

Inventory digestion and currency tailwinds are cyclical factors; they help in 1H25, but they are not strategies.

The key question for 2H25–2026 is whether demand tied to architectural shifts—cloud-native cores, transport modernization, and access upgrades—can offset softer RAN expansion and keep the growth line intact.

5G‑Advanced Prioritizes Core and Transport

As operators prepare for 3GPP Release 18 (5G-Advanced) features, many are investing first where flexibility and monetization potential are highest: the core and the transport/IP layers.

Core investments enable network slicing, MEC integration, and policy-driven QoS, while transport upgrades deliver the deterministic capacity and latency targets these services require.

Ex‑China Momentum Signals Balanced Demand

The stronger ex-China performance suggests more balanced contributions across regions, easing the sector’s recent dependence on a small set of large buildout markets.

For vendors, a broader demand base reduces concentration risk; for operators, it indicates peers are finding budget room for modernization even in constrained capex environments.

Segment Outlook for 2H 2025 and 2026

The spending mix offers clues on what will hold up next and where caution is warranted.

Broadband Access: Targeted PON Upgrades

Fixed access spend is shifting to targeted PON upgrades (XGS-PON and above), improved CPE mix, and operational automation rather than aggressive greenfield fiber overbuilds.

Fixed wireless access persists as a complement, but spectrum efficiency and backhaul constraints will limit outsized unit growth.

RAN: Optimization Over Expansion

Macrocells are in a digestion phase in many markets, with emphasis on software features, energy savings, massive MIMO optimization, and limited densification.

Private cellular and 5G SA expansions offer pockets of growth, but they are not yet large enough to swing the global RAN trajectory.

Optical/IP: 400/800G and Convergence Drive Spend

Metro/regional networks are absorbing 400G now and planning for 800G in high-density corridors, often with IP-over-DWDM to collapse layers and reduce power and footprint.

In IP, refresh cycles tied to 400GE line cards, SRv6, and network automation are supporting the router/switch uptick, particularly where operators are converging mobile, residential, and enterprise traffic.

Microwave Transport: Steady 5G Backhaul

Microwave remains a pragmatic choice for 5G backhaul and rural extensions, benefiting from spectrum refarming and higher-capacity radios, though overall growth is measured versus optical.

Strategy Priorities for Operators and Vendors

A modestly expanding market favors those aligning capex and product focus with the parts of the stack showing durable demand.

Operators: Shift Capex to Core/Transport; Pace RAN

Prioritize cloud-native core capabilities, security, and observability to prepare for 5G-Advanced features and enterprise SLAs.

Advance optical/IP modernization to cut cost per bit and enable converged services, while pacing RAN spend around utilization and TCO rather than coverage ambition.

Vendors: Convergence, Software Value, Open Integrations

Strengthen platform convergence across IP/optical and access, tie hardware transitions to measurable opex savings, and differentiate with lifecycle automation and assurance.

Partnerships and open interfaces remain essential to compete where multi-vendor cores, disaggregated optics, and cloud-native toolchains are becoming the norm.

Geopolitics: Manage Exposure and Compliance

Revenue concentration in restricted markets, export controls, and localization requirements will continue to shape share dynamics.

Maintaining supply chain resilience and multi-sourcing strategies is as much a differentiator as product performance.

Outlook: Modest Upgrade, Selective Momentum

The near-term forecast improves, but the ceiling is still low single digits, making execution and mix critical.

2025 Guidance: 2–3% Growth

Dell’Oro now expects global telecom equipment revenues across its six sectors to grow 2%–3% in 2025, a step up from a previously flat outlook.

Watch booking trends and lead times into Q4 as operators finalize 2026 budgets; durable strength in core, optical, and IP would validate a more sustained upcycle, even if RAN stays subdued.

What to Watch Next

Adoption timelines for 3GPP Release 18 features and 5G SA, the pace of 400/800G deployments in metro, and the cadence of public broadband programs will shape the spend mix in 2026.

Vendor share shifts—particularly around transport and core software—and new alliances across IP/optical ecosystems will indicate who is positioned to compound gains as the cycle turns.