Rural Broadband Competition Tightens

New performance data shows U.S. WISPs are getting faster, but low‑Earth orbit players like Starlink are advancing just as quickly—and the competitive gap in rural markets is narrowing.

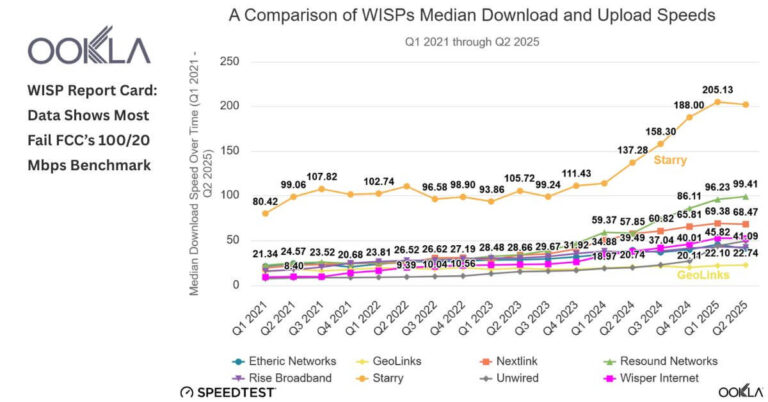

Ookla WISP Speed Results 2021–2025

Based on Speedtest Intelligence data from Q1 2021 to Q2 2025, eight of the larger WISPs—Starry, Resound Networks, Nextlink, Wisper Internet, Unwired Broadband, GeoLinks, Etheric Networks, and Rise Broadband—improved speeds, with download gains outpacing uploads. Starry led by a wide margin with a 202 Mbps median download in Q2 2025, followed by Resound at 99 Mbps and Nextlink at 68 Mbps; GeoLinks trailed at 23 Mbps. Crucially, only a minority of WISP users consistently achieve the FCC’s 100/20 Mbps fixed broadband benchmark: Starry delivered it to roughly two‑thirds of tested users, while most peers fell well short, with several in the single or low‑double digits. The picture is improving, but uneven.

Why It Matters Now

Policy and market forces are reshaping competition. NTIA’s technology‑neutral BEAD guidance pushes states to prioritize cost per location, shifting awards from a fiber‑first stance to a mixed toolkit where FWA and LEO satellites can compete. Early state tallies indicate meaningful slices for both WISPs and satellites. Meanwhile, the FCC is tuning satellite spectrum rules, SpaceX’s Starlink has doubled median download speeds to about 105 Mbps as of early 2025, and Amazon’s Kuiper is approaching commercial service. Expect intensified rivalry for hard‑to‑reach households and MDUs at the edge of cable and telco footprints.

What’s Driving WISP Performance Gaps

Performance deltas among WISPs reflect spectrum portfolios, radio choices, network design, and target segments.

Spectrum Strategy Drives Performance

Most WISPs blend licensed and unlicensed bands, often combining 5 GHz and 6 GHz unlicensed with CBRS at 3.5 GHz. Providers with cleaner, licensed spectrum or well‑managed CBRS PALs generally achieve steadier throughput than those leaning on congested unlicensed lanes. The SAS‑managed CBRS framework helps, but users in the GAA tier must accept interference. WISPA is urging the FCC to preserve broad GAA access as Congress pressures the agency to identify auctionable mid‑band spectrum. Any curtailment would raise costs and risk service degradation across rural footprints.

Network Architecture and Equipment Impacts

Starry’s mmWave‑centric, MDU‑focused design and proprietary radio platform underpin its lead, but mmWave alone is not a silver bullet; performance depends on deployment density, line‑of‑sight, and interference mitigation. Mid‑band FWA paired with new-generation radios—such as multi‑beam systems from vendors like Tarana—has lifted speeds notably at operators including Resound and Wisper. Backhaul also differentiates outcomes: fiber‑fed towers and optimized middle‑mile reduce contention and stabilize uploads.

