NBTC’s free 4.8 GHz plan for private 5G

Thailand’s regulator is preparing a targeted spectrum policy to accelerate industrial private 5G without subsidizing consumer mobile services.

Free 100 MHz at 4.8 GHz for factory 5G

Thailand’s National Broadcasting and Telecommunications Commission (NBTC) plans to allocate 100 MHz in the 4.8 GHz range to factories and industrial estate operators to deploy non-public 5G networks under a private network operator (PNO) framework. The spectrum is to be granted on request and used solely for internal, non-commercial operations, whether applicants deploy themselves or partner with vendors and service providers. Enterprises that wish to deliver external services on this band would shift into a commercial regime, potentially requiring participation in a future auction.

Guardrails to keep spectrum non-public

Mobile operators may bid for PNO rights but cannot use this spectrum for public mobile service, nor can they extend or roam it with existing 2.6 GHz (2600 MHz) 5G networks. The guardrails are designed to prevent capacity offload for mass-market traffic and to focus the band on industrial digitalization use cases that benefit from dedicated resources, deterministic performance, and local control.

Why Thailand needs private 5G now

The policy directly targets Thailand’s lag in enterprise-grade 5G adoption and aligns spectrum with operational technology priorities.

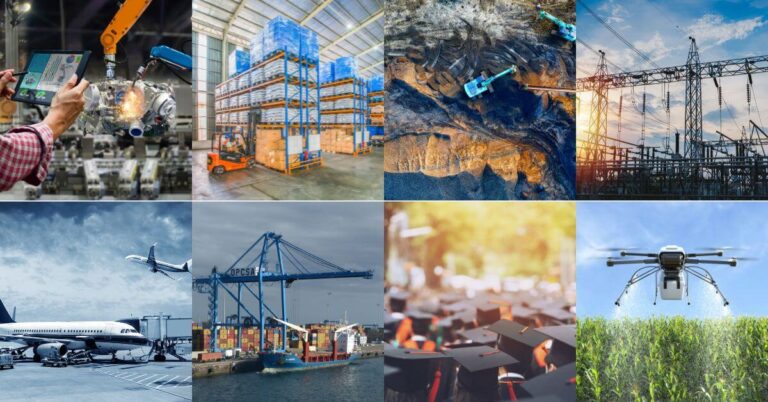

Accelerating enterprise private 5G uptake

Despite nationwide 5G on 2.6 GHz, industrial uptake has been modest, constrained by limited use cases on public networks, integration complexity, and cost. A free, dedicated band reduces barriers to proof-of-value, allowing factories to pilot and scale digital twins, machine vision, automated guided vehicles, and worker safety solutions with local control over coverage, QoS, and security. It also catalyzes a market for neutral host and specialist PNOs that can package integration, managed services, and SLAs tuned to operational environments rather than consumer mobility.

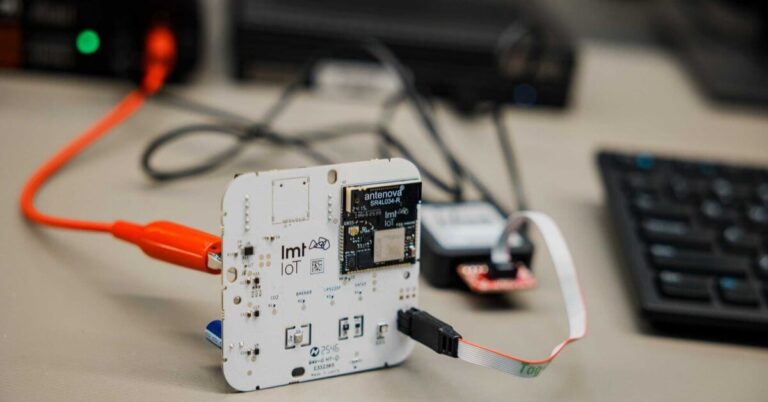

n79 device ecosystem benefits

The 4.8 GHz range sits within 3GPP Band n79 (4.4–5.0 GHz), a band widely used in parts of Asia, notably China and Japan, which means a relatively deep device and radio ecosystem. This matters for Thailand’s factories: broader availability of n79 small cells, CPE, industrial routers, and modules can lower total cost of ownership, accelerate time-to-deploy, and improve multi-vendor choice compared to more niche bands.

Spectrum backdrop and 4.8 GHz rationale

The 4.8 GHz policy also reflects Thailand’s complications with reallocating the popular 3.5 GHz mid-band for 5G.

3.5 GHz constraints from broadcast incumbents

Globally, 3.5 GHz has emerged as prime mid-band 5G spectrum, but Thailand faces ongoing coexistence pressures from legacy satellite TV and broadcasting users in the 3.5–3.8 GHz range. While NBTC has discussed future auctions, timing and scope remain uncertain. Opening 4.8 GHz for industrial campuses offers a near-term alternative to spur enterprise 5G without waiting for broader C-band clearance.

