Expanding 5G Coverage Beyond Cities

By 2023, the major U.S. wireless providers had achieved much of their 5G coverage and capacity goals in urban and suburban markets. With subscriber growth slowing in these areas, operators have shifted their focus to rural expansion.

Each provider is taking a different approach to deploying 5G in less populated regions, largely influenced by their spectrum holdings—particularly mid-band spectrum.

Key Insights

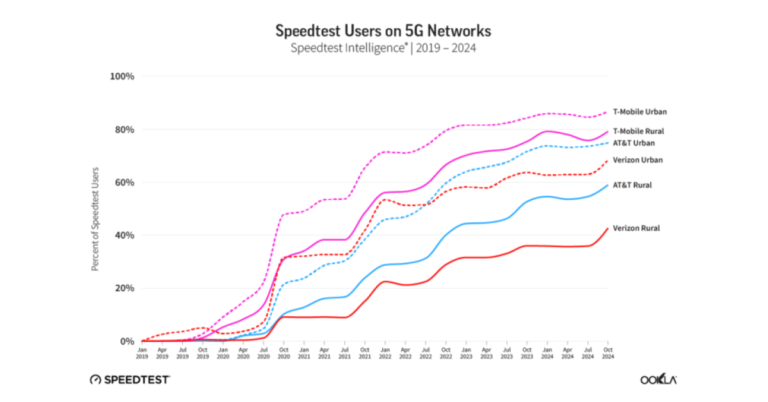

- T-Mobile leads in 5G availability, with the highest percentage of users spending most of their time on its network in both urban and rural areas.

- Nevada and Illinois rank in the top 10 for 5G availability from T-Mobile, AT&T, and Verizon, indicating a strong focus on these states.

- Wyoming has the lowest rural 5G availability for all three providers, which aligns with its ranking as the second-least densely populated U.S. state.

This analysis is based on Ookla®’s 5G Availability metric, which measures how often users with 5G-capable devices connect to 5G networks. It reflects network coverage as well as provider policies on prioritizing 5G versus LTE connections.

T-Mobile’s Rural 5G Growth: Market Share & Coverage Goals

T-Mobile has been aggressive in targeting rural markets. In 2021, the company set a goal to expand its market share in small towns and rural areas from 13% to 20% by 2025 and committed to covering 90% of the rural U.S. population by 2026.

Speedtest® data from 2019 to 2024 shows T-Mobile’s significant lead in urban and rural 5G availability compared to AT&T and Verizon. The U.S. Census Bureau’s urban-rural classifications were used to differentiate urban and rural areas.

T-Mobile’s 5G Strategy: Low-Band, Mid-Band & New Acquisitions

- Low-Band 600 MHz (Extended Range 5G): Deployed in 2019, covering 98% of the U.S. by 2024.

- Mid-Band 2.5 GHz (Ultra Capacity 5G): Gained through Sprint’s acquisition in 2020, now covering over 300 million people.

- Recent Expansion: In May 2024, T-Mobile announced a $4.4 billion acquisition of U.S. Cellular’s customers, retail stores, and approximately 30% of its spectrum holdings, further strengthening its rural presence.

Top States for T-Mobile’s 5G Availability (Q4 2024):

Rural:

- Florida – 83.58%

- Connecticut – 80.62%

- Illinois – 80.49%

- Delaware – 80.39%

- Georgia – 80.18%

Urban:

- Illinois – 91.86%

- Nevada – 91.78%

- Oklahoma – 91.77%

- Florida – 91.57%

- North Dakota – 91.30%

AT&T FirstNet 5G: Expanding Coverage for First Responders

AT&T has expanded 5G in rural areas primarily through FirstNet, a dedicated public safety network for first responders operating on Band 14 (700 MHz spectrum).

AT&T’s 5G Expansion: FirstNet & Mid-Band Investments

- FirstNet Contract: Awarded in 2017, requiring AT&T to expand coverage to remote areas.

- 5G Upgrade: In 2021, AT&T upgraded FirstNet to support 5G.

- Continued Investment: In 2024, the FirstNet Authority committed $8 billion over 10 years to enhance coverage.

Beyond FirstNet, AT&T has expanded 5G using low-band and mid-band spectrum, spending approximately $37 billion on C-band and 3.45 GHz spectrum.

Top States for AT&T’s 5G Availability (Q4 2024):

Rural:

- Texas – 78.17%

- Florida – 75.24%

- Alabama – 74.77%

- Louisiana – 74.76%

- California – 72.81%

Urban:

- California – 92.47%

- Florida – 91.1%

- Nevada – 90.92%

- Texas – 89.91%

- Louisiana – 89.45%

Verizon’s 5G Strategy: C-Band Spectrum & Rural Expansion

Verizon faced challenges in rural 5G expansion due to a lack of low-band spectrum. Initially, the company used Dynamic Spectrum Sharing (DSS) to run 5G and LTE on the same bands, but the performance gains were minimal.

Verizon’s Rural 5G Buildout: Spectrum Auctions & Acquisitions

- C-Band Spectrum: Acquired 161 MHz of mid-band spectrum in a $52 billion auction in 2021, now forming the core of its 5G expansion.

- Acquisitions for Rural Coverage: Purchased smaller regional operators, including Bluegrass Cellular, Chat Mobility, and Triangle Mobile, improving LTE coverage but with limited immediate impact on 5G.

- Ongoing Expansion: In October 2024, Verizon announced plans to spend $1 billion acquiring additional 850 MHz, AWS, and PCS spectrum from U.S. Cellular.

Top States for Verizon’s 5G Availability (Q4 2024):

Rural:

- Ohio – 56.07%

- Arkansas – 44.51%

- Texas – 43.09%

- New Jersey – 41.8%

- Delaware – 40.56%

Urban:

- Ohio – 73.86%

- California – 67.76%

- Nebraska – 67.45%

- Arkansas – 66.26%

- Arizona – 66.01%

Why Wyoming Has the Lowest 5G Coverage in the U.S.

Wyoming has the lowest 5G availability among all states, largely due to its low population density. Covering nearly 98,000 square miles but home to fewer than 600,000 people, Wyoming presents a challenge for network operators.

Rural 5G Availability in Wyoming (Q4 2024):

- T-Mobile: 59.29%

- AT&T: 29.73%

- Verizon: 9.8%

5G Hotspots: Why Nevada & Illinois Lead in Availability

In contrast, Nevada and Illinois have benefited from concentrated 5G investments due to major urban centers like Las Vegas and Chicago.

Why Las Vegas and Chicago Lead in 5G

- Las Vegas: Hosts major events, driving T-Mobile, AT&T, and Verizon to prioritize coverage.

- Chicago: A key market for AT&T’s mid-band 5G and Verizon’s C-band deployment.

Urban 5G Availability in Nevada (Q4 2024):

- T-Mobile: 91.86%

- AT&T: 90.92%

- Verizon: 63.38%

Urban 5G Availability in Illinois (Q4 2024):

- T-Mobile: 91.78%

- AT&T: 85.27%

- Verizon: 62.5%

The Future of Rural 5G: FCC Funding & Network Growth

The FCC’s 5G Fund for Rural America aims to expand 5G access to underserved areas with $9 billion in funding. This initiative will target more than 14 million rural homes and businesses through a reverse auction process.

As operators continue investing in mid-band spectrum, rural infrastructure, and government partnerships, 5G availability is expected to improve nationwide.

We will continue monitoring 5G coverage trends and tracking operator expansions.