Market Focus and Economics

Serving MDUs in dense metros (Starry, now being acquired by Verizon) enables higher spectral reuse, simpler installation, and stronger unit economics than sparse rural builds. Rural specialists (Rise Broadband, Nextlink, Unwired, GeoLinks, Etheric, Wisper) balance broader coverage against interference and distance constraints, which can depress median speeds unless networks are densified and spectrum holdings improve.

LEO Satellites Raise the Rural Bar

Satellite broadband is no longer just a last‑resort option; it is a credible competitor for many rural and exurban households.

Starlink Speed Gains and Pricing Pressure

Starlink’s median download speeds have roughly doubled since 2022, reaching about 105 Mbps in Q1 2025, and the company is discounting equipment while testing lower‑priced service tiers (alongside a well‑known $80 residential plan). As Kuiper enters the market, price/performance pressure on WISPs will grow, particularly in low‑density areas where trenching fiber or densifying FWA is costlier. Latency remains a WISP advantage in many cases, but that edge narrows as satellite constellations scale and ground segment improves.

WISP Bottlenecks and Constraints

Unlicensed band congestion, rising interference, and limited access to licensed mid‑band—all while customer expectations trend toward symmetrical‑feeling experiences—are the structural headwinds. mmWave brings capacity but requires careful siting and LOS, and it struggles with foliage and obstructions. Without capital for spectrum, backhaul, and tower densification, WISPs risk ceding high‑ARPU segments to LEO or cable where available.

Actions for WISPs, Satellites, and Policymakers

To stay competitive through the BEAD window and beyond, WISPs and their partners must tune spectrum, architecture, economics, and go‑to‑market in concert.

Playbook for WISPs and Regional ISPs

Prioritize spectrum resilience: acquire or lease CBRS PALs where economics pencil, lock in 2.5 GHz leases where available, and plan for standard‑power 6 GHz with AFC as devices mature. Densify selectively and fiberize backhaul at bottleneck sites to lift uploads and consistency. Adopt next‑gen FWA platforms that improve interference rejection and spectral efficiency. Segment product tiers by QoS and latency, not just peak rate, and aim to push a majority of subs above 100/20 Mbps to remain BEAD‑eligible and defend against LEO churn. In MDUs, accelerate rooftop and riser rights, leveraging Verizon‑Starry’s playbook as a signal of where the market is headed.

Guidance for Satellite Providers

Target geographies where WISPs remain below the 100/20 threshold, bundle business‑grade SLAs for SOHO and agri‑enterprise, and explore wholesale agreements with WISPs for hybrid access or failover. Keep equipment subsidies sharp; upfront CPE costs remain a friction point versus FWA self‑install kits.

Recommendations for Policymakers and Funders

Maintain technology neutrality while enforcing measurable, verified performance (including latency and reliability) post‑award. Preserve CBRS GAA capacity that underpins many rural footprints, and streamline siting and rights‑of‑way to accelerate tower densification and fiber backhaul essential to durable FWA upgrades.

2026 Watchlist: Policy, Industry, KPIs

Several market and policy milestones will determine whether WISPs hold ground against LEO in rural America.

Regulatory and Funding Milestones

Outcomes of FCC satellite spectrum proceedings, any CBRS band changes, and the pace of BEAD contract execution will shape capital allocation and technology choices. Watch how states measure compliance with the 100/20 benchmark and whether enforcement tightens.

Industry Moves and Consolidation

Monitor Verizon’s integration of Starry for signals on MDU FWA strategy, additional WISP roll‑ups, and how RDOF and BEAD builds alter competitive overlap with cable and telco fiber. Expect more spectrum leasing arrangements as operators seek capacity without large auctions.

KPIs That Matter

Track the share of subscribers consistently above 100/20, median upload progress, latency under load, evening peak stability, and churn where Starlink markets intensify. The operators that lift these metrics fastest will set the pace in the next phase of rural broadband competition.