Why 4.8–4.9 GHz fits industrial campuses

At 4.8–4.9 GHz, propagation is somewhat shorter than 3.5 GHz but still favorable for dense indoor and campus deployments with TDD configurations and contiguous 80–100 MHz channels for enhanced uplink and deterministic scheduling. For most factory footprints, radio density is manageable, especially with 5G Standalone (SA) and Release 16/17 features like improved uplink, positioning, and time synchronization supporting demanding automation and quality control workloads.

Global private 5G spectrum playbooks

Thailand’s approach echoes successful models that carved out local spectrum to accelerate Industry 4.0.

Lessons from Germany, UK, Japan, and US

Germany’s 3.7–3.8 GHz local licenses, the UK’s shared access at 3.8–4.2 GHz, Japan’s 4.6–4.9 GHz local 5G, and the US CBRS framework have validated that dedicated or lightly licensed spectrum for enterprises drives uptake. Key success factors include streamlined licensing portals, clear interference coordination rules, indoor-first power limits, and an ecosystem program spanning testbeds, device certification, and systems integrator enablement.

How Thailand can tailor the model

NBTC can amplify impact by publishing channelization and power masks tuned to factories, creating a transparent database for local coordination, and partnering with industry bodies such as 5G-ACIA to align on reference architectures. Defaulting to 5G SA cores, defining quality KPIs, and offering guidance for public network integrated non-public networks (PNI-NPN) will help balance local control with backhaul and roaming needs across multi-site estates.

What this means for industry players

The policy shifts how spectrum, integration, and accountability for industrial outcomes will be procured and delivered.

Guidance for factories and estates

This is an opportunity to build campus-grade connectivity tied to production KPIs. Prepare by mapping priority use cases to 5G requirements (uplink-heavy video, latency-sensitive motion control, safety-critical interlocks), validating device support for n79, and deciding on operating model: DIY NPN, managed PNO, or operator-led solutions under PNO terms. Estates can offer multi-tenant private 5G with per-tenant slicing, shared indoor RAN, and edge compute for analytics while maintaining data sovereignty under Thailand’s PDPA.

Guidance for MNOs and specialist PNOs

Incumbent MNOs must shift from macro capacity mindsets to outcome-based industrial services: private 5G as-a-service, lifecycle SLAs, and OT-aware integration. The prohibition on roaming to 2.6 GHz necessitates dedicated RAN and core footprints for this band, but it enables differentiated offers such as neutral host in estates, deterministic QoS profiles for AGVs, and integration with MES/SCADA. Specialist PNOs can carve niches in vertical-specific stacks—e.g., vision QA, predictive maintenance—bundled with 5G connectivity and edge AI.

Guidance for vendors and systems integrators

Bring a ready n79 portfolio: indoor small cells, outdoor micro sites for yards, 5G SA cores (cloud-native), and certified industrial devices. Emphasize Release 16/17 features—URLLC, TSN integration, advanced positioning—and offer blueprints for OT/IT convergence, cybersecurity hardening, and high-availability designs aligned to IEC 62443 and 3GPP security baselines.

Deployment and design best practices

Execution quality will determine whether free spectrum translates into predictable, safe, and scalable industrial networks.

Architecture: 5G SA, URLLC/TSN, and edge

Prioritize 5G SA with a local or on-premises UPF to keep time-sensitive traffic on-campus, and use MEC for video analytics and closed-loop control. Where motion control is in scope, plan for TSN interoperability and deterministic profiles, noting current URLLC maturity and vendor support. For multi-plant enterprises, consider a hub-and-spoke NPN with centralized control plane and localized user planes to balance latency and operations overhead.

RF coordination and zero-trust security

Design RF with clear indoor/outdoor segmentation, coordinated TDD frame configs, and synchronization to minimize inter-cell interference across dense machinery. Implement zero-trust segmentation, SIM/eSIM/eUICC lifecycle controls for OT devices, and continuous monitoring. Validate coexistence with nearby 5 GHz systems and align with any NBTC coordination database to avoid adjacent channel conflicts.

Next steps, timelines, and success metrics

Clarity on mechanics and ecosystem readiness will shape investment pacing through 2026.

Licensing, application, and timing

Enterprises should track application procedures, spectrum blocks, site limits, and compliance obligations, including reporting, coverage footprints, and potential renewal conditions. Any future auction criteria for customer-serving PNOs will influence go-to-market models.

Device certification and n79 readiness

Monitor the availability of n79-capable industrial devices, module certifications, and local homologation. Vendor roadmaps for Release 17 features, time sync, and industrial-grade resilience will be a leading indicator of viable use cases beyond pilots.

How to measure program success

Meaningful progress would show as rising counts of operational NPNs, measurable productivity or quality gains in plants, and an active partner ecosystem spanning MNOs, PNOs, and integrators. If realized, Thailand’s 4.8 GHz policy could become a regional reference for pragmatic, industry-first private 5G.