Apple’s $1B Google Gemini deal: Siri’s AI pivot

Apple is reportedly nearing a deal to license Google’s Gemini for Siri, a move that would reshape assistant architectures and near-term AI roadmaps across devices and networks.

Deal terms: $1B/year, 1.2T‑parameter Gemini for Siri

Multiple reports indicate Apple is close to licensing a custom version of Google’s Gemini model, reportedly at a scale of around 1.2 trillion parameters, for roughly $1 billion per year. The model would power a major Siri upgrade while Apple continues building its own foundation models. Neither company has confirmed the arrangement, and sources suggest the agreement is separate from Apple’s default search deal and from any plan to embed a Google chatbot into Siri. The objective is clear: boost Siri’s reasoning and task execution in the near term without ceding control over Apple’s system-level integrations or search defaults.

Why Google Gemini now: scale, multimodality, production

Siri has trailed Google Assistant and Amazon Alexa in handling complex, multi-step requests and third‑party workflows. With rivals rolling out assistants powered by large multimodal models—Google with Gemini and Amazon with its new Alexa LLM—Apple needs a step change, not an iteration. Reports say Apple evaluated OpenAI and Anthropic before favoring Gemini’s scale, multimodal strengths, and production footprint. The deal would be a bridge: bring stronger reasoning and generative capabilities to Siri now, while Apple matures its own models for tighter on-device integration and privacy controls.

Timeline and org shifts toward a 2026 Siri upgrade

Apple previously signaled that major Siri enhancements would slip into 2026. Leadership changes around Siri and AI, including a shift in operational oversight, underscore urgency to close the capability gap. A spring 2026 launch window for an upgraded Siri is being floated, though timelines and scope could change as integration and testing proceed.

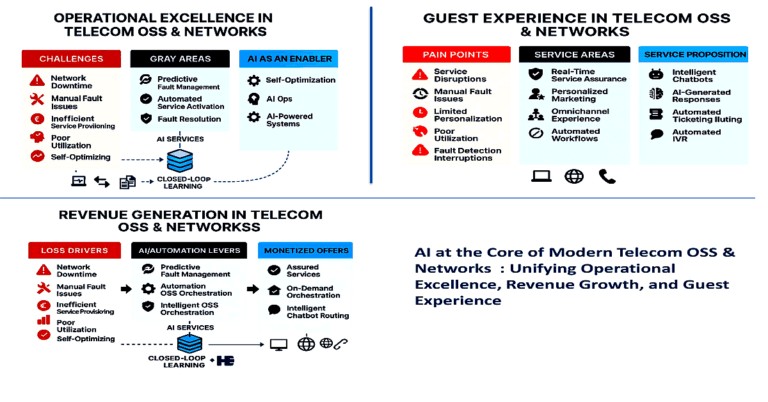

Impact on telecom, 5G networks, and enterprise IT

A more capable, multimodal Siri alters traffic patterns, edge priorities, and application design across 5G, Wi‑Fi, and enterprise networks.

Assistants as autonomous enterprise agents

Voice assistants are moving from command-and-control to autonomous agents that plan, call APIs, and orchestrate workflows. If Gemini augments Siri’s reasoning, expect deeper links to notifications, calendaring, documents, and third‑party services. For enterprises, that means new entry points for employee productivity, customer support, and field service. For carriers, it opens service bundling around device management, voice, and AI assistance for SMB and enterprise accounts, competing with Microsoft Copilot, Google Workspace, and Amazon’s Alexa for Business.

Network and edge: latency, bandwidth, and inference placement

A Gemini-assisted Siri will likely adopt a hybrid architecture: on-device for simple tasks, cloud inference for harder, multimodal queries. That split drives two actions for network leaders. First, prepare for jitter‑sensitive, bursty upstream flows when users issue voice or image queries; QoS and peering with Google infrastructure grow more consequential. Second, invest in edge strategies where it makes sense. ETSI MEC and 3GPP capabilities such as edge discovery, traffic steering, and NWDAF-driven analytics can help route requests to nearer inference endpoints to control latency and egress costs. Carriers can also tap GSMA Open Gateway APIs to expose QoS-on-demand and slice-like guarantees to app providers that want consistent assistant experiences.

