India’s Indigenous 4G Stack Powers Telecom Equipment Manufacturing Shift

India’s nationwide launch of BSNL’s “Swadeshi” 4G stack moves the country from a services-first model to domestic production of core telecom equipment at national scale.

Nationwide BSNL 4G Launch and Scale Metrics

India formally launched an indigenous 4G stack for state-run BSNL, alongside more than 97,500 towers announced from Jharsuguda, Odisha. Government leaders framed the move as India entering a select group of countries that build end-to-end telecom equipment domestically, citing peers such as Denmark, Sweden, China, and South Korea. The rollout aims to extend modern mobile connectivity to underserved regions—border areas, islands, and hilly terrains—where coverage and backhaul have lagged.

Officials highlighted early reach metrics, noting that roughly 92,000 sites are active and connecting an estimated 22 million users. The message is clear: India wants to be seen not only as a software and services hub, but as a producer and exporter of telecom infrastructure aligned with its Aatmanirbhar Bharat (self-reliance) agenda.

Why Now: Supply Chain, Security, and Cost Control

Telecom equipment sovereignty has become a board-level issue as operators de-risk supply chains, comply with trusted source mandates, and balance costs amid rising traffic and spectrum refarming needs. An indigenous RAN and core supply option, backed by policy incentives, gives India leverage on price, roadmap control, and security assurance. It also offers a viable diversification path for public and private networks at a time when geopolitics and licensing models are reshaping vendor choices across Asia, Africa, and parts of Europe.

Inside India’s “Swadeshi” 4G Stack: Architecture, RAN, Core, Compliance

While the launch emphasized national capability, the technical composition points to a maturing homegrown ecosystem spanning core, RAN, and systems integration.

Architecture and Vendor Ecosystem (C-DOT, Tejas, TCS)

BSNL’s 4G build is widely understood to be delivered by an Indian consortium—core network software from C-DOT, RAN hardware and software from Tejas Networks, and systems integration by TCS—aligned with 3GPP standards. The stack includes EPC/IMS for VoLTE, radio units and baseband, OSS/BSS integration, and automation layers for provisioning and monitoring. The deployment targets India’s prevalent LTE bands and is designed for phased upgrades, paving a path toward 5G NSA/SA with software evolution and additional spectrum.

3GPP Standards, Interoperability, and Trusted Telecom Compliance

Conformance with 3GPP releases, interop with multivendor devices, and adherence to India’s Trusted Telecom requirements are critical. The domestic stack must pass rigorous carrier-grade benchmarks—latency, throughput, VoLTE quality, handovers, and security hardening—across diverse terrains and power conditions. Success here is a precondition for export credibility and private network adoption.

Coverage, TCO, and Bridging India’s Digital Divide

The roll-out is positioned as both a network modernization and a rural inclusion strategy with measurable impact on access and affordability.

Extending Reach to Border, Island, and Hilly Terrains

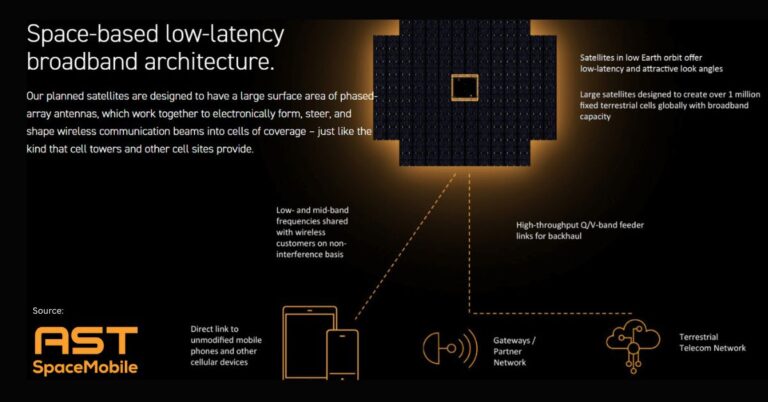

BSNL’s footprint gives the indigenous stack immediate scale in regions where commercial ROI is thin. Expect targeted deployments with optimized RF planning and hybrid backhaul—microwave, fiber, and possibly satellite or LEO gateways—depending on terrain. Energy-efficient radios and site-level power innovations will matter to keep OPEX in check in off-grid areas.

