Q3 2025 Results: 5G, FTTH Expansion and Cash Flow Reset

Telefónica delivered modest organic growth and wider 5G and fiber reach in Q3, while resetting free cash flow expectations amid operational and macro headwinds.

Key Financials and Access Metrics

Group revenue reached €8,958 million in Q3, with organic growth of 0.4% as currency effects weighed on reported figures, and EBITDA rose organically by 1.2% to €3,071 million. Net income from continuing operations was €271 million in the quarter, reflecting resilient core-market performance offset by FX and one-off items linked to discontinued operations. The company ended September with 350.2 million total accesses, including 16.4 million fiber connections (+8% year over year), and maintained network leadership with 5G covering 78% of its main markets and fiber-to-the-home (FTTH) passing 82.6 million premises. Net financial debt stood at €28,233 million as of September 30.

Regional Performance: Spain and Brazil Lead, Germany Recovery in Focus

Performance diverged across core geographies, with Spain and Brazil outpacing Germany as migration and pricing dynamics weighed on the latter.

Spain: Convergent Growth, Wholesale Headwinds

Telefónica España delivered its strongest fixed broadband net additions in nine years (+2.4% in the quarter), supporting revenue growth of 1.6%, EBITDA up 1.1%, and operating cash flow up 3.9%. Despite solid retail momentum across convergent bundles and access lines, the wholesale segment declined due to legacy contracts signed in the prior year, tempering the overall uplift.

Brazil: Postpaid and FTTH Leadership Drives Growth

Telefónica Brasil reinforced its market leadership with local-currency revenue up 6.5%, EBITDA up 8.8%, and EBITDAaL-CapEx up 13.6%. Growth was driven by postpaid mobility and expanding FTTH, positioning the business to monetize 5G capacity and premium broadband while maintaining disciplined capital allocation.

Germany: ARPU Pressure, Efficiency Measures and Migration Normalization

Telefónica Deutschland saw revenue decline by over 6% year over year and EBITDA fall 9.5%, primarily due to a one-on-one migration effect and ARPU pressure in O2 postpaid. Management highlighted ongoing efficiency measures, with the EBITDAaL-CapEx margin improving by 0.2 percentage points, and guided to recovery over coming quarters as migrations normalize and cost actions take hold.

CapEx Discipline with 5G and Fiber Leadership

Telefónica kept investment tight while pressing its advantage in 5G and fiber coverage across priority markets.

CapEx Mix and CapEx-to-Sales Ratio

CapEx was €1,167 million in Q3 (-7% year over year) and €3,170 million year-to-date, translating to an 11.8% CapEx-to-sales ratio for the first nine months. Importantly, EBITDAaL-CapEx increased 3.4% in the quarter to €1,252 million, underscoring improving cash generation from the asset base as rollout intensity moderates.

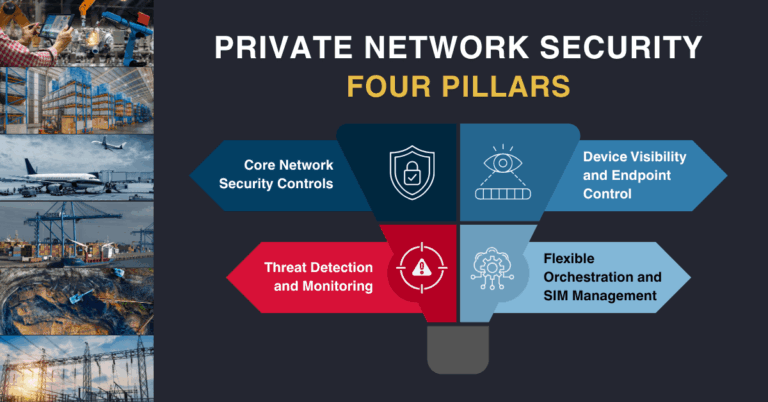

5G Coverage and FTTH Expansion

5G coverage reached 78% across core markets, up eight percentage points year over year, while FTTH passings rose 9% to 82.6 million premises. With 16.4 million fiber connections, Telefónica’s footprint is well placed to support convergent upsell, premium broadband, and enterprise-grade connectivity, laying groundwork for private wireless, IoT, and low-latency applications as demand matures.

Free Cash Flow Outlook, Guidance and Dividend

Management reaffirmed operational guidance while trimming free cash flow expectations to reflect timing and working capital shifts.

2025 Free Cash Flow Reset (€1.5–€1.9bn)

Telefónica now expects 2025 free cash flow of €1.5–€1.9 billion, lower than initially planned due to delayed tax refunds in Spain (now expected in 2026), the staged timing of Millicom litigation cash proceeds (2025–2027), lower working capital contribution, FX pressure, and items tied to restructuring and an accelerated B2P impact. Free cash flow from continuing operations was €123 million in Q3 and €414 million for the first nine months.

2025 Guidance Reaffirmed and €0.30 Dividend

The company reaffirmed 2025 guidance for growth in revenue, EBITDA, and EBITDA minus CapEx. It also confirmed a €0.30 per share cash dividend, signaling confidence in core cash generation despite near-term timing effects.

HispAm Portfolio Simplification and De-risking

Telefónica continued to streamline its footprint to focus capital and management attention on scale markets.

Divestments to Reduce FX Risk and Refocus on Core Markets

The group closed sales of its units in Uruguay and Ecuador in October, following exits from Argentina and Peru earlier in the year, with the sale of Colombia pending. The strategy reduces earnings volatility, pares exposure to FX-driven swings, and concentrates resources on Spain, Germany, and Brazil, where network leadership can be translated into durable returns.

Implications for Telecom Buyers, Vendors and Partners

For enterprises, vendors, and channel partners, Telefónica’s mix of network reach and tighter capital discipline shapes near-term opportunities and risks.

Enterprise Takeaways: 5G, FTTH and Private Wireless

Expanded 5G and FTTH coverage in Spain and Brazil supports mobile-first transformation, SD-WAN/SASE overlays on premium broadband, and pilots for private 5G and IoT. Customers in Germany should watch service migrations and ARPU normalization; confirm SLAs and migration timelines for critical workloads.

Vendor and Hyperscaler Opportunities

Expect demand for 5G densification, RAN energy savings, transport upgrades, and software-driven operations to sustain, even as CapEx efficiency tightens. Fiber co-investment and wholesale models in Spain will evolve as legacy contracts roll off; align offers to cash-conversion metrics and currency risk management.

Investor and Wholesale Considerations

Key sensitivities include the cadence of tax refunds and litigation proceeds, Germany’s EBITDA stabilization, and Spanish wholesale transitions. Dividend sustainability is anchored in EBITDA-CapEx growth and working-capital discipline; monitor FX trends and any incremental asset monetization.

Key Watchlist for the Next Two Quarters

Execution against these milestones will determine whether Telefónica converts network leadership into stronger free cash flow and stable returns.

Operational KPIs: Net Adds, Churn, ARPU, EBITDA

Net adds and churn in Spain and Brazil, ARPU trends and migration completion in Germany, and group-level EBITDA trajectory versus guidance.

Cash Flow Drivers and Net Debt

Working capital contribution, timing of Spanish tax refunds, Millicom-related inflows, CapEx phasing, and net debt evolution.

Network Milestones: 5G Coverage, FTTH Passings, Enterprise 5G Wins

Progress toward 5G coverage expansion beyond 78%, incremental FTTH passings and connections, and tangible enterprise 5G wins that signal monetization beyond coverage.