India’s telecom and broadband sectors maintained steady momentum in FY2024–25, with new data from the Telecom Regulatory Authority of India (TRAI) painting a clear picture of digital expansion, revenue growth, and the challenges ahead.

India’s Internet Users Near 1 Billion in FY25

As of March 2025, India’s total internet subscriber base touched 969.10 million, up 1.54% from the previous year’s 954.40 million. A significant driver has been the shift from narrowband to high-speed broadband.

Of the total internet users, 944.12 million now use broadband connections — an annual increase of 2.17% — while narrowband users fell sharply by 17.66% to 24.98 million. This signals India’s push for better digital infrastructure, including faster 5G and Fixed Wireless Access (FWA) adoption.

Wireless Data and ARPU Growth Remain Strong

India’s appetite for mobile data is rising. Wireless data subscribers grew 2.87% to reach 939.51 million. The total wireless data traffic surged 17.46% year-on-year, hitting a new high of 2,28,779 PB.

Average Revenue Per User (ARPU) for wireless services rose from ₹149.25 to ₹174.46 per month — a robust 16.89% growth. Prepaid ARPU saw a notable jump to ₹173.84, while postpaid ARPU slipped slightly to ₹180.86.

The average Indian mobile user now consumes 21.53 GB per month, with revenue realization at ₹8.97 per GB, underscoring India’s global lead in affordable mobile data.

Average Call Minutes Grow Alongside Data Use

Voice remains relevant alongside data. Average Minutes of Usage (MoUs) per subscriber per month increased from 963 to 1,000, a growth of 3.91%. Prepaid MoUs rose to 1,047 minutes per month, while postpaid MoUs fell to 503 — hinting at growing adoption of OTT calls and messaging apps.

Urban vs Rural: India’s Twin Connectivity Story

The total telephone subscriber base in India nudged up slightly by 0.13% to 1,200.80 million. Urban subscribers accounted for 666.11 million connections, while rural connections stood at 534.69 million.

Urban tele-density dipped to 131.45%, down from 133.72% a year earlier. Rural tele-density too saw a slight fall, landing at 59.06%. Despite the drop, rural subscribers continue to make up about 44.53% of India’s total telecom base.

Some states outperform national averages. Himachal Pradesh, for example, leads rural tele-density with 86.96%, while Odisha registered the highest growth in subscriber base at 4.24%.

India’s Wireline Broadband Grows Strong in FY25

India’s wireline segment showed healthy growth — a 9.62% jump, pushing the wireline base to 37.04 million. This points to stronger fiber broadband adoption in homes and enterprises. Urban wireline tele-density rose to 6.62%, while rural wireline tele-density inched up to 0.39%.

Market Leaders: Jio and Airtel Dominate

Among private operators, Reliance Jio and Bharti Airtel continued to expand market share, adding 6.43 million and 6.60 million subscribers, respectively. In contrast, Vodafone Idea lost 14.41 million subscribers, reflecting its ongoing churn challenges.

Public sector operator BSNL added 4 million users, and wireline-focused MTNL saw a decline.

Private players now hold 91.47% of India’s telecom market, while public sector units hold 8.53%.

Revenue, Spectrum Fees, and Policy Metrics

The industry’s financial performance remains strong:

- Gross Revenue (GR) rose 10.72% to ₹3.72 lakh crore.

- Adjusted Gross Revenue (AGR) jumped 12.02% to ₹3.03 lakh crore.

- Spectrum Usage Charges (SUC) climbed by 13.02% to ₹3,807 crore.

- License fees increased by 12.02% to ₹24,242 crore.

Access services accounted for 83.65% of AGR — a testament to the revenue importance of wireless and 5G FWA.

Media & Broadcasting: DTH Shrinks, Radio Grows

The satellite TV and DTH sector showed mixed trends. India has 918 permitted private satellite channels, with 333 pay-TV channels (232 SD and 101 HD). Pay DTH subscriber numbers fell by 5 million to 56.92 million, confirming a clear shift towards OTT streaming.

Conversely, FM radio stations grew to 388 across 113 cities, operated by 33 private players. Community radio is expanding too, from 494 to 531 stations, playing a vital role in local content delivery.

Future Outlook for India’s Telecom & Internet Growth

The 2024–25 TRAI report confirms a sector adapting to new consumption patterns. While voice calls are still widely used, data drives growth. The shift from narrowband to broadband, the rising popularity of wireline, and steady 5G deployment highlight India’s digital ambitions.

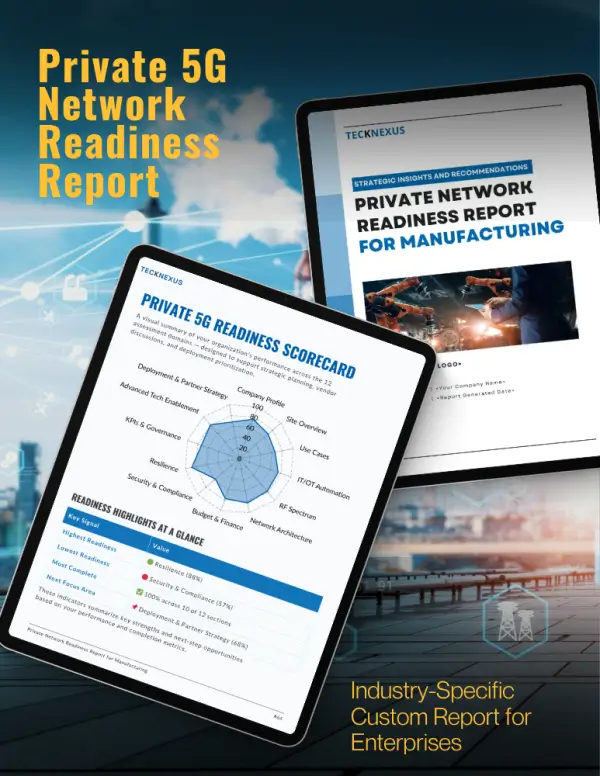

Yet, challenges persist: urban and rural tele-density have slightly declined, and subscriber churn remains high for some operators. The industry must innovate to tackle these headwinds — from deploying Open RAN and Private Networks to leveraging AI for network automation and assurance.

As India’s digital economy expands, its telecom backbone — the world’s second largest — remains vital to driving inclusion, connectivity, and growth for over a billion people.

For detailed charts, maps, and the full performance report, visit the TRAI official site.