Lowering TCO via Domestic Manufacturing and Policy Incentives

Domestic manufacturing plus policy levers (e.g., production-linked incentives for telecom and networking products) can lower TCO over the lifecycle. The real savings will come from software velocity, supply assurance, and localized spares and services. If the vendor ecosystem sustains timely feature drops and security updates, Indian operators could compress time-to-service in rural markets without importing high-cost gear.

Strategic Takeaways for Operators, Vendors, and Private Networks

This milestone opens new options for procurement, network design, and export-led growth across public and private networks.

Guidance for Mobile Operators: Diversification and 5G Path

Indigenous 4G provides a credible diversification lever alongside incumbent global vendors. Operators should pilot mixed-vendor footprints, validate multiband performance, and plan VoLTE migration at scale. A clear upgrade path to 5G SA—core readiness, RIC/automation, and spectrum strategy—will determine long-term competitiveness.

Vendor and SI Priorities: Hardening, Interop, Certifications

The near-term opportunity lies in fulfilling BSNL’s scope with carrier-grade quality while building references for international bids. Priorities include hardening software, simplifying integration, accelerating interoperability testing, and achieving certifications across security and emissions. Partnerships for exports to South Asia, Africa, and Southeast Asia will hinge on proof points in scale, SLA adherence, and energy efficiency.

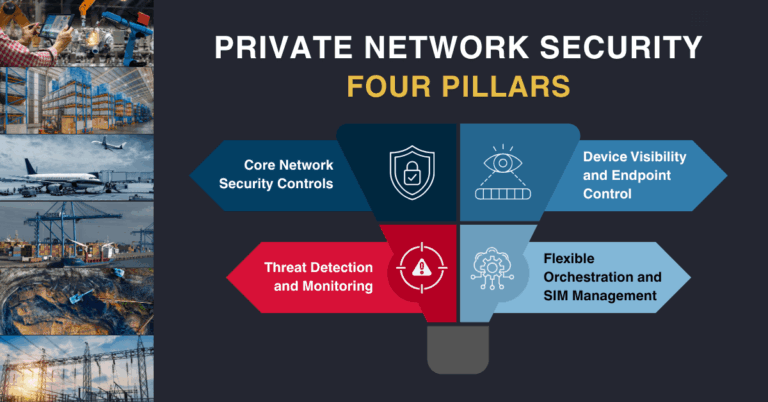

Enterprise Private 4G/5G: Cost, QoS, and Local Support

Manufacturing, ports, logistics, and utilities should reassess private 4G/5G roadmaps with Indian suppliers in the mix. A domestic stack could reduce cost of entry for on-prem LTE/5G with VoNR readiness, deterministic QoS, and simpler local support. Enterprises should demand reference architectures, device validation lists, and clear lifecycle policies for updates and vulnerabilities.

Execution Risks, KPIs, and 5G Migration Signals

Scale is achievable; sustained performance, reliability, and global competitiveness will be the true tests.

Key Risks: Interop, Device Breadth, Software Lifecycle

Interoperability with legacy networks, device ecosystem breadth across LTE/VoLTE profiles, and seamless handovers will determine user experience. Software lifecycle discipline—patching, zero-day response, and observability—must match tier-1 expectations. Supply chain resilience for semiconductors and optics remains a macro variable, even with domestic assembly.

Signals to Watch: Activations, VoLTE KPIs, 5G Roadmap

Watch for month-on-month site activations, VoLTE adoption rates, and KPIs like call drop rates and throughput in difficult geographies. Look for transparent 5G migration timelines, inclusion of Open RAN interfaces where appropriate, and participation in international RFPs. Third-party audits and certifications will be vital for credibility beyond India.

Bottom Line and Next Steps for Telecom Decision-Makers

India’s indigenous 4G launch is a meaningful step toward telecom equipment self-reliance with direct implications for cost, control, and coverage.

Action Items: Trials, Validation, Roadmaps, Partnerships

Operators: run controlled trials with the indigenous stack, define 5G-SA migration tracks, and negotiate outcome-based SLAs. Enterprises: shortlist Indian vendors for private LTE/5G pilots and insist on full device and security validation. Vendors: invest in conformance testing, publish roadmaps aligned to 3GPP releases, and build export partnerships now. Policymakers: double down on certification labs, export finance, and skilling to convert momentum into durable market share.

If execution matches ambition, India can evolve from import dependence to a competitive producer in the global telecom equipment market—and bring millions more into the digital economy in the process.