Privacy, compliance, and data residency pressures

Apple’s brand rests on privacy and on-device processing, while frontier models still lean on cloud inference. Expect Apple to gate sensitive workloads and keep default data minimization intact. Even so, enterprises in regulated industries will scrutinize data flows, retention, and residency. CIOs should ask for clear policy controls, per‑app entitlements, and auditability, and should push for on-device or on‑prem variants for sensitive use cases when feasible. For global deployments, data localization and DPIA/impact assessments remain table stakes.

Competitive shifts across Apple, Google, Microsoft, Amazon

The reported arrangement would reshape platform dynamics and raise new questions for developers, regulators, and partners.

Platform power and economics of the AI stack

If finalized, this would be a rare reversal of the usual Apple–Google economics: Apple reportedly paying Google for core AI capabilities even as it still receives large payments for default search placement. It also sharpens contrasts across ecosystems: Samsung leans on Gemini for Galaxy AI, Microsoft builds around OpenAI for Copilot, and Amazon pushes its Alexa LLM. The result is a de facto multicloud, multimodel reality for app builders who must design for differing capabilities, rate limits, and privacy postures across platforms.

Regulatory and antitrust watchpoints for AI assistants

Any deep tie-up between two platform giants will draw scrutiny. Regulators will probe whether model access confers unfair advantage, whether defaults steer usage, and how data is shared. Even if search remains separate, authorities will ask if combined agreements entrench positions in assistants, app distribution, and advertising. Clear separation of concerns, transparent policies, and user controls will be critical to avoid regulatory drag.

Developer and ISV implications: APIs, intents, multimodality

If Siri’s capabilities jump, expect updates to SiriKit, App Intents, and conversational APIs to enable richer task delegation. Multimodality will matter: images, screenshots, and context windows can lift completion rates for complex tasks. ISVs should plan for intent taxonomies, robust schema design, and fallbacks across models. Watch WWDC for SDKs that expose planning, tool use, and enterprise-grade controls. Also monitor how Apple handles usage-based billing or quotas for agentic features that tap cloud inference.

What businesses should do now to prepare

Teams should prepare for hybrid on-device and cloud AI scenarios, balancing experience, cost, and governance.

Actions for operators and OEMs

Reassess peering and interconnect with Google to manage assistant traffic and minimize latency. Map assistant-heavy geographies and place compute or caching accordingly via MEC. Expose network APIs for assurance to app ecosystems that need deterministic performance. Bundle assistant-enabled plans for enterprise verticals, with device management, identity, and policy controls integrated.

Actions for enterprises and app providers

Identify top workflows where a smarter Siri can reduce friction: scheduling, approvals, CRM updates, knowledge retrieval, and field documentation. Build against intent and tool-call patterns so your app can be “agent-ready” across Apple, Microsoft, and Google stacks. Establish guardrails: red teaming, PII handling, and prompt risk assessments. Prepare for usage-based cost models tied to token volumes and multimodal content.

Metrics and milestones to watch through 2026

Track Apple’s formal announcement, the degree of on-device versus cloud split, and any enterprise controls for data residency. Watch for SDK updates that expose planning and tool use to third parties. Monitor performance SLAs, quality benchmarks on complex tasks, and how Apple prices or throttles assistant features. These signals will determine integration depth, network impact, and total cost of ownership in 2026 rollouts.

Bottom line: a Gemini-powered Siri would be a pragmatic bridge that accelerates Apple’s assistant roadmap, and it will ripple across networks, devices, and enterprise stacks—rewarding teams that design for hybrid AI, predictable performance, and strict governance from day one.