Insight Research, is pleased to announce the launch of its latest report, “AI and RAN – How Fast Will They Run?”. The report delves into the intersection of Artificial Intelligence (AI) and Radio Access Network (RAN), shedding light on their evolving relationship and forecasting their future trajectories. In recent years, AI has emerged as a pivotal force driving innovation across industries. The telecom sector, in particular, has witnessed a transformative impact with the integration of AI into RAN architecture. The report explores this synergy, uncovering the dynamics behind their convergence and the implications for the telecommunication landscape.

“At Insight Research, we recognize the seismic shifts occurring within the telecommunications industry, and our latest report elucidates the symbiotic relationship between AI and RAN,” remarked Kaustubha Parkhi, Principal Analyst at Insight Research. “We’re witnessing a paradigm shift in RAN architecture, with AI playing a pivotal role in driving efficiency, agility, and performance.”

Key Insights from the Report:

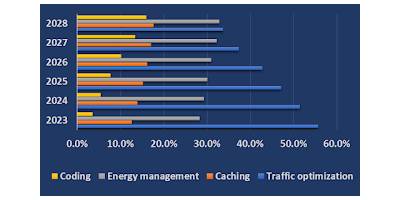

- End-Applications for AI in RAN: The report identifies key end-applications for AI in RAN, including traffic optimization, caching, energy management, and coding, showcasing the diverse potential of AI integration within telecommunications infrastructure.

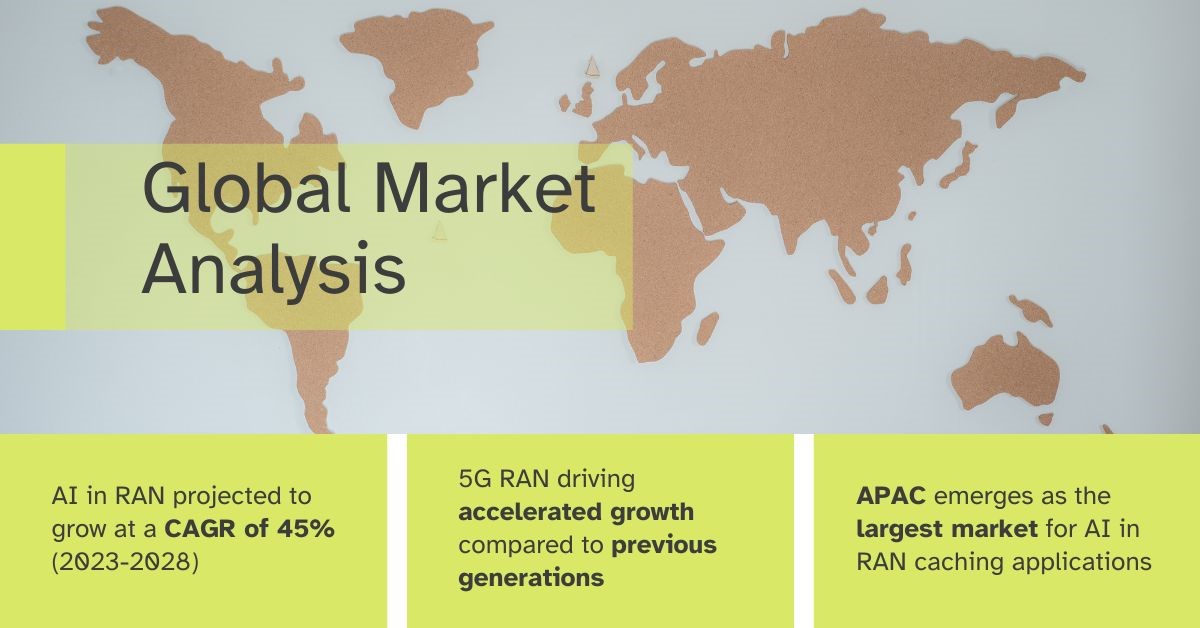

- Market Dynamics: Insight Research forecasts a remarkable compounded annual growth rate (CAGR) of 45% in the addressable market size of AI use-cases within RAN from 2023 to 2028, indicating significant growth opportunities within the sector.

Excerpted from our report AI and RAN – How fast will they run? Figure charts the progression of the revenue shares of the key end-applications for AI in the RAN.

- Vendor Landscape Analysis: The report comprehensively analyzes key vendors and their solutions related to AI in the RAN, uncovering the seminal impact that AI is engineering on the RAN vendor landscape. Notable vendors profiled in the report include Aira, Cisco, Ericsson, Huawei, Qualcomm, and more.

- Telco Initiatives: Additionally, the report details the approaches and initiatives of leading telcos in the context of AI in the RAN. Telcos such as AT&T, Bharti Airtel, China Mobile, Deutsche Telekom, Verizon, and Vodafone are among those profiled in the report. It chronicles the telco initiatives and their outcomes, highlighting the gradual induction of AI in RAN architecture and the pivotal role played by telcos in championing initiatives such as NFV. The RIC through the O-RAN initiative has been a major step in advancing AI integration within RAN architecture.

- Quantitative Forecast Taxonomy: The report breaks down the market for each end-application along two criteria: mobility generation and geographical regions. It considers two mobility generations, 5G and others, and four geographical regions: NA, EMEA, APAC, and CALA.

|

|

With a meticulous breakdown of the market by application, region, and telephony generations, the report offers unparalleled quantitative insights, empowering stakeholders to make informed decisions in a rapidly evolving landscape.

Of all the announcements at MWC24, the one that validates our focus on AI in RAN is the formation of the AI-RAN Alliance. Coinciding with the release of our report “AI and RAN – How fast can they run?”, the Alliance checks all the boxes to furthering AI from the periphery of the RAN to its very core.

Insight Research’s “AI and RAN – How Fast Will They Run?” report is essential reading for telecom operators, technology providers, policymakers, and investors seeking to navigate the evolving landscape of AI-driven telecommunications infrastructure.

Report is available in three formats:

- Single User Licence

- 6-Seat Licence

- Unlimited Corporate Licence

For further information and to purchase the full report, visit https://www.insight-corp.com/product/ai-and-ran-how-fast-will-they